Summary:

- We’re downgrading AMD to sell from hold after 2Q24 results and outlook.

- We think AMD’s AI-related sales will not be able to materially outperform consensus expectations.

- AMD has two things working against it: widening performance gap with NVDA AI GPUs and high market expectations.

- We also still don’t see any catalyst at play to boost PC TAM, and hence we don’t see material outperformance driven by Client sales.

- We see a higher risk profile for AMD in the back end of the year and recommend investors take profits and explore exit points out of the stock.

marcophotos/E+ via Getty Images

We’re downgrading Advanced Micro Devices (NASDAQ:AMD) to a sell from a hold. The company reported its 2Q24 results and outlook late last month, initially causing a surge in the stock price, up +8% the day after, before erasing some of those gains. AMD has been branded as the next big thing in AI since Nvidia (NVDA) showcased the potential of being tapped into the AI market last May; we disagree with this branding and have been waiting for expectations related to AMD’s AI sales to reset, which hasn’t fully happened yet. The lag for any real expectation reset from the buy-side guys, coupled with the widening performance gap between NVDA and AMD’s AI products, cause us to believe AMD holds a higher risk profile in the back end of the year and 1H25, even after management raised its 2024 forecast of AI-related sales by $500M. We recommend investors begin taking profits and explore exit points out of the stock.

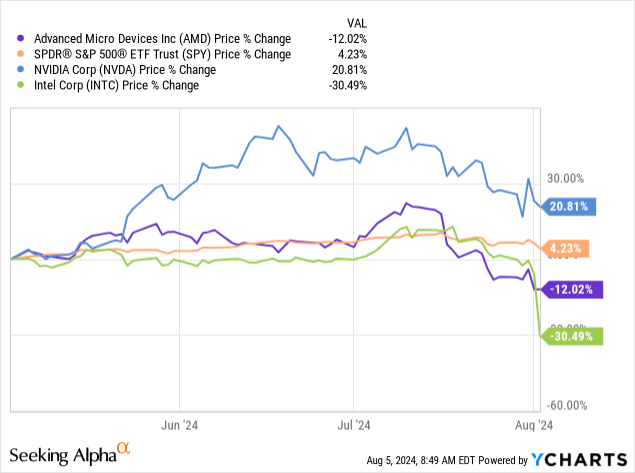

Consistent with our expectations in November of last year, AMD stock traded higher on market excitement around AI, enabling a high of $211.38. The company guided slightly ahead of the consensus outlook for sales of $6.7B versus estimates of $6.61B, after five consecutive quarters of missing consensus outlook. We think market expectations for AMD’s AI-related sales growth have been more balanced compared to 1H24. However, we continue to believe that buy-side expectations for the stock are too optimistic. We see a higher risk profile for AMD as we don’t expect AMD to be able to show material upside to current consensus expectations. This quarter confirmed our expectation, with data center sales at $2.8B, only slightly ahead of consensus at $2.79B. The following graph outlines AMD’s stock performance against the S&P 500, NVDA, and Intel (INTC).

YCharts

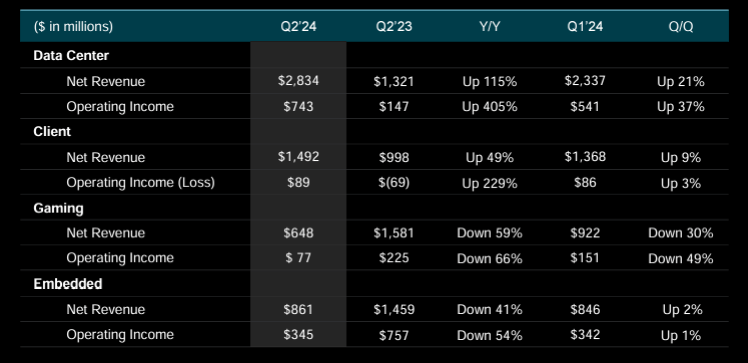

The proof is in the pudding; the company’s AI GPU results and outlook commentary confirm our more conservative outlook on the stock. With the ramp of MI300X AI GPU and server CPU demand, data center sales were able to grow 21% Q/Q to $2.83B, impressive but not impressive enough to fulfill Wall Street’s AI growth narrative. The 21% Q/Q growth also follows a mediocre 2% Q/Q growth last quarter. Management’s raised guidance on its AI chip sales was more of a positive for the market to latch on to, but again, nothing that would foreshadow its position as the next big benefit from AI; the company raised guidance from $4B to $4.5B for 2024. We see more room for data center sales to grow with the continued MI300X ramp, but we think this will only serve as a temporary tailwind before Nvidia’s next-generation is deployed and actively widens the performance gap with AMD’s offerings. AMD’s next-gen MI325X solution is still inferior to NVDA’S next-gen B200 Blackwell and will lack a competitive edge even more against NVDA’s GB200 NVL72 solution once it’s deployed.

Aside from NVDA’s products being superior to those of AMD, the other factor to look at here is lead times/supply. Our industry research indicates that there are relatively no more lead times for NVDA’s H100 GPUs after a +12-month shortage; lead times were down to 8-12 weeks in April and are currently non-existent as the industry prepares to transition to the next-gen B200 Blackwell platform. To put into perspective how bad the shortage was, in October (just six months before the reported lead time window shrunk to 2-3 months), “lead times reached 11 months, meaning that most of Nvidia’s customers had to wait a year to have their AI GPU orders fulfilled.” Whatever AI traction AMD got on the back of NVDA’s shortage will fade quickly, or in other words, AMD’s advantage of having shorter lead times is now lost, or more precisely, has been lost since the start of 2H24. We now expect the thesis we proposed back in September of the majority of cloud customer dollars spent favoring NVDA will show more visibly as lead times are no longer an issue for cloud customers when placing orders. The bottom line here is that NVDA’s AI GPU supply is healthier, i.e., it’s catching up to demand, and we think it will show up as a negative for AMD into 2025. With these factors in mind, it seems from a logical standpoint, very difficult for AMD to meet buy-side AI expectations.

The following graph outlined AMD’s segment results for 2Q24.

AMD 2Q24 earnings presentation

Why PC won’t save the day?

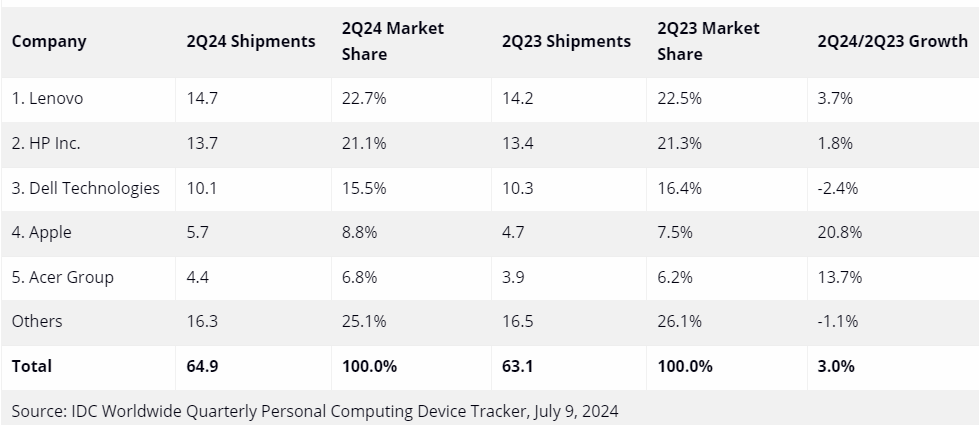

AMD’s Client sales performed better in 2H24 than in the first, but we still don’t think they’ll be able to make up for shortcomings in AI-related sales. PC demand growth has been lackluster at best this year, with mid-single-digit anticipated growth but no material catalyst for PC TAM expansion. While the market was anticipating a bounce back after the inventory correction cycle was completed, we’re seeing a post-correction lull as PC end demand fails to rebound materially. PC TAM Y/Y growth forecasts were revised since 1QCY24; this is not to say there has been flat growth Y/Y but to emphasize that there’s been no significant PC TAM expansion. International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker noted in early July that “the Traditional PC market delivered its second quarter of growth following eight consecutive quarters of decline,” that growth is a low 3% Y/Y growth. The following graph shows the top five Companies, Worldwide Traditional PC Shipments, Market Share, and Year-Over-Year Growth, Q2 2024, from IDC to help further showcase the Y/Y trend. The reason PC expectations for a rebound this year haven’t been fulfilled is due to macro uncertainty weighing on the upgrade cycle and consumer spend, in addition to no real catalyst that materialized. The IDC has forecasted that “Growth is expected to slowly ramp up over the year along with the availability of AI PCs,” but the AI PC moment hasn’t happened, and we don’t see it happening until next year.

IDC Worldwide Tracker

AMD is not immune to this industry downturn, nor is it immune to a lack of growth catalysts. This quarter, the company’s Client sales were up 49% Y/Y and 9% Q/Q on post-channel inventory normalization; the impressive Y/Y growth was more doable due to the weak demand amid the correction in a year-ago quarter and seasonal inventory replenishment ahead of Back-to-School season in the Fall. CEO Lisa Su emphasized that the company’s launch of the new Zen 5 chips for desktops and notebooks in 2H24 will help improve Client revenues further, but we think this will have a minimal impact considering how high expectations run for AMD at the moment.

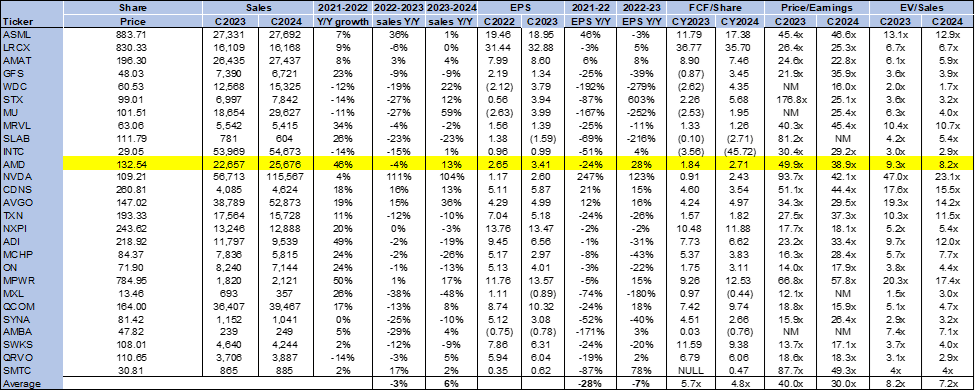

Valuation & Word on Wall Street

Consistent with our note back in November, AMD stock is still overvalued. On a P/E ratio, the stock is trading at 38.9x CY2024, compared to 36.6x in our last note and a group average of 30.0x. The stock trades at 8.2x EV/Sales versus a ratio of 6.9x last November and a group average of 7.2x. We don’t think AMD’s premium valuation is justified, particularly given its multiple expansions between November and today. AMD’s metrics are unjustifiably higher than industry averages. The following chart outlines AMD’s valuation against the peer group average.

TechStockPros

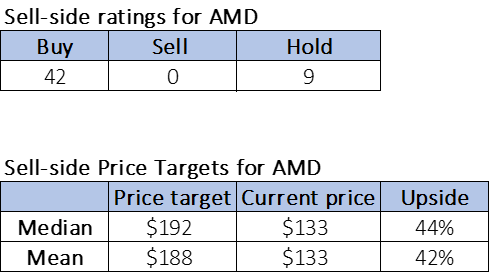

The positive sentiment toward AMD among retail investors is a direct result of high buy-side expectations for the company’s AI growth exposure. Of the 51 analysts covering the stock, 42 are buy-rated, and the remaining are hold-rated with no sell ratings. The sell-side price targets are also inflated, in our opinion. The stock currently trades at $133 per share with a median price-target of $192 and a mean price target of $188, which represents a 42-44% potential upside. Our sell-rating on AMD is based on our belief that this will be very difficult for the company to achieve.

The following charts outline AMD’s sell-side ratings and price targets.

TechStockPros

What to do with the stock?

We’re downgrading AMD from a hold to a sell; we think investors would be better positioned outside the stock, as the negatives from a fundamental standpoint will outweigh what little positives were supporting AMD’s AI growth story and reset (again) Wall Street’s high AI expectations. We understand investor concern over stepping out of AMD after the pullback we’ve seen cannibalize tech stocks since mid-July, but we do believe there is more downside to come for the stock, particularly if our thesis on NVDA provides a softer guidance for its October quarter.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.