Summary:

- Devon Energy Corporation investors suffered a recent bear market decline.

- Underlying energy market volatility has caused some anxiety for oil and gas investors.

- Devon’s recent acquisition and upgraded production outlook indicate its bullishness on the industry’s long-term growth prospects.

- DVN’s robust capital return framework underpins its bullish investment thesis.

- I argue why bearish sentiments on DVN have been overcooked and why the buying opportunity is timely. Read on.

mysticenergy

Devon Energy Corporation (NYSE:DVN) investors have endured a highly challenging four months, as DVN topped out in April 2024 just under the $55 level. It fell 25% through its August 2024 lows before dip-buyers returned to defend against further downside last week. As a result, I assessed a potential dip-buying opportunity for investors following Devon Energy’s Q2 earnings release. Underlying energy market volatility has affected crude oil futures (CL1:COM) as they also fell from their April 2024 highs.

In my previous article, I urged investors to ignore the market pessimism on DVN. I highlighted that it has continued to execute well while returning capital to investors. In addition, its relative undervaluation should help mitigate potential downside risks, as its recent recovery demonstrated.

Moreover, Devon’s earnings scorecard underpinned its operational excellence and astute capital allocation strategy, bolstering investor confidence while delivering a beat-and-raise quarter.

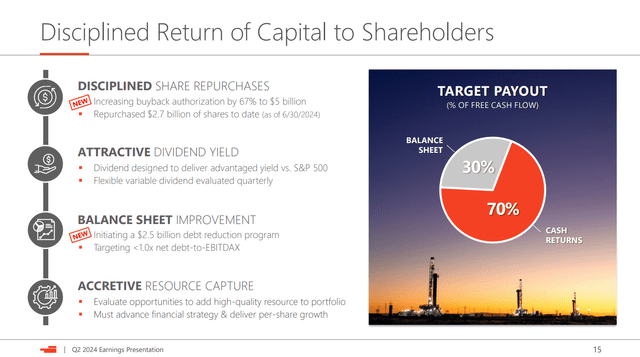

Devon Energy capital allocation (Devon Energy filings)

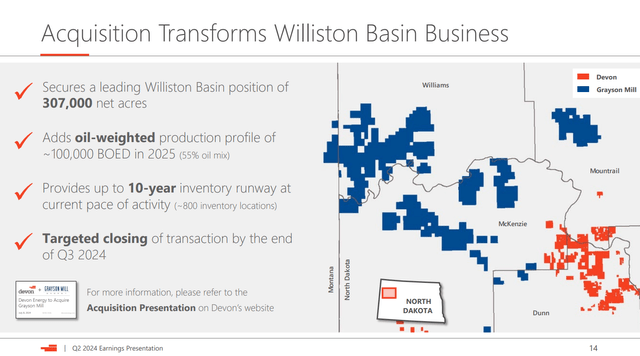

In DVN’s Q2 earnings commentary, management assured investors by providing an upgraded capital return framework as the market dissects the execution risks and dilutive effects from its recent Grayson Mill Energy acquisition. Analysts were relatively pessimistic about the deal, as Devon acquired its Williston Basin assets.

However, analysts worry that the acquisition “may not be enough to keep up with industry leaders.” Hence, the market could be concerned whether Devon needs to bulk up its portfolio with further acquisitions to drive growth more robustly. Such moves could also introduce potentially higher execution risks and the risks of maintaining its high operational performance and productivity.

The deal is anticipated to be accretive, although detailed 2025 guidance isn’t ready. Despite that, Devon’s upgraded share repurchase program (up 67% to $5B) should help mitigate further downside volatility.

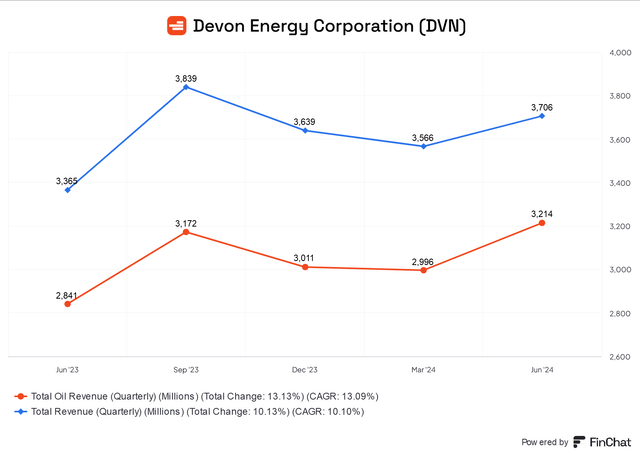

Devon Energy oil revenue (FinChat)

With natural gas revenue still in the doldrums, Devon Energy’s oil production is increasingly pivotal to driving its revenue growth prospects. While oil prices are still expected to remain relatively high, further upside could be limited if macroeconomic conditions worsen. Furthermore, OPEC+’s influence could be waning, and geopolitical tensions don’t seem to have the intended effect of leading to sustained oil price surges. Therefore, worries about a relatively well-supplied oil market are expected to pressure Devon to integrate its recent acquisition quickly to lift volume and counter potential price declines.

Benefits from the Williston Basin deal (Devon Energy filings)

Accordingly, the deal is expected to provide an additional 100K barrels of oil equivalent per day from 2025, improving Devon’s positioning as one of the US’s most significant oil producers (post-closure).

In the near term, Devon has telegraphed an upgraded production outlook of more than “680K boe per day in 2024.” The lifted guidance represents a 5% uptick against initial projections stated at the start of 2024. Therefore, I assess that Devon is confident of executing against higher production guidance while working to close its Williston Basin acquisition.

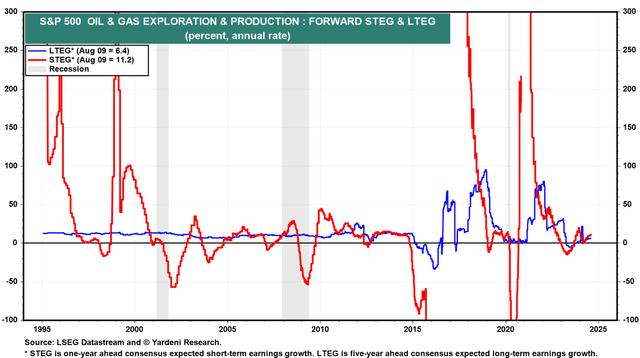

Oil & Gas exploration and production industry forward earnings growth estimates (Yardeni Research)

While near-term supply risks in the industry are justified, Devon’s assurance in allocating capital prudently should bolster its long-term earnings growth prospects. Big oil and gas companies are not expected to be disciplined in their investments over the next few years. In addition, Devon’s capital return framework on capitalizing on share repurchases (given relative undervaluation) is expected to bolster shareholder value. Also, its healthy balance sheet (adjusted EBITDA leverage ratio of 0.6x) allows ample buffer for it to capitalize on potentially accretive acquisitions moving ahead. Hence, I assess that Wall Street’s optimism about oil & gas producers’ long-term growth profile isn’t misplaced.

DVN’s forward EBITDA multiple of 4.3x is almost 30% below its sector median. Its forward dividend yield of 4.5% has likely improved the appeal for income investors. Hence, the stock isn’t considered expensive, suggesting pessimism has likely been priced into its recent decline.

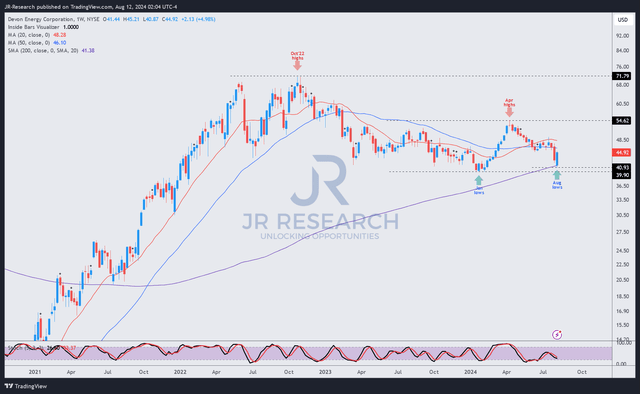

DVN price chart (weekly, medium-term, adjusted for dividends) (TradingView)

DVN’s price action indicates the lack of robust buying momentum that would have bolstered my bullish thesis. However, the stock seems to have bottomed out above the critical 200-week moving average (purple line), helping to form a higher-low against its January 2024 bottom.

As a result, buyers appeared to have returned to help DVN potentially bottom out above the $40 level. Therefore, the stock seems to have price action validation against its bullish fundamental thesis, as highlighted previously.

Notwithstanding my optimism, investors must observe the macroeconomic conditions carefully, as a hard landing could significantly impact Devon’s oil revenue. In addition, we need to monitor Devon’s integration risks related to its recent acquisition, as they are fundamental to its improved production outlook. As indicated, we should have better clarity over its 2025 guidance after the deal successfully closes in Q3.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!