Summary:

- I am impressed by Lucid Air, and I believe these luxury vehicles offer better-than-average specs at a premium price.

- Lucid’s business strategy is centered around capturing a share of the luxury EV market, and the company made some progress in doing so in Q2.

- Lucid faces a scalability problem, and if the company expands into the mass market for EVs, a new set of challenges will limit growth.

Khosrork

Lucid Group (NASDAQ:LCID) opened its first store in Dubai, where I live, a couple of months ago. Ever since then, I have been waiting to do some research about the company to understand the hype behind its luxury electric vehicles. The company’s first showroom in the Middle East was opened in Riyadh, Saudi Arabia, and the expansion into Dubai – home of the luxury car market in the Middle East – marks an important step in its goal of becoming a global EV brand.

After a careful evaluation of the Lucid Air, the flagship vehicle designed and developed by Lucid, I find it reasonable to conclude that the vehicle offers luxury specs indeed, including a luxury feel, generous horsepower, a high-tech interior, and a top-of-the-line range. As an investor, however, this is not good enough. A company – whether it be a retail business or a luxury carmaker – needs to find ways to expand profitably. This is where Lucid Group has failed and will continue to fail in the absence of a major strategy pivot. Although I am impressed by Lucid Air and the upcoming Lucid Gravity, I am forced to take a bearish stance on the company.

Second-Quarter Highlights

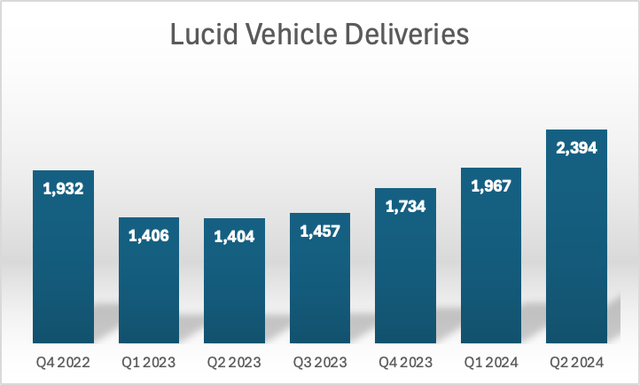

When Lucid reported earnings yesterday, there were some encouraging signs. Revenue increased 33% YoY to $200.5 million, and the adjusted EBITDA loss also narrowed from $710 million a year ago to $648 million. Lucid delivered 2,394 vehicles in Q2, a record high for the company.

Exhibit 1: Lucid vehicle deliveries

Company filings

Lucid expects to produce 9,000 vehicles this year, and in more interesting news, the company announced a $1.5 billion commitment from an affiliate of the Saudi Public Investment Fund.

The Niche Market Focus Makes Profitability Challenging

The biggest challenge for Lucid today is scaling profitably. The company is trying to position itself as a luxury EV maker compared to Tesla, Inc. (TSLA) which has already made inroads into the mass market for electric vehicles. It took 18 years for Tesla to become profitable, but investors were rewarded handsomely during this journey as the company quickly emerged as a global EV superpower. Lucid, however, may never achieve a similar feat.

First, let’s understand Lucid’s brand strategy.

Lucid is focused on developing high-end EVs to cater to the demand for luxury electric vehicles. This is a niche market segment where the company will have to compete with established automakers such as Mercedes-Benz and BMW. Another key part of Lucid’s brand strategy is its consistent emphasis on innovative technology, which enables the company to design premium vehicles. These technologies can be primarily seen in the motor design and battery performance. Advanced tech allows Lucid to offer a market-beating range and high performance, but these features do come at a high cost to the consumer, similar to any other luxury car.

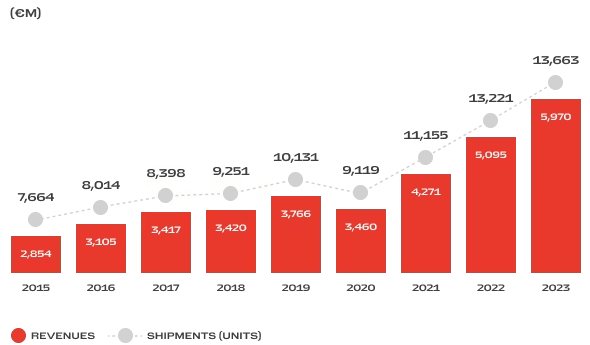

Another key aspect of Lucid’s business strategy is maintaining meticulous design to attract high-end buyers. This strategy resonates with Ferrari (RACE) which has built a loyal customer base through meticulous designs, high-performance features, and premium branding. If you take a look at the cabin interior of Lucid Air models, you will notice the use of high-quality material, which does not come as a surprise given the company’s vision. The only way that I see Lucid succeeding in the long run with this strategy is if it somehow emerges as a premium luxury EV brand respected by car collectors worldwide. Ferrari, as you can see below, is only selling a fraction of the units sold annually by big automakers, but still enjoys high profits.

Exhibit 2: Ferrari revenue and shipments

Ferrari

Lucid, similar to other luxury carmakers, offers a personalized buying experience to potential customers (which I experienced in Dubai), which includes custom vehicle configurations as well.

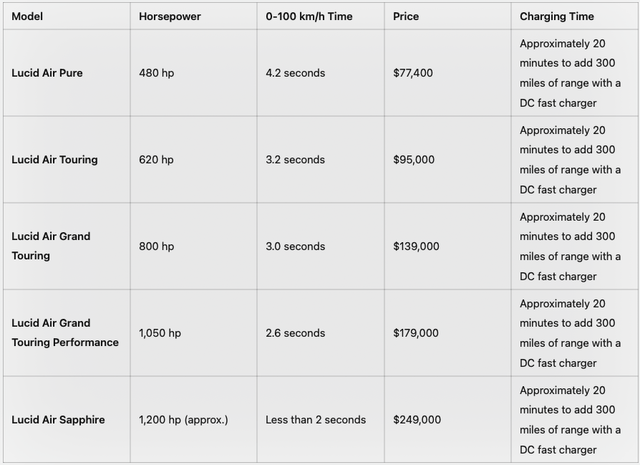

Although many investors are comparing Lucid with Tesla, I believe this is an apples-to-oranges comparison given the brand strategy differences that I have observed between the two. While Tesla caters to the mass market, Lucid is focused on the high-end market. The table below summarizes some key details of Lucid Air vehicles. Tesla’s most expensive vehicles, such as Model S and Model X start at around $76,000 today, while the cheapest Lucid Air Pure starts at a fraction above that cost.

Exhibit 3: Lucid Air prices and specifications

Lucid Group

Lucid is losing money with every car it sells. Scaling production, for now, will not take the company anywhere as it would backfire on its premium brand strategy. Lucid, therefore, has found itself backed into a corner today. To make matters worse, the competition in the luxury EV market is already heating up, and I fear increased competition will displace small-scale players such as Lucid.

Mercedes-Benz EQS and EQE sedans, BMW i7 and iX, Audi e-tron models, and Porsche Taycan have already made their presence felt in the luxury EV segment. What’s more concerning, is that there is a strong lineup of luxury EVs scheduled to debut in the foreseeable future. These include the Cadillac Celestiq, Porsche Macan EV, Mercedes-Benz EQG, BMW i5 Touring, Audi A6 e-tron, and the planned Range Rover EV.

Lucid needs to sell a substantially higher number of vehicles to break even, and this will be easier said than done amid the intensifying competition in the luxury EV space. Established luxury brands – not Tesla – pose the biggest risk to Lucid’s success, in my opinion, contrary to the belief of many investors and analysts who believe the EV sector is a zero-sum game where any newcomer has to beat Tesla to earn profits. I believe Lucid, as a luxury EV maker, can coexist with Tesla but I am doubtful whether it can ever scale profitably amid the rising competition in the luxury space.

The Mass Market Narrative

In September 2023, Lucid CEO Peter Rawlinson indicated that the company is planning to capture a share of the mass market for EVs by launching an EV priced around $50,000, which would help it compete with the likes of Tesla Model 3 and Y. Speaking at the Goodwood Festival of Speed last May, CEO Rawlinson reiterated the need to tap into the mass market.

If you only come away with one thing from this meeting with me today, do not think of Lucid as a niche luxury car company. We’re gonna be huge. I want us to sell a million units a year and have a much bigger impact than that.

Although the mass market narrative is compelling under the assumption that Lucid will leverage its technology to bring a more economical option with better specs such as a higher range than a Tesla Model 3 or Y, this will put the company in direct competition with almost all traditional automakers and Chinese EV giants such as BYD Company Limited (OTCPK:BYDDF). This is not an attractive proposition either, given that Lucid will have to incur substantial R&D and marketing expenses to make inroads into this competitive market.

Overall, I believe Lucid faces a challenging future regardless of whether it expands into the mass market or not, which makes its cheap valuation compared to established EV makers a trap.

Takeaway

Lucid Group is making some progress in establishing itself as a leading player in the luxury EV market. However, the company is finding it difficult to scale profitably, which I believe will be an ongoing challenge in the foreseeable future. The competition in this niche market segment is also primed to intensify, which creates a displacement risk for Lucid. On the other hand, the planned expansion into the mass market segment may also yield lackluster returns in the next few years due to structural disadvantages faced by the company compared to traditional automakers, who are years ahead of EV adoption due to investments in service centers, charging networks, battery technology, and more market visibility for products. Despite acknowledging the appeal of Lucid Air and Lucid Gravity to a small segment of car enthusiasts representing the luxury EV market, I am taking a bearish view of the company due to the lack of expected profitability in the next five years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.