Summary:

- Energy Transfer LP unitholders have outperformed its energy sector peers recently.

- ET is well-positioned to benefit from the AI gold rush moving at full speed ahead.

- ET’s expanding natural gas pipeline footprint is pivotal to its bullish case.

- I also find its valuation attractive, bolstered by high yields, attracting income investors to stay.

- With ET consolidating well over the past four months, I explain why investors shouldn’t miss buying more now. Read on.

onurdongel

Energy Transfer Milks The AI Gold Rush

Energy Transfer LP (NYSE:ET) unitholders have outperformed their energy sector (XLE) peers recently as crude oil futures (CL1:COM) fell back toward their June 2024 lows. As a result, Energy Transfer’s mostly fee-based business has performed incredibly well, even as the sector was hit by market volatility. The LP’s thesis is predicated on its broad portfolio of energy infrastructure assets. Accordingly, the ET owns “one of the largest and most diversified portfolios of energy assets” in the US.

As a result, the LP has also been able to capitalize on the AI gold rush opportunities expected to drive electricity demand to new heights through 2030. Data center operators are under pressure to lift their technical AI infrastructure to avoid falling behind in their Generative AI endeavors. Google (GOOGL) (GOOG) CEO Sundar Pichai also underscored the risks of underinvesting and potentially falling behind the curve.

In my previous bullish ET article, I urged investors to let their winning bets on the LP run further. I assessed Energy Transfer’s growing volume prospects, bolstered by its primarily fee-based model underpins its earnings clarity.

In a recent Invesco QQQ Trust ETF (QQQ) article, I presented crucial insights about why the AI gold rush is sustainable. Given their substantial natural gas midstream assets, the surge is expected to benefit energy infrastructure stocks like ET. Energy infrastructure companies are expected to play an increasingly pivotal role as data center operators seek a consistent and reliable source of electricity.

Energy Transfer’s Expanding Natural Gas Pipeline Footprint

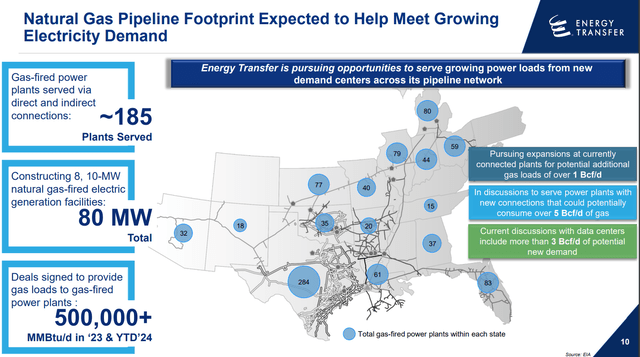

Energy Transfer’s expanding natural gas pipeline footprint (Energy Transfer filings)

As a result, I read with palpable enthusiasm from management’s commentary at ET’s Q2 earnings conference. The LP is constructing eight 10-MW natural gas-fired electric generation facilities, bolstering its footprint. The data center opportunity has expanded beyond Northern Virginia’s dominance, underpinning the benefits for midstream players like LP with an extensive portfolio.

ET highlighted the opportunities linked to data centers in “four, five different states in discussions with multiple data centers of different sizes.” In addition, Texas is expected to be a significant data center player, undergirding the anticipated surge in electricity demand. Management emphasizes that the data center AI opportunity could play a pivotal role in lifting the demand for natural gas in Texas. As a result, ET projects an “astronomical” rise in electricity demand “over the next six to eight years, about 30K or 40K megawatts at least” in Texas alone.

Energy Transfer’s Stable Earnings Profile

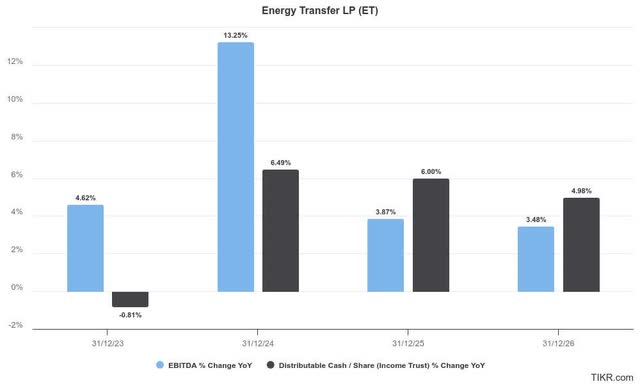

Energy Transfer estimates (TIKR)

Therefore, Energy Transfer’s solid portfolio seems well-positioned to capitalize on the long-term electricity demand growth prospects attributed to the AI surge. Wall Street estimates suggest a relatively stable adjusted EBITDA growth over the next two years. Hence, it should provide clarity over ET’s distributable cash flow per share, underpinning its attractive distribution yield.

Furthermore, the LP has earmarked $3.1B in growth capital spending in 2024, given its recent WTG acquisition and “quicker returning projects in the Crude Oil segment related to the Crestwood acquisition.” The LP also indicates its confidence in aligning future CapEx trends closer to the $3B mark, underscoring its confidence in its strategic growth opportunities.

I assess that the secular growth in data center opportunities has likely altered the growth algorithm for leading energy infrastructure players like Energy Transfer. Wall Street’s estimated industry long-term earnings growth rate is highly constructive, anticipating a 5Y forward average of 9.6%. As a result, I’m confident that the earnings visibility should lower the execution risks from its recent acquisitions. Therefore, it should provide more confidence for unitholders to add more aggressively at steep pullbacks.

ET Stock: Valuation Is Cheap

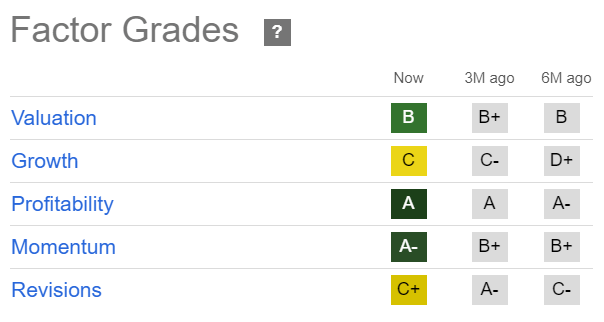

ET Quant Grades (Seeking Alpha)

ET’s “B” valuation grade underscores my confidence that it’s still undervalued. Its forward distribution yield of 8.4% is just under its 10Y average of 8.5%. Hence, the market has likely not fully revalued ET’s growth prospects in the early stages of its data center AI opportunities. Uncertainties about the Lake Charles LNG export permits could also have discouraged investors from adding more. The caution makes sense, as the race to the White House is getting harder to call.

Notwithstanding my optimism, investors must reflect potentially higher execution risks as the LP moves on with its strategic projects while integrating WTG and Crestwood into its business model. Furthermore, ET and its energy infrastructure players aren’t immune to cyclical energy market risks. Hence, worse-than-expected macroeconomic headwinds could put more pressure on utilization factors, hurting investor sentiments on ET.

Is ET Stock A Buy, Sell, Or Hold?

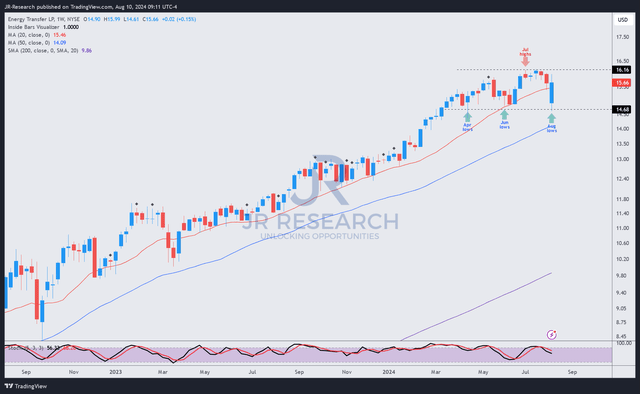

ET price chart (weekly, medium-term, adjusted for distributions) (TradingView)

ET’s price chart (adjusted for distributions) shows it has been consolidating above its April 2024 lows over the past four months. However, it’s still in an uptrend bias, suggesting buying the dips is still a sound strategy.

I assess that Energy Transfer’s highly visible earnings profile should underpin income investors’ confidence in sustaining steep pullbacks. While ET suffered near-term volatility this week attributed to its secondary public offering, its bullish weekly finish corroborates my conviction.

Consequently, I remain confident in ET’s bullish rating, which is bolstered by new growth prospects linked to the data center AI surge. Its relatively attractive valuation and high yields further support my bullish proposition.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, QQQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!