Summary:

- Telco businesses faced significant pressure with income investors rotating towards other risk-free alternatives.

- Verizon Communications Inc. is a quality business with a dirt-cheap valuation, primed to benefit from great rotation as the Fed cuts interest rates.

- Q2 earnings were solid, driven by strong profitability with a new phone upgrade cycle on tap to drive top-line growth.

- Verizon’s 6.6% dividend yield, secure 66% payout ratio, industry-leading profitability, and potential for share buybacks make it an attractive investment.

- I maintain my “Strong Buy” rating.

hapabapa

Telco businesses have historically been seen as an attractive income vehicle for dividend-oriented returns, often compared to bond-like investments.

Even as the major players’ top-line growth generally peaked, with analysts now expecting sluggish 2% to 4% annual growth, the companies still offer attractive investment profiles, particularly with their stable, high single-digit dividend yields.

Price Development (Seeking Alpha)

In spite of that, following the Fed’s 525 basis points rate hikes to combat inflation, investors turned sour as other investment alternatives, such as treasuries or high-yield cash savings accounts, became once again viable alternatives with less risk for yield-hungry investors after a decade of low interest rates.

Additionally, telcos require significant CAPEX spending in the infrastructure to keep up with new technology, e.g., the switch from 4G to 5G, piling up debt, which acts as an anchor on future growth and profitability, particularly if the debt is refinanced at interest high rates.

That’s to say, the economy moves in cycles, with interest rates rising and falling, making dividend-paying companies more attractive at certain times and less attractive at other times.

As the US economy is slowing down, with the unemployment rate increasing from 4.1% to 4.3%, perhaps more than some economists would like to see, JPMorgan and Citigroup analysts are expecting to see the following rate cuts from the Fed this year:

- September: 50 basis points cut.

- November: 50 basis points cut.

- December: 25 basis points cut.

Perhaps too aggressive expectations, if you ask me, yet as rates fall, bonds, treasuries, and high-yield cash accounts will become less attractive, and high-quality, high-yielding companies like Verizon Communications Inc. (NYSE:VZ) should benefit due to simple supply/demand dynamics.

To make it even better, Verizon shares trade around $40. That’s only 8.8x its FY24 forward earnings, and the company currently offers a well-covered 6.6% dividend yield.

Since my last coverage, the total return has only been 4.1%. Yet, it is still beating the market with significantly less risk, and expecting double-digit returns over the next twelve months is absolutely feasible.

Last Coverage (Seeking Alpha)

Q2 2024 Earnings

Following Verizon’s Q2 earnings report release, the stock plummeted by 6% on the day.

Let’s have a look at the numbers and what investors did not like.

Verizon reported marginal topline growth of 0.6% YoY, with revenue reaching $32.8B, missing analysts’ estimates of $33.04B. Higher pricing helped drive the revenue growth, while revenue from Business fell from the same quarter last year.

Yet, we see a positive growth of 2.8% in Adjusted EBITDA, with its margin now at 37.5%, as the phone upgrade cycle plummets, boosting profitability, which I will return to later.

The bottom line came at $1.15 EPS, down 5% YoY, matching the consensus and reaffirming the stagnating trend of the previous few quarters that is raising concerns on Wall Street.

During the quarter, investors were not satisfied with the wireless customer numbers, the pacing of the free cash flow, and the new wave of phone upgrades potentially hitting later this year driven by Apple’s (AAPL) expected upgrade super-cycle due to new AI features in the phones.

From my standpoint, none of these points are a reason for genuine concern, and the dip from $42 presents a buying opportunity for investors.

Verizon is well-known for reducing its workforce to optimize costs. In Q2, the company announced it was laying off 1.4% of its workforce, with potential cost savings hitting the P&L in Q4 2024.

Financial Summary (VZ IR)

Verizon’s main asset in the industry is its broad coverage and most extensive customer base in the US. Thanks to its scale, Verizon’s profitability outperforms its peers.

Even as winning over new customers might prove difficult at Verizon’s size, the wireless service revenue grew 3.5% YoY in Q2, landing at the upper end of management’s 2% to 3.5% range.

Verizon has lost 8K postpaid phone customers this quarter. However, without counting low-cost second phone customers, the loss is closer to 120K. Management still expects to report positive customer growth this year, significantly better than the 132K net loss reported last year.

One could easily assume that attracting new customers would come at a cost to Verizon, yet the company’s pricing is actually healthy. Revenue per consumer account is up 5% so far this year, driven predominantly through price increases.

While management has guided only for sequential growth in H2, I expect top-line growth for the full year between 0.5% and 2%.

Even though revenue growth was only 0.6% in Q2, with the release of AI-enabled applications on iPhone 16 later this year, I am expecting accelerating top-line growth in Q4 for Verizon and other telcos as the phone upgrade cycle, a pain point of the previous few years, reverses.

However, the reversal of the phone upgrade cycle is a double-edged sword for telcos. It drives top-line growth but pressures profitability as telcos offer promotions on the new devices, requiring working capital upfront to fund future receivables.

To put the numbers into perspective, during Q2, only 2.9% of wireless customers upgraded their devices, the lowest reading on record.

Operating Metrics (VZ IR)

Verizon’s core business is the wireless segment, and the company remains in a solid position to defend its market share, acquiring wireless spectrum to improve performance and network capacity while expanding its fiber in key areas.

Analysts are expecting rather lackluster growth of around 1%-2% annually over the next few years, which is fair given Verizon’s size and the mature state of the industry, competing against well-established players like AT&T and T-Mobile.

If you are expecting significant growth, you might want to skip one, yet Verizon is a great income play and potential valuation reversal opportunity.

Revenue Growth Projections (Seeking Alpha)

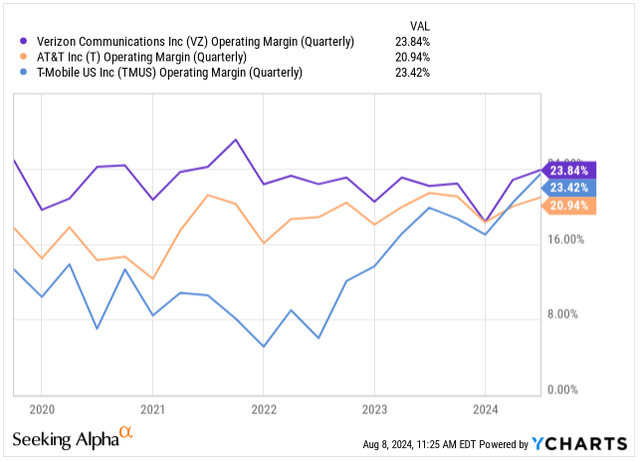

Verizon’s continuous investment in wireless and fixed-line technology, combined with its network quality and scale, positions it very well to retain industry-leading profitability and continue delivering well above the industry’s average ROE (5Y average at 24.5%) as the company holds roughly 40% of the postpaid market, well ahead of AT&T and T-Mobile.

Operating Margin (Seeking Alpha)

Even as I expect T-Mobile and AT&T to keep investing in their own networks as well, eventually benefiting from scale, all three companies are set to attract similar numbers of customers in the future without jeopardizing profits by underpricing the offerings of the competitors.

Debt Load & Dividends

Telco is an inherently capital-intensive industry, where operators of the networks have to maintain and build new infrastructure, requiring significant CAPEX spending to retain their market share.

The net financial debt graph below shows that all three major telcos have significantly increased their debt levels following the investments in the 5G network. In fact, only a portion of the debt is ever paid back, with the exception of AT&T Inc. (T) reducing its debt meaningfully load following the spin-off of Warner Media back in 2022.

On the other hand, we see T-Mobile US (TMUS), where the debt load is still relatively small, which will allow the company to grow faster in the future, mainly as it improves its profit margins.

Net Financial Debt (Seeking Alpha)

Debt isn’t a problem by itself as long as it’s financed through issued bonds with low coupons or borrowed at low, fixed interest rates.

Verizon’s Q2 interest expense was $1.7B, an increase from $1.3B in the previous year. This pressured the EPS somewhat but did not threaten the business, as Verizon had $2.4B of cash on the balance sheet at the end of the period.

The company’s net unsecured debt to adjusted EBITDA stood at 2.5x after Verizon reduced its net debt by $3.4B in H1 compared to the previous year.

Management has previously flagged that once the net unsecured to adjusted EBITDA falls below 2.25x, which I expect to happen by the end of 2025, the company will start repurchasing its shares as part of its capital allocation strategy. Yet, I would prefer to see a more aggressive debt repayment program to strengthen its balance sheet and provide flexibility during future CAPEX cycles.

Speaking of dividends, Verizon currently offers the most attractive yield among its peers:

- VZ: Dividend yield of 6.6%

- T: 5.8%

- TMUS: 1.4%

The free cash flow during H1 hit $8.5B, an increase from $8.0B the previous year. The company has paid $5.6B in dividends so far this year, putting the payout ratio at a very comfortable 66%.

Cash Flow Summary (VZ IR)

Even though Verizon’s dividend growth has been rather lackluster in the last five years, increasing in total by only 8.1%, hardly offsetting double-digit inflation, the comfortable free cash flow payout ratio, coupled with potential share buybacks in the future, which will result in fewer total dividends paid, puts the company in a healthy position to grow its dividends once again in the range of 3% to 5% annually.

Dividend Per Share (Seeking Alpha)

Dirt Cheap Valuation

Due to the negative sentiment towards heavily leveraged businesses during a period of elevated interest rates and with risk-free alternatives to earn yield outside of equities, Verizon has found itself in a downward spiral, with shares down 35% from its all-time high of $62, reached back in 2019.

The lackluster performance took a significant toll on its valuation, with the shares now trading at a P/E of 8.8x its FY24 earnings.

Periods like these are the ones where buying shares of Verizon can provide investors with double-digit returns as the stock valuation reverses potentially towards its 15Y P/E average of 13x.

All while being paid a quarterly dividend of $0.665 per share while waiting.

To be perfectly clear, I would not be interested in investing in Verizon if the stock were trading near its historical valuation level, pricing it at around $60 in FY24 earnings.

Since I do not rely on dividend distributions, being paid 6.6% on top of a minor 2%-3% EPS growth annually is not my cup of tea. I am always looking for alpha over the market’s performance; otherwise, I would buy the market as a whole.

For income-oriented investors, perhaps being paid a 6.6% dividend yield is enough, but that’s not my case.

However, Verizon is a quality business that is still expected to deliver some growth, and the valuation reversal is absolutely feasible, especially as the attractiveness of its dividend increases once the Fed cuts rates:

- 2024: EPS of $4.58E, YoY growth of -3%

- 2025: EPS of $4.71E, YoY growth of 3%

- 2026: EPS of $4.87E, YoY growth of 3%

I learned through my investment career that buying stalwarts like Verizon or dollar-cost-averaging into their stock is not worth it if the stock is fully priced.

Instead, buying the stock at a deep discount, as long as the fundamentals do not deteriorate, can generate significant alpha and outperformance while maintaining a reasonable margin of safety, particularly in today’s pricey markets.

Investors buying the shares today can expect up to 25% total annual returns if the valuation reverses, combined with the attractive dividend.

VZ Valuation (Fast Graphs)

Takeaway

In summary, telcos were not attractive investments, even for income-oriented investors, following the 525 basis point Fed interest rate hikes as other risk-free alternatives became more viable.

JPMorgan and Citigroup analysts are now expecting as much as 125 basis points of rate cuts this year to strengthen the weakening economy, which should drive a meaningful rotation toward quality dividend-paying stocks.

With its 6.6% dividend yield, Verizon is set to be one of the primary beneficiaries of the great rotation and, thanks to its fundamentally strong business, which keeps delivering even as the industry reaches its mature phase.

The valuation is dirt cheap, with enough margin of safety, potentially setting investors for up to 25% annual total returns over the next three years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.