Summary:

- Tesla, Inc. is coming down to earth, and it isn’t only because of Elon Musk’s stock sales.

- The market is finally realizing that valuation matters — even for Tesla.

- Tesla is not a bad company (just a polarizing one), and investors would do well to remember that they have the option to sit on their hands.

Xiaolu Chu

Perma-Bears and Mega-Bulls

Let’s start with an uncontroversial statement: few stocks in the world are as polarizing as Tesla, Inc. (NASDAQ:TSLA). The electric vehicle (“EV”) maker founded by Elon Musk seems to attract extreme personalities on both sides of the ticker tape. You don’t have to look far to find ultra-Elon Musk fanboys raving about how Tesla stock will soon resume its journey back to the moon, or raving Elon Musk haters predicting the stock will soon crater into oblivion.

After years of eating crow, however, the bears are finally having their day. Elon Musk has purchased Twitter and has offloaded billions of dollars of shares of Tesla to finance the deal. Long-time investors are angry that Tesla appears to be a rudderless ship without Musk.

Amidst a sea of sad APEs and broken meme stocks, 2022 proved to us that Tesla stock could come back to earth:

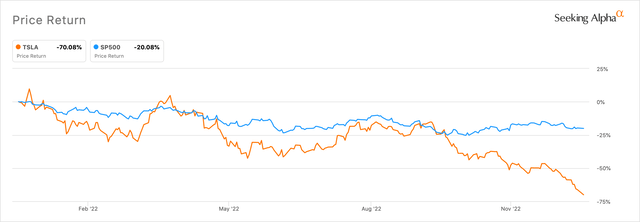

Tesla YTD Performance (Seeking Alpha)

Tesla returned roughly -70% in 2022 vs a decline in the S&P 500 (SP500) of close to -20%. Today, the stock trades hands around $113, and throughout message boards on the Internet, people are either rejoicing or pulling out their hair.

Whatever your stance on Tesla, it’s helpful to remember that Tesla is a stock like any other, and its current falling price gives us an opportunity to stand back and assess it as such. How much further, in fact, might Tesla fall, and is now a good time to invest? We believe that to answer that question, we need to compare Tesla with its two main American competitors–Ford (F) and General Motors (GM).

This method of valuing Tesla has not been uncontroversial in the past – bears insist that it’s an absolutely necessary exercise, while bulls contend that Tesla should not–cannot–be compared to old dinosaur carmakers. In a sense, the bulls of previous years were correct. It was almost useless to compare Tesla with GM and Ford while Tesla was trading at an astronomical valuation. But today, we believe the comparison is quite useful to determine how far the stock may fall.

Let’s dive in.

Revenues

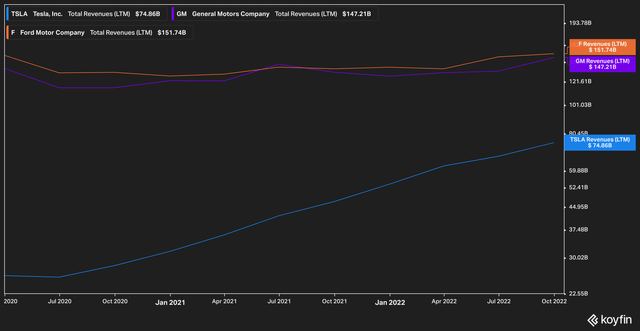

TSLA, GM, F Revenues (Koyfin)

We’ll start with a basic review of revenues, since sales are the building block for any business. Tesla’s LTM revenues are around $74 billion, compared with GM’s $147 billion and Ford’s $151 billion. The fact that Tesla’s sales are roughly half of GM and Ford’s has never troubled Tesla bulls–they point out that Tesla’s growth of revenue can’t be beat. This has historically been true, but as Tesla faces declining demand in both new and used car sales, it’s difficult to see the exponential growth continuing. Even worse for the prospect of double-digit growth, consumers are no longer coveting Tesla vehicles the way they used to, as other carmakers roll out ever more popular electric vehicles. Even more alarming, Tesla’s core customer–the semi-affluent buyer–is beginning to project Elon Musk’s personal and political escapades onto the brand.

Add in the fact that a recession in 2023 seems unavoidable to some degree and the situation seems even more concerning. It doesn’t take much imagination to know that domestic recessions are bad for car makers. But a global recession? Specifically in China? Well that is, to put it mildly, bad news for Tesla and its near-term future revenue.

All of this should set alarm bells ringing for anyone who believes that Tesla can achieve its lofty revenue growth targets. And no, we are not willing to accept that battery packs and solar panels and other business ventures will push Tesla across the finish line any time soon, as roughly 90% of the company’s sales still come from vehicles. Let’s move along.

Price to Sales (LTM)

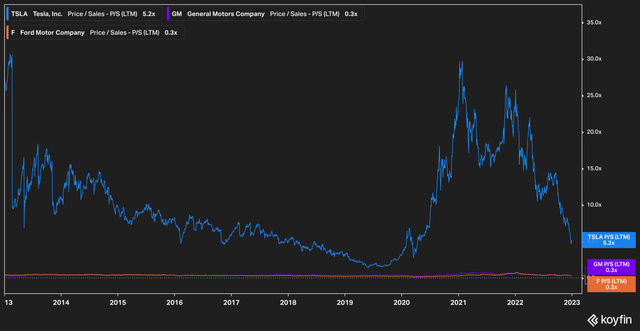

TSLA, GM, F Price to Sales (Koyfin)

Revenues alone only get you so far, so let’s take a look at a price-to-sales comparison. We like this metric as a starting point because it tunes out a lot of noise that can muddy other metrics. Things like stock-based compensation (“SBC”) and accounting gimmicks can quickly make a useful metric meaningless, but a raw sales-to-price gives us an interesting, unsullied view. It also gives us a window into how investors view the quality of the revenue a company takes in.

Going back ten years, GM and Ford have been more or less constant, trading at around 0.3x price-to-sales on a trailing twelve month (TTM) basis. We interpret this to mean that investors have consistently valued the earnings of GM and Ford as steady, and relatively constant.

Tesla’s price-to-sales valuation, however, paints a very different picture. With its dizzying highs and rapid descent, the market currently values Tesla’s shares at around 5x P/S. Tesla bulls will point out that the stock and subsequent valuation have already fallen so far–how much further could it go? But the bearish interpretation of the chart (and our own) can only conclude that Tesla shares still remain highly overpriced against its competitors, who, again, are producing competing EVs at alarming high rates amidst shouts of dissatisfaction from Tesla customers and reviewers.

(As a side note, it is difficult to overstate how unhappy Tesla owners are becoming, and this is something that investors must take into account. It’s worth the time to check out the avalanche of negativity from Tesla owners at Consumer Affairs.)

Another way to interpret the falling valuation on Tesla on a P/S basis is that market participants are no longer fully buying into every bit of hype that Elon Musk spews. From a cyber truck that has yet to be delivered, to AI robots, to a Tesla Semi (which has actually been delivered but the future of which is highly uncertain) investors seem to be telling Tesla–and by extension, Musk–that money is what truly talks.

Hence the reason for our preference of utilizing a TTM metric vs. a Next Twelve Months (NTM) metric. Anyone can say that their company is going to produce gangbusters revenue in the next twelve months. In fact, most securities analysis are entirely based on future earnings projections. But we find Tesla’s projections and estimates of low to mid-double digits–not just from the company, from analysts also–to be so wildly optimistic as to border on fanciful. We are not alone. Short sellers and Tesla critics have been pounding the drum on this for years, that Tesla simply cannot escape the bounds of economic gravity and conjure more mid-to high-end car buyers than actually exist. It simply won’t happen. To further this point, it also seems foolish to now, after so many delayed product launches, to believe that something in the next twelve months will suddenly change. (And let’s not forget investing prudence: should Tesla suddenly deliver on its promises, we can always buy in at that point. We aren’t missing out by not buying here.)

EBITDA Margin

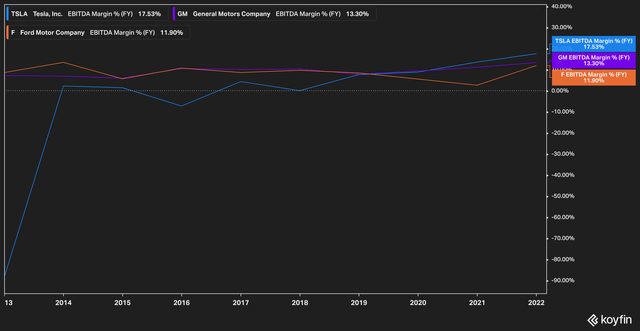

TSLA, GM, F EBITDA Margin (Koyfin)

Much has been written about Tesla’s margin, with bulls and bears once again reading the tea leaves to mean two entirely different things. It was only over the past two years or so that Tesla found itself surpassing GM and Ford in its EBITDA margin, with Tesla set to end 2022 at 17.5%, and GM and Ford closing out their FYs at 13.3% and 11.9%, respectively.

Bulls insist that Tesla has some unique insight into how to manufacture cars that the legacy companies simply can’t compete with, and hence believe that the elevated margins are here to stay. Others argue that there is no way that Tesla can maintain these margins in an otherwise mature business, and that macro conditions will eventually bring them back to earth.

The great investor Jeremy Grantham is reported to have said that “profit margins are the most mean-reverting numbers on earth.” Companies that over-earn have an historical tendency to revert, because when margins move up at a rapid clip, it’s due to outside factors–better macro environments, etc. Once those outside influences wane, or once the market writ large adjusts, the benefit usually disappears.

In Tesla’s case, the recent boost in margin appears to have come from the re-opening of its Shanghai plant. It was October, 2022, and headlines were positive. Then, in December 2022, it was announced that the plant would be suspending operations, and it was rumored that the production suspension would last through the Chinese New Year. Life comes at you fast.

Why Value Tesla This Way?

We are certain that, after reading this, many Tesla bulls will be quick to jump on us for pointing out there are lots of discounted cash flow (“DCF”) valuations of Tesla that demonstrate that Tesla’s shares currently a great value or wildly undervalued.

This is true–there are any number of DCF models that show that Tesla is undervalued. But every time we look at them, we are reminded of the old adage garbage in, garbage out.

Given Tesla’s propensity for laying out highly ambitions revenue goals and its CEOs habit of hyping each launch to varying degrees of success, we find that a DCF on Tesla is… well, not reliable. While we do believe that DCF models have a good place when forecasting demand for a company like, say, Clorox (CLX), they seem to fall apart any time you plug in numbers for Tesla, where the numbers are so widely variable.

For example, understanding what Tesla’s cost of capital will be, along with projecting future cash flows, are extremely difficult to do. Not only do you have to contend with a majority shareholder who has just left a number of the world’s largest banks (read: potential Tesla lenders) holding the bag with an ill-advised social media purchase, which could prove costly for them and damage future opportunities for Tesla to secure funding at advantageous rates, but you also have to incorporate a full macro-analysis of China’s future appetite for high-end electric vehicles to accurately predict the quality of the future cash flows. And that’s just for starters. The amount of conjecture involved in assembling a DCF for Tesla is, in our mind, not the most prudent way to value the company at this time.

The Bottom Line

We believe that, even at these new lows, Tesla remains expensive. To be sure, there is a good price for Tesla–we aren’t perma-bears suggesting the company will one day go bankrupt. We would even go so far to say that Tesla could deserve a premium valuation compared to legacy car manufacturers (even in the face of waning customer demand, a consumer base wary of the Musk-centric news cycle, and competition of increasing quality). We just believe it shouldn’t be such a high premium as the one that exists today.

So, what’s a fair price?

Returning to our LTM P/S, which for reasons explained above is our current preferred valuation indicator for Tesla, LTM revenues were about $74.8 billion. If we make the big–and it is big–assumption that Tesla will slow its stock-based compensation and share issuance in the near future (an issue for another article), then we believe a 1.2x price to sales valuation is reasonable, vs. its current valuation of roughly five times price to sales. For context, this places a premium on Tesla’s sales that is four times that of the legacy car manufacturers, so we are still assigning a higher growth potential to Tesla. Given Tesla’s current share count of 3.14 billion, the company’s current sales per share is $23.82. With an ascribed value of 1.2x sales, this gives us a valuation of $28.58–still a far cry from the current trading price north of $100.

Needless to say, we believe investors should steer clear of Tesla at this time.

Perhaps we are painting a wildly negative picture of Tesla in many investor’s minds. Perhaps it seems that we are overly discounting Tesla’s projected future growth. Perhaps Elon Musk will eliminate the distraction of Twitter from his life and return to Tesla to lead it to a glory yet untold. Perhaps it will be said that we simply don’t understand Tesla. All of these are common refrains from Tesla bulls. Yet, the numbers don’t lie.

Take any other valuation metric you like–PE (NTM or LTM), EV/EBITDA, EV/Sales–and the story remains the same. Tesla was, and remains, an overvalued stock. The day will come when Tesla, Inc. will be competitively valued, but it is not this day.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is not intended as investment advice. Due diligence is necessary for every investor. Do not take anything written in this article as advice to either buy or sell any security.