Summary:

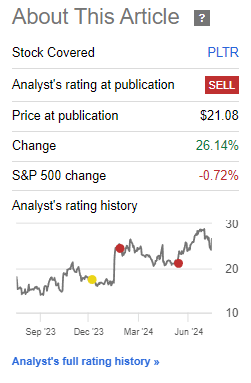

- My earlier ‘Sell’ view on Palantir was wrong. I should have placed more weight on the strong operational results in my assessment. Now I am bullish.

- Insider sales have dramatically decreased during the last 3 months, quelling some of my earlier concerns here.

- More importantly, PLTR shows signs of continued strong growth and margin expansion. The quality of growth is also improving, and there is more room for margins to sustainably grow.

- The market is pricing in two increments of rate cuts with an 85% probability in September’s Fed meeting, which is another tailwind.

- The stock trades at a small premium relative to its historical averages; however, I believe this is warranted as there is a case for multiple expansions and the presence of earnings-led growth.

georgeclerk

Performance Assessment

My prior assessment on Palantir (NYSE:PLTR) has been wrong. I had rated the stock a ‘Sell’. However, the stock has outperformed the S&P 500 (SPY) (SPX) by +26.86%:

Performance since Author’s Last Article on Palantir (Seeking Alpha, Author’s Last Article on Palantir)

Thesis Update

Q2 FY24 results were a strong reminder to me that the quality of operational results ought to carry more weight than other factors such as high insider sales and slightly elevated valuations. I am changing my mind and becoming a bull on Palantir based on these 5 thesis points:

- Insider selling has dramatically reduced

- Growth is great

- Rate cuts are a tailwind

- Valuations are high but supported by strong earnings growth

- Relative technicals vs. S&P 500 suggests further room for outperformance

Insider selling has dramatically reduced

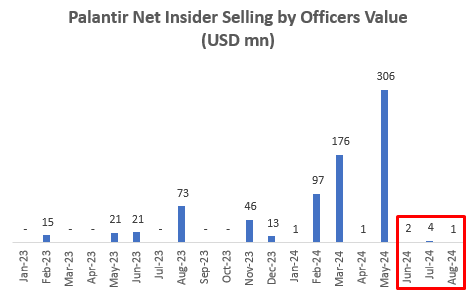

In early June 2024, when I last shared my thoughts on Palantir, I was rather concerned not only by the record high value of net insider sales, but also by the fact that some insiders had sold large % stakes of their Palantir stock ownership.

However, the latest data shows that the last 3 consecutive months have been minimal net insider sales, marking the longest stretch of quiet activity on this front since 2023:

Palantir Net Insider Selling by Officers Value (OpenInsider, Author’s Analysis)

This puts my insider concerns a little bit more at ease. In any case, I am trying to weigh the quality of operational execution more in my overall assessment.

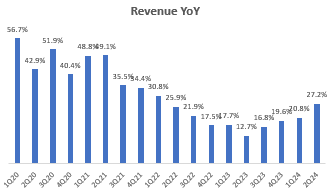

Growth is great, consistently surpassing expectations

Palantir’s excellent growth on both top-line and bottom line estimates continue. Revenue is growing in the high 20% YoY, which is in the upper echelon of companies in the current environment:

Revenue YoY (Company Filings, Author’s Analysis)

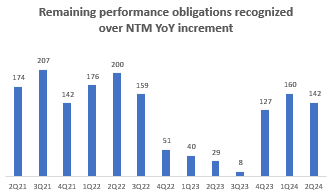

Remaining performance obligations (RPO) are a leading indicator of revenues. After a quiet 2023 for the most part, Palantir is clocking in a quarterly ~$140mn YoY incremental additions to its RPOs over the last 3 quarters:

Remaining Performance Obligations Recognized over NTM YoY Increment (USD mn) (Company Filings, Author’s Analysis)

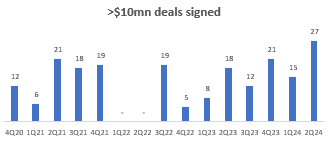

I believe this supports the case for continued, high revenue growth. Importantly, the quality of that growth is also improving as the company is signing a record number of large (>$10 million) deals:

Number of >$10mn Deals Signed (Company Filings, Author’s Analysis)

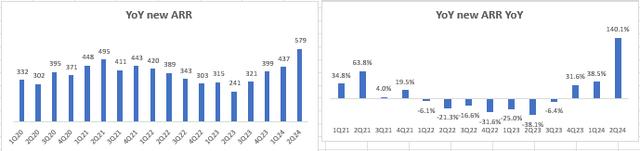

Large deals tend to be executed over multiple years, providing a business with increased revenue visibility and stability. The proof that this is playing out in Palantir is visible when we look at the annual (YoY) increments in new ARR (annual recurring revenue), which saw a sharp bump to a record high of $579 million in Q2 FY24, representing a massive 140% jump from last year:

New ARR YoY Increments (Company Filings, Author’s Analysis)

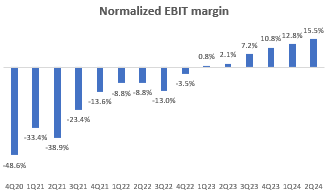

On the normalized margins (I count stock-based compensation as a real expense) front, the company is steadily expanding:

Normalized EBIT Margin (Company Filings, Author’s Analysis)

There are strong indications that this margin expansion will continue because the incremental YoY normalized EBIT margin is ticking much higher at 65%.

Overall, I believe the stickier nature of revenues and structural increase in margins make for a credible case for multiple expansion in the stock to reflect the increased chances of business longevity.

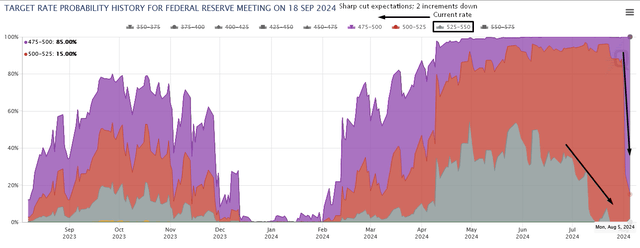

Rate cuts are a tailwind

Palantir is a long-duration equity growth stock. Such stocks tend to be more sensitive to interest rate changes, as that leads to greater changes the value of cash flows weighted more into the future. Given this characteristic, Palantir seems well-poised to benefit from the market’s drastic change in the Fed Funds rate expectations; from 525-550 bps down 2 whole increments to 475-500bps with an 85% probability in next month’s Federal Reserve meeting:

Target Fed Funds Rate Probabilities for September 2024 Meeting (CME FedWatch Tool, Author’s Analysis)

Valuations are high but supported by strong earnings growth

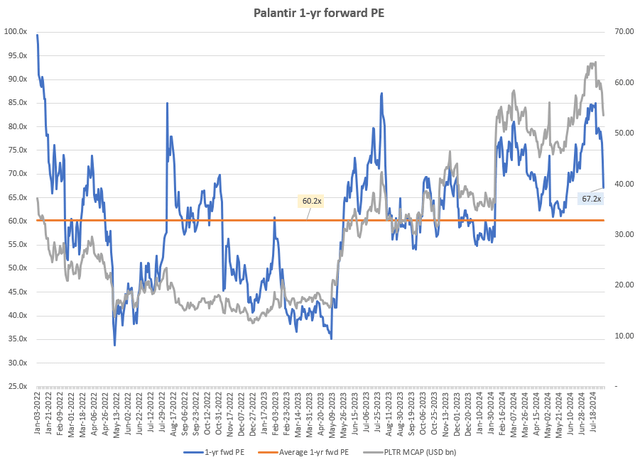

Palantir today trades at a 1-yr fwd PE of 67.2x; an 11.5% premium to the longer-term average is 60.2x. This premium is higher than the 8.3% level that it was at in early June 2024.

However, as mentioned earlier, I think it’s important to make some allowance for multiple expansion given the improving revenue quality and structural margin profile of the business.

Palantir 1-yr fwd PE (Capital IQ, Author’s Analysis)

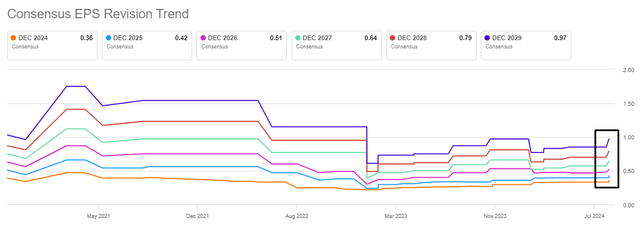

Moreover, looking closely at the recent drop in MCAP and 1-yr fwd PE in the chart above, it is apparent that MCAP has fallen less (-16.4%) than the 1-yr fwd PE (-21.0%). This suggests that the stock is being driven by genuine earnings growth, not just multiple expansion. Indeed, the recent upward EPS revisions support this view:

Palantir’s Consensus EPS Revisions (Seeking Alpha)

Relative technicals vs. S&P 500 suggests further room for outperformance

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

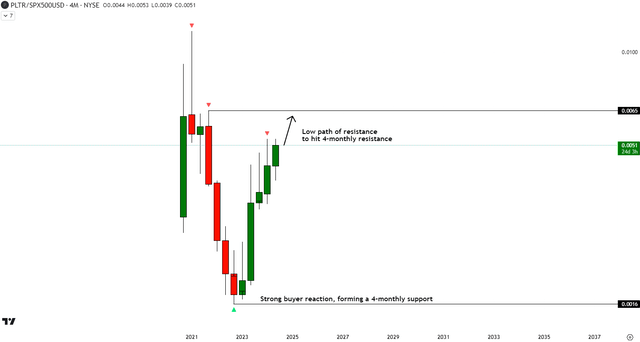

PLTR vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

In my earlier relative technical analysis of Palantir vs the S&P 500, I noticed that the buyers were weakening (as suggested by the top-end wicks in the recent candles). However, more recently, it looks like the buyers’ momentum has picked up. And zooming out, I see a low path of resistance to hit the 4-monthly resistance area.

Key Risks

From a bottom-up company perspective, Palantir is executing very well. I do not see many risks on this front. I believe my thesis is most sensitive to the rate cut expectations. I suspect the market’s +24% bullish reaction after Q2 FY24 earnings is driven not only by expectations of continued strong growth in the company, but also by the higher rate cut probabilities. Naturally, this makes the Federal Reserve’s policy a key monitorable for my thesis. Before next month’s Fed Funds Rate decision, I’ll be tracking the commentary in the Jackson Hole Symposium later in August 2024 for indications on future rate policies.

Takeaway & Positioning

I think my earlier ‘Sell’ view was wrong and premature. Failing to place more weight on the operational results – for which no fault could have been identified – over other factors such as insider sales and a slightly higher valuation was probably the key lapse in my judgement.

Now, Q2 FY24’s results have prompted me to revisit my thesis, which has changed my mind on the stock. Palantir continues to show strong growth and indications of continued high growth. Its revenue profile is becoming more stable, sticky and with higher visibility. The numbers clearly suggest that operating margins are on a structural expansion track with much room to rise further. All this makes for a case of multiple expansion. I believe this, combined with higher earnings growth, makes the 11.5% 1-yr fwd PE premium to longer-term averages acceptable.

As a couple of further bonuses, insider sales have reduced to minimal levels. And there is also an upside catalyst if the Fed delivers on the 50bps of rate cuts expected by the market in September 2024. The Jackson Hole Symposium later this month is a key monitorable for more clues on the chances of this catalyst playing out.

Rating: ‘Buy’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.