Summary:

- Both Baidu, Inc. and Google have high growth prospects in the artificial intelligence and cloud computing markets.

- This is a tale of search engines which are looking to diversify to potentially trillion-dollar markets.

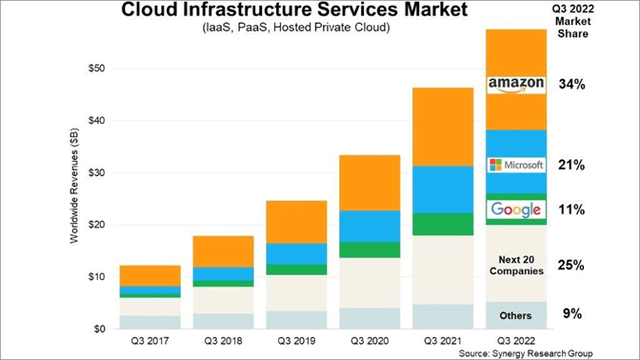

- Google is a major player in the cloud market, currently holding the third-largest market share globally.

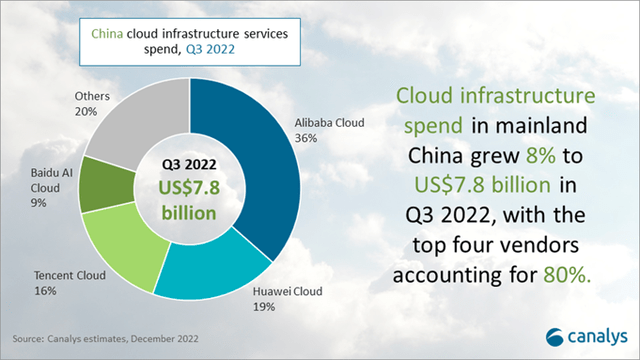

- Baidu is an important player in China’s cloud computing market, being the fourth-largest player.

Khanchit Khirisutchalual

In this article, I will provide a look into Alphabet Inc. (NASDAQ:GOOGL) (“Google”) from the United States and Baidu, Inc. (NASDAQ:BIDU) from China from a purely fundamental perspective. I believe both companies present interesting long-term investment opportunity, based on fundamentals. As mentioned in my previous article on Meta Platforms (META) and Tencent (OTCPK:TCEHY), I will be conducting a detailed analysis on all these companies in future articles. But before we delve into those specifics, I would like to provide a more comprehensive overview for readers, as all these companies I will discuss are well-positioned in markets such as the cloud computing, metaverse and artificial intelligence.

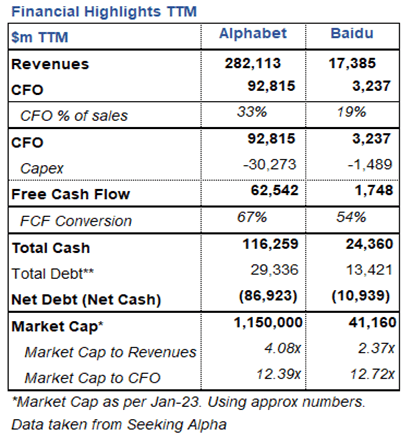

Please find below a comparison of the companies’ financial metrics during the trailing twelve months:

Financial Highlights GOOGL & BIDU (Seeking Alpha)

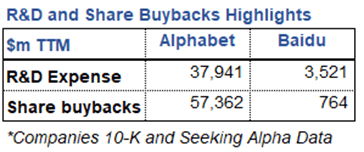

As also mentioned in my previous article, I believe R&D spend and share buybacks are important metrics for these well-established companies. These two metrics give us an idea of how much cash these companies are investing in innovation and their platforms as well as how much they are spending to repurchase their common stock and decrease the number shares of outstanding in the open market.

R&D and Share Buybacks Highlights (Companies 10-k and Seeking Alpha)

Examining Google and Baidu Fundamentals and Growth Strategies

The Google search engine is the preferred search engine used by most people in the Western world. Thanks to its ad revenue, the company has been able to rake in $282 billion in revenue during the last twelve months. Google is diversifying its revenues by competing and being the third biggest cloud service provider in the world just behind Amazon’s (AMZN) AWS and Microsoft’s (MSFT) Azure. This is an important market for Google, as it is currently highly reliant on the revenue from its ad business, with ad revenue accounting for approx. 90% of total revenues. Additionally, the global cloud market is expected to grow in market value to approx. $1.2 trillion by 2027.

Cloud Market (Synergy Research Group)

Google also has a true fortress when it comes to its balance sheet with $116 billion in cash and cash equivalents and debt close to $30 billion. The company was able to generate an extensive free cash flow of $63 billion during the trailing 12 months. This allows the company to repurchase a substantial amount of its common stock. For reference, Google spent $57 billion during the last twelve months in share repurchases. Shareholders must be happy, as fewer outstanding shares are available in the open market. Important to note here that Google has fallen by approx. 40% from its all-time highs, and this provides a nice opportunity to redeem shares from the open market at a substantial discount.

Google also spends a significant amount of cash in R&D, expenses amounting to $38 billion during the TTM. This helps the company improve its services such as cloud computing, Google search, YouTube, etc. Not only does Google already have very strong fundamentals, but management also keeps investing for the future, which has allowed them to take advantage of markets such as the cloud computing market. Google is currently valued by the market at approx. $1.2 trillion, which positions it among the top five most valuable companies in the world. This does not mean that the company can’t see its value appreciate, not long ago, Google had a market valuation over $2 trillion. So, can we see the company at those levels again? I believe this is very possible, however, this is a long-term play, with the current market environment investors can expect some choppiness in the market for some time.

Baidu

BIDU is best known as the Google from China; it is the leading search engine for a country with over 1.4 billion people. This alone makes BIDU an important player in the technology sector of China, nonetheless, BIDU is more than just a search engine: it is also the fourth largest cloud business player in China´s cloud industry.

As per revenues, cash flow from operations and market valuation, BIDU still lacks size compared to Alibaba (BABA) and Tencent, which are the two biggest technology companies in China. With TTM revenues of $17.4 billion and an operating cash flow of $3.2 billion, the market is valuing the company at $39.5bn. This is approx. 12x cash flow from operations and 2.5x sales. BIDU size should not worry investors as the company is a dominant position to take advantage of the digital advertising market in China. This market is set to grow to $190 billion by 2026. Further, BIDU has a long runway ahead, as it is an important player in the cloud industry, which is expected to grow in China alone from $13 billion in 2020 to $84 billion by 2027.

The cloud computing segment for BIDU is quite important, as it is helping the company diversify its revenues which highly reliant on ad revenues. For reference BIDU ad revenue amounts to approx. 77% of total revenues. BIDU’s size should not worry investors, as the company is also well-positioned to take advantage global AI market, which is expected to grow over $400 billion by 2028. The potential of these three markets give BIDU a nice growth runway ahead. Management is making sure to have the company well-positioned to take advantage of these markets by spending almost 20% of revenues in R&D, which is a good indication that management is investing in its search engine, artificial intelligence, and cloud computing capabilities. Finally, it is worth mentioning that BIDU has a net cash position and is buying back its shares to the tune of $764 million during the previous twelve months, signaling that management believes the company is undervalued. Let’s not forget that BIDU share price has fallen 60% from its all-time highs.

Risks:

Competition: Google and Baidu operate in highly competitive environments, with both companies competing in their domestic search engine cloud computing markets which have other large and well-established companies vying for market share. We can expect fierce competition for the next years.

Dependence on advertising Revenues: Both Google and Baidu generate a significant portion of their revenues from advertising. In the case of Google, it is approx. 90% of total revenues, while for BIDU it is around 77% of total revenues. This is way it is important for these companies to diversify revenues streams, as their financial performance could be impacted by changes in the advertising market.

Bottom Line

In summary, Google and BIDU are both leading technology companies with strong financials and a focus on innovation and expansion to high growth markets. Google has a dominant presence in the search engine and cloud computing markets and has done a good job at starting to diversify its revenue streams by expanding into the cloud market. Baidu has followed a similar path by also becoming a key player in China´s cloud computing market. While it lags behind other Chinese technology companies such as BABA and TCEHY in terms of revenue size and market valuation, it is well-positioned to take advantage of the growth in the digital advertising and cloud markets in China.

Both Google and Baidu, like all other technology companies, face risks and challenges, but their strong financials and dominant positions in their respective markets enable them to maintain their long-term growth trajectories.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.