Summary:

- Lumen Technologies (LUMN) stock has very negative quant ratings.

- Such ratings are well supported given its poor profit outlook, stretched balance sheet, and highly uncertain turnaround plan.

- The current cheap valuation is only in terms of topline-driven metrics.

- With no net profit in sight for years, I do not consider the valuation cheap at all.

gustavofrazao

LUMN stock: quant ratings are so negative for good reasons

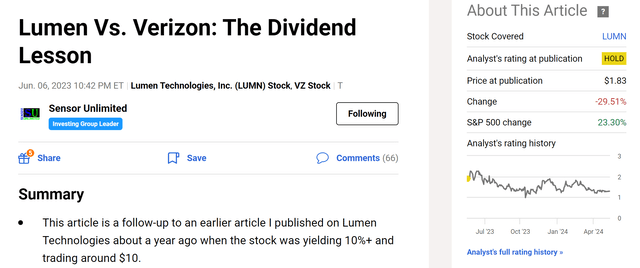

About a year ago, I wrote a few articles on Lumen Technologies (NYSE:LUMN) stock (see the chart below) to caution potential investors about the dangers lurking behind the cheap valuation and high yield. At that time, the stock was trading around $1.80 per share and an FY1 P/E of 4.6x. Despite such beaten down prices and valuation ratios, my top concerns at that time were twofold:

I am concerned about LUMN’s outlook for both the top and bottom lines ahead. LUMN is suffering from a high leverage ratio and structural underinvestment.

I went on to add:

Due to the lack of growth potential, the stock is actually more expensively valued than its peers such as Verizon in my view despite its dramatic price corrections.

Seeking Alpha

Fast forward to now, the stock’s price corrected for another ~30% as seen in the chart above, hovering around a record low. To add insult to injury, the correction was against a terrific advancement of the broader market (the S&P 500 gained about 23%). Verizon (VZ) gained even more in terms of total returns with a price appreciation of 19% and a dividend yield of about 7%.

Against this backdrop, the thesis of this article is to explain why I see the risk/reward ratio has become even less favorable for LUMN. Despite the near record-low prices, fundamentals have already deteriorated. In the remainder of this article, I will make my argument in two steps. First, I will argue that the current investment thesis in LUMN is largely a bet on its turnaround plan. And second, I will argue why I see the odds against LUMN in this turnaround plan.

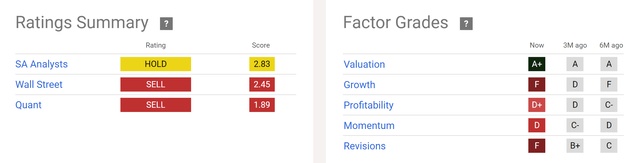

The broader market sentiment seems to echo my above thesis. For example, the chart below shows the Wall Street ratings and Seeking Alpha’s quant ratings on the stock. Based on the chart, LUMN has a sell rating from both Wall Street analysts with a score of 2.45 and an even lower Quant rating of 1.89. Looking at the factor grades closer, the only bright spot is the valuation grade, which is a strong A+. Otherwise, the grades paint a very pessimistic picture. For example, profitability gets a weak D+ grade, but the growth and revisions grades are even worse with both being Fs.

Next, I will examine the valuation more closely. You will see it get an A+ grade largely because of its topline-oriented metrics, and I will explain why I strongly suggest against the reliance on such metrics in this case.

Seeking Alpha

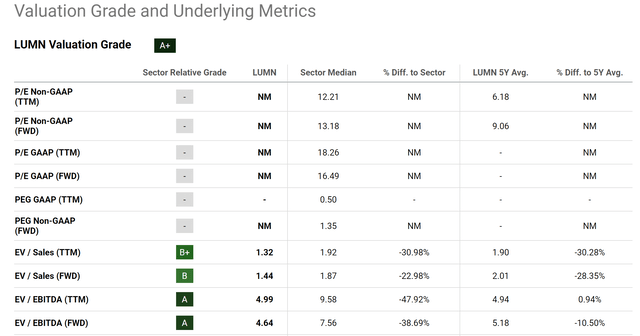

LUMN stock: a closer look at valuation

The chart below summarizes LUMN stock’s valuation grade. As seen, bottom-line oriented ratios such as the P/E ratios (even on non-GAAP basis) are not meaningful (“NM”) because of the lack of profit. As such, investors have to rely on topline-oriented valuation metrics such as EV/sales ratios. Here, the numbers are indeed attractive. For example, its EV/Sales (“TTM”) ratio has a B+ grade with a value of 1.32x, which is significantly lower than the sector median of 1.92x and its 5-year average of 1.90x.

However, I am in general against the reliance on topline-oriented metrics, especially when A) the company has no net income (well, if it does, we won’t need topline-oriented metrics to start with), and B) when the company is highly leveraged. And next I will explain that I am concerned about LUMN on both fronts.

Seeking Alpha

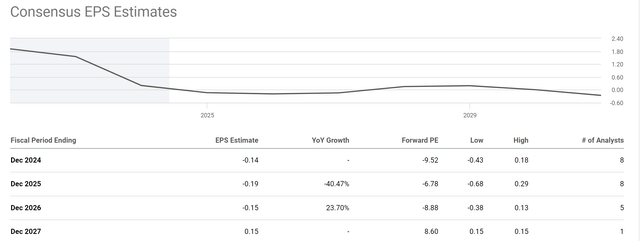

First, LUMN is unlikely to have any positive net earnings for years to come. The next chart below shows the consensus EPS estimates for LUMN in the next few years. As you can see from the chart, analysts expect LUMN to be unprofitable in the next three years. To wit, the consensus EPS estimates point to a loss of -$0.14 in fiscal year 2024 and expect the loss to further worsen to -$0.19 for fiscal year 2025 and -$0.15 for fiscal year 2026. A small profit of $0.15 is expected for the fiscal year 2027, and the implied P/E would be 8.6x, not cheap at all in my view.

Seeking Alpha

Furthermore, I am very skeptical of a forecast that is four years out given the large uncertainties surrounding the business. Any bullish LUMN thesis is now a bet on its turnaround plan in my mind. Indeed, the company has plans to reinvent itself. It has reclassified its reporting structure for better transparency, as it merged its global accounts and large enterprises into one channel. It also moved the public arm into its own sector. One of its most valuable assets in my view is its fiber broadband segment. And its management does plan to focus on further building out the Quantum Fiber. Looking further out, there are other initiatives that aim at cloudifying its network to become a digital company.

However, all of this means heavy investments for years to come. At the same time, this most likely will also require new executive hires and spending on automation. Even if the plan works – a big if in my view – I expect a strain on its performance in the process of years before the initiative can bear fruit.

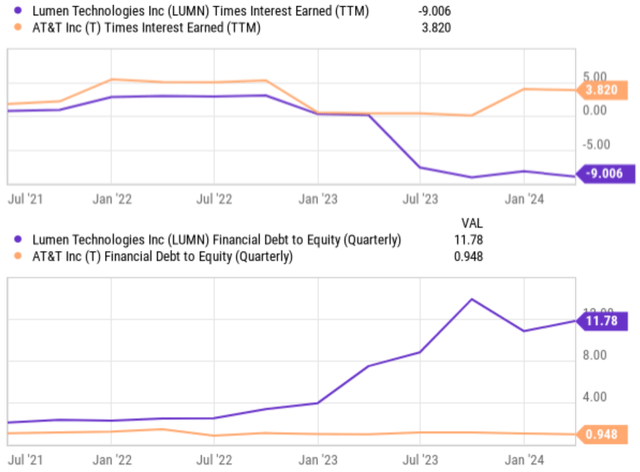

In the meantime, I am not that sure if the resources or time are on LUMN’s side. The company’s balance sheet is very stretched to start with as shown in the chart below. Actually, LUMN is far more leveraged compared to AT&T (T), a peer that is often cited for its heavy debt burden.

YCharts

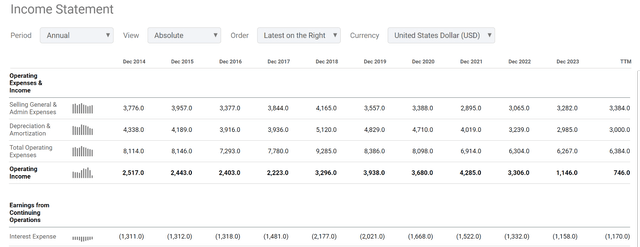

The declining operating earnings and persisting high borrowing rates further compound the issues. As aforementioned, I do not expect the company to show a meaningful net profit for years. Even in terms of operating income, the picture is quite concerning as shown in its income statement below. Its operating income declined sharply from about $3.3B in 2022 to only about $746M TTM, while the interest expenses have been hovering over $1B. After servicing its debts, there is not much organic income – if any – left for the company to finance the initiatives.

Seeking Alpha

Other risks and final thoughts

In terms of upside risks, I see two major ones under current conditions. The first one involves the successful execution of its cost-cutting plan. LUMN aims to achieve substantial annualized cost savings in the next two to three years. If this is successful, it could make its organic income better than my projection above and provide more resources for its turnaround plan. Second, I also agree with LUMN’s overall turnaround strategy. Overall, the strategy is to focus on innovations in Network-as-a-Service (“NaaS”), enterprise-to-cloud connectivity through ExaSwtich, as well as new security offerings (i.e., Lumen Defender). I agree that these are the right moves and could enjoy a secular tailwind. I just doubt it has the resources to execute it and/or in a way that is competitive to its peers.

To conclude, investors should be cautious about LUMN’s seemingly beaten down price and cheap valuation (in terms of topline-driven metrics). Considering that negative EPS is expected for the next few years, the valuation is not cheap at all in my view. The upside here is largely a bet on its turnaround plan. As explained in an earlier article analyzing the turnaround prospects of Medical Properties Trust,

Turnarounds do happen from time to time, but not nearly as often as many investors think. The many successful turnaround stories we read are largely the results of survivor bias. For every successful story we read, there are many unsuccessful stories untold. And for the turnaround to work, it always takes time and resources.

In LUMN’s case, I do not see either factor on its side given the considerations above.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.