Summary:

- Financial sector is dealing with the long-term volatility of the current permacrisis.

- JPMorgan Chase has a very promising short-term setup which is in line with its great long-term performance.

- There might be some period of narrow trading before the return to a confirmed uptrend.

Guido Mieth

Sector and Industry Performance

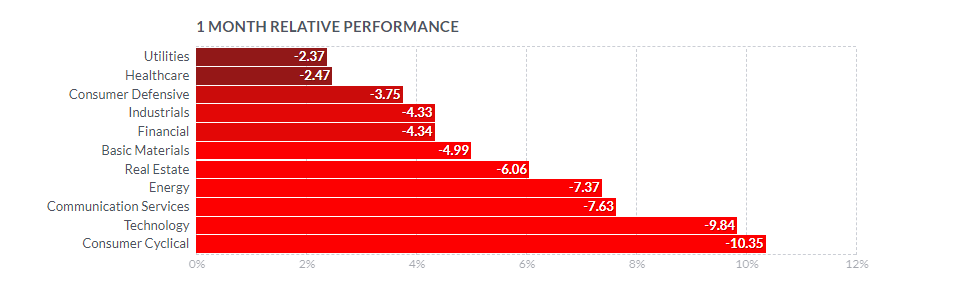

As for the 1-month relative performance, the Financial sector has been an average performer with a loss of 4.34%, just 2 percentage points worse than Utilities.

1-month performance of sectors (Finviz)

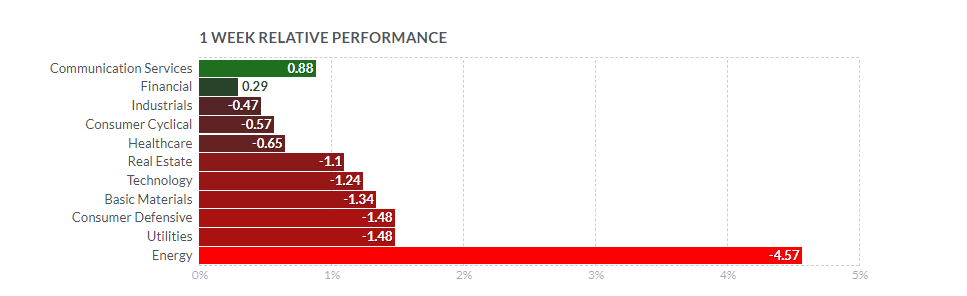

The 1-week return of the Financial sector has been, however, already in positive territories, with nearly 0.3%, the second best of all sectors.

1-week performance of sectors (Finviz)

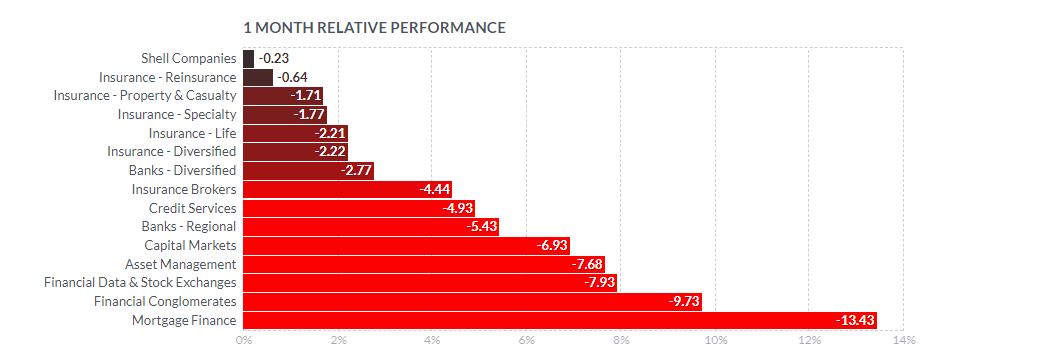

On the level of the Financial sector, the Banks-Diversified industry, to which JPMorgan Chase & Co. (NYSE:JPM) is classified on Finviz, was also bringing a loss of 2.77%, not as bad, however, as Asset Management or Mortgage Finance industries.

1-month performance of industries within the financial sector (Finviz)

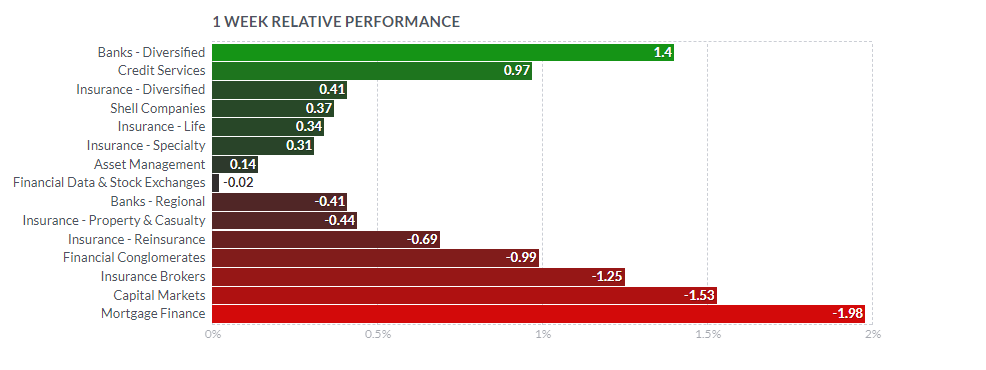

On the 1-week return basis, Banks-Diversified rule supreme with a green 1.4%, leading the sector.

1-week performance of industries within the financial sector (Finviz)

Peers and relative performance

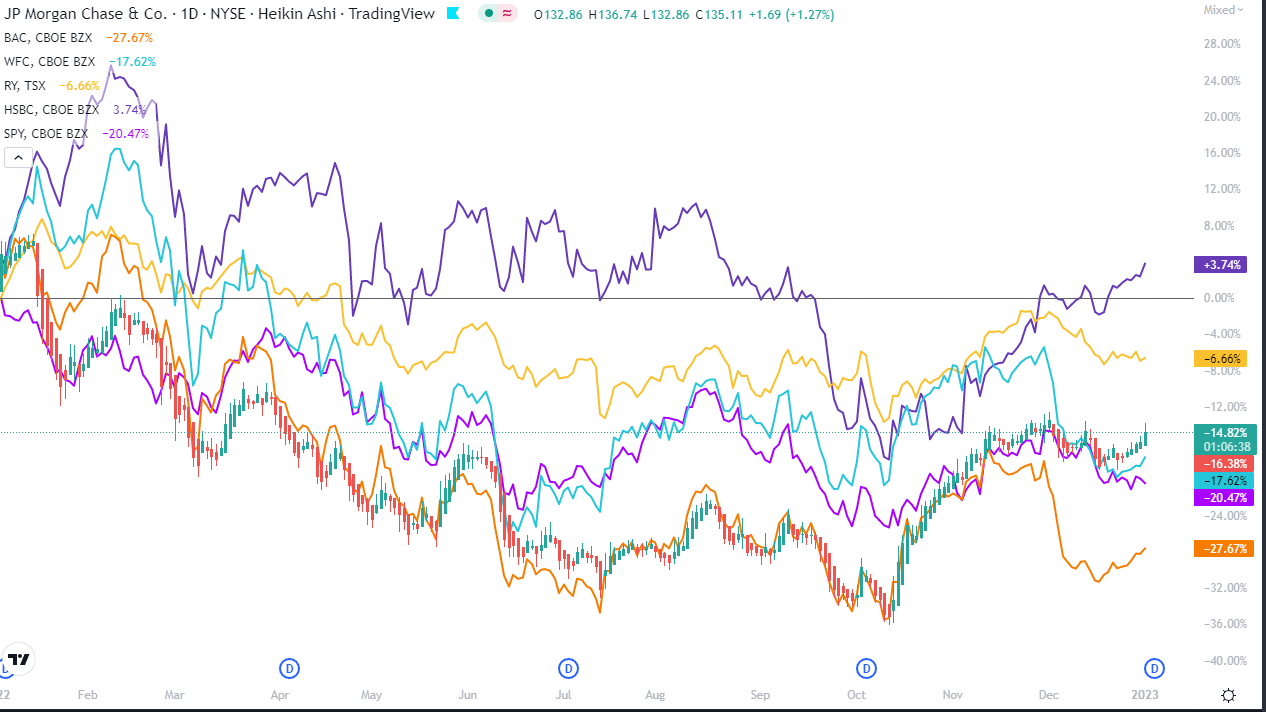

As can be seen below, the 1-year return of JPMorgan Chase of -14.80% has been slightly better than the return of its competitor, Wells Fargo (WFC), which came with -17.56%, and much better than the S&P500 index (to which it belongs) reflected by SPY ETF, which returned -20.37% at the time of writing. Better results are seen for Royal Bank of Canada (RY, -6.68%), and only HSBC Holdings (HSBC) has a positive 1-year return of 3.76%. Bank of America (BAC) did the worst with -27.65%.

1-year performance of JPM and peers (TradingView)

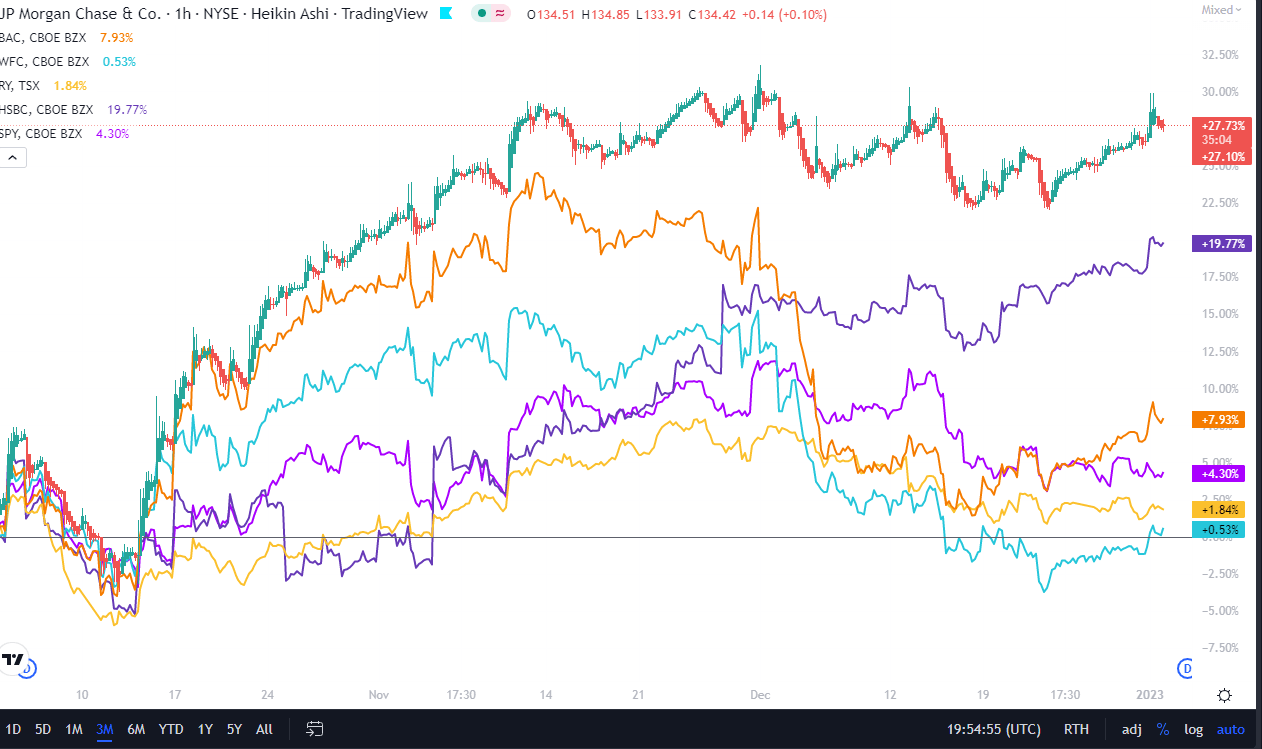

On the 3-month timescale, JPMorgan Chase has taken over HSBC and leads the pack with a very decent return of nearly 28%.

3-month performance of JPM and peers (TradingView)

I will analyze JP Morgan from a perspective of a number of technical analysis tools and show the screenshots on the monthly, weekly, and daily Heikin Ashi candles charts – each timeframe presented through two separate sets of indicators – which I will complement with a simplified daily Renko chart.

Explanation of My Technical Analysis Toolbox

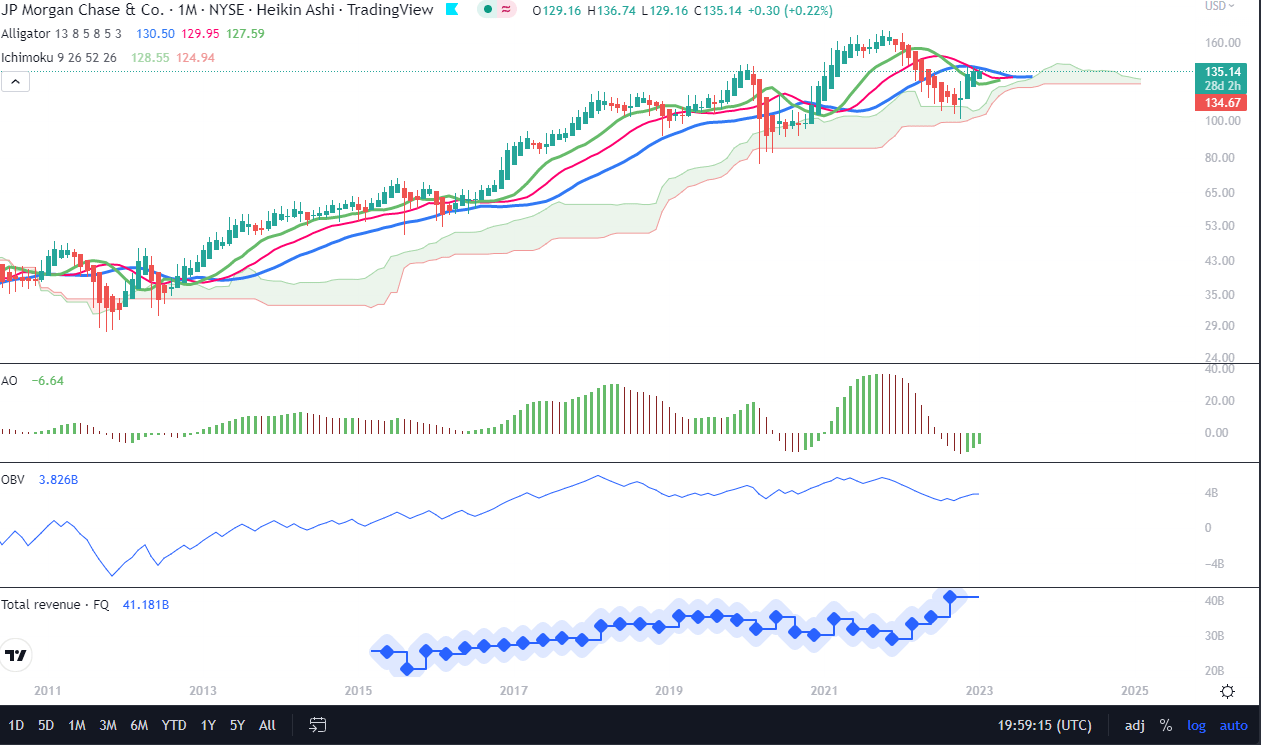

The first chart setup (I will call it Chart 1) uses Bill William’s Alligator indicator and Awesome Oscillator, as well as Ichimoku Clouds and On Balance Volume indicator line. For fundamentals, I show the quarterly revenue trend which I use for quick visual triage.

The Alligator technical analysis tool uses three smoothed moving averages that are based on thirteen, eight, and five periods, called also Jaw (blue line), Teeth (red line), and Lips (green line), respectively. Due to the smoothing of each moving average, the Jaw makes the slowest turns and the Lips make the fastest turns. The Lips crossing down through the other lines signals a short opportunity while crossing upward signals a buying opportunity.

William’s Awesome Oscillator (AO) is a market momentum tool that visualizes a histogram of two moving averages, calculated on median prices of a recent number of periods compared to the momentum of a larger number of previous periods. If the AO histogram is crossing above the zero line, that’s indicative of bullish momentum. Conversely, when it crosses below zero, it may indicate bearish momentum.

As for the Ichimoku Cloud – I am not using a full set of lines of Ichimoku lines, only the Leading Spans A and B, whose crosses dictates the color of the cloud and whose individual lines provide levels of the strongest support and resistance lines. Ichimoku averages are plotted into the future which in its own right provides a clearer picture but have no predictive powers.

On-Balance-Volume (OBV) indicator is a volume-based tool and is supposed to indicate the crowd sentiment about the price. OBV provides a running total of an asset’s trading volume and indicates whether this volume is flowing in or out, especially when viewed in divergence with the price action.

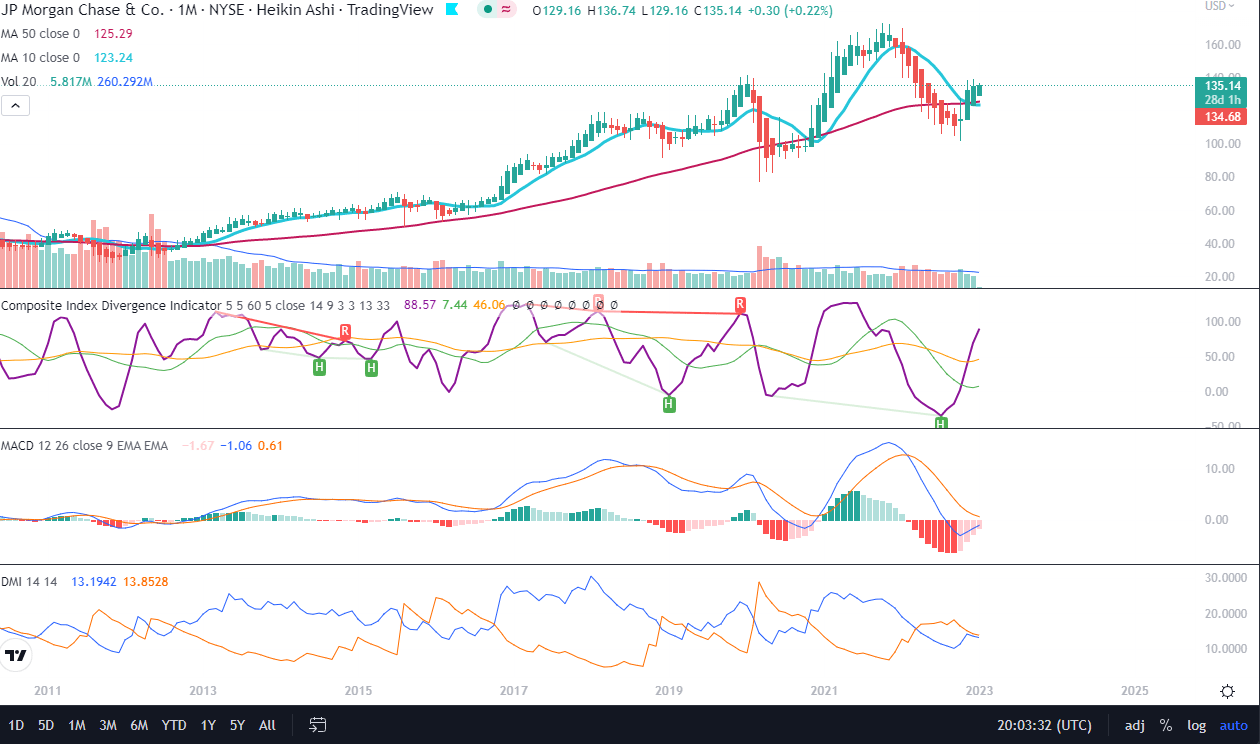

The second chart setting (Chart 2) uses 2 moving averages (10- and 50-period), volume, and volume’s 20-period average. On the screenshot from top to bottom, you will see the Composite Index Divergence Indicator (CIDI), which I learned from the book of Constance Brown, as well as J. Welles Wilder’s Directional Movement Indicator (DMI). I also use MACD (Moving Average Convergence Divergence) which is well known to everybody: I seek crossovers of MACD and signal, as well as above/below the zero level.

CIDI comes from a combination of RSI with the Momentum indicator. For more literature, see Brown’s paper or read her book. CIDI has been developed to solve the problem of RSI not being able to show divergence. I personally use the CIDI’s crossover above and below its slow and fast-moving averages, as well as the position of the averages against each other.

As for DMI, I skip the ADX line because it doesn’t give me anything. Instead, I focus on the crossovers of the Positive Direction Indicator DI+ and Negative Direction Indicator DI-. When the DI+ is above DI-, the current price momentum is upwards. When the DI- is above DI+, the current price momentum is downwards.

On the use of Heikin Ashi candles and Renko boxes, I use them as tools for trend reversal and continuation identification. Renko charts do not have a time scale and they are built on price movements that must be big enough to create a new box or brick. Similar to Heikin Ashi, Renko charts filter the noise.

As you might have guessed, my focus is on identifying the trend reversal and filtering the noise that allows the position continuation without the risk of too many false signals. However, I will be honest with you – I am not showing here all the technical indicators that I use for screening and analysis since they belong to my secret sauce.

The Long-Term Trend

For the long-term trend analysis, I use monthly charts. See below Chart 1, where JPM continues the green march despite a couple of hiccups in the past. The Ichimoku Cloud has not changed its color ever since it turned green in January 2012. Awesome Oscillator, although now in the negative territory, has been rising for the last 3 months. Alligator’s lines have not yet crossed decisively, but are touching each other (Lips line touches Teeth line, Teeth line touches Jaw line) and all three of them are slightly flattish to directing upwards. Were the green Lips already above the red Teeth line and AO above the zero line, I would be recommending a Strong Buy. OBV is directing upwards and slowly recovering from the mi-2022 lows. The bottom pane is the revenues line.

Chart 1 – Monthly (TradingView)

On Chart 2, besides the 10-month Moving Average still below the 50-month (but flattening), we can appreciate the continuous upward slope of the 50-month MA. CIDI has crossed above its both fast (green) and slow (orange) averages and the fast average is seemingly flattening to possibly make a U-turn in the nearest future. The monthly MACD seems to be one or two months away from crossing its signal from below – another positive momentum signal. Monthly Positive Direction Indicator DI+ has not crossed above Negative Direction Indicator DI- yet but has significantly narrowed the distance. DI+ and 10-month MA are the only technical signals that I am waiting for on this specific chart to confirm the uptrend potential.

Chart 2 – Monthly (TradingView)

The Mid-Term Trend

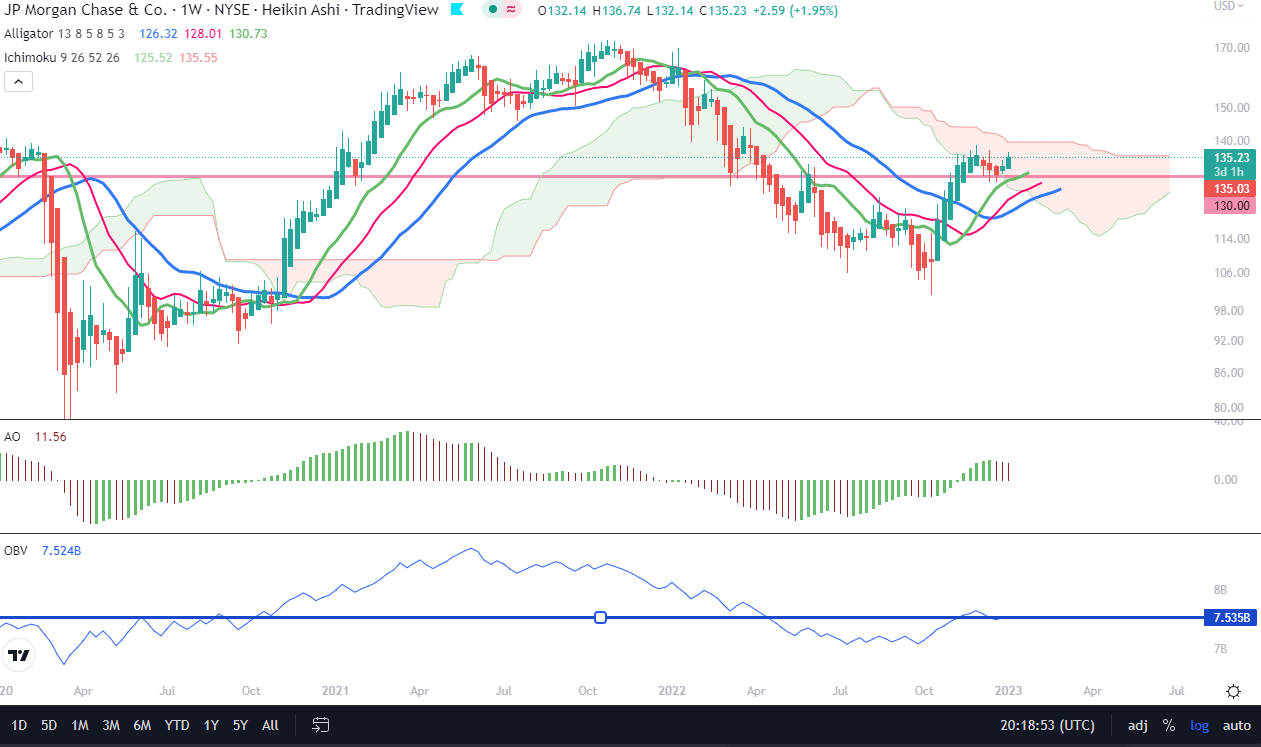

As we can notice in Chart 1, the Ichimoku Cloud is narrowing with the lower edge rising. The upper edge constitutes a strong resistance line around the $136 price. I have drawn a thick horizontal line (pink color) on the level of $130 which seems to be the closest mid-term support line and is also overlapping with the lower edge of the previous green Cloud from the period nearly a year ago.

All the lines of the Alligator are flowing upwards after the positive crossings took place at the end of November – beginning of December. Awesome Oscillator is already in the positive territory but recently has been falling. OBV is rising and reaching the levels (connected by the blue horizontal line) from the period of the 2020 crash and the following accumulation and the 70% rally.

Chart 1 – Weekly (TradingView)

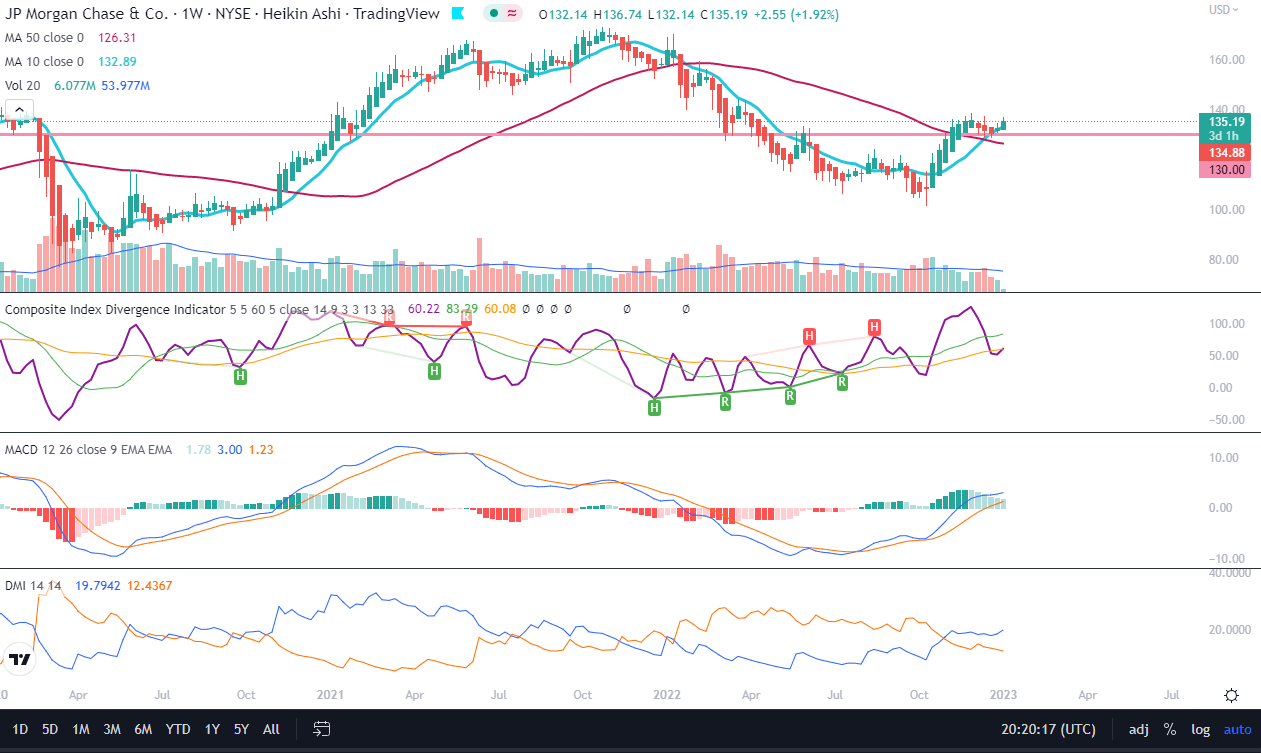

On Chart 2, we can appreciate that 10-week MA has just crossed the 50-week MA from below but it took place on a low volume. The most positive build-up we see in the CIDI line making a U-turn and bouncing off the slow average, which is below the fast average already anyway. Both weekly MACD and its signal are above the zero level and MACD is above the signal, too. The lines are facing upwards. DI+ crossed DI- some weeks ago and is widening the distance with a sharp positive uptick. The only worrying signs are the low volumes and narrow range of trading. It may take an unknown time before the price decision becomes clear. It will most certainly surprise everyone.

Chart 2 – Weekly (TradingView)

The Short-Term Trend

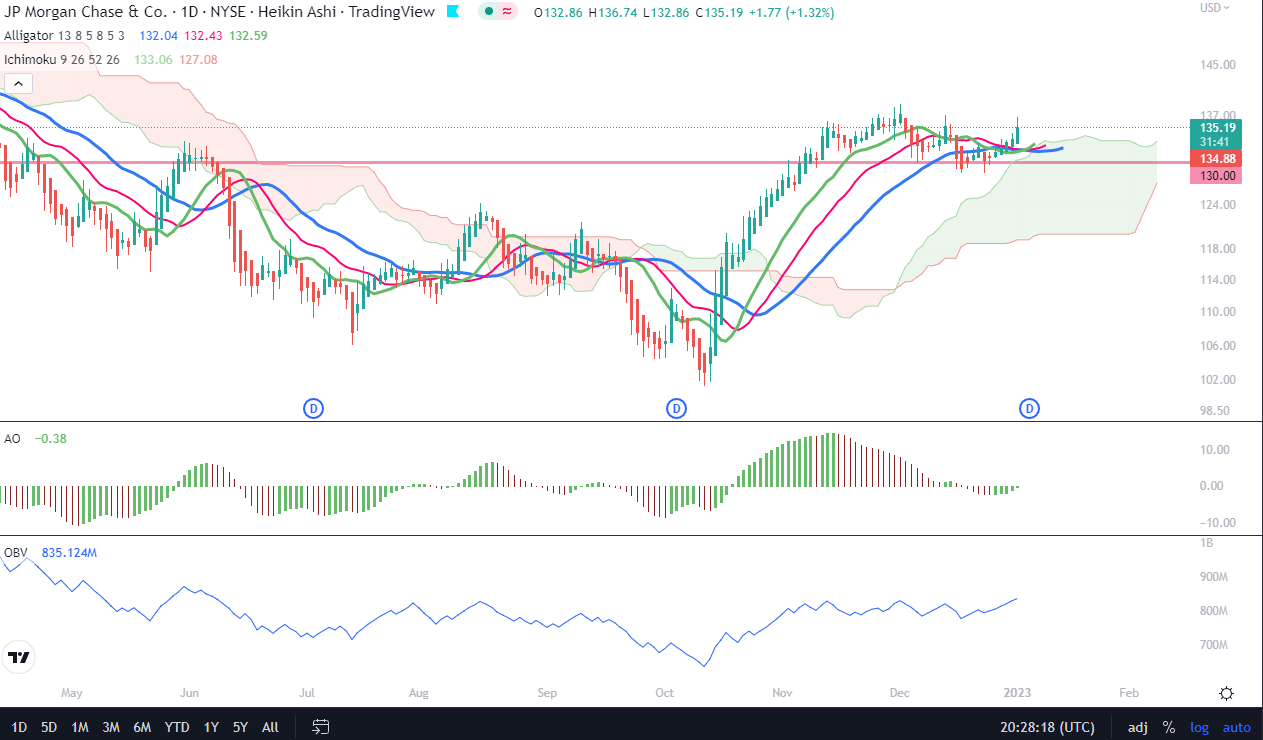

As we can see on Chart 1, the Ichimoku Cloud is fat, green, and facing upwards with its both upper and lower edges. Alligator’s lines are all in the positive setup and also rather facing upwards than laying flat. Awesome Oscillator seems to be coming to cross over the zero line within the next days. However, there is a high probability of a shakeout if the price will drop to or slightly below the $130 support line. OBV line seems to be stable on the current levels and directed upwards.

Chart 1 – Daily (TradingView)

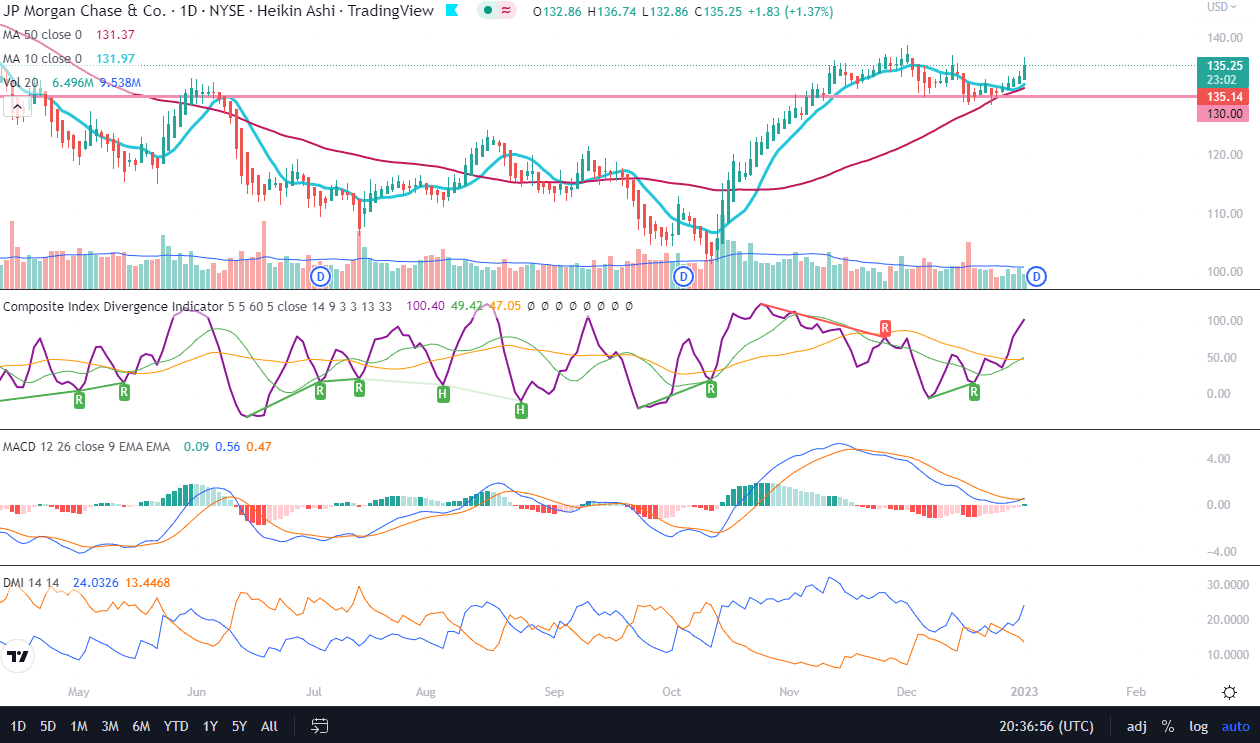

As for the picture on chart 2, the readings of indicators are positive for all of them. The 10-day MA is bouncing off the 50-day MA, the latter having made a beautiful round bottom in the last months. CIDI is strongly going upwards and its fast average is just now crossing the slow average. MACD is just now crossing over its signal, and the DI+ has made a sharp move above the DI-.

Chart 2 – Daily (TradingView)

Price Momentum

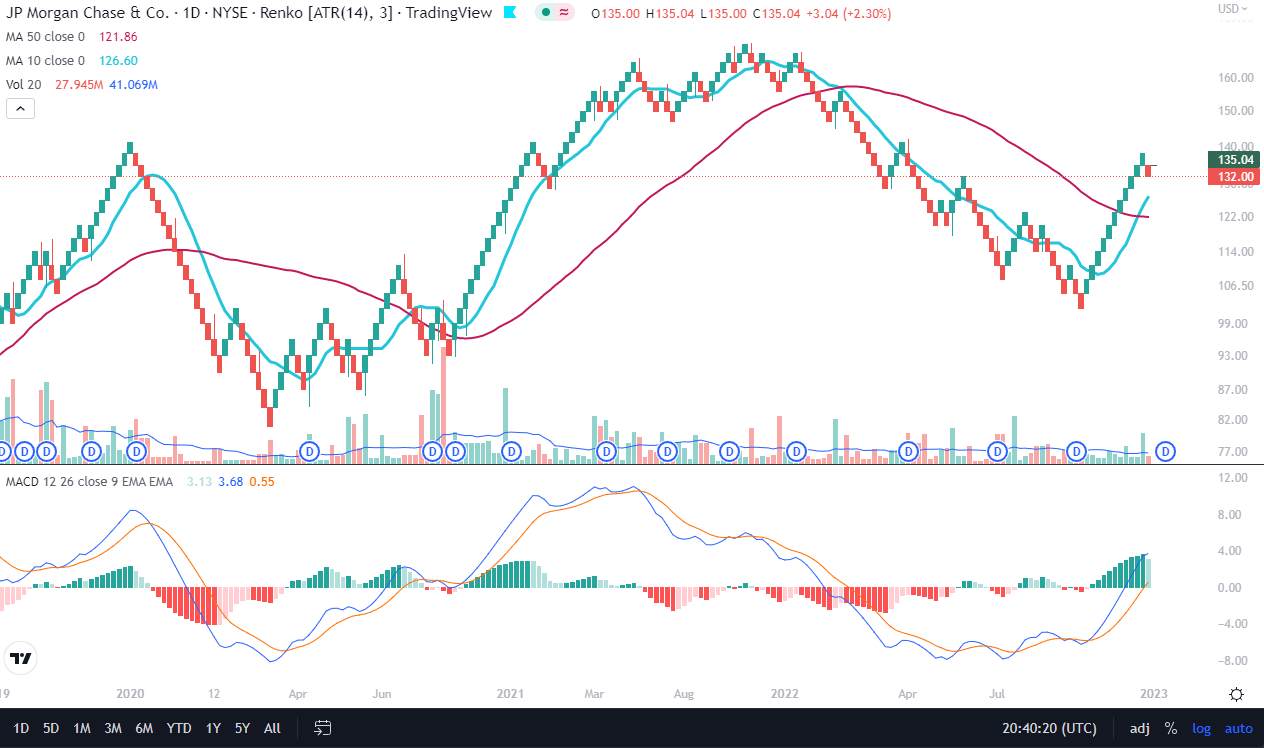

The daily Renko chart presents the important junction of the moving averages which may resolve both ways. The looks of MACD and its signal crossing above the zero line and the cross of the 10-box MA above the 50-box give strong hopes for the beginning of an uptrend. The last time a similar setup was visible was in the Summer of 2020.

Renko Daily (TradingView)

Conclusions

Technically, JPMorgan Chase seems to be ready for a breakout. There might be a period of accumulation that aims at exasperating the weak hands, however, the following upwards direction seems to be cooking underneath.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.