Summary:

- In 2Q 2024, GM sold 1043 thousand cars, which was driven by a sharp increase in sales in North America and beyond.

- The Company’s North American auto sales surpass pre-COVID levels, but its operating margin remains high. But the company continues to face challenges in the Chinese market.

- General Motors’ EV sales rising faster than the market, flexible guidance for EV production, and raising sales forecast for 2024 and 2025.

- We are maintaining the rating for the shares as Buy. The target price is $77 per share.

RiverNorthPhotography

Investment thesis

Since our previous article on General Motors, the company’s shares have corrected and continue to show negative momentum in the pre-market due to a broad market correction. However, there are no fundamental reasons to sell the company’s shares, and we maintain our BUY rating on GM shares.

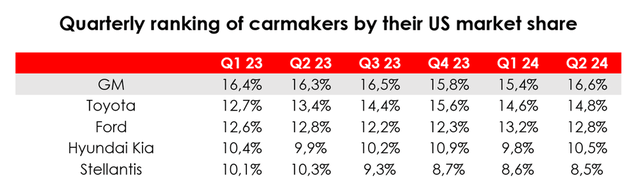

In the second quarter, the company consistently increased its market share in its largest market, the US, to 16.6% (+1.2 pp qoq), in contrast to its major competitors, whose share remained virtually unchanged overall. As a result, GM’s North American auto sales surpassed pre-COVID levels for the first time in four years. Car sales in the GMI segment also increased significantly during the quarter, despite the ongoing difficulties in China. In addition, the operating margin remains very high compared to historical data due to the continued optimization of production processes and the introduction of lower-cost models.

The situation in the car market

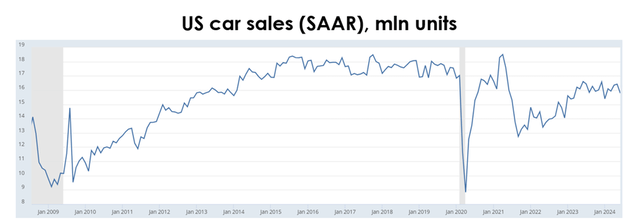

In 2Q 2024 US car sales continued to stagnate and averaged 16.2 mln units, compared with 16.3 mln units a year earlier (-0.7% y/y).

Affordability is increasingly often a problem for US car buyers, as the average annual interest rate on a loan to buy a new car rose to 10%, or by 1 pp from a year before.

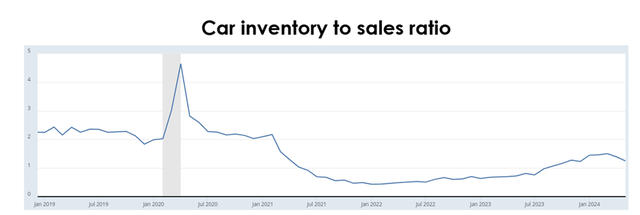

The inventory-to-sales ratio of cars was 1.25x at the end of May 2024 compared with 1.39x at the end of April, indicating that auto supply is exceeding demand, prompting a buildup of inventories at dealerships.

It’s worth noting that in late June 2024, there was a cyberattack on the software provider CDK that hobbled several dealerships at a crucial time for sales, additionally (as a one-off event) increasing inventory. For example, GM said that due to the software hack, some of the sales will be delayed to 3Q 2024, making a minor impact on the company’s operations.

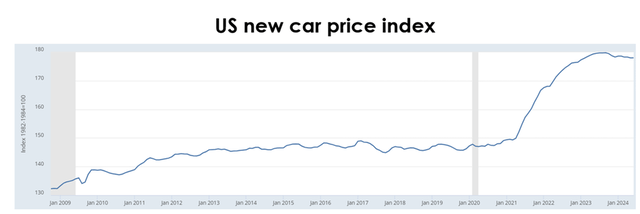

As in the previous quarter, the US new car price index remains high amid a persistent imbalance between supply and demand, barely declining from the previous level.

We are maintaining our expectations that new-car prices will incrementally decline amid US efforts to tame inflation, and we do not expect a sharp drop anytime soon.

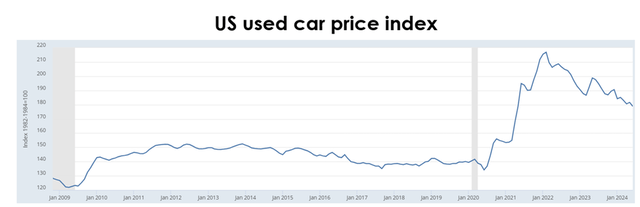

US used-car prices continue to fall faster than new-car prices, which reduces the total cost of car ownership. Prices for used electric cars are falling faster than prices for cars with internal combustion engines.

It should be added that this correlation between price dynamics is causing new-car sales to stagnate, so they have not yet returned to their peak of 2021.

Outlook for GM’s car sales

In 2Q 2024 GM sold 1043 thousand cars, up from our forecast of 918 thousand cars, which was driven by a sharp increase in sales in North America and beyond.

Car sales in North America

About 87% of the company’s 2Q 2024 sales were in North America, with the US being the key region. Amid continued stagnation in US car sales, GM expanded its market share to 16.6% (+1.2 pp q/q) in 2Q 2024, in contrast to its major rivals, whose combined market share remained almost unchanged q/q. As a result, GM’s car sales in North America topped pre-Covid levels for the first time in the past 4 years.

Company data, Invest Heroes calculations

GM continues to stack its portfolio of internal combustion engine cars with new/redesigned models. For example, eight crossover models started arriving in showrooms in 2Q 2024, including the most profitable ones such as the Chevrolet Traverse, GMC Acadia, Buick Enclave and Chevrolet Equinox. GM plans to continue to stick to its strategy and regularly release high-quality and more profitable models.

During the conference call discussing the 2Q 2024 financial results, management representatives cited some statistics for better understanding of the scope of achievements in this area:

…through smarter contenting and optimizing selectable options, we have been able to eliminate more than 2,400 unique parts on 10 vehicles we’re launching through the first quarter of 2025. On the 2025 Cadillac LYRIQ alone, we’ve reduced the part count 24% from the 2024 model year with no compromises to performance or features.

A couple of quarters after the end of strikes in the US auto industry, GM regained its market share, and we expect the company will hold on to it in the future. Given the solid sales in 2Q 2024 and the expectation that GM will retain market share, we are raising our forecast for GM’s sales of internal combustion engine vehicles in North America from 3.2 mln cars to 3.4 mln for 2024 and 3.6 mln for 2025.

Car sales outside North America

GM ramped up sales not only in North America. Sales of the GM International (GMI) segment jumped by 35% q/q to 140 thousand cars.

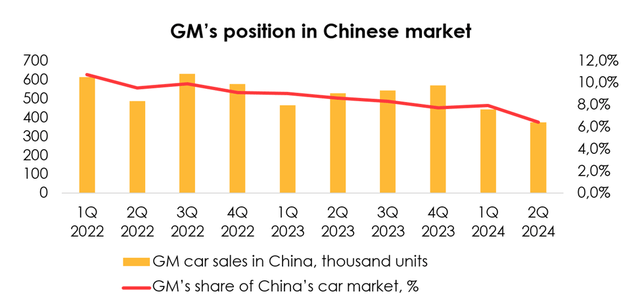

In its largest market in the GMI segment, the company continues to face the challenges we described in our previous report: price competition, rising consumer confidence in domestic brands and rising demand for electric vehicles, and a tightening regulatory environment with respect to emissions. GM’s market share in China declined to 6.4% (-1.5 pp q/q) in 2Q 2024.

Company data, Invest Heroes calculations

Management is taking measures to reduce inventories, align production to demand, protect pricing and reduce fixed costs. In addition, as planned, GM through its JV is designing and producing some new models specifically for the Chinese market, which are just beginning to gain traction. However, it recognizes that the steps that were taken are still not enough, although significant. Comments from Chief Executive Officer Mary Barra about the market were disappointing:

…when you get into the type of pricing war that’s going on now, it’s really a race to the bottom and destroy residuals. There’s nothing good that comes from the behavior that we’re seeing right now.

Unlike much local competition, GM prioritizes profitability over production.

Despite all efforts to restructure the JV business, serious competition prevented the company from returning to positive net income in 2Q 2024, in a departure from management’s plans. Judging by market trends, the situation will remain difficult until the end of the year.

In the remaining GMI markets (Middle East, Africa, South America), the company generally maintains its share, which fluctuates from quarter to quarter within acceptable limits. Management noted high brand recognition and strong customer loyalty, which allows GM to remain competitive. We expect car sales outside North America to enter positive y/y territory within the valuation period of 2024 and 2025, despite the current headwinds in China.

Progress in production, sales of electric vehicles

In 2Q 2024, the company delivered 22 thousand electric vehicles in the US, which means supplies – spearheaded by Chevrolet Blazer EV and Cadillac LYRIQ – increased by 34% q/q and 43% y/y. One of potential drivers of electric vehicle sales in the region is the Chevrolet Equinox EV, which just went into production in 2Q 2024 (it is the most affordable electric vehicle on the market among long-range models, capable of going 300 miles on one charge and selling at <$30 thousand if the tax credit is deducted from the price).

One can see that GM’s EV sales are rising faster than the broader electric vehicle market in the US – and this comes at a good time as the company, while demand for EVs was weak, resolved its capacity constraints and now has a chance to scale up production at a rapid clip to keep up with demand.

It is important to note that about 54% of GM’s electric car buyers are new customers of the company. GM is working to increase the number of customers by planning regular releases of new-generation models.

Over the next few months, in line with promises made earlier, there will be releases of the GMC Sierra EV and the Cadillac models OPTIQ and Escalade IQ. The Cadillac CELESTIQ and several other luxury SUVs are anticipated to be brought to market next year, in a development that the company expects to attract new customers as EV adoption in the luxury segments happens faster and is more sustainable than in the broader market. One of the limiting factors for demand growth in the broader market is the lack of chargers, as in addition to being far apart, 1/5 of them are out of service. GM management said they are in discussions with Tesla about giving drivers of GM brands access to Tesla’s charging network to encourage potential customers to purchase a GM electric vehicle.

Given GM’s higher-than-expected sales of electric vehicles in 2Q 2024 (21.9 thousand versus the forecast of 19.7 thousand) and as the outlook for future sales growth remains unchanged, we are raising the forecast for GM’s sales of electric vehicles in the US from 102.4 thousand units (+37% y/y) to 112 thousand units (+50% y/y) for 2024, and from 175.9 thousand units (+72% y/y) to 195.7 thousand units (+75% y/y) for 2025.

GM’s flexible guidance for EV sales

It is worth noting that General Motors narrowed its guidance for the output of the Ultium plant in 2024 from 200-300 thousand units to 200-250 thousand units, and didn’t reaffirm the earlier outlook that North America will produce 1 mln EVs by the end of 2025.

The company explained that it aligns production to demand and does not want to engage in overproduction, seeing that the volumes that had been announced earlier would not be absorbed by the market, but instead cause an even bigger buildup of inventories.

We continue to believe that the 2024 target for EV sales, even after it was scaled back to 200-250 thousand units, remains unattainable in the current market environment. GM’s global deliveries totaled 75 thousand EVs over 1H 2024.

Making EV production profitable

Thanks to the incremental scaling up of production, improved assembly efficiency, and the lower cost of EV batteries due to the effect of scale at the Ultium Cells plant, GM expects to achieve variable profit in EV production in 4Q 2024.

Regulatory incentives and restrictions for EVs

In light of recent developments, namely the Biden administration’s tightening of tariffs on batteries and battery raw materials from China, as well as the potential removal of support for electric vehicles if Donald Trump wins the US presidential election in November 2024, management was repeatedly asked about these issues during the 2Q 2024 earnings conference call with analysts and at various other events.

Certainly, the company realizes that tax incentives for EV production are not going to last forever, and it is necessary to gradually achieve profitability without government support, which, as mentioned above, is something General Motors is hard at work to accomplish. However, the abolition or reduction of existing incentives would take a toll on the profitability of the EV segment, and despite the flexibility to shift between ICE cars and EVs in terms of production, sooner or later, the company would incur a loss.

Robotaxi Cruise

In the cruise business, things are moving forward as the company is working to rebuild trust, engaging with regulators, and adding new management staff (for example, a new CEO and a new head of safety).

Currently, Cruise returned to the road in Houston, Phoenix, and Dallas. From May 2024, the company is deploying two autonomous vehicles, albeit with safety drivers behind the wheel, in Phoenix for the first time since the October 2023 incident. Other cars are manually driven for the time being.

It’s also worth noting that the company decided to scrap plans to deploy the purpose-built Origin driverless vehicle (which doesn’t have a steering wheel or pedals) and will instead switch to the next-generation Chevrolet Bolt EV, which is expected to be released in 2025. This was done to make it easier to scale up the robotaxi in the future, both in terms of removing regulatory uncertainty with respect to the Origin and cost savings.

General Motors continues to believe in cruise and the business opportunity of autonomous driving, and is supporting the company through a challenging period by providing financing to meet their operational needs. Cruise’s 2Q 2024 expenses totaled $458 mln, down $153 mln from a year earlier, reflecting a commitment to cost reduction and focus on operational excellence.

GM’s financial results

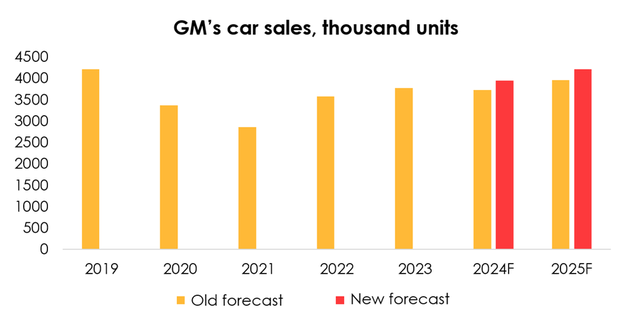

We are raising the forecast for GM’s car sales from 3.7 mln units (-0.9% y/y) to 3.95 mln units (+4.8% y/y) for 2024, and from 4 mln units (+6.1% y/y) to 4.2 mln units (+6.7% y/y) for 2025 following the improved outlook for car sales in and outside North America (for both gas-powered and electric vehicles).

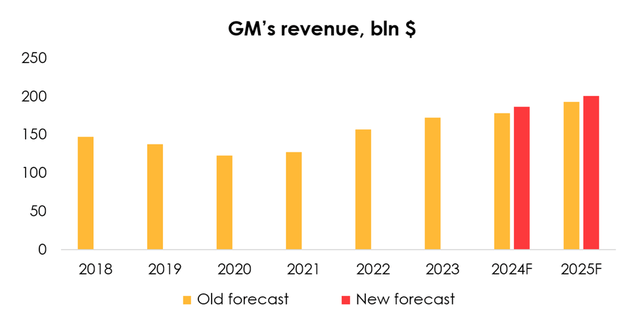

We are raising the forecast for GM’s revenue from $177.7 bln (+3% y/y) to $186.6 bln (+9% y/y) for 2024, and from $192.5 bln (+8% y/y) to $200.7 bln (+8% y/y) for 2025 on the back of a higher estimate for GM’s car sales in 2024 and 2025, although it was partially offset by the reduction of the forecast for the average selling price from $43.4 thousand to $43.3 thousand for 2024, and from $44.2 thousand to $43.5 thousand for 2025.

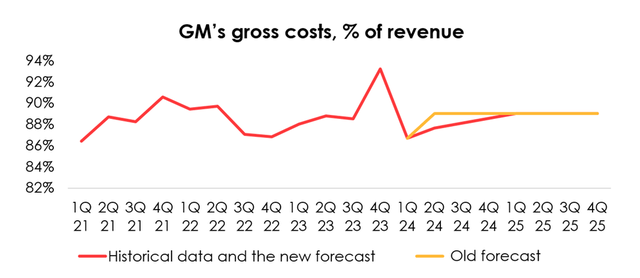

Gross costs in the automobile segment reached 87.6% in 2Q 2024, down from our forecast of 89%. Dollar margin per unit totaled $5220 in 2Q 2024, compared with $5820 in 1Q 2024 and $4720 in 2Q 2023.

We have revised our outlook for gross costs as a percentage of revenue in favor of a smoother increase to 89% by 2025. So, given the lower level of 2Q 2024 and the reduced forecast for 3Q and 4Q, we expect the average for 2024 to reach 87.7%, compared with our old forecast of 88.4%. We are leaving the outlook for 2025 unchanged at 89%.

Selling, general, and administrative expenses (SG&A) are going down in line with our expectations, which means our prior outlook remains current. The forecast for the remainder of operating costs, as a percentage of revenue, has been cut slightly for 2024, given the lower level of 2Q 2024.

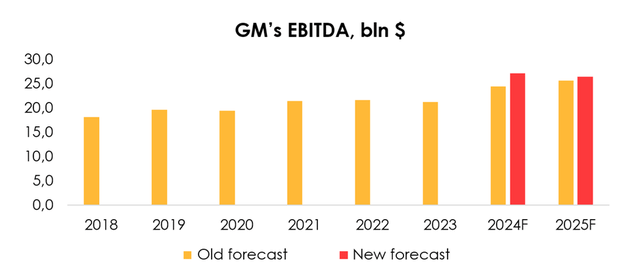

We are raising the EBITDA forecast from $24.4 bln (+15% y/y) to $27 bln (+27% y/y) for 2024, and from $25.6 bln (+5% y/y) to $26.4 bln (-2% y/y) for 2025 due to the increased forecast for GM’s revenue in 2024 and 2025.

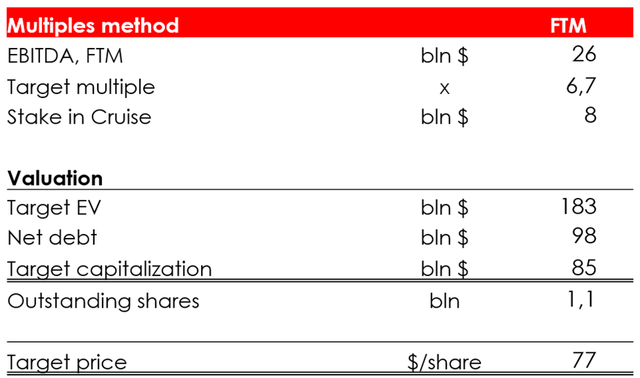

Valuation

We are raising the target price of the shares from $69 to $77 due to:

- the increased EBITDA forecast for 2024 and 2025;

- the reduction of the company’s projected net debt from $101 bln to $98 bln, where, among other things, we deducted from the projected net debt the $500 mln that were provided to General Motors by the White House to convert the Michigan plant from producing internal combustion engine cars into producing electric vehicles;

- the shift of the FTM valuation period.

We are maintaining the rating for the shares at BUY.

Conclusion

GM continues to develop the electric car segment and is committed to its plans to capture this market by launching new models in various auto categories. Despite the crisis, GM will continue to invest heavily in EVs, both through the opening of new plants and through the development of new product lines: the largest portion of capex is spent on the development of electric vehicles and batteries for them.

We expect the company to continue to gain market share faster than it did in 2023, driven by a strong sales portfolio that is based on internal combustion engine cars, and as production slowdown that was caused by strikes came to an end.

We believe the company has strong underlying fundamental strength and is still trading well below fair value. The rating is BUY.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.