Summary:

- Advanced Micro Devices, Inc. reported strong Q2 2024 earnings above expectations, driven by data center and client segment growth.

- Data center segment revenue doubled, with strong demand for EPYC CPUs and Instinct GPUs.

- Data center GPU guidance was increased as a result of strong demand.

- Client segment growth in the second half will likely also be strong due to product launches and AI PCs.

JHVEPhoto

Advanced Micro Devices (NASDAQ:AMD) reported Q2 2024 that was above expectations.

In particular, at a time when the AI story is being debated and questioned, AMD showed investors that it is seeing strong demand, and that it is getting started.

Even the non-AI side of the data center business looks promising in the second half of 2024, along with the client segment posting strong growth from product launches and growing demand for AI PCs.

I have written extensively about AMD on Seeking Alpha, which can be found here.

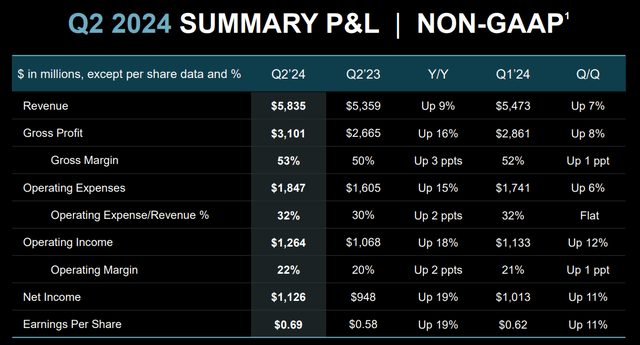

2Q24 earnings

AMD’s 2Q24 financial results came in above expectations, with the data center segment being the main star of the show as revenues more than doubled in the quarter, while client segment revenue also grew rather significantly.

For 2Q24, revenues were up 9% from the prior year to $5.8 billion, where revenue growth in the data center segment and client segments were offset by lower revenues in the gaming and embedded segments. Revenues beat consensus by 2%.

Gross margins expanded by 340 basis points from the prior year to 53%, which was largely due to the higher data center revenues.

Operating income was up 18% from the prior year to $1.3 billion, representing a 22% operating margin, 200 basis points higher than the prior year. This was despite operating expenses increasing 15% during the quarter as AMD continues to invest in the R&D and go-to-market necessary to tackle the AI opportunities.

Diluted earnings per share grew 19% from the prior year to $0.69 per share, beating consensus by 1%.

I will now share more on individual segments.

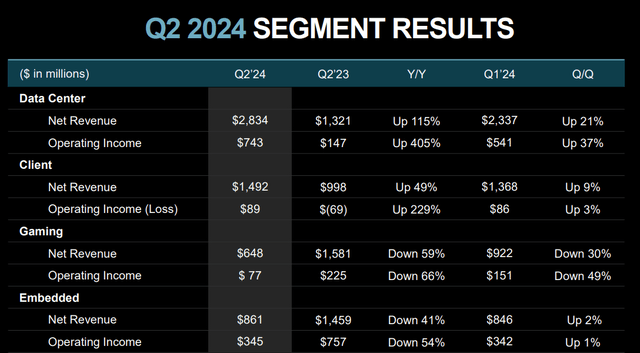

The data center segment now represents almost 50% of AMD’s total revenues. In the 2Q24 quarter, AMD’s data center segment revenues grew 115% from the prior year to $2.8 billion. This was largely due to the steep ramp of its new AMD Instinct GPUs, along with solid double-digit revenue growth for EPYC server CPUs. The operating income came in at $743 million, up 405% from the prior year due to the steep ramp in revenues and operating leverage, despite increasing its investment in R&D significantly.

The client segment now makes up about 25% of revenues, the second-largest segment for AMD. The client segment revenue grew 49% from the prior year to $1.5 billion, showing strong growth due to AMD Ryzen processor sales. Operating income for the client segment came in at $89 million, improving from the loss of $69 million in the prior year.

The gaming segment now only makes up 10% of revenues, down from close to 30% in the prior year. The gaming segment revenue fell by 59% from the prior year to $648 million in 2Q24, largely because of the digestion of semi-customer inventory and lower end-market demand. Operating income for the segment came in at $77 million, down from $225 million in the prior year.

Lastly, the embedded segment revenue mix also fell from the almost 30% in the prior year to 15% today. The embedded segment revenue came in at $861 million, down 41% from the prior year, as inventory levels continue to normalize. Operating income for the segment came in at $345 million, down from the $757 million from the prior year.

AMD generated $439 million in free cash flows in the quarter, and the company has $5.3 billion in cash and short-term investments in its balance sheet as of end 2Q24.

In the quarter, AMD bought back $352 million worth of shares and has $5.2 billion in shares remaining in its current authorization.

Outlook

In 3Q24, management expects revenue to be $6.7 billion, up 15% sequentially, largely due to the continued strength in the data center and client segments.

While the gaming segment is expected to continue to be down by double-digit percentage, the embedded segment revenue is expected to increase.

From a year-on-year perspective, the 3Q24 revenue implies 16% growth, largely due to the steep ramp of AMD Instinct processors and strong server and client revenue growth to more than offset the declines in the gaming and embedded segments.

3Q24 gross margins are expected to be 53.5% and operating expenses expected to be $1.9 billion.

Management raised data center GPU expectations for 2024 from the earlier $4 billion guided in April to the new $4.5 billion due to the strong customer demand and solid traction the company is seeing.

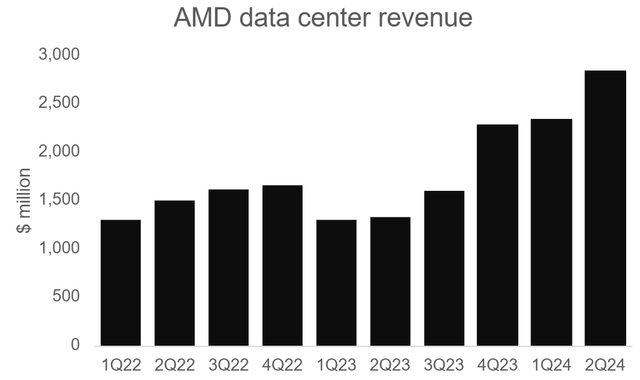

Data center segment

As highlighted before, the data center segment is now the largest segment for AMD, at approximately half of total revenues.

The strong 115% growth in the data center revenue in the quarter was due to both AI and non-AI businesses.

AMD data center revenue (Author generated)

The server CPU side of the business, or the non-AI side, was strong this quarter, delivering solid double-digit revenue growth.

This is largely due to hyperscalers deploying the fourth generation of EPYC CPUs to more of their own internal workloads and public instances.

It is clear that within the non-AI data center business, AMD is gaining market share.

Firstly, AMD’s EPYC CPUs are used to power an increasing number of applications and workloads, displacing AMD’s competitors and incumbent offerings in the process. This is largely due to the advantages in terms of performance and efficiency for EPYC CPUs. The clearest evidence of this is that the number of AMD-powered cloud instances available from the largest providers increased 34% from the prior year to more than 900. These instances are seeing a strong pull for both enterprise and cloud-first customers, with customers like Uber and Netflix selecting fourth-gen EPYC Public Cloud instances to power their workloads.

Secondly, in 1H24, more than 30% of AMD’s enterprise server wins were with customers that were deploying EPYC in their data centers for the first time. This highlights how AMD can win new customers while continuing to grow with its current customers. Enterprise sales were up a strong double-digit percentage sequentially, with wins from large customers like Adobe (ADBE), Boeing (BA), Siemens (OTCPK:SIEGY), among others.

Why will this continue?

AMD is not stopping with EPYC.

Its next-generation Turin family was recently publicly previewed in June, and customers saw the significant performance advantages it brought for compute intensive workloads.

The next-generation Turin family is expected to bring AMD further in terms of performance and efficiency leadership.

Turin is already ramping production ahead of launch and is expected to be broad OEM and cloud availability later in the second half of 2024.

I am optimistic about the server CPU business going into the second half of 2024. One reason is that AMD is seeing some spending return to the enterprise and cloud markets, which is a positive trend for the server CPU market. Then the launch of Turin in the second half will bring some additional revenue tailwind. Put together, I expect share gains to continue within the server CPU space for AMD.

The second part of the data center business is the AI business. This is where we saw a steep ramp in MI300 GPUs led to a third quarter of record data center GPU revenue and the MI300 quarterly revenue exceeding $1 billion for the first time.

While there was some debate about who will use AMD’s MI300, the current and potential customers of MI300 we see today are very encouraging signs.

Firstly, on current customers, Microsoft (MSFT) is one of the first buyers of AMD’s MI300, where the company expanded the use of MI300X accelerators to power GPT-4 Turbo and multiple co-pilot services, including Microsoft 365 Chat, Word, and Teams. Moreover, Microsoft is the first large hyperscaler to offer general availability of public MI300X instances in 2Q24. Hugging Face is another customer of AMD, and it was one of the first customers to adopt the new Azure MI300X instances, allowing many other enterprise and AI customers to deploy models on MI300X GPUs with just one click.

Secondly, on customer pipeline, AMD’s enterprise and cloud AI customer pipeline grew in the quarter. The focus in the quarter continues to be working with system and cloud partners to ramp availability of MI300 solutions to meet this customer demand. Dell, HPE, Lenovo, and Supermicro all have Instinct platforms in production, and multiple hyperscale and tier-2 cloud providers are on track to launch MI300 instances this quarter. On the AI software front, we made significant progress enhancing support and features across our software stack, making it easier to deploy high-performance AI solutions on our platforms.

Management shared that the acquisition of Silo AI brings into AMD a team that significantly expands its ability to service large enterprise customers looking to optimize their AI solutions for AMD hardware.

Management highlighted its AI solutions work, where companies like Broadcom, Cisco, HP Enterprise, Intel, Google, Meta, and Microsoft joining AMD to announce the Ultra Accelerator Link, an industry standard technology to connect AI accelerators based on AMD’s infinity fabric technology.

In terms of the roadmap, AMD commits to an annual cadence.

The MI325X is expected to be launched later in 2024, which will have twice the memory capacity and 1.3 times more peak compute performance than competitive offerings.

The MI350 series that will be based on the new CDNA 4 architecture will then be launched in 2025, which is expected to a 35x increase in performance compared to CDNA 3.

The MI400 series will then be launched in 2026, which is powered by the CDNA “Next” architecture.

Client segment

The client segment grew strongly this quarter, due to strong demand for its Ryzen processors and initial shipments of its next-generation Zen 5 processors.

Zen5 brings an average of 16% more instructions per clock than AMD’s previous generation of Ryzen processors.

AMD’s newly announced Ryzen AI 300 series brings to the industry the fastest NPU with 50 tops of AI compute performance for Copilot Plus PCs. This weekend, the first Ryzen AI 300 series notebooks were sold and there have been strong reviews thus far. Management expects more than 100 Ryzen AI 300 series platforms will be launched from Acer, ASUS, HP, Lenovo, among others in the upcoming quarters.

AI PC is a category that will be incremental tailwinds to the overall PC category, with AMD expecting above typical seasonality, as a result of the product launches during the second half of 2024.

When asked about competition from Arm-based systems, AMD continues to see that the PC market is large and AMD continues to be underpenetrated, and that its products remain competitive and well positioned.

AMD expects continued share gains due to the strong interest in its new Ryzen processors, strong leadership in its portfolio and traction in its design win activity.

Gaming and embedded

Both gaming and embedded were weak in 2Q24

Gaming graphics saw revenue increase from the prior year due to better sales of Radeon 6000 and 7000 series GPUs in the channel.

That said, semi-custom SoC sales declined in-line with expectations and demand remains soft.

We have seen the bottom for the embedded segment revenue as of the first quarter, with the second quarter revenue being flat sequentially.

There are early encouraging signs as AMD is seeing early signs of order patterns improving.

Thus, they expect embedded revenue to gradually recover in the second half of 2024.

The design wins for the first half of 2024 in the embedded segment increased more than 40% from the prior year to more than $7 billion, which highlights a strong design win momentum longer term.

AI upside

Management is pleased about how MI300 has progressed as of the half-year mark.

AMD started the year getting the MI300 to be qualified into its customers’ data centers, and it is now seeing successful ramping of production.

The second half of 2024 will continue to be about ramping MI300 in the third and fourth quarter, with continued expansions with existing customers and tapping into the large pipeline of customers that AMD is working through.

AMD is seeing supply constraints as it continues to increase supply over the second half of the year, but the company expects supply to remain tight through 2025 as it continues to build capacity and ramp to meet demand.

The MI300 has strength in the memory bandwidth and memory capacity department relative to the competition, most of the deployments with MI300 has been in inference. Management expects that it will ramp training over time, so both inference and training will be opportunities for AMD.

Management feels confident about its product roadmap and having the MI350 series, which will be very competitive with Nvidia’s (NVDA) Blackwell. For AMD, this is a long-term play with its product roadmap continuing to improve and mature, which should lead to a similar dynamic with EPYC, where AMD gains share over the long term through its product roadmap.

On the software side of things, ROCm has now been put to use in many environments and matured substantially.

In terms of market opportunity, AMD remains bullish in the overall AI market, seeing demand for more compute. Management firmly believes that for most of its customers, the view is that they have to invest because of the large potential of AI. Thus, they expect this investment cycle to be strong, and that the GPU market opportunity is so large that it will be able to accommodate multiple players.

I believe that AMD’s AI product, in terms of hardware, capabilities, customers, ramp are on track with my expectations. We are starting to see AMD benefit from this AI upside, similar to what we saw for Nvidia in the last year.

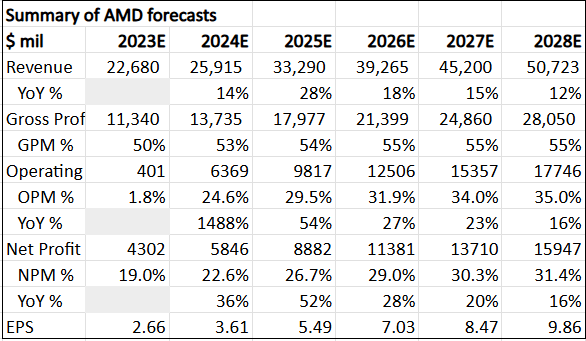

Valuation

I am updating my financial model for the upward revision for data center GPU, based on the 2Q24 commentary and strong performance.

I am increasing my revenue numbers for the $500k increase in guidance for data center revenues, and this trickles down to the net profit line at about 20% margins.

Summary of 5-year financial forecasts for AMD (Author generated)

My intrinsic value is revised higher due to the forecasts being revised upwards.

My intrinsic value for AMD is now $207, based on 12% cost of equity and 35x terminal multiple.

I would enter AMD discounted of 20% to its intrinsic value, meaning an ideal entry price would be $166 or better.

My 1-year and 3-year price targets move up marginally to $247 and $339 respectively. They imply 45x 2025 P/E and 40x 2027 P/E respectively.

Conclusion

AMD achieved a great quarter in my view.

The record MI300 revenue and revenue exceeding $1 billion this quarter just shows the strong demand for data center AI business.

The market is likely underestimating AMD’s opportunity here.

I take the view that the GPU market is large enough to accommodate multiple players.

While AMD is not the first in the GPU race, it has demonstrated that it can offer hardware that is comparable to competition, a product roadmap that ensures competitiveness, and customer interest in its products.

Moreover, EPYC continues to gain share in the server CPU market, with the next-generation Turin likely to do even better.

While the gaming and embedded segments continue to be soft, these are increasingly smaller parts of the puzzle, with embedded showing signs of stabilization and even improvement.

In my opinion, the data center segment will run the show in the near-term, with the growth in client segment providing additional tailwinds.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, the AI deep dive report, and access to The Barbell Portfolio.

The Barbell Portfolio outperformed the S&P 500 by 50% in the past year through owning high conviction growth and contrarian stocks.

Apart from providing bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join Outperforming the Market before the 20% price hike next month.