Summary:

- There’s a few undervalued tech investments, but Microsoft Corporation is one that stands out in particular.

- The company has an incredibly strong and diversified portfolio, with cash flow growing in the double-digits.

- Cash flow growth, combined with strong present cash flow, should enable substantial long-term shareholder returns.

FinkAvenue

There’s not many undervalued technology investments, though we think one is Amazon (AMZN), which we discussed recently. Microsoft Corporation (NASDAQ: NASDAQ:MSFT) is another, despite its lofty valuation. The company continues to grow and drive increased shareholder returns, making it a valuable investment, backed by an impressive portfolio of assets.

Microsoft Financial Summary

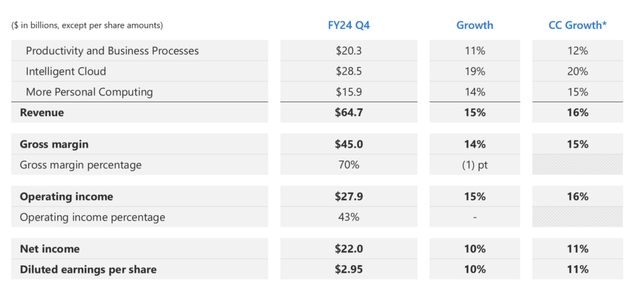

Microsoft had a strong quarter, highlighting its continued financial success.

Microsoft Investor Presentation

The company earned almost $65 billion in revenue with a 70% gross margin and 43% operating income percentage. The company’s revenue might not be as high as some of its peers, but it continues to generate incredibly strong profits as software remains a high margin business for the company. Net income came in at $22 billion, supported by double-digit growth.

Annualized, the company’s P/E is ~34 and the company is continuing to grow its cash flow significantly, which could enable it to drive hefty shareholder returns.

Microsoft Segment Highlights

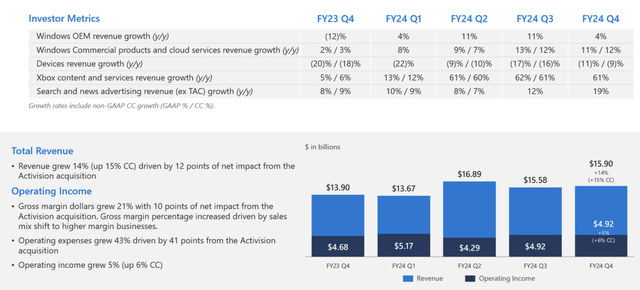

Microsoft has seen strength in all of its segments.

Microsoft Investor Presentation

The company’s productivity and business processes continue strong YoY growth, especially in the company’s office commercial segment, which has seen double-digit growth for numerous years. The company’s Microsoft 365 portfolio has more than 80 million customers, achieving strong growth for one of the oldest major software products.

The company’s dynamic products and cloud services both remain strong, and LinkedIn continues to be the dominant social network within its category. The company earned $20.3 billion in revenue here and crossed $10 billion in operating income, strong YoY performance.

Microsoft Investor Presentation

The company’s cloud segment has continued to grow rapidly while maintaining strong margins. The company has one of the largest clouds in the industry and benefits well from its incredibly strong software portfolio overall. The company earned almost $30 billion in revenue in this segment, with almost $13 billion in operating income, despite massive continued investment in Azure.

Microsoft Investor Presentation

The company’s personal computing segment remains one of the most important in the world. The company saw growth across all segments here, while its Bing search engine continues to grow rapidly and its Xbox gaming division benefited massively from the acquisition of Activision Blizzard. The company’s lower antitrust concerns help it out here.

The company earned almost $16 billion in revenue, with just under $5 billion in operating income. This shows strong growth across all the company’s segments.

Microsoft Shareholder Returns

Putting this all together, the company is committed to using its portfolio of assets to generate strong returns on its $3 trillion market capitalization.

Microsoft Investor Presentation

The company returned $8.4 billion to shareholders, a modest amount as its dividend is only 0.76%. The company’s operating expenses remain hefty, and the company is continuing to invest heavily, with capex at almost $80 billion annually. That’s massive capital expenditures that will enable hefty future growth and returns.

The company’s almost $100 billion in FCF positions it well to continue driving shareholder returns. We’d like to see the company ramp up share purchases, and we expect it to announce a much larger buyback next year when it revamps its share buyback program.

Another thing we want to highlight is Microsoft’s ability to generate future returns based on a unique strength we feel the company has. Specifically, as company’s like Google face antitrust lawsuits threatening its business, the company defeated its antitrust lawsuits 25 years ago. That has let the company undergo larger acquisitions than all remaining tech companies.

The company has taken advantage of that through acquisitions such as Activision, and that unique strength due to the company’s prior legal victories gives it a unique avenue for future growth.

Thesis Risk

The largest risk to our thesis is Microsoft’s current valuation, which still requires some additional growth for the company to justify. That could take years and be difficult to achieve as the company continues to face strong competition from the likes of Google (GOOG) Cloud and Amazon AWS. That could hurt the company’s future share price.

Conclusion

Tech stocks are expensive these days, but there are some diamonds in the ruff. Microsoft, with its unique ability to avoid antitrust concerns, as it continues to dominate market segments through acquisitions such as Activision Blizzard, is a unique opportunity. The company has a strong portfolio of assets and continues to generate massive cash flow.

The company’s almost $100 billion in FCF that continues to grow, along with massive continued investments in its business, should enable both FCF growth and long-term shareholder returns. Overall, that makes Microsoft a valuable investment, please let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.