Summary:

- Elon Musk’s bears, chips, and crypto.

- The Twitter distraction.

- Has Tesla, Inc. stock bottomed?

SimonSkafar

I have only written occasionally about Tesla, Inc. (NASDAQ:TSLA), but have been following the company a long time. I don’t believe the current electric vehicle (“EV”) and battery technology is going to bring us to a total EV world like many of the politicians are mandating. That said, there is some support and incentives from many governments, such as the U.S. where there is up to a $7,500 tax credit for EVs and some States add additional incentives. Canada offers a Cdn$5,000 incentive and the provinces also have some incentives. These government subsidies will help all EV makers, but there are challenges that lie ahead.

One of these challenges has been a shortage of chips that hit the auto industry hard. Business Insider reported that in 2021, automakers built 3.23 million fewer vehicles than expected in North America because of the chip shortage. This continued into 2022. However, according to the Wall Street Journal, there now is a chip surplus, so this part of the storm should subside in 2023.

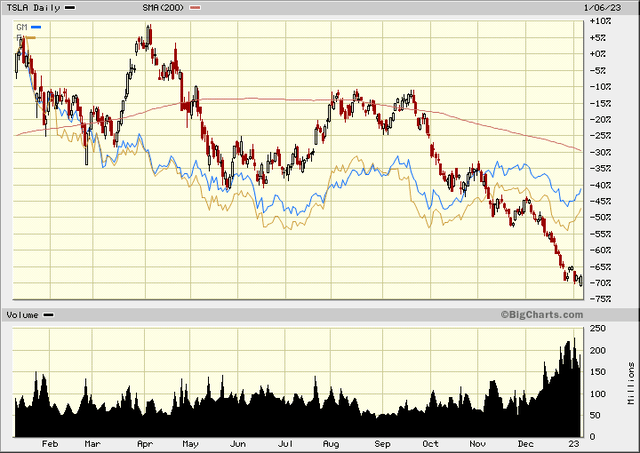

Another big wave of the storm in 2022 was the bear market that affected most stocks, driving them down significantly. The S&P 500 (SP500) was down about -19.5% and the NASDAQ down about -33%. I am still very bearish on 2023, but that does not mean there cannot be good rallies in the market. As the chart below shows, something more than chip shortages and a bear market affected Tesla in 2022. General Motors (GM) and Ford (F) dropped about -45% to -50% while Tesla plunged -70%. They all did much worse than the market averages, but a -70% drop in Tesla is very large.

Another factor that probably pushed Tesla lower than the other car manufacturers is that Tesla is a pure EV company. Many investors consider it more of a tech company than GM and Ford, although all vehicles are loaded with technology these days. Tech companies took the brunt of the bear market in 2022 so Tesla suffered another wave in the storm in this regard.

Elon Musk was always in the headlines in 2022 in regards to his acquisition of Twitter. I am sure most of you saw releases of the Twitter files, that I refer to as the “Twitter X Files.” Unfortunately, these Twitter Files may seem bizarre and unbelievable, but they are true, like the FBI paying over $3 million for censorship. The market narrative goes along the line that Twitter is distracting Musk from his duties at Tesla. I don’t see this as such a huge factor as Tesla is well-established now and I am sure there is efficient management to oversee day-to-day operations.

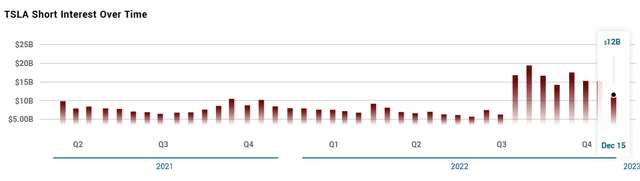

What is probably overlooked is that Musk has created many enemies with his free speech and twitter file agenda, especially on the far Left, that could be sellers or shorts of Tesla. You don’t have to look any further than the fact that Tesla was not even invited to the EV summit at the White House in 2021. This, despite Tesla representing about 74% of U.S. EV sales in the preceding 3 years. There is no doubt that Musk has no friends in the Biden Administration and can only be worse with the Twitter factor. This chart from marketbeat.com highlights the much more aggressive shorting in the later part of 2022, during the Twitter controversy.

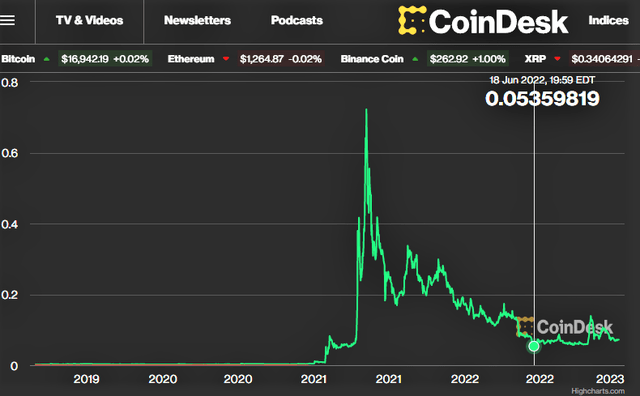

If there was not enough going wrong, there is Dogecoin. Musk was a big promoter of the token, Dogecoin, and Tesla announced in January 2022 that Tesla would accept Dogecoin for payments on some products. Dogecoin plunged from a high of about $0.65 in 2021 to a low of just over $0.05 in 2022 along with the Crypto bubble popping. Musk got labelled as a pump and dumper by many investors. Whether true or not, it weighed negatively on the sentiment for Tesla stock.

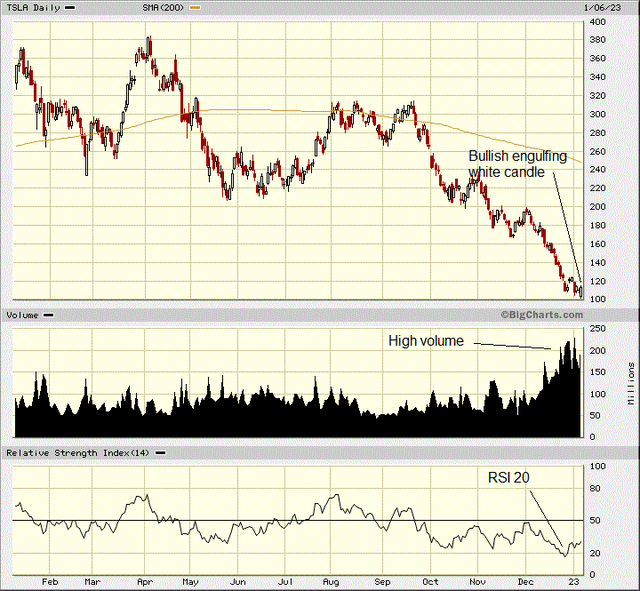

All of this negative sentiment from chip shortages, bear markets (especially technology), and Dogecoin, along with more enemies from the Twitter files accumulated to a huge selloff and bottom on the stock chart. The technical picture on the chart highlights this very well.

An RSI of 20 is very low and often signals an oversold condition or bottom. We also have much higher volume than normal in the last part of December on this bottom, probably some tax-loss selling as well. On Friday, there was a strong white candle that engulfed the trading range of the previous day, and this is also a bullish technical indicator.

There is still a lot of retail speculators in this stock, so the premiums on Call options remain very high. I believe the best way to play this is to buy the stock and better still, also write Covered Calls. The stock closed Friday at $113.06 and the April 2023 $140 Call option was priced at $8.60. You receive this Call premium so protects you on the downside by $8.60 to $104.46 ($113.06 – $8.60). If the stock goes above $140 by April 21, it does limit your upside as the stock would be called away. Your return would be $140-113.06 = $26.94 plus the $8.60 Call premium so $35.54. That works out to a 31.4% return in just over 3 months. Investors would have killed for this return in 2022. If the stock does not go over $140 by April, you can do it again and write June or July covered calls.

Risks and Conclusion

Tesla was always picked on for being unprofitable, but that changed with consistent profits in 2020 that have improved since. Their next quarterly release is January 25th and marketwatch.com has an average forecast of $1.19 per share for Q4. There is risk that Tesla does not meet expectations, but not likely. According to marketbeat.com, Tesla has been consistently beating earnings forecast consensus.

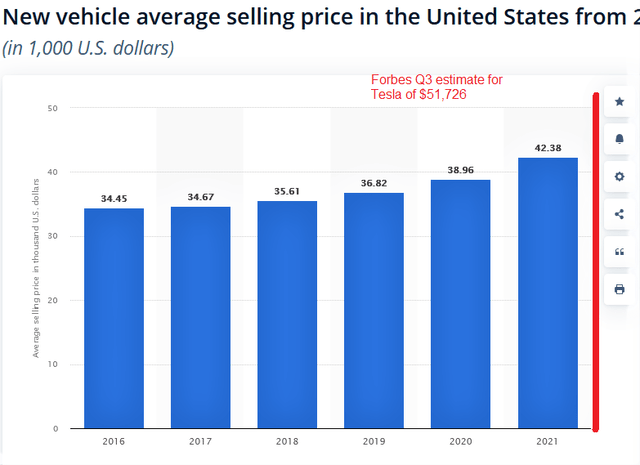

I believe one thing many analysts have overlooked is Tesla’s higher margins because the average sell price of its cars is over $50,000. Forbes estimated the average selling price for Tesla in Q3 2022 was $51,727. And most production, 94.5% according to Tesla’s Q3 report, is now the Model 3 and Y crossover. They have lower prices than Model S but share the same production platform so costs are lower.

Another risk is Musk selling more shares, but it looks like the selling related to the Twitter acquisition should be over. After Covid-19 affecting some production in China, this should also improve in 2023. All said and done, I believe all the bad news is priced into Tesla, Inc. stock and it is currently oversold.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.