Summary:

- Block reported better than expected results for Q2, driven by Cash App strength.

- Cash App segment generated 24% Y/Y growth and Block’s adjusted EBITDA is surging.

- The Fintech is trading at only a 13X P/E ratio and offers a high safety margin to investors.

BlackJack3D

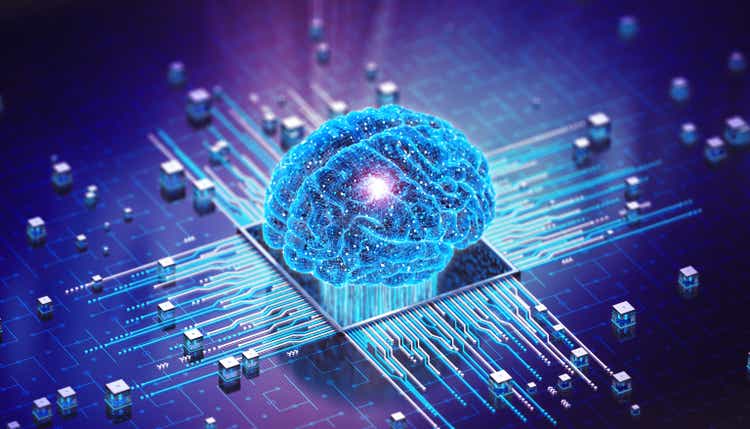

Block (NYSE:SQ) reported better than expected results for its second fiscal quarter last week, driven by Cash App strength, but fell short on top-line estimates. Block generated double-digit growth in gross profits in both segments, Cash App and Square, but the former continues to grow significantly faster. Block’s shares have come under pressure since the earnings report date, chiefly because of market weakness that is driven by concerns over a recession. I believe the drop is another buying opportunity for long term-oriented growth investors that like to capitalize on Block’s continual Cash App momentum!

Previous rating

I rated shares of Block a strong buy in June because the Fintech saw considerable upside momentum in Q1’24 in its Cash App ecosystem, in terms of both users and gross profit growth, which created a favorable contrast to slower-growth Fintech plays like PayPal (PYPL). In the second fiscal quarter, Block continued to execute its growth strategy well, and gross profits in its crown jewel segment Cash App generated 9 PP faster growth than Square. With the market currently creating new investment opportunities on sentiment weakness, Block is one Fintech I am adding to on the drop.

Cash App momentum, expanding market size, strong capital inflows

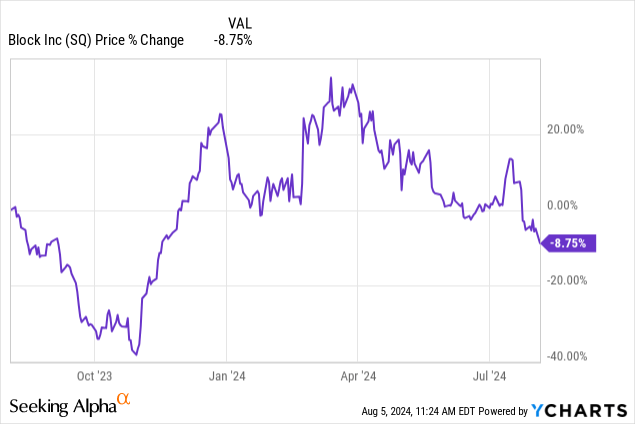

Block reported better than expected earnings results for Q2, but missed on the top line: the Fintech beat EPS estimates by $0.09 per-share on an adjusted basis, due to Cash App momentum, while falling short of the average revenue estimate by $143M. Overall, Block reported solid results, however, and the Fintech is experiencing an upswing in profitability.

Seeking Alpha

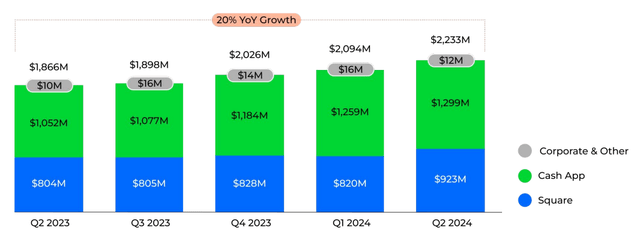

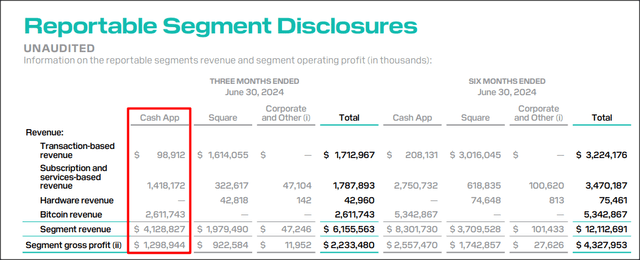

Block’s Cash App segment, which is centered on its mobile payments platform, generated $1.3B in gross profits in the second-quarter, showing 24% year over year growth. Square, which offers point-of-sale technology, added $923M in gross profits, which reflected a year over year growth rate of 15%. On a consolidated basis, Block’s gross profits grew 20% year over year to an all-time record of $2.23B.

Block

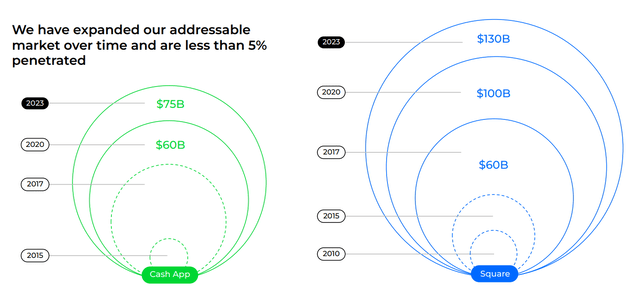

What makes Block valuable is the Cash App, which is seeing serious growth momentum and the segment is facing a growing market opportunity. The addressable market opportunity has expanded greatly for Block in the last decade, chiefly because of the growth of Block’s Cash App ecosystem, which makes instant mobile payments easy and convenient. Block is especially successful in attracting Gen-Z and Millennial users to its ecosystem, which are, as an example, driving Cash App Card adoption.

Block

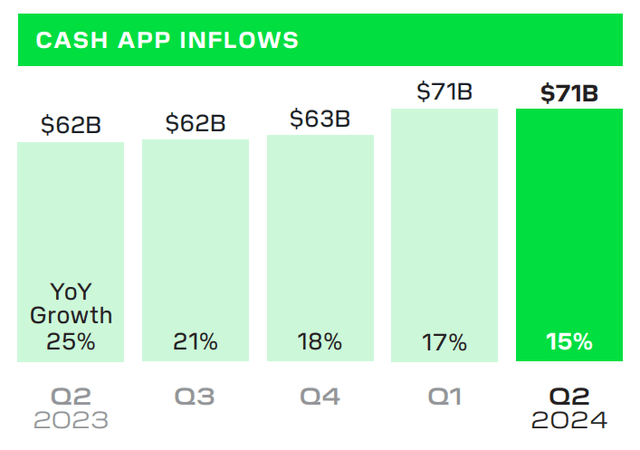

The popularity of the Cash App can be assessed, as an example, by looking at the amount of capital that is flowing into the Cash App ecosystem. The Cash App ecosystem saw an inflow of $71B in new cash in the second-quarter, which represented a 15% year-over-year growth rate. While this growth rate is decelerating, down from 17% in Q1’24, the amount of new cash entering the ecosystem sets the Cash App up for continual gross profit growth in this specific segment.

Block

The Cash App’s gross profits come chiefly from subscription and services-based revenue, which leads to a high-quality earnings profile. Square is more transaction-oriented and therefore the earnings prospects of the segment depend chiefly on the usage of the company’s technology at retail locations. From a growth perspective, I like the Cash App segment more as the company has more control over its payments platform.

Block

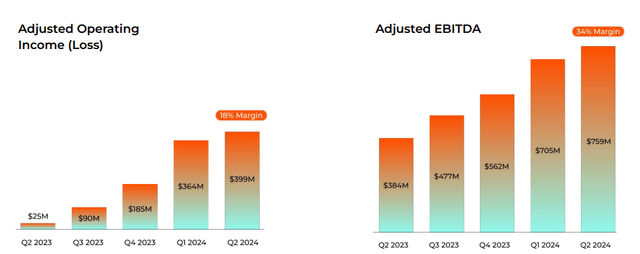

Surging profitability and EBITDA margin expansion

Block’s Cash App growth has led to a serious upswing in the Fintech’s profitability, which I feel is not properly reflected in the company’s valuation. In the second fiscal quarter, Block generated $759M in adjusted EBITDA, showing 98% year over year growth. Block’s EBITDA margin also expanded considerably: the EBITDA margin, calculated as a percentage of gross profits, expanded from 21% last year in Q2 to 34% in Q2’24, showing a 13 PP gain.

Block

Catalysts for an upside revaluation

There are three specific catalysts for Block that I could see drive a revaluation of the Fintech’s shares going forward:

- Growing Cash App usage and continual inflows of capital into the Cash App ecosystem. Within Cash App, the number of Cash App Card users is growing and will likely continue to grow. At the end of the June quarter, Cash App Card users totaled 24M, showing 13% year-over-year growth. This growth in Card users could make the Cash App ecosystem more attractive for users and led to a steady stream of new Card adopters.

- Block also has an opportunity to grow its profits internationally, through expansion. Square International generated $121M in gross profits from markets outside the U.S. which represented 13% of Square segment gross profits in Q2’24. The growth rate in international Square gross profits exceeded 30% Y/Y in Q2, indicating that Square has a strong opportunity for growth here.

- Stock buybacks at a low P/E ratio of 13X are a good use of capital for the company. Block authorized a $1.0B stock buyback last year in October and repurchased $390M worth of its shares in the last quarter. I would expect, especially in the context of surging profitability, to see an upside to Block’s stock buyback plan next year.

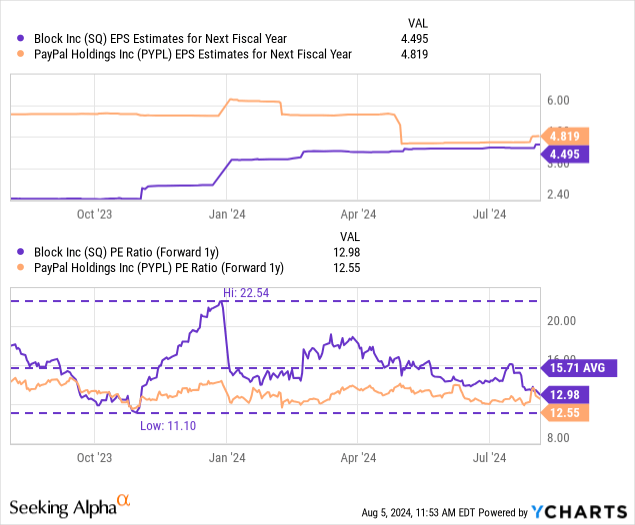

Block’s valuation compared against other Fintech rivals

Block is profitable on an operating income and adjusted EBITDA basis, which is why I am valuing the Fintech’s potential based on a price-to-earnings ratio. Block is currently valued at a forward (FY 2025) P/E ratio of 13.0X, which, in my opinion, is largely due to the Fintech experiencing selling pressure as part of the recent market down-turn.

PayPal is trading at 12.6X forward earnings, but PayPal is also expected to grow slower than Block: PayPal is projected to see about 10% earnings growth next year, while Block is expected to 27% growth. This growth comes chiefly from Block’s Cash App segment, as discussed above. PayPal, which is the most serious rival in the Fintech market for Block, also reported better than expected results for Q2 and I believe that PayPal especially makes a strong value proposition given its large platform size and considerable, recurring free cash flow of $1.0B+ per quarter: Hard Not To Love At This Price.

In my last work on the Fintech in May, I said that Block could trade at a much higher P/E ratio of 25X given it expanding total addressable market, surging profitability and consistent momentum in both Square and Cash App, but especially the latter. Analysts expect ~$4.50 per-share in earnings next year, which I consider to be reasonable given the current explosion of profitability at the Fintech. As a result, based off of consensus estimates, I derived a fair value of $108. I am standing by my fair value calculation after Block’s Q2 results, but believe it may take the Fintech longer to realize this stock price target, especially with the market getting more difficult. With shares trading 46% below my fair value estimate, Block’s valuation also reflects a high safety margin.

Risks with Block

Mobile-focused payment platforms like Block are seeing strong user growth as customers tend to do everything they need to do these days on their smartphones. As such, Block is set to benefit from the overall expansion of its payment network and growing addressable market, especially in the Gen Z and millennial demographics. What would change my mind about Block is if the company were to see a leveling off of its adjusted EBITDA growth and weaker gross profit growth in Cash App. There is also the general risk of Fintechs remaining out of favor in a market, which may make investors more defensive and risk-averse.

Closing thoughts

Block executed its growth strategy well in the second-quarter, and the Fintech continued to stand out with its strong gross profit growth in its important Cash App segment. While Square is also growing, the segment achieves a much lower gross profit growth rate and customers sign on to Block chiefly because of the Fintech’s Cash App ecosystem. The continual expansion of EBITDA margins and earnings upswing are two reasons why I believe Block can grow into a higher valuation. Investors currently appear to favor a risk-off approach to investing, but I believe the long-term growth prospects for Block are intact. With shares now trading at a comparable P/E ratio as PayPal, while offering significantly faster EPS growth prospects, I believe shares remain a strong buy after Q2!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SQ, PYPL, UPST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.