Summary:

- I see Palantir as the top AI play, driven by its product superiority, strong “Rule of 40,” and robust commercial growth.

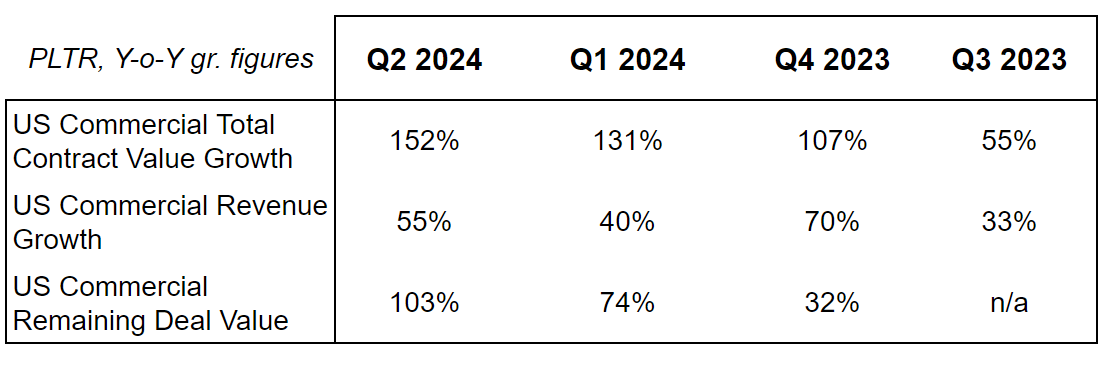

- Palantir beat expectations on both revenue and EPS, with US Commercial Total Contract Value growing 152% year-over-year, highlighting the company’s success in scaling its business and signing new contracts.

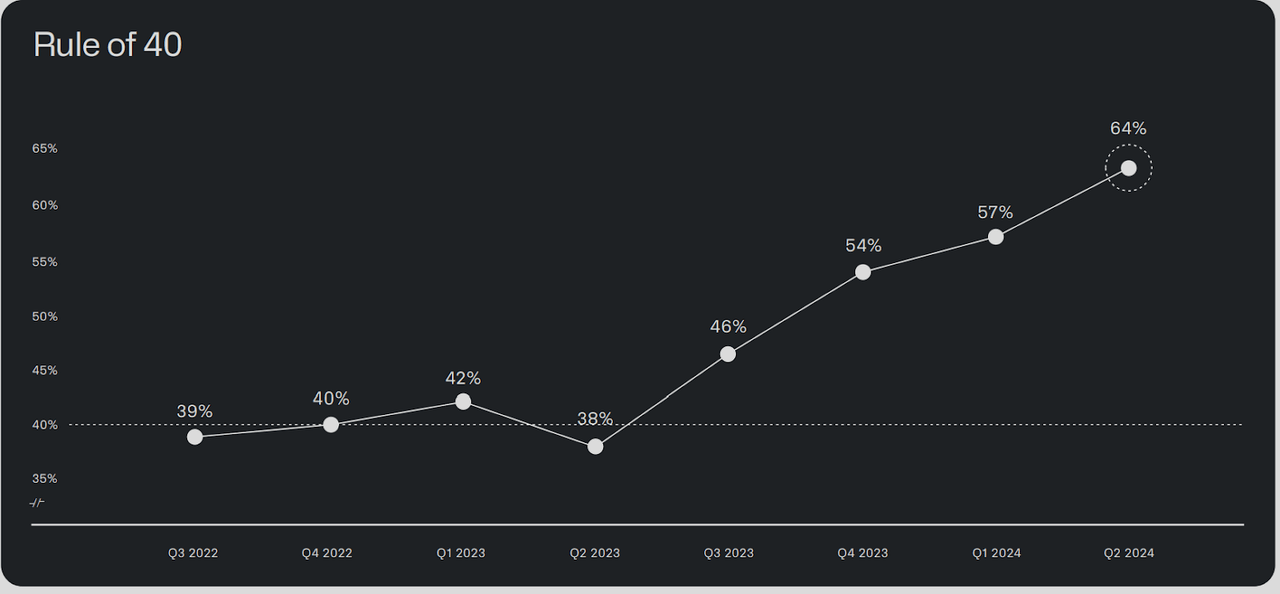

- Palantir’s Rule of 40 score of 64% surpasses most other AI companies, demonstrating its effective monetization of scalable AI applications.

- Palantir has announced pivotal partnerships, including collaborations with GE Aerospace and Microsoft, which I expect to further accelerate the company’s growth and scalability in the AI sector.

- I am doubling my position in Palantir, rating it a “STRONG BUY” with a target of 5X from current price levels.

Michael Vi/iStock Editorial via Getty Images

I last covered Palantir Technologies (NYSE:PLTR) in May, stating how I see the company as an asymmetric bet on AIP and scaling to a SaaS-like business model. Since then, Palantir has organized a conference where 70 existing customers have showcased use cases of AIP products. The company also launched an important update to Foundry, announced several partnerships and reported stellar Q2 earnings, beating all expectations.

In this article I will go over the applications that Palantir’s customers are reporting, and why I see Palantir as the best bet on AI technology to date. I will also cover why I am doubling my position, on the back of data from Q2 earnings and announced partnerships.

Thesis: Based on Q2 earnings figures, I believe Palantir is the best AI company in the market.

Following Q2 earnings, I view Palantir as the best AI play in the market, primarily due to its product superiority, which is evident in its latest “Rule of 40” figure—a key metric used by Venture Capitalists to gauge a company’s health by combining its growth rate and profit margin. Palantir boasts a Rule of 40 figure of 64%, surpassing any other AI company except NVIDIA Corporation (NVDA).

The way I explain this fact is that while Nvidia is selling the hardware needed to fuel the “AI revolution”, most AI companies are still trying to find monetizable applications of AI itself. Palantir stands out as the exception: I think the company has already discovered scalable and highly profitable AI applications. This is further proven by the 152% year-on-year growth in US Commercial Total Contract Value and 55% year-on-year growth in US Commercial Revenue.

Palantir’s AI approach is centered on ontology, a method of organizing data that reduces AI “hallucinations,” leveraging the company’s decades of experience working with militaries worldwide. Palantir’s AI applications span from Supply Chain efficiencies to cost reduction strategies. I will go into the details of Palantir’s AI product approach in the second half of this article.

While volatility is to be expected going forward, I still see Palantir as an asymmetric bet on this company becoming an AI SaaS global leader. I rate the company a “STRONG BUY,” with a target of 5X from current price levels.

Q2 Earnings: I am still focusing on US Commercial Total Contract Value as gauge for scalability

With Palantir’s Q1 earnings, the market reacted negatively to a slowdown in US commercial revenue growth. Back then, I argued how this metric was not as important as US Commercial Total Contract Value, because it can take time for Palantir to register revenue once it signs a contract.

Palantir beat earnings expectations on both Revenue and EPS in Q2, I am still focusing on US Commercial Total Contract Value as the key figure to my thesis.

I see Total Contract Value as the best figure to gauge the scalability of Palantir’s business model. That’s because Palantir’s AIP is still relatively recent as a product – having been introduced one year ago. Also, Palantir tends to sign larger and multi-year deals with its customers, and revenue can take time to be registered in the books. What really matters to understand whether Palantir is scaling its business, in my view, is that the company is successful at signing new contracts with US commercial customers.

Palantir key financial figures at a glance (PLTR’s past Earnings Report, Author’s Elaboration)

The good news for Palantir bulls is that US Commercial Total Contract Value has been accelerating in Q2, and registered a +152% growth Year-on-Year. This figure has been increasing rapidly throughout earnings for the past year, as shown by the chart above.

What the Rule of 40 says about Palantir: is this the best AI company in the world?

While I am focusing on US Commercial Total Contract Value growth, I still want to call out how Q2 earnings were strong across the board, with a beat of 3.94% and 10.55% in Revenue and EPS, respectively.

However, what’s even more impressive in my view is how the “Rule of 40” has been rapidly scaling since Q2 2023. The Rule of 40 is a metric used by Venture Capitalists to value Software-as-a-Service ((SaaS)) companies that, while experiencing somewhat limited profitability, are rapidly scaling up. The rule states that a company’s combined growth rate and profit margin should total at least 40% for the company to be considered a good SaaS investment.

PLTR – Rule of 40 (PLTR’s Q2 Earnings Report)

Palantir currently has a 64% ratio when it comes to the Rule of 40, up from 57% last quarter and rapidly increasing since the introduction of AIP in Q2 2023. Once again, I think this is proof of how Palantir’s products work and, more importantly, can scale.

The Rule of 40 is also a large part of the reason why I believe Palantir is the best AI company in the market at the moment. Here is how other companies that I currently consider great AI plays do in terms of rule of 40 (latest 12-months):

-

Nvidia at 257%.

Here is how I am reading these figures: META, Google and Microsoft are all investing heavily in AI, but they have not yet found applications that can be monetized effectively to the point of being reflected in their growth and profit. In other words, monetization of AI products such as Microsoft’s Copilot or META’s Llama is still a long way off.

NVIDIA, as the prime company that is effectively powering the AI revolution with its hardware, is already benefiting from the AI revolution.

What about Palantir? I think Palantir is one of the first companies that has found real, scalable applications for AI software that can be monetized. This is the fundamental reason why I believe Palantir is the best AI play in the market today. I will go through examples of how the company has found its footing in AI in the next sections of this article.

As a side note, I think that Adobe is another company that has figured how to monetize AI, as shown by its second-best Rule of 40 figure. I think this is because many software applications of AI today concern image and video editing, two core areas of Adobe’s offering.

My price target for Palantir: still a 5X from current levels

On the back of Q2 earnings, I see Palantir as a rapidly scaling SaaS-like business. In line with my previous thesis, I still expect the company to eventually match Salesforce, Inc. (CRM) in terms of market capitalization, maturing into the global leading SaaS company for AI. This represents a roughly 5X opportunity from current price levels.

To reach Salesforce’s size, Palantir would need to increase revenue 13 times from what it has reported as of Q2. Assuming Palantir ends up growing at the 50% rate it registered in Q2 for its US commercial business, it would take about six and a half years to reach Salesforce’s scale.

In terms of Gross Margin and Net Income, Palantir is already reporting figures in line with those of Salesforce. Specifically, a gross margin (calculated as % of gross profit on revenue) of roughly 80%, against Salesforce’ 75% figure and a Normalized Net Income at 13% of revenue in Q2, against Salesforce’s 12.5% (Seeking Alpha data for Q2).

I find it interesting how Palantir only achieved sustainable profitability for the first time in Q1 2023 – one year and a half ago. In less than two years, the company has reached the same profitability metrics of Salesforce, while experiencing growth at a much higher rate. This achievement is also what makes me believe that Palantir is worthy of its rich valuation, currently at a P/E of above 75, against Salesforce’s historical P/E of mid to high 40s.

An overview of Palantir’s technology as it emerged in the past 3 months

Back in June, Palantir hosted a conference (AIPCon) with 70 customers that agreed to talk about Palantir’s applications to their business. I have been closely following this event, to gauge how Palantir is working in scaling their highly customized AI software solutions.

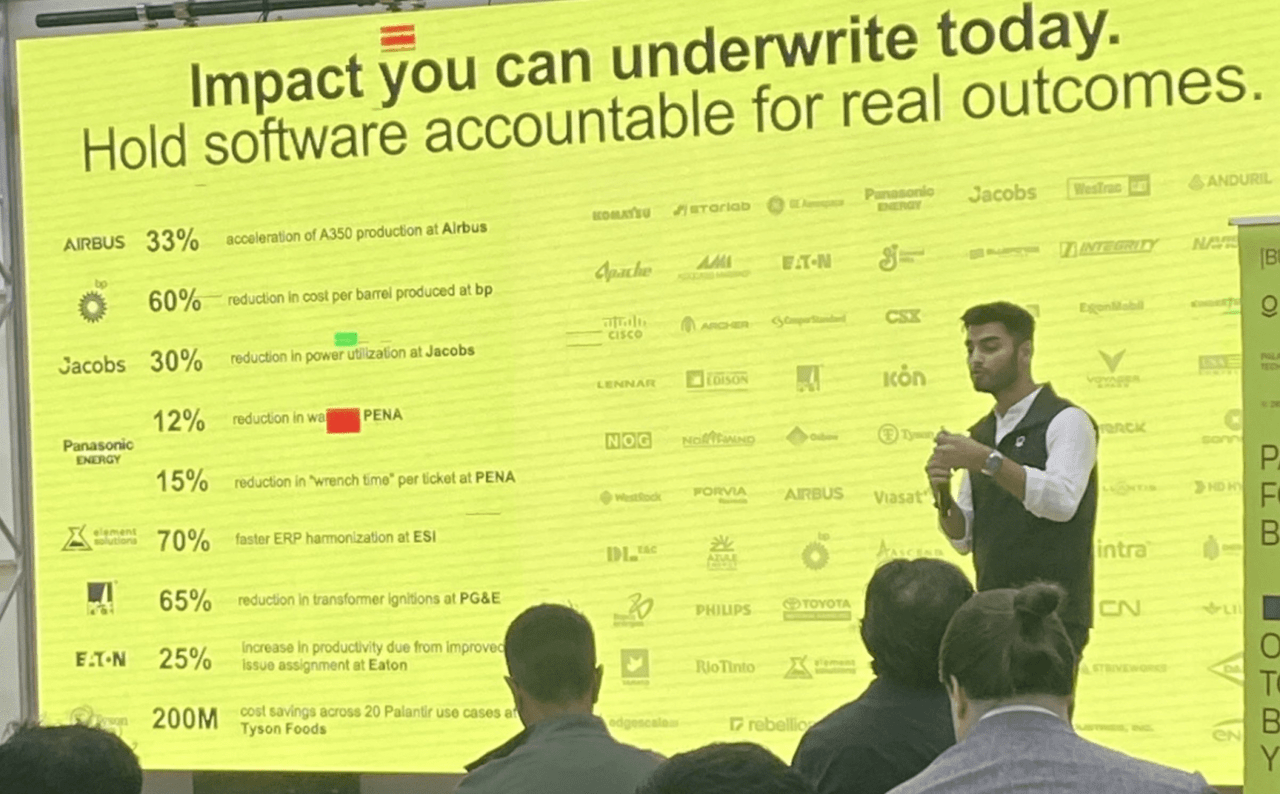

Palantir’s AIPCon KPI slide (Arny Trezzi’s event report)

The above picture was taken during that customer event, and it summarizes the results that Palantir’s customers have experienced in working with the company. Specifically:

-

Airbus saw a 33% acceleration of their A350 plane production

-

British Petroleum saw a 60% cost reduction per barrel

-

Jacobs Connect saw a 30% reduction in power utilization

-

Panasonic saw a 12% reduction in waste

-

ESI Group saw a 70% faster ERP harmonization

-

Pacific Gas & Electric saw a 65% reduction in transformer ignitions

-

Eaton Corporations saw a 25% increase in productivity

-

Tyson Foods saw $200mn in cost savings

I believe many investors (and Palantir skeptics) have had doubts about this company because its products are somewhat difficult to understand and seem to promise a lot. I think this picture, which summarizes the event perfectly, leaves no doubt on the fact that Palantir’s solutions can create value for its customers.

During the event there were many other customer testimonies that I found very interesting – including a Healthcare company that managed to reduce time needed to schedule therapies from 95 minutes to 5-7 minutes per day. As well as someone posting how they were able to build a Bike App in a few hours during a Palantir Bootcamp.

I do not want to go into too many details about this specific event in this article, preferring to give readers an overview of what customers are reporting in terms of results. However, in case readers are interested, I suggest going through this event report from Arny Trezzi, an early Palantir bull and Seeking Alpha contributor that I have no relationship with.

New deals and partnerships that I see as pivotal for Palantir

As a believer in Palantir, I closely follow the company and all news related to it. There has been no shortage of announcements in terms of partnerships and deals between Palantir and leading companies in the past months. I am collecting here a selection of those announcements that I consider the most interesting. For each deal, I briefly outline the reason why I see it as pivotal for the business.

The first deal I want to call out is that with GE Aerospace. Palantir and GE recently announced a collaboration to help the US Air Force address supply chain issues. Palantir’s expertise in the commercial space (related to Supply Chain) is now being used in a contract with the US military compartment, a historical client base of the company. This, in my view, means that Palantir is not only re-applying its military know-how to commercial customers, but managing to do the exact opposite.

Another key deal I see as pivotal for Palantir is that with Microsoft. Very recently, on August 8th, Microsoft announced that Palantir’s AIP – the Artificial Intelligence Platform that has been key to Palantir’s scalability – will be offered through Microsoft Azure Cloud platform. Additionally, Palantir will adopt Azure’s OpenAI Service within Microsoft’s government and classified accounts.

The reason why I see this Microsoft deal as pivotal is that AIP can now further accelerate its growth by being rolled-out with Microsoft Azure, which currently has a roughly 25% market share of global cloud infrastructure at the time of writing. As a reminder, Palantir already has a similar deal with Oracle, another leading player in the Cloud space, since Q1.

The two final deals that I want to call out concern Wendy’s, the famous fast food chain, and TES Forge, a global leader in the production of electric natural gas. Both relate to supporting these companies with their supply chain issues.

These deals are more straightforward, showing Palantir’s ability to deliver value to companies by helping them achieve efficiencies in the supply chain. This is, in my view, a clear proof of what Palantir has been promising to investors: the company’s military technology, used on the battlegrounds from Ukraine to Israel, can translate into commercial applications such as supply chain.

Palantir’s secret sauce: Ontology as a cure for LLM’s “hallucinations” and AI “self pleasuring”

Having gone through success cases and partnerships announced by Palantir in the last months, readers might still find themselves asking what exactly Palantir does and why do Palantir’s products work.

This is why I want to spend a few paragraphs explaining what I believe is Palantir’s revolutionary and unique approach to AI.

Readers who have used Large Language Models ((LLMs)) such as Google Gemini or ChatGPT, might be familiar with the concept of AI “hallucinating” when answering a question.

In a nutshell, “hallucinations” means the LLM producing a nonsensical, and / or plain false, answer – often just in the hope of “satisfying” the query. Hallucinations in LLMs include:

-

An LLM answering to made up facts confirming them and adding more made-up facts in its answer

-

An LLM contradicting itself against a previous answer or even within the same answer

-

An LLM reporting wrong or made up information along with correct and factual information

Example of LLM hallucinations in ChatBot (Google Images)

Palantir’s focus on “ontology” in AI means the company can create a clear framework for organizing and understanding data. In a nutshell, ontology means building a model that defines how different pieces of data relate to each other.

By using ontology, Palantir’s AI can better interpret and analyze large amounts of information, leading to more accurate insights and better decision-making. Using LLMs such as Google Gemini as a normal user does not involve having an ontology – which is the root issue behind hallucinations.

Palantir’s CEO Alex Karp has been very vocal about the company’s product superiority and competitive edge being exactly in their ability to create an ontology, applicable to AI. Karp refers to the issues of LLMs not having real applications due to hallucinations and being “stuck” with chatbots as “self pleasuring”.

While Karp can be a controversial character, I personally find that Q2 earnings have shown how Palantir’s approach towards ontology and AI is working. I see this as the core reason behind Palantir’s leading “Rule of 40” figure, and why Palantir is the leading AI company at this point in time in terms of AI monetization and applications.

Risks to my thesis – shares dilution, market volatility

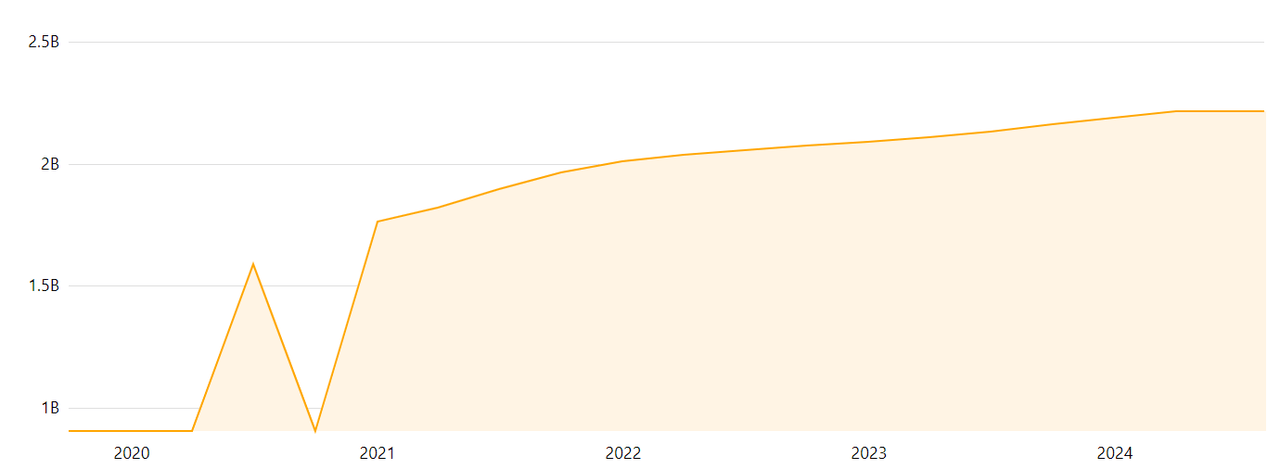

I believe the main risk to my thesis, on the back of strong Q2 earnings, concerns shares dilution. Palantir has historically relied on shares dilution to reward employees and management. Since its 2021 IPO, Palantir’s shares outstanding have more than doubled – from 900 Million to 2.21 Billion at the time of writing.

Palantir’s shares outstanding (Companiesmarketcap.com)

Share dilution has been stabilizing in the past couple of years, and Palantir has announced its first shares buyback program in 2023 (despite, since then, shares outstanding have been slightly increasing). However, I think it’s too early to say whether Palantir has stopped significantly diluting existing shareholders and therefore this is a risk that must be considered by anyone interested in entering an investment in this company.

Another broader risk to my thesis concerns market volatility. Palantir is historically a very volatile stock. Furthermore, the company is undoubtedly richly valued, with a P/E of above 75 at the time of writing this article.

Volatility is, in my view, still to be expected in the foreseeable future for this stock. Investors should therefore be wary that entering Palantir – even as a potential asymmetric bet – remains a fairly risky move at this stage.

Conclusion (and a note about my position)

I started covering Palantir earlier this year, and after Q2 earnings I reiterate how I see Palantir as an asymmetric bet on the company maturing it into the “SaaS of AI”.

I began the year with a position of roughly 500 shares in Palantir, which I increased to 1,000 following a dip after Q1 earnings. My goal now is to double my position to 2,000 shares. Currently, I hold 1,450 shares in the company and expect to reach my target before Q3 earnings are released.

My average purchase price is around $20, but I am comfortable entering at higher levels, given my strong conviction in this company. As mentioned earlier, I rate Palantir a STRONG BUY and see a 5X opportunity from current price levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.