Maximusnd/iStock via Getty Images

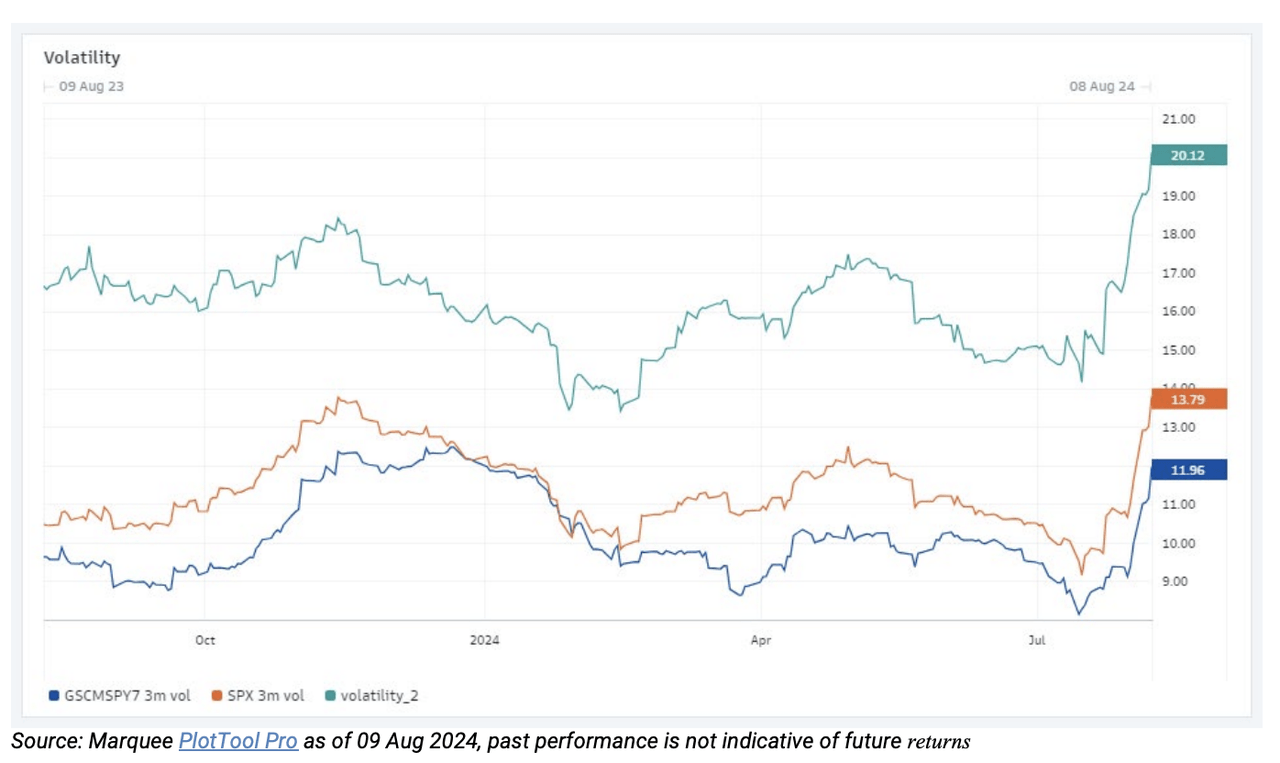

As volatility begins to normalize from a historic shock last week, the Magnificent 7 stocks offer better hedging value than the S&P 500 as a whole, according to the Goldman Sachs trading desk.

The basket of Mag 7 stocks — Apple (AAPL), Alphabet (GOOG) (GOOGL), Amazon (AMZN), Meta (META), Microsoft (MSFT), Nvidia (NVDA), Tesla (TSLA) — trades at a volatility discount to the S&P 500 (SP500) (NYSEARCA:SPY) (IVV) (VOO) and offers “cheaper protection,” the thematic team led by Louis Miller and Faris Mourad wrote.

“Meanwhile, AI capex risks feel well understood here, leaving room for upside risk if earnings deliver,” they said, adding that hedging market beta with the Mag 7 makes “more sense than SPX in this backdrop.”

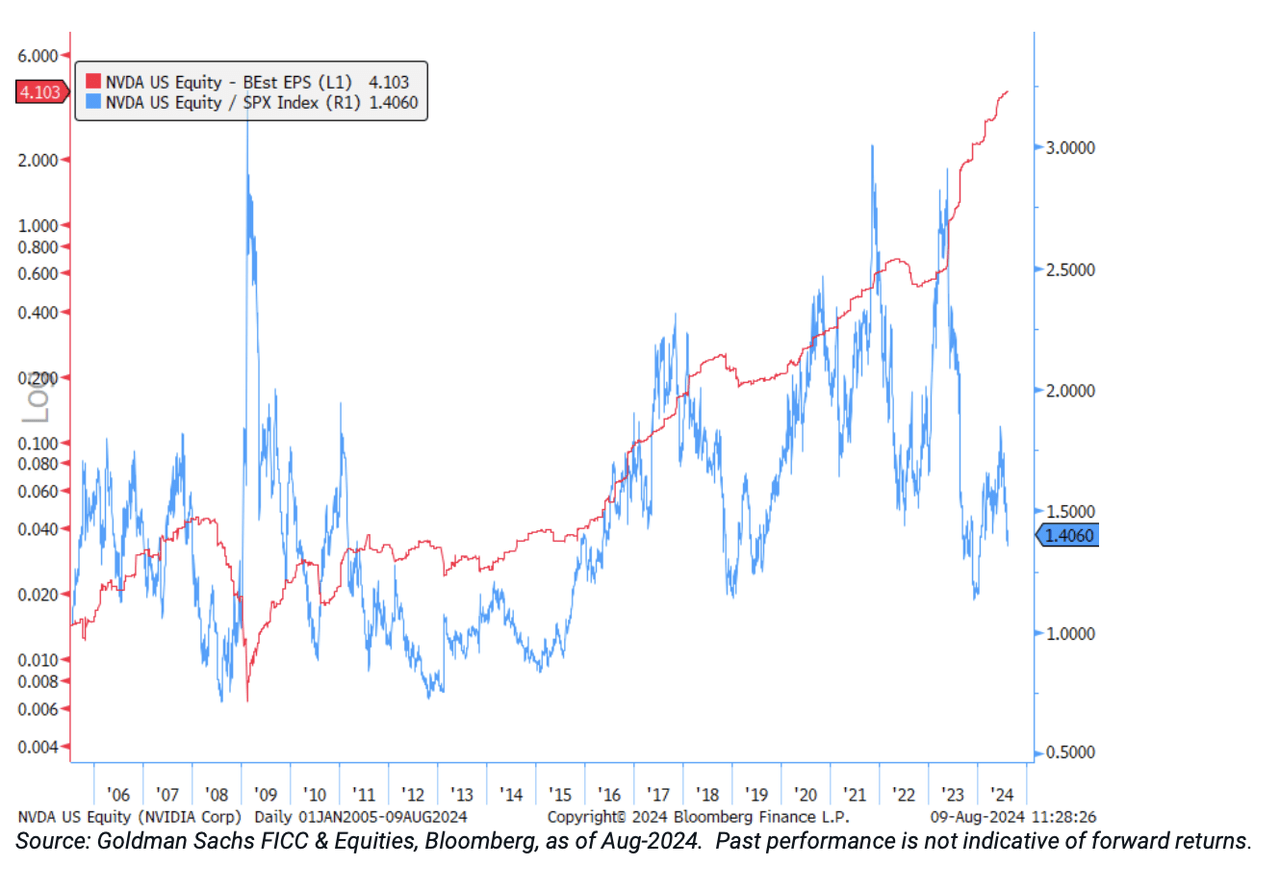

Looking specifically at Nvidia’s valuation premium to the S&P, they said it looks balanced vs. history.

“NVDA 24m PE has reset back to 25x, down from 35x in July and close to 5y lows c.20x … and its weight in SPX is close to 5%, levels at which mutual funds demands kicks in.”