Summary:

- Lumen Technologies has improved its recovery prospects by extending debt maturities and by confirming a positive free cash flow forecast for the current year.

- The company’s broadband business, particularly fiber, is experiencing strong momentum and contributing significantly to revenue.

- Lumen’s success in pushing out maturities has caused a stabilization of the telecom’s share price.

- At 6.5X FCF, at the mid-point of guidance, I see a promising risk profile for speculative investors.

style-photography

One reason I recommended to sell Lumen Technologies (NYSE:LUMN) last year was that the telecommunications company burned through a considerable amount of its equity as it repositioned its business and sold off assets. However, most recently, Lumen has managed to extend a considerable amount of its debt maturities and the company confirmed a positive free cash flow forecast for the current year, in part because of its fast-growing broadband business. Although Lumen will remain a highly speculative and volatile stock going forward, I believe the recovery prospects have improved here lately!

Previous rating

I down-graded Lumen’s shares last year (in Q4’23) to sell due to a deteriorating debt situation as well as continual pressure on the top line related to the firm’s asset sales. In February 2024, I up-graded shares to hold — A High-Risk, High-Reward Play — given that the telecom submitted a favorable free cash flow forecast for the current fiscal year. With the company recently succeeding in pushing out debt maturities, I believe Lumen’s turnaround prospects have further improved. Lumen, however, will remain a highly speculative investment for investors and if the company fails to return to positive top-line growth, I would expect the company’s shares to continue to languish.

Core business momentum in broadband

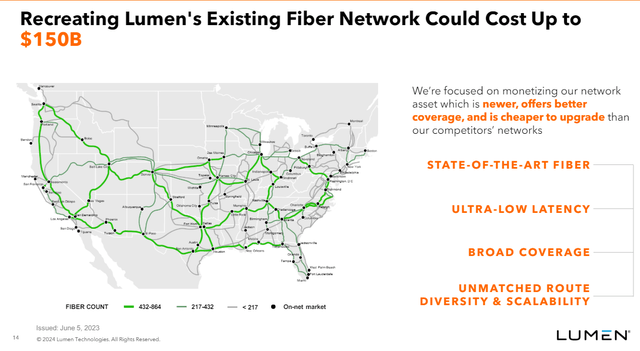

Lumen sold a number of non-core assets in the last couple of years to focus more on its core business, fiber broadband. Just like AT&T (T) and Verizon (VZ), the roll-out of fiber broadband networks is going smoothly for Lumen as customers value a strong broadband connection with better bandwidth profiles. A key asset for Lumen, therefore, is the telecom’s extensive, country-spanning fiber network whose recreation, the telecom estimated, would cost up to $150B.

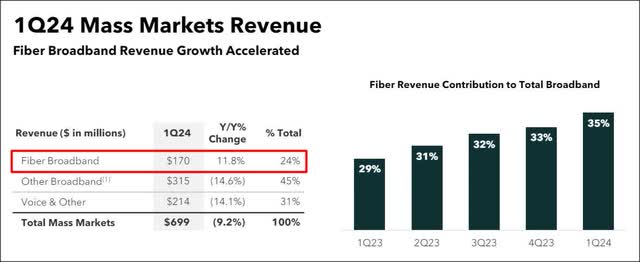

Lumen continued to have considerable momentum in broadband in the first fiscal quarter, especially fiber. Fiber broadband revenues soared 12% year over year to $170M on chiefly subscriber momentum. In fact, Lumen saw its highest net subscriber additions in the first fiscal quarter (+36k) which is backing the company’s expansion in this segment. In Q1’24, Lumen also added a massive 129K enabled fiber broadband location to its network, bringing the total to 3.8M. In the last year alone, the telecommunications company added more than half a million new locations to its fiber broadband platform, representing a growth rate of 16%. Broadband is also becoming more important for Lumen in terms of top-line contribution: the segment was responsible for a 35% revenue share in the broadband business in Q1’24, showing 2 PP expansion compared to the previous quarter.

Debt extensions give Lumen room to breathe

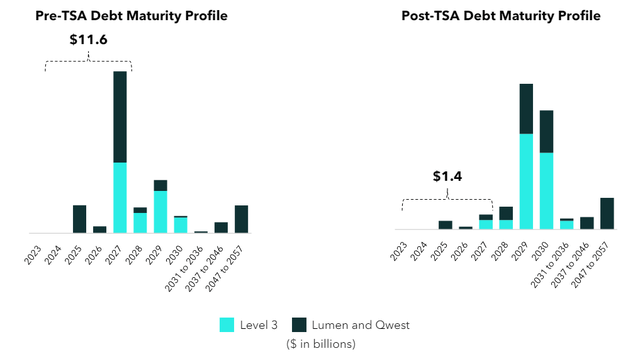

Besides broadband momentum, I believe the debt situation of Lumen has improved, triggering a rating up-grade by one notch. The reason: management recently worked out a deal with lenders that pushed its debt maturities out into the future, relieving short-term free cash flow, but also allowing the company to reposition its business after the company sold off some of its assets in recent years (including its ILEC assets in 20 states and its telecom business in Latin America).

Lumen is now on the hook for only $1.4B in financial obligations (that mature until FY 2027) compared against $11.6B in front-loaded maturities before the company struck a deal with its lenders. Additionally, Lumen has worked out arrangements to boost its liquidity by $2.3B… a chunk of which could be invested into the continual expansion of the telecom’s fiber broadband roll-out.

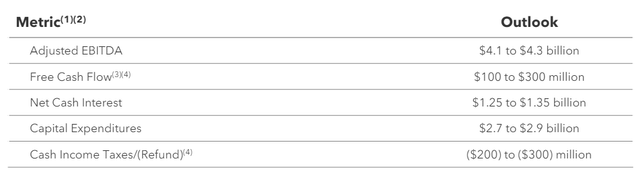

Free cash flow forecast

Lumen is expecting to generate between $100M and 300M in free cash flow for the full fiscal year, which confirmed Lumen’s forecast first presented in the fourth-quarter of FY 2023. With up to $300M in free cash flow expected in FY 2024 and progress in the company’s debt maturity reorganization, I believe Lumen could be an attractive telecom restructuring investment and achieve its free cash flow target now that it has succeeded in pushing out a big chunk of its debt maturities. Additionally, with Lumen delivering stellar performance in the fiber broadband, I believe the telecom even has a slight chance to beat full-year expectations… under the condition that subscriber momentum is here to stay.

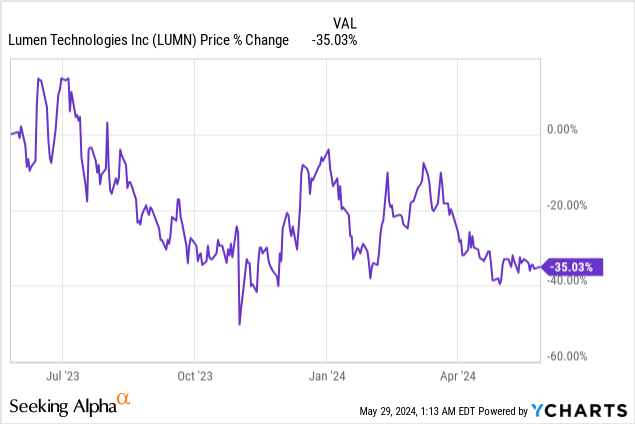

Lumen’s shares appear to have bottomed

Lumen is still priced, as one would expect, as a restructuring play. One reason why shares of Lumen are so cheap is that impairments eroded the company’s equity value last year, and the company has sold assets to reduce some of its debt. Shares also appear to have bottomed in the $1.20 price range, which could be seen as a potentially attractive entry window into the stock.

Lumen currently has a market cap of $1.3B. With $100-300M in free cash flow expected in FY 2024, Lumen is valued at a P/FCF ratio of 4-11X… depending on what the final number will be. Assuming the mid-point of Lumen’s free cash flow guidance range, $200M, shares have a price-to-FCF ratio of 6.5X and therefore trade significantly below the FCF multipliers of AT&T and Verizon.

AT&T and Verizon have P/FCF ratios of 7.1X and 9.2X based off of FCF expectations of $17.5B (as per guidance for AT&T) and $18B (as per my mid-point estimate). AT&T and Verizon have larger telecom businesses, are more diversified and generate significantly more free cash flow than Lumen, but if Lumen’s reorganization pays off and the company returns to positive top line/FCF growth, I don’t see why Lumen couldn’t revalue to 8-9X free cash flow. Assuming this multiplier range, Lumen may have a fair value of $1.58-1.77 per-share (assuming the $200M/year FCF baseline scenario). If Lumen could boost its FCF through strong execution in broadband and achieve its upper-case $300M FCF scenario in FY 2024, then I would see a fair value in a range of $2.36-2.66 per-share.

In my last work on Lumen, I said that the telecom could be valued at 7-8X FCF (which led to a fair value calculation of $1.50 per-share at the time), but the telecom clearly has improved its debt situation, which is why I am raising my expected multiplier range. With pressure coming off its cash flow (due to debt maturity extension), Lumen also has a very direct catalyst for re-pricing of its shares. Since the telecom also reduced negative sentiment overhang by striking a debt deal with its lenders, I believe a revaluation could happen in the next 12 months… which is the time horizon during which I expect my price target to be realized.

Risks with Lumen

The biggest risk for Lumen is that the company’s revenue base will continue to erode and that the telecom won’t be able to maintain its subscriber momentum in broadband. However, given that Lumen is in a restructuring setup, the telecom has much less room for error than AT&T and Verizon, both of which generate billions each year in free cash flow. If Lumen were to either lose momentum in fiber subscriber net additions or failed to achieve its mid-point FCF forecast, then I would change my mind and rating about the telecom.

Final thoughts

Lumen has made considerable progress so far in FY 2024 extending debt maturities and reorganizing its debt profile that is taking pressure off short-term free cash flow. Additionally, Lumen boosted its liquidity, which could ultimately benefit the company’s fiber broadband roll-out… the one area where Lumen is experiencing a ton of momentum right now. Shares of Lumen also appear to have bottomed in the $1.20 price range as the company recently confirmed that it succeeded in its debt maturity negotiations and confirmed its FY 2024 free cash flow forecast. I am moderately optimistic that Lumen’s recovery setup has improved, and this is why I am up-grading shares of the telecom as a speculative buy!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LUMN, T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.