Summary:

- Schlumberger acquired ChampionX this past week, primarily for the latter’s production chemicals business.

- The Company is getting the leading spot in a new market and a less risky cash flow stream.

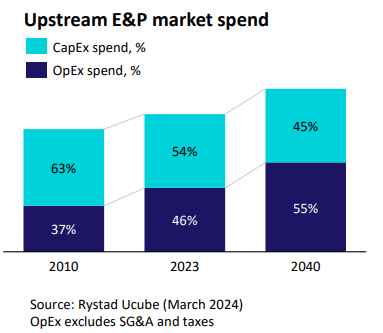

- SLB is positioning for the 2030s when the E&P spending is expected to transition from new development (capex) to more production optimization (opex).

AdrianHancu

Investment Thesis

Schlumberger Limited (NYSE:SLB) announced this past Tuesday it would acquire ChampionX (CHX) in an all-stock deal valued at $8 billion; this is quite a significant transaction even for a behemoth like SLB as post-close, the ChampionX shareholders will control 9% of the combined company.

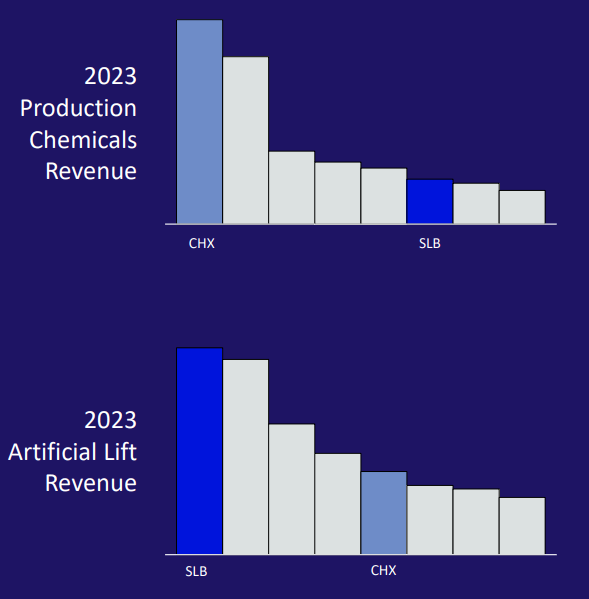

While management has offered several reasons for the acquisition, the main benefit from SLB perspective appears to be establishing leadership in production chemicals, a segment where Schlumberger wasn’t dominant so far.

Moreover, production chemicals is an “opex business”, meaning it is funded by the ongoing production expenses of its exploration and production (E&P) customers. Unlike drilling and completions services, which depend on E&P capex decisions, production chemicals spend is more robust to oil price changes as the drilling and completions capex is a sunk cost at that stage.

Looking at the resurgence in upstream capex after the pandemic, especially in the international and offshore markets, SLB is basically positioning itself for a decade from now when today’s developmental assets will be mature and require production optimization services.

As a secondary benefit, Schlumberger has a great track record of integrating acquisitions into its sales machine, and I would expect that they can extract more value from the ChampionX product portfolio than the 14% premium paid, especially given the high CHX overhead.

I rate SLB as a “buy” noting the stock is up 10% from my prior article.

Please note, I have covered Schlumberger before on Seeking Alpha. This article should be seen as an update to my prior coverage.

What does ChampionX do?

While most readers will be familiar with SLB, one of the “Big 3” oilfield services (OIH) providers alongside Halliburton (HAL) and Baker Hughes (BKR), ChampionX is a less known name and hasn’t been around for that long.

Back in 2018, Dover (DOV) corporation, one of the American industrial manufacturing conglomerates, spun off its oil and gas business under the name “Apergy.” Most of the Apergy business focused on artificial lift technologies, or means to extract oil from the ground when the reservoir pressure can’t do this naturally, such as rod lift, electrical submersible pumps and others. Its smaller drilling technologies business manufactured diamond cutters they would sell to drill bit manufacturers.

Apergy, however, didn’t last long. In 2020, it merged with the former upstream business of Ecolab (ECL), which focused on production chemicals, to form ChampionX. The rationale was to create a fuller scope “production optimization” business that would cross-leverage the combined sales channels for both chemicals and artificial lift equipment.

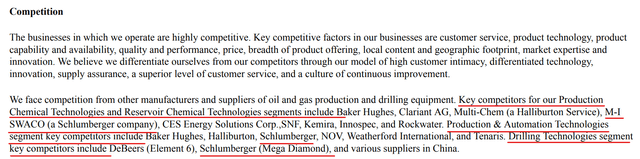

As of today, ChampionX continues to operate in both segments and also competes with Schlumberger:

So the $400 million synergies mentioned in the deal announcement won’t be limited to corporate overhead but will also come from the operations.

What will SLB get from the ChampionX deal?

The primary benefit will be establishing leadership in the production chemicals segment where SLB previously wasn’t the in the top position:

SLB Presentation

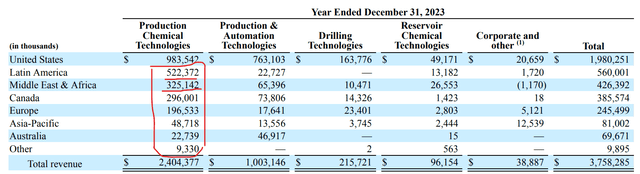

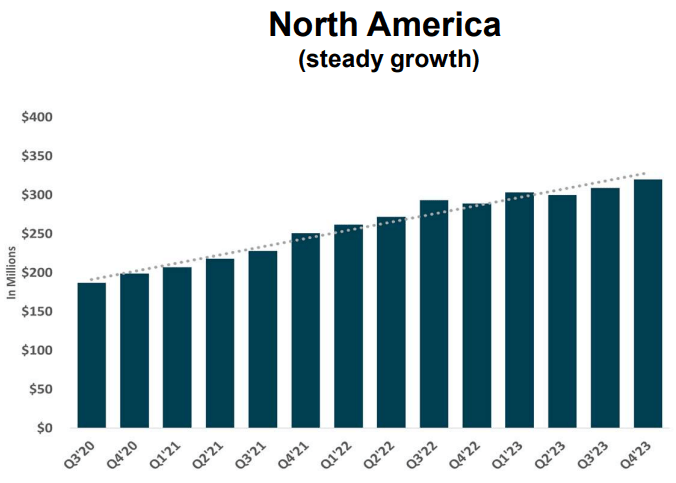

Further, ChampionX derives half of its revenue from international markets, including LatAm and the Middle East:

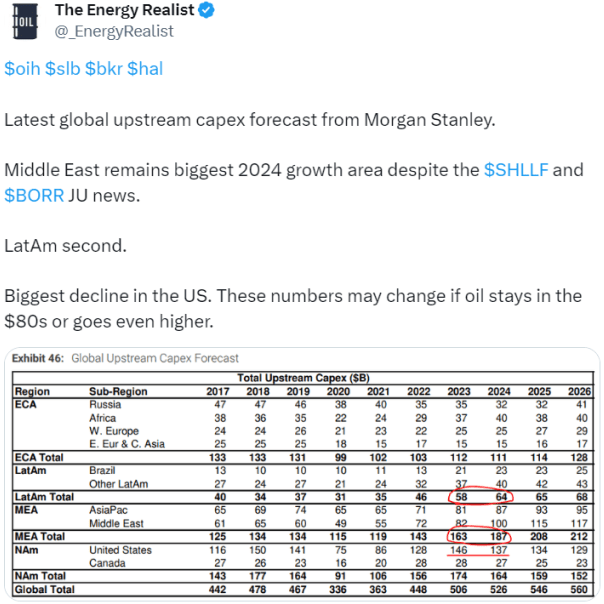

These are considered by industry analysts as the highest growing markets over the next years:

Twitter/X

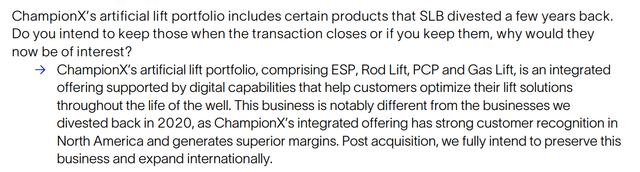

On the artificial lift side, there have been some concerns as SLB divested some artificial lift products not so long ago. Management apparently even felt necessary to address this in a Q&A posted on their investor site:

Finally, there may be a question mark around the drilling technologies. On the joint SLB-CHX call on, the Barclays analyst was concerned with Schlumberger’s MegaDiamond business essentially competing with ChampionX’s drilling segment. CHX also sells diamond cutters to SLB competitors BKR and HAL, so it could be an interesting situation. Nonetheless, the drilling technologies are fairly small from CHX’s perspective and can probably be easily divested if necessary.

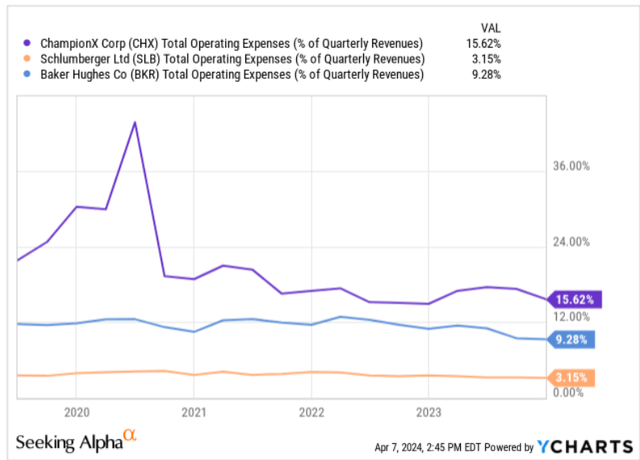

The business fit aside, it is also worth mentioning ChampionX has a very high overhead cost structure:

This should provide some room for optimization given SLB’s much bigger scale over which these costs can be spread.

SLB is thinking two moves ahead

While upstream capex has recovered from the 2020 lows (see table above) and many OFS companies are now doing great, especially those levered to international and offshore, SLB is looking beyond the capex cycle to when the current development projects mature:

SLB Presentation

Going into the 2030s, the E&P spend is expected to shift from capex (new development) to opex (production maintenance). This is what Schlumberger seems to be after.

In the meantime, the production chemicals business adds a less risky cash flow too. Even in 2020 the segment did well for CHX:

ChampionX Presentation

Bottom line

Over its 100-year history, SLB has probably done more than 100 acquisitions, and the market shouldn’t be scared by one more. Paying out $8 billion in stock isn’t trivial, but Schlumberger is getting the leader position in a market where it was previously even outside the Top 5. Further, most of the acquired CHX business is robust to capex downturns and may be in much demand several years out when the currently developed upstream assets mature.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My articles, blog posts, and comments on this platform do not constitute investment recommendations, but rather express my personal opinions and are for informational purposes only. I am not a registered investment advisor and none of my writings should be considered as investment advice. While I do my best to ensure I present correct factual information, I cannot guarantee that my articles or posts are error-free. You should perform your own due diligence before acting upon any information contained therein.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.