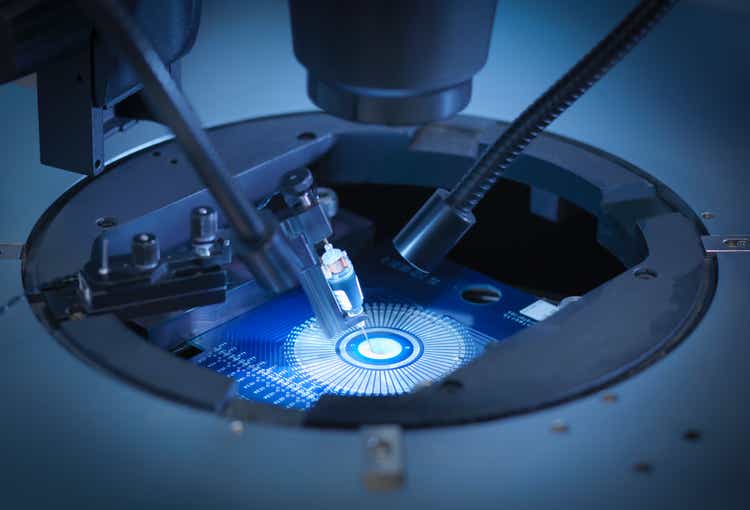

Monty Rakusen

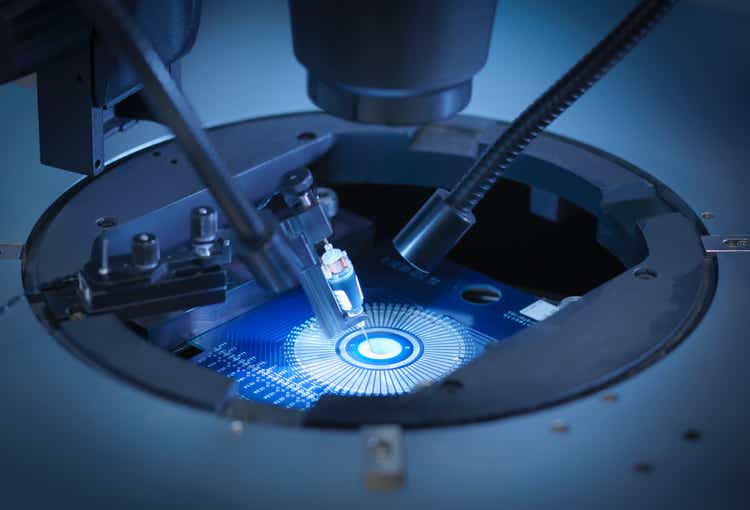

Semiconductor stocks have had a rocky couple of weeks for a multitude of reasons, including concerns about delays, whether the artificial intelligence spending boom will continue and some weaker-than-expected results.

Despite all of that, Citi is still bullish on the sector, as it sees no slowdown in spending related to AI and memory any time soon.

“Fundamentals from the AI and memory end markets (roughly 30% of semi demand) remain robust with AI capex increasing and DRAM pricing already better than expected in 3Q24,” analyst Christopher Danely wrote in an investor note.

Micron (NASDAQ:MU) is the firm’s top pick, as now is the time “to double down,” Danely said on the belief that the upturn in dynamic random access memory should persist on reduced capacity and pricing for the upcoming quarter is “better than expected.”

Buying opportunity

Consensus estimates fell 11% during earnings, due in large part to weakness from Intel (INTC) and some concerns from GlobalFoundries (GFS), Microchip (MCHP) and NXP Semiconductors (NXPI), as the analog inventory replenishment (aside from Texas Instruments (TXN)) is not happening as fast as some thought.

And with the Philadelphia Semiconductor Index having traded at nearly a 70% premium to the S&P 500 (its highest valuation since 2008), expectations were “very high” going into earnings season, Danely said.

Despite all of that, there are pockets of strength, including AI and memory, as well as markets like PCs, data centers (excluding AI) and handsets.

“Fundamentals in the PC, Data Center and Handset end markets (combined roughly 60% of overall semi demand) appear solid given commentary from the supply chains,” Danely explained. “In addition, semi unit shipments remain well below end demand.”

Danely reiterated his Buy ratings on AMD (AMD), Broadcom (AVGO), Analog Devices (ADI), Microchip, Nvidia and KLA Corp. (KLAC).