Summary:

- Besides the emerging revenue streams, Walmart has consistently improved its e-commerce offering, which is now 16% of Walmart’s revenue.

- The interesting technical point is that Walmart made a new all-time high and has sustained it, while Amazon has been rejected twice at its August 2021 high of $188–$190.

- Walmart is a margin expansion story, and a burgeoning revenue growth story with the new ventures, but it’s really not a cheap stock.

- Walmart’s real competitive strength today is grocery.

Alexander Farnsworth

The one thing about Walmart (NYSE:WMT, NEOE:WMT:CA) if you’ve followed them over the years (and this blog has modeled the financials since 1995), is that the retail giant is always innovating, sometimes transparently and sometimes internally.

In the late 1990s, it was RFID (radio frequency identification devices) chips, which were used to track inventory on Walmart trucks, and it was thought Walmart merchandisers could track every pallet of every item, moving around the country. Walmart’s primary strength back in the 1980s and 1990s was its ability to move merchandise to and from various stores, anticipate inventory re-stocking, or inventory depletion, and move inventory when it was needed to where it was needed and in the quantities it was needed, and do it far cheaper and better than the competition, thus maintaining their “EDLP” (everyday low price) competitive edge.

The best story I personally ever heard about Walmart’s efficiency and logistics was that during the aftermath of Hurricane Katrina in late August 2005, when New Orleans and the 9th Ward were absolutely devastated, Walmart got their trucks into New Orleans before even the Department of Defense and the FEMA. Maybe it’s folklore, maybe not, but I’m not surprised that America’s largest retailer could beat the government to the punch.

But that’s the old Walmart.

In April 2023, Walmart announced they were beginning to automate their supply chain (Walmart is a prime AI beneficiary given the customer data they hoover-up from store and omnichannel venues), at the same time, they reiterated their mid-single digit revenue and operating income growth targets for the next 3-5 years, but for those who have followed the stock for as long as this blog has, the news quickly goosed the stock as those who know Walmart, knew that higher margins were coming.

For those readers that want to save time, a list of all the Walmart articles written on this blog is found below: start with the May ’23 and August ’23 articles, which set the table for Walmart’s renewal.

Within one of the articles below, the growth in Amazon (AMZN, AMZN:CA) e-commerce within the “general merchandise category” has probably cost Walmart 200 basis points of operating margin in the last 24 years. It’s been a slow erosion, and Walmart’s dominance of grocery has probably aided the gradual decline in operating margin, since grocery is higher turnover but lower margin within the DuPont ROE model.

However, I do think the operating margin trend (and the gross margin for that matter) trend is poised to improve over the next few years.

The New Walmart:

Walmart made an interesting observation on their fiscal Q1 ’25 conference call in May ’24: about 1/3rd of Walmart’s operating income in the May ’25 quarter came from new businesses like data ventures, advertising, and other new businesses. Here’s the direct quote from the May ’25 conference call:

“In addition to sales growth and gross margin improvement, the reshaping of our profit composition is an exciting part of our strategy. We’re enhancing capabilities in higher margin growth drivers, such as advertising, membership, marketplace and fulfillment, and data analytics and insights, and seeing the corresponding improvement in our business mix.

Global advertising grew 24%, led by 26% growth from Walmart Connect in the U.S., and International’s 27% growth. Walmart’s U.S. ad sales reflected more than 50% growth from marketplace sellers, while overall active advertiser counts increased nearly 19%. Sam’s ad business now has 30% more active advertisers versus last year.“

Frankly, it’s a lot of buzzwords and jargon-heavy business-speak, so the proof will be margin expansion and cash flow growth.

Besides the emerging revenue streams, Walmart has consistently improved its “e-commerce” offering, which is now 16% of Walmart’s revenue. (To be frank, I don’t know if that’s total Walmart revenue or just Walmart US, or some other derivation therein. I know Walmart’s goal at one time was to have total e-commerce revenue be 1/3rd of Walmart revenue by fiscal 2026 (ends January ’26), but that was pretty ambitious, and I do think Walmart remains well below that target).

But e-commerce is growing nicely, as the May ’24 conference call noted international e-commerce sales rose 19%.

One final note on Walmart’s margins: Sam’s Club has been a big contributor to the margin improvement happening at Walmart, even though it’s still a smaller part of Walmart at 13% of total revenue. However, Sam’s operating profit has jumped into the mid-20% range in the last few quarters, which is probably not sustainable, and will likely recede back to the high-single digits, low teens, but the Sam’s Club divisional manager, whoever that is, has really done a remarkable job at improving comps and margins the last 6-8 quarters, even though revenue growth has averaged just 3% in the last 5 quarters.

Technical analysis:

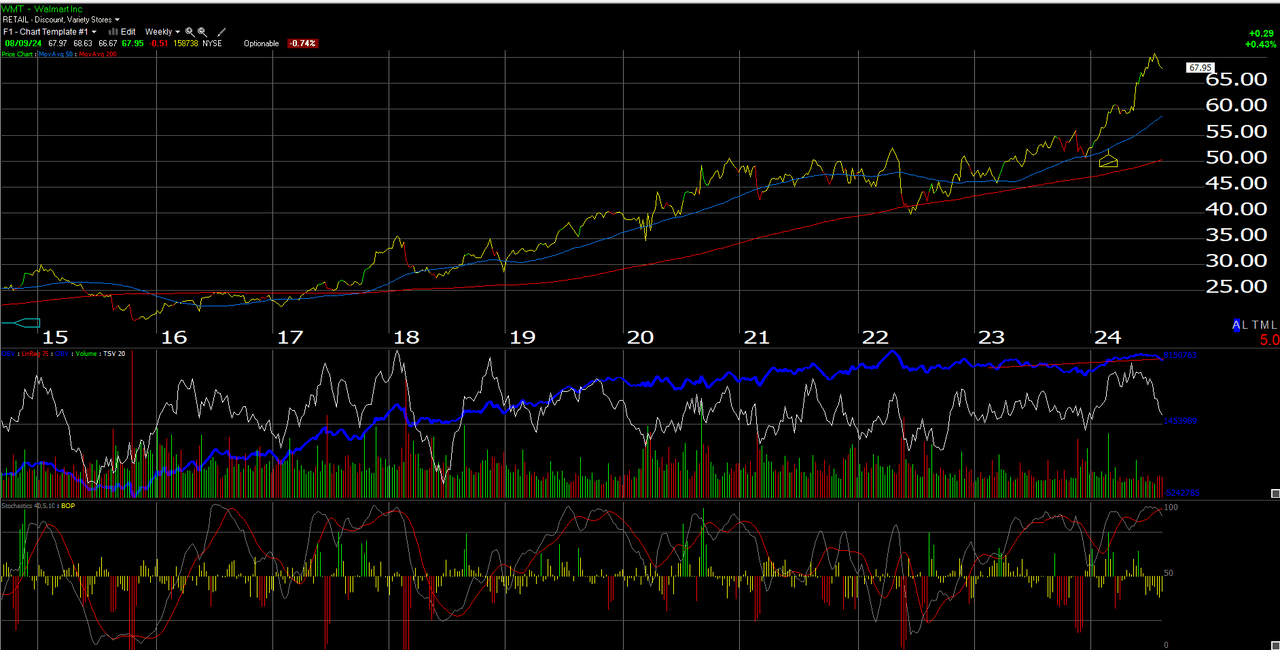

This Walmart weekly chart shows that a pullback to the low-$60s for Walmart (between $60 and $62) would be a great place to add to the stock.

The 50-week moving average is roughly $58.50, so any trade below that would likely see the 200-week moving average at $50 per share.

The stock is overbought at its current price level, so there is downside risk with the earnings report.

The interesting technical point is that Walmart made a new all-time high and has sustained it, while Amazon has been rejected twice at its August 2021 high of $188–$190. AMZN broke out above $190 and even $200 for a short period of time this July ’24, but the stock is back down below the ’21 highs.

As a fundamental investor who does watch charts, Walmart technically trades better than Amazon. (It’s been a while since anyone has said that.)

Valuation:

Being a consumer staple, Walmart always trades with a higher P/E multiple than its traditional EPS growth of mid-single digits, and today is no exception with Walmart trading at 25x P/E for the next three years (fiscal ’25, ’26, and ’27), with an expectation of 10% EPS growth each of those years.

On Thursday morning, August 15th, sell-side consensus is expecting $168.5 billion in revenue, $6.5 billion in operating income, and $0.65 in EPS, for expected y-o-y growth of 4% in revenue, a decline of 12% in operating income, and 6.5% EPS growth. Walmart’s fiscal Q1 ’25 saw revenue, operating income, and EPS grow 6%, 13%, and 22%, respectively, with operating margin of Walmart US expanding 10 bps to 4.9%.

The only real compelling valuation metric is Walmart’s price-to-sales, which remains below 1x at 0.75x. The fascinating aspect of this metric for me is that Costco (COST, COST:CA), which also traditionally traded below 1x revenue for years, has now exceeded that key metric, beginning in late 2021. Costco today sells for 1.5x price-to-revenue, and I’ve been looking over the valuation spreadsheet trying to determine what might have been the catalyst for the stock to suddenly trade over 1x to 1.5x price-to-revenue, after trading below 1x revenue for 25 years.

Relative to Walmart, Costco’s historical revenue and EPS growth have usually been 2%-3% higher for both EPS and revenue. (The two retail giants are not directly comparable, since COST is a warehouse club, which is what Sam’s Club is to Walmart, but Walmart is still very much the traditional brick-and-mortar retailer.)

Sell-side consensus estimates are expecting Walmart to be $676 billion in revenue by January ’25, and $703 billion by January ’26, or just 17 months from now.

What’s surprising is that Amazon – using sell-side consensus estimates – is expected to generate $700 billion in revenue by December ’26, so both Walmart and Amazon are on track to hit $700 billion in annual revenue at the same time.

Walmart’s price to cash flow and free cash flow are still in nosebleed territory, at 14x and 33x, respectively, so don’t own Walmart because you think the stock is cheap, (it’s not) except on the price-to-revenue metric.

Walmart is a margin expansion story, and a burgeoning revenue growth story with the new ventures, but it’s really not a cheap stock.

Summary/conclusion:

This blog’s “Walmart comp” history goes all the way back to the year 2000, and you can tell the historical periods when Walmart really underestimated Amazon’s strength and penetration, and Walmart comps suffered for it, and those periods were late 2009 when Walmart endured 9 consecutive quarters of 0% or negative declines in quarterly comps (ex-gasoline), and then again in late 2013 through 2014 or a period of 6 quarters where Walmart endured flat or negative quarterly comps (ex-gas) again.

And that’s when I believe Walmart woke up and realized they had to find an “omnichannel” or e-commerce answer to Amazon.

But Walmart’s real competitive strength today is grocery, and from reading the sell-side research, Walmart’s annual revenue is 50% to 70% grocery, which is a considerable moat (in my opinion), and even Amazon Fresh and their physical store presence (which I patronize along with Walmart’s InHome e-commerce service for grocery) won’t likely make a dent in Walmart’s grocery business.

The only threat I can see to Walmart grocery is antitrust and the considerable threat the current Administration has shown in attacking America’s best businesses, even though with Walmart, management has talked about grocery deflation and their ability to lower prices – think about what that means for America’s household budgets.

Last quarter, Walmart comped at +3.8%, and all of it was traffic, not ticket. The ticket attribution was 0%.

The financial media is pushing the “weakening consumer” angle, but even during the depths of late 2008 and early 2009, Walmart comps never went negative. In times of economic duress or worries about a recession, it tends to help Walmart’s business, since the American consumer tends to gravitate to Walmart during more difficult economic times.

As a big believer in what AI and the new business initiatives could do for Walmart, know that the stock’s overbought and extended, and I’d add more to the position in the high $50s, low $60s if that drop should happen.

Clients have a 2% position in the stock, with the goal of adding more on weakness over time.

(Here are this blog’s recent Walmart articles that summarize the “emerging Walmart” of 2023 and beyond: May ’24, Feb ’24, Feb ’24, Nov ’23, Aug ’23, May ’23).

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.