Summary:

- Last week’s US jobs report caused a market downturn, leading investors to seek defensive stocks like Coca-Cola.

- The Company’s high quality, steady returns, and defensive traits make it a suitable addition to portfolios in uncertain economic times.

- Despite risks like sugar consumption awareness and raw material price spikes, KO’s valuation and quality make it a buy recommendation.

Jonathan Knowles

Introduction

Last week seems to have ushered in a significant narrative shift in equity markets, as a sharp weakening of the US jobs market delivered a sharp sell-off in the S&P 500, Nasdaq and Russell 2000. Until now, the market has seemed to welcome a gradual weakening of the labor market as it provided cover for the Fed to start cutting interest rates. This was one of those good news is bad news situations. Where a modest amount of bad news can be perceived as good due to its knock on effect in terms of the interest rate outlook. However, Friday’s nonfarm payroll and unemployment prints suggested the economy is weakening at a much faster pace than had been previously thought. Based on price action from the end of last week and the beginning of this week, it seems bad news is once again being perceived as bad news.

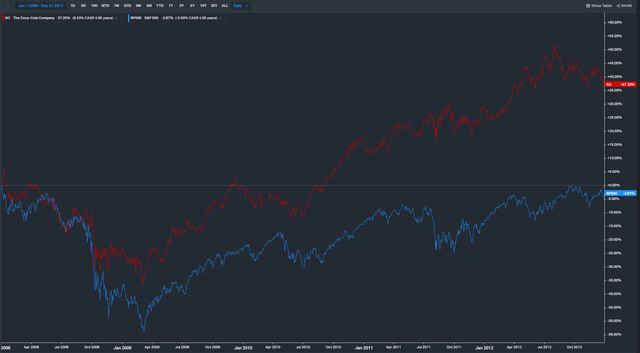

It is with this backdrop in mind that I recommend Coca-Cola (NYSE:KO) (NEOE:COLA:CA) today. The stock gained over 2% on Friday, in stark contrast to a broader market melt down. I think now is a suitable time for investors to consider adding high quality defensive names to their portfolio to weather the potential storm of recession. Coke has been a high-quality consumer staple for decades. The firm boasts an excellent track record with a steady and consistent return profile. In prior times of economic stress, the firm has outperformed the broader market due to its more defensive nature. This can be evidenced below by examining KO’s performance vs the S&P 500 during the Great Financial Crisis.

I believe Coca-Cola would be a suitable addition to portfolios given its attractive dividend, healthy balance sheet, reasonable valuation and defensive traits. I recommend a Buy on KO, as a portfolio ballast against a weakening economy and potential recession.

High Quality

When I think of the word quality and its application in investing, I specifically look for things like a consistent track record, a high-quality fortress balance sheet, an attractive consistent dividend and steady returns on investor capital.

KO has an extremely robust balance sheet, the company has a net debt/EBITDA ratio of just 1.6x. Additionally, the firm generates a healthy amount of cash and can easily cover interest on debt with an EBIT/Interest ratio of over 9x. The firm has been well managed for decades, and this is evidenced by its remarkable record of increasing dividends for 61 straight years. I believe the ability to raise dividends through thick and thin is a clear indication of a prudent management team and business culture. If we are staring down the barrel of a recession or substantial macro weakness, this is the type of business I want to own to provide resilience.

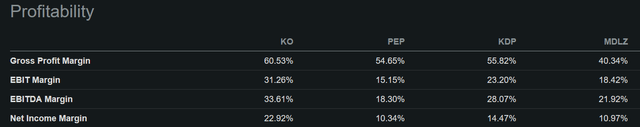

Coke’s profitability stands out vs its main peers in the US consumer staples space. We can see the KO delivers the best in-class industry margin profile. I think this is yet another indication of a superior managed business which will be a good steward of shareholder capital.

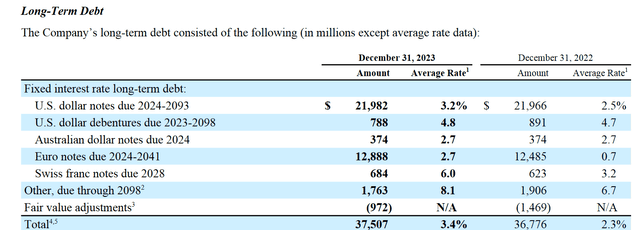

In assessing Coke’s returns on capital, we need to first make an estimate of the company’s cost of capital to determine if they are generating value for shareholders and to what degree. The company currently has $45B in total debt, which means that of its roughly $300B in market cap, about 15% is debt and the 85% balance is the equity portion of the business.

Looking above at the firm’s debt schedule, from the company 10-K report, we can see an average cost of debt is 3.4%. We then consider the cost of equity using the below formula. My inputs use the latest 10-year treasury bond yield as the risk free rate, Coke’s beta and the implied equity risk premium sourced from the workings of Aswath Damodaran at NYU Stern to derive the implied cost of equity capital.

Author

The resulting weighted average cost of capital or WACC for Coke is around 6%. As we can see below, the firm has dependably delivered returns on capital in excess of its WACC. This, in simple terms, means that for every dollar put into the business, management are consistently delivering greater than a dollar of value for shareholders. To be clear, this is not a stock that is high growth and shooting the lights out. Rather, it is a steady compounder to own as part of a broader portfolio and I believe if we are heading into a potential recession, investors need to have some steady defensive names to reduce volatility and protect their portfolios.

Valuation

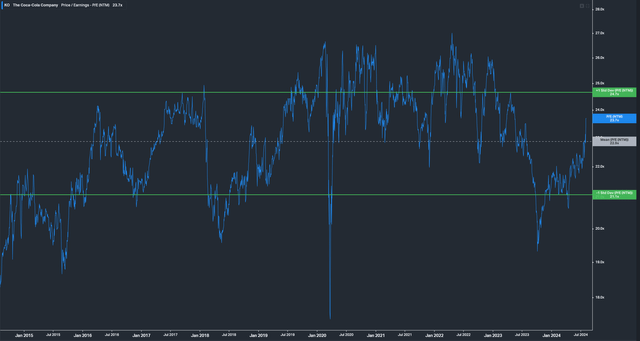

In addition to attributes of quality in a business, we need to always be mindful of the valuation we pay for that quality. Looking below at KO’s forward P/E against its ten-year history, the stock looks to be close to an average historical value. Despite the P/E of the S&P 500 index being expensive vs history, we can see that under the hood there are high-quality names like Coke which have not participated heavily in the significant multiple expansion seen in other sectors such as tech. This gives me comfort that we are not entering a position in KO at a time when the valuation looks stretched.

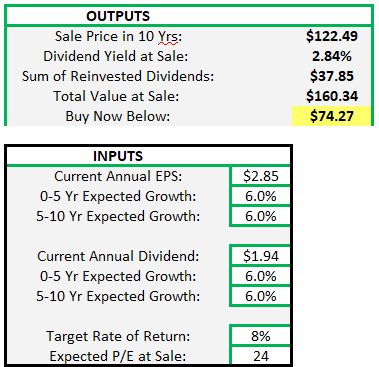

For my own DCF calculation, I assume earnings will grow at a rate of 6% per year, which is in-line with consensus analyst forecasts per Seeking Alpha. I assume that dividends can grow in-line with earnings, and I assume no multiple expansion from here. I target a return of 8% per year, which, I think, is a reasonable expectation when investing in mature consumer staples companies. Based on my numbers, KO look’s to be slightly undervalued at current prices, and thus I do not see valuation as an impediment to investors entering a position in Coke at this time.

Author

Risks

The most salient risk I see for KO is its product portfolio exposure to sugar-based products. As the world and governments become more aware of the risks posed to society from excessive consumption of sugar, there has increasingly been movement to incentivise people to consume less. This can come in many forms, including, levying additional taxes on sugar products and promoting healthy eating campaigns to increase public awareness. Additionally, the relatively recent rise of weight loss GLP-1 drugs has the potential to be a meaningful future headwind to snacks and sugar consumption if the drugs become widely used across the developed and developing world. At present, the prohibitive cost of the drug restricts their use to a small cohort of wealthy global citizens.

A secondary risk for KO is the risk of spiking raw materials prices. In their 10-k the firm states:

The Company is subject to market risk with respect to commodity price fluctuations, principally related to our purchases of sweeteners, metals, juices, PET and fuels” (Coca-Cola 10-K).

If we enter into a stagflationary environment with large increases in the price of raw materials for an extended period, Coke could find it difficult to offset margin dilution through price hikes to an already stretched consumer.

Conclusion

In conclusion, I believe that given the heightened macroeconomic uncertainty following last week’s jobs report, investors would be prudent to add high quality defensive stocks to their portfolio. I believe KO fits the bill perfectly as its price action last week stood in contrast to the broader market move, a signal I believe that investors will start to rotate into KO to protect their portfolios.

The stock provides investors with access to a steady stream of reliable growing dividends, a robust balance sheet that should allow investors to sleep easy at night, profitability metrics and returns on capital that stack up well against industry peers. Finally, based on my calculations, the stock seems to be trading at close to a fair value level for an 8% total return CAGR from here. For all of these reasons, I am recommending a buy on Coca-Cola.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.