Summary:

- Northrop Grumman is facing challenges in normalizing its cost profile due to supply chain disruptions and inflationary pressures.

- The Pentagon recently approved production of the company’s B-21 Bomber aircraft, but contract details forced the company to take a $1.2 billion charge, hitting its FY23 margin profile.

- Management is taking steps to stabilize margins and grow while better bidding for better-aligned defense contracts.

- Still early days, but the company is also working as a secondary contractor on integration projects while leaning on international revenue.

Alberto E. Rodriguez/Getty Images Entertainment

Investment Thesis

The defense sector is generally set to benefit from tailwinds on the back of heightened geopolitical conflicts that are compelling sovereign entities and agents around the world to upgrade their current state of armory and defense systems. At the same time, the supply-chain disruptions that were initially caused by the pandemic, coupled with severe inflationary pressures seen in the last few years, have started to weigh down on many defense contractors that have usually bid on contracts from sovereign entities many years ago.

Northrop Grumman (NYSE:NOC) is one such defense contractor that, I believe, is currently facing challenges in normalizing its cost profile for reasons that I have mentioned before. The company is best known for building the U.S. Air Force’s B-21 “Raider” bomber, which it finally launched late last year via flight tests. But the management revealed on the full-year FY23 earnings call that it was forced to take a $1.2 billion after-tax charge on the B-21 bomber program. Management has mentioned they will be taking active efforts to revitalize their margin profile, which I will explain in detail below.

But for now, I believe Northrop’s stock is fully priced in and warrants a Hold at the moment.

Updates to Northrop Grumman’s business

As mentioned in the previous paragraph, Northrop successfully completed test flights of its B-21 bomber late last year. The bomber was part of a mixed contract program awarded to the company in 2015 that included cost-plus and fixed-price contracts. The bomber aircraft is part of Northrop Grumman’s Aeronautics Systems operating segment, which involves the development, production, and maintenance of military aircraft systems.

The company operates via 3 other operating segments, such as Defense, Mission and Space systems, and participates in a range of activities in each segment, ranging from the design, development, production, integration, maintenance, and advancement of systems in each segment.

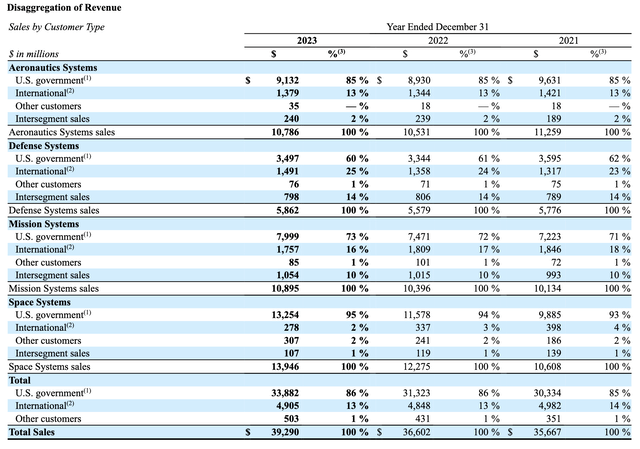

While Aeronautics and Mission Systems have been the main contributors, with the company winning contracts such as the B-21 contract mentioned before, its Space Systems segment has been the fastest growing over the past few years, with programs such as the Intercontinental Ballistic Missile Program, Sentinel, or Trident II Missile Mods still major weapon programs of the U.S. Defense Budget.

Lastly, it is important for investors to keep in mind that the company relies heavily on U.S. government defense agencies for its revenue.

Costs are weighing down on Defense Industry’s Big 5, including Northrop

Northrop Grumman’s management had been warning of costs burgeoning over any scope for profit in the production of its B-21s, but the financial scope of that was revealed earlier this year. In the earnings call to discuss full-year FY23 results, Northrop’s management revealed increased and unforeseen costs as the main culprit behind taking the massive $1.2 billion charge to their bottom line.

This resulted in the company missing Q4 FY23 consensus estimates by a shocking $9.28 earnings per share. After the successful test flight that Northrop completed late last year, the Pentagon awarded the LRIP (low-rate initial production) contracted to Northrop to begin production of its first batch of B-21 bombers. I have added an excerpt below that further explains management’s view on the $1.2 billion charge.

As you know, like all of industry, we and our suppliers have experienced cost pressure from recent global macroeconomic conditions, which are significantly different from the assumptions the team made when bidding on these five production lots in 2015.

During the fourth quarter of 2023, we again reviewed our estimated profitability for the LRIP phase of the program. And we now believe it is probable that each of the first five LRIP lots will be performed at a loss. The charge is largely driven by a change in our assumptions regarding funding to mitigate the impact of macroeconomic disruptions on the LRIP phase of the program and higher projected manufacturing costs that reflect recent supplier negotiations and our experience in completing the first aircraft. The after-tax cash impact related to these updates will be spread over a number of years.

Management also explains that this will not materially impact their free cash growth outlook since a majority of it was absorbed in the fourth quarter, but I believe the implications of the contracts picked up by Northrop over the last many years will weigh down on the company for some time. I think the implications are principal in Northrop’s case because it expects just 40% of its backlog as revenue this year, per its FY23 10-K. These trends are quite similar to Northrop’s peers, who also expect between 36% and 40% of revenue to be recognized over the next year.

|

Defense Contractor |

Revenue to be recognized over the next 12 months |

|

36% |

|

|

25% |

|

|

40% |

|

|

40% |

|

|

40% |

Most of the backlog for Big 5 defense companies is sourced from contracts that are multi-year and were agreed upon well before the pandemic, when inflation and interest rates were low. Moreover, contracts like the B-21 contract that was awarded to Northrop in 2015 also included fixed price terms, leaving defense contractors such as Northrop at greater risk if prices were to suddenly rise, as seen in the post-pandemic era.

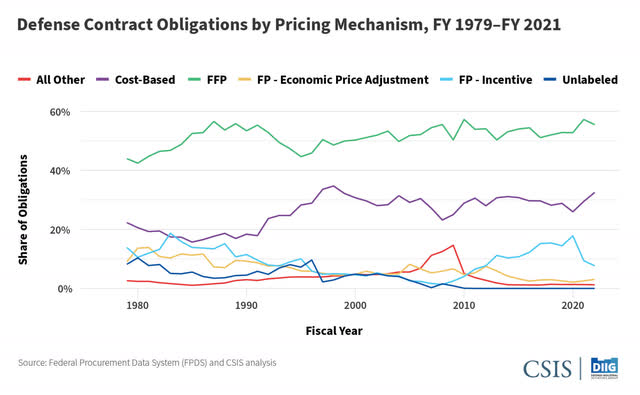

An analysis by CSIS on +4 decades of defense contracts shows how defense contractors are at most risk in the post-pandemic world of inflation and supply chain issues because most of the contracts issued before the pandemic by the U.S. government were some variation of fixed-price contracts, as can be seen in the chart below.

U.S. government increasingly has awarded fixed price contracts risking defense contractors in an era of high inflation (CSIS)

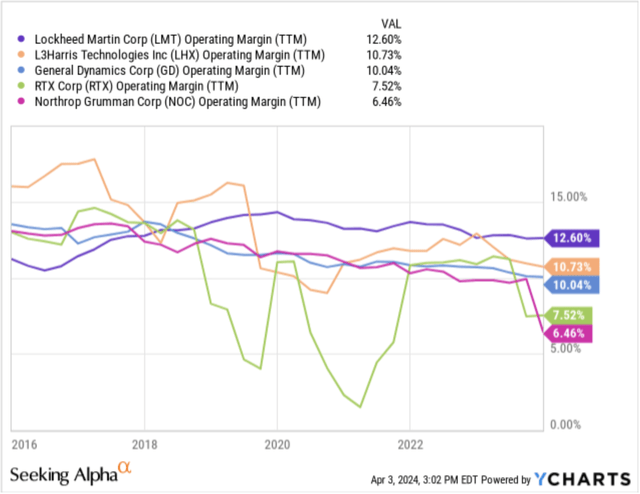

This affects defense contractors that have seen their margins dwindle over the past decade, per my observation. I have added a chart below that shows the margins of the Big 5 in defense.

Operating Margins at the Big 5 of Defense are trending lower (yCharts)

Northrop’s plan to stabilize margins and sustain growth involves the “pass-on”

On the FY23 earnings call, management mentioned that they have “passed on some high-profile programs as a result of the risk balance that the customer put forward in the RFP not meeting our standards.”

The company had highlighted examples of this earlier, where they did not bid on USAF’s NGAD program due to unfavorable constraints in the contract. But at Barclays’ recent Industrial Conference, Northrop’s management mentioned it may still participate in the contract as a secondary contractor by supplying components such as AARGM missile systems, part of its Defense Systems operating segment. Some of these initiatives may be working as the company is making some progress in leaning away from fixed-price contracts, as can be seen in the table below, which I gleaned from previous 10-Ks.

|

Contract Type |

2023 |

2022 |

2021 |

2020 |

2019 |

|

Cost-Type |

53% |

51% |

51% |

50% |

49% |

|

Fixed-Price |

47% |

49% |

49% |

50% |

51% |

In addition, they also plan to lean on their Mission Systems segment by integrating more of the weapons systems in these two segments into weapons systems developed by primary defense contractors.

I have added a table taken from Northrop’s recent 10-K that breaks out its revenue for the past 3 years by customer type and operating segment.

Northrop Grumman’s revenue disaggregated by segment and customer type (FY23 10-K, Northrop Grumman)

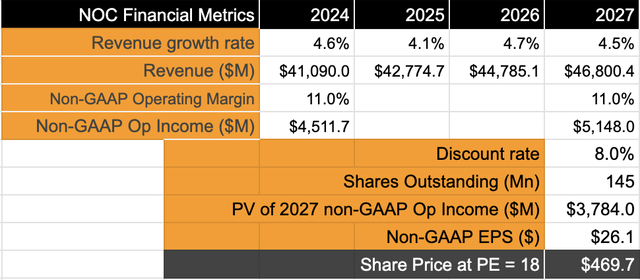

Valuation suggests Northrop Grumman has hit a ceiling

Management has initiated guidance for FY24, projecting it will grow adjusted operating income by 63.5% to $4.5 billion at the midpoint of its guidance range. While impressive, most of the y/y gains are because of the $1.2 billion charge that the company has already taken in FY23, which, in my view, provides a favorable base for y/y calculations. Management also expects sales to grow by ~4.4% at the midpoint of its guidance to $41 billion, which is per its long-term 4-5% guidance range mentioned on previous calls and conferences. I have factored this into my model.

Here is some more context for my other assumptions:

-

Outstanding shares will continue to trend lower given previous trends, including the company’s recent plan to accelerate its share buybacks. Has scope to trend lower than 145M.

-

Operating margin to remain unchanged at 11% to conservatively account for previous margin compression and management’s initiatives to tackle compression.

-

The discount rate is 8%, in line with market estimates for mature, late-stage companies.

Northrop Grumman may trade in a fair range for a while (Author)

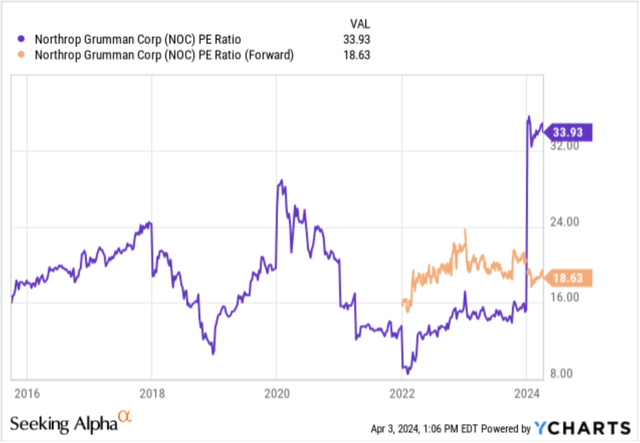

Given that its adjusted operating income will grow at a CAGR of ~16.9% from FY23 to FY27, the company’s stock looks fully priced if I assume the implied forward earnings multiple of 18x, which is in line with previous estimates as seen in the chart below.

Northrop Grumman’s forward earnings multiple vs trailing PE (yCharts)

Risks & Other Factors to consider

I had listed the cost pressures earlier, which may continue to pose headwinds for Northrop’s operating segments. Based on the extent of the financial impact it has already caused, I expect Northrop to use all of 2024 to continue working on its initiatives to arrest margin declines and continue sales growth throughout the year.

In addition, management also mentioned that there may be some benefit in terms of inflationary relief that may be credited to Northrop to alleviate their cost pressures. Management mentioned that $60 million has already been appropriated as mentioned last year, but the exact tailwinds are yet unknown, as mentioned by management on the FY23 earnings call.

Also, the U.S. government released their FY25 Budget Request last month (page 2-7), which shows reduced/unchanged budgets for many programs in which Northrop participates in such as the B-21, Sentinel Intercontinental Ballistic Missile, and the F-35 programs. This may impact future backlog prospects for Northrop Grumman.

(Note: Northrop works with the F-35’s primary contractor, Lockheed Martin on certain solutions as outlined here).

Takeaway

Temporary headwinds persist for Northrop Grumman, and the company may take time to work through mitigating all the threats and risks that I have listed in this research note. In my opinion, the defense sector still has a bright outlook, but certain structural issues need to be ironed out by management, which would encourage me to upgrade this stock.

For now, I will rate Northrop Grumman as a Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.