Summary:

- Exxon Mobil Corporation is beginning on a period of production growth.

- The management goal to double cash flow is finally becoming apparent to shareholders. Investors can bet on more growth after that.

- Management is exploring for more large projects that “move the needle” to add to ones already discovered.

- The Guyana project has the potential to add 50% to current production levels in a decade, with 10 likely FPSOs already in planning.

- A discovery in Brazil could likewise be significant to the future of Exxon Mobil Corporation.

Leonid Ikan

(Note: This article was in the newsletter on December 11, 2022.)

Exxon Mobil Corporation (NYSE:XOM) spent a good period of time treading water. But the latest management clearly has “thrown that out the window” (water and all). Now, management has the company searching for decent return projects all over the globe. The results of this strategy are finally becoming apparent to investors. But it took several years for that to happen. Now that the process is well underway, this company is heading towards some growth that is slowly becoming apparent to investors to add to a very safe dividend.

So, returns are likely to be abnormally high in the future for a company of this stature. It takes elephant discoveries to “move the needle for a company of this size.” Management is loading up on potential elephant-type projects to produce growth for a long time to come.

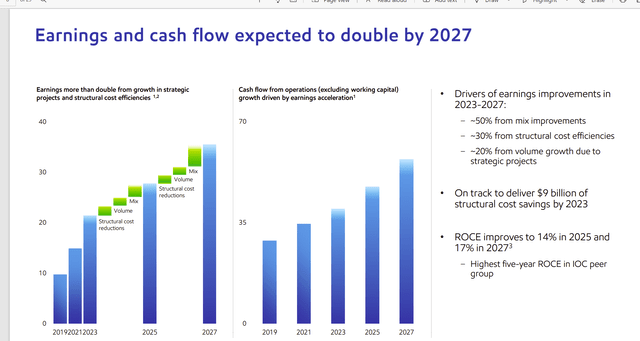

Exxon Mobil Plan To Grow Earnings (Exxon Mobil Plan Update December 2022, Corporate Presentation)

For those who know the “Rule of 72,” this plan, by 2027, should lead to a compound growth rate of about 9% (give or take a little). Companies this large and integrated do not usually grow at that pace because the logistics when you are as large as this company are tremendous. Management actually announced this plan a while back. However, it takes time (in fact a lot of time for large companies) before investors can see the results of a change in strategy like this.

Given the recent dividend, the total return going forward is likely in the low teens without including any dividend growth that is likely to occur as well. This is a stellar opportunity for an above-average return when compared to what most investors (according to research) report long term, with far lower risk than the typical stock investment. Exxon Mobil has a far-above-average financial strength and diversification that lowers the usual upstream risk.

Notice that in the presentation, at least for now, production growth is lower than the earnings growth projections. So, the rest of the earnings growth rate will be made through either efficiency gains or new low-cost projects. Management also mentioned that they will sell the higher-cost older part of the portfolio to help lower the company breakeven.

One of the historical differences between Exxon Mobil and the competition is that management often chooses a time of robust commodity prices to sell the higher-cost items. Those items are not prime, and the marketability is usually something less than optimal. However, selling during a period like now results in far better prices than when much of the industry tries to unload “junk” in the middle of a downturn.

This strategy is the answer to a lot of opinions during the last industry downturn about what management would do with that high-cost production. Now the announcements are coming steadily at the rate of a $1 billion or $2 billion at a time. All that was needed was a decent environment to sell that high-cost production.

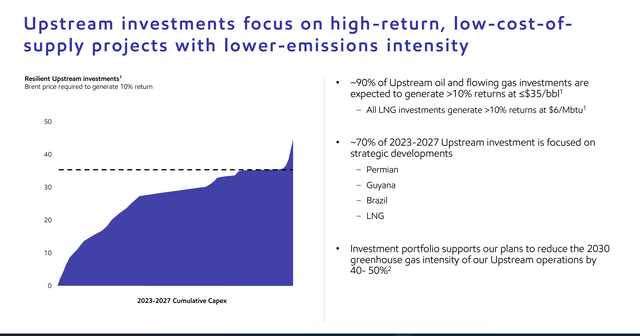

Upstream Focus

The company has some darn good growth projects well underway. Those projects are beginning to have visible returns.

Exxon Mobil Upstream Project Breakeven Points (Exxon Mobil Plan Update December 2022, Corporate Presentation)

Exxon Mobil does have some benefits from far more integration than many competitors. That will help the breakeven point. However, a fair number of these projects are very profitable at every single profit point throughout the integration. That is something that maximizes the profitability of integration.

There are managements out there that are not particularly detail oriented enough to get profits from every step of the integration. That usually results in spinoffs long-term because the integration did not work. Diversification only works when every single part of the company “pulls its weight.”

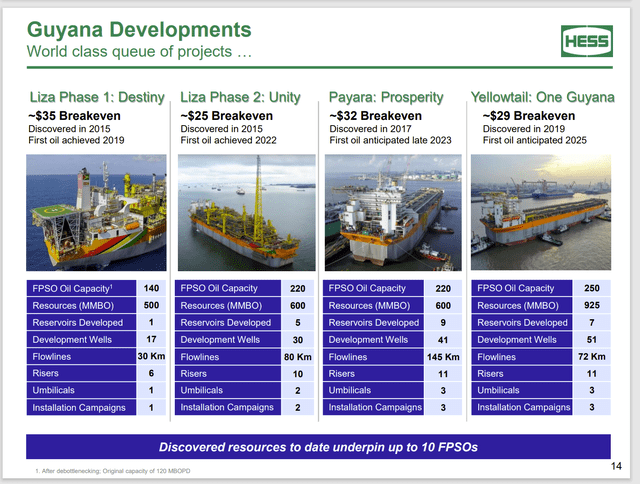

Hess Detail Of FPSO’s Coming Online In Guyana And Length Of Time From Discovery (Hess Presentation January 2023, At Goldman Sachs Global Energy And Clean Technology Conference)

Here is Hess (HES) detailing the profitability of the Guyana project one FPSO at a time to back up what Exxon Mobil is telling shareholders about profitability of the upstream profits. The way things are going, this partnership is likely to have more than the often-stated goal of 1,000,000 barrels of oil per day production by the end of the decade. That amount of production is significant to a company the size of Exxon Mobil even though it receives the partners share of the production (and not all of it).

It should be noted that Hess is considerably more optimistic about production than is the Exxon Mobil guidance. In fact, John Hess believes that one of the recent discoveries may justify an 11th FPSO all by itself. Hess management also believes that there is the potential to exceed that 1 million barrels of oil per day by 2027 rather than the end of the decade. John Hess also stated that a decision to move forward with the 5th FPSO should be made in the first half of 2023.

There is considerably more upside potential in the form of more blocks where exploration has just begun, or those blocks have not been explored at all as well as far more upside potential in the current block. Mr. Hess has mentioned several times that much of the reserves shown were obtained at the 15,000 ft level of drilling. But they now think there is a lot of oil at the 18,000 ft level in the same area. Should that prove to be the case, then there is a lot of “exploration” drilling to be done in the same area that will likely prove to be lower risk than the usual exploration drilling.

From an Exxon Mobil shareholder viewpoint, this project for years, was a “blip on the radar” without really any kind of benefit and some expenses because it takes a large project a while to get going. But as more blocks become successful, this project has several ways to get larger including potential success in neighboring Suriname. This area could provide years of above-average low-cost growth for the company.

This is just one project. Several more are listed by management, and even more have the future potential to make the list to be mentioned by management in the future. This represents a big change for Exxon Mobil from the previous CEO.

Exploration

Even though Exxon Mobil Corporation management has some darn good projects that would keep it busy for a long time to come, this management is busy finding still more projects to keep that growth going potentially for a very long time.

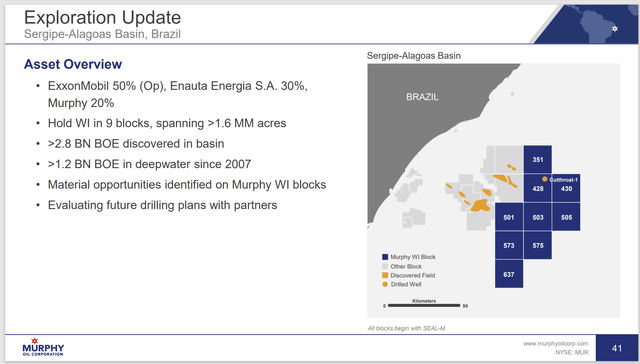

Murphy Oil Description Of Exxon Mobil Partnership Opportunities In Brazil (Murphy Oil Corporate Presentation November 2022)

Murphy Oil (MUR) detailed the partnership with Exxon Mobil for potential success in Brazil. This is one of example of Exxon Mobil looking for opportunities to extend this growth out well into the future.

A company the size of Exxon Mobil needs large projects to “move the needle.” Management is looking for those large projects. The company has a whole world to look for those projects, and frankly it is looking for those projects throughout the world. Barring a lot of bad luck, management should have its fair share of successes to continue growing – probably long after I am gone.

The Future

Exxon Mobil Corporation management has detailed that production growth will slowly head into the single digits. The current level of exploration activity indicates that rate of growth could potentially accelerate more. But if it does, the change in the growth rate will be slow due to the sheer size of the company.

However, that growth will now add to a well-covered dividend that has made Exxon Mobil a dividend king for a long time. Dividend growth has slowed in the last few years until the current growth plans allow for larger increases consistently. However, past successes combined with likely successes from current explorations will likely allow for a faster dividend growth rate in the future.

Management has been repurchasing shares. This likewise will aid in per share earnings growth in excess of company growth. What was an income investment is slowly turning into an income and growth investment. This turn of events should allow for an unusually low risk return in the teens for the foreseeable future.

The price of oil and gas can be very volatile. So, earnings reported by Exxon Mobil Corporation are likely to vary somewhat with that volatility. But the overall trend should be one of slow growth that generally exceeds the growth rate for a company of this size. That makes Exxon Mobil Corporation common shares very attractive to a wide variety of investors. The very high debt rating signals an unusual level of safety for the level of return management appears to be aiming for.

Disclosure: I/we have a beneficial long position in the shares of XOM, HES, MUR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

I analyze oil and gas companies like Exxon Mobil and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.