Summary:

- Affirm has accelerated top-line growth while boosting profitability.

- The company’s Affirm Card is gaining traction with consumers, helping the company to adjust to the higher interest rate environment.

- Affirm is set to be offered as a BNPL option on Apple Pay, with Apple no longer offering BNPL in the United States.

- The stock looks quite attractive here given the valuation and growth opportunity.

Kevin Dietsch/Getty Images News

With Apple (AAPL) appearing to announce an exit from the Buy Now, Pay Later space, Affirm (NASDAQ:AFRM) is looking like an increasingly attractive bet. The company has posted torrid top-line growth along with rapidly improving operating margins. The company has a net cash balance sheet and the Affirm Card is clearly gaining traction with consumers. The company’s solid execution over the last several years in the high interest rate environment may suggest that bearish fears are overblown. I reiterate my buy rating for the stock.

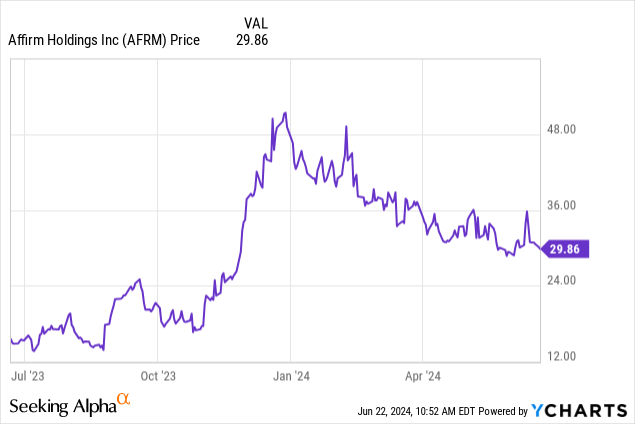

AFRM Stock Price

I last covered AFRM in April where I rated the stock a buy on account of the stunning acceleration in top line growth. The stock has underperformed the broader market since then.

While the stock has performed strongly over the past year, this still looks like early innings for this growth company.

AFRM Stock Key Metrics

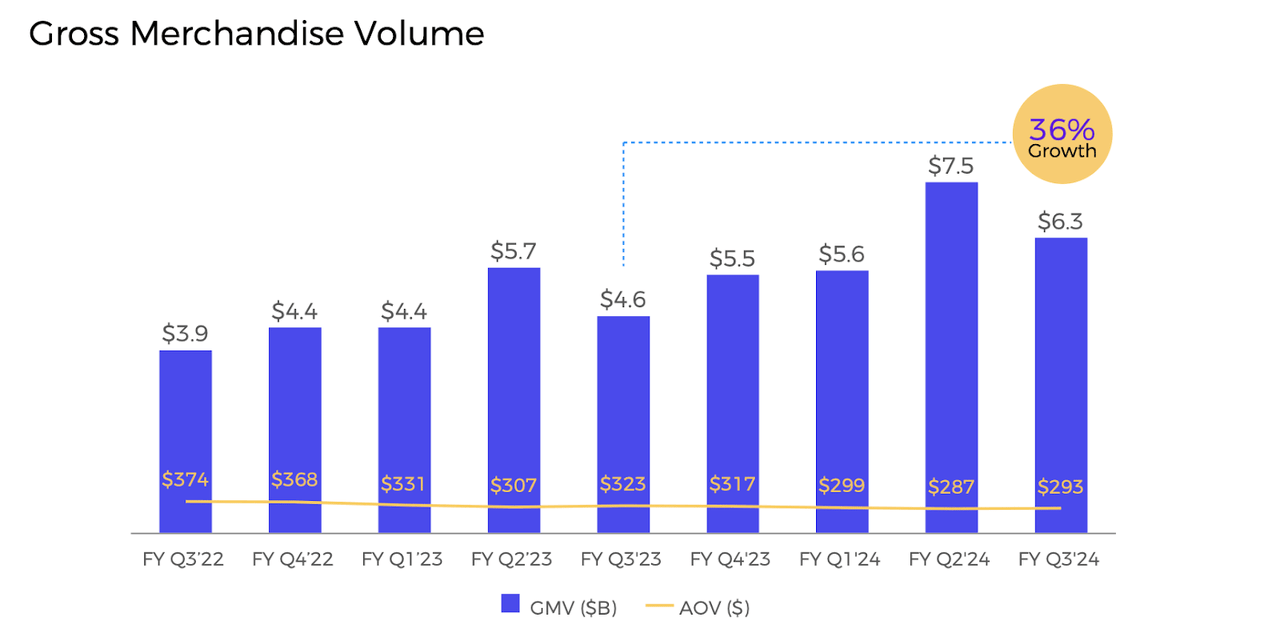

AFRM is a leading buy now pay later company with a focus on the United States. In the most quarter, the company posted its 4th consecutive quarter of accelerating gross merchandise value (‘GMV’) growth, with GMV growing 36% YoY.

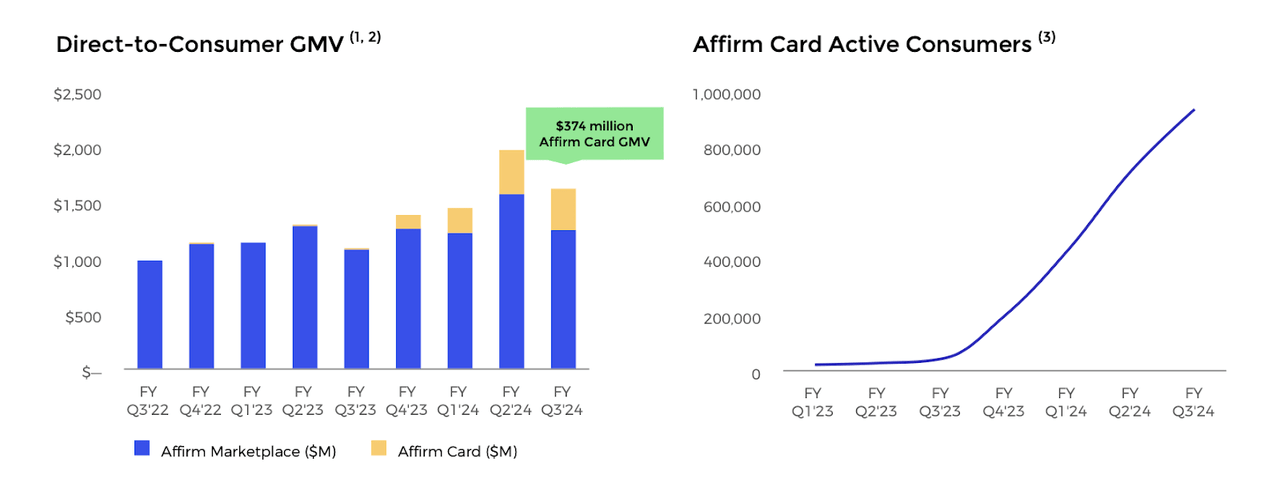

A substantial portion of that growth is being driven by the Affirm Card, which has been a runaway success for the company.

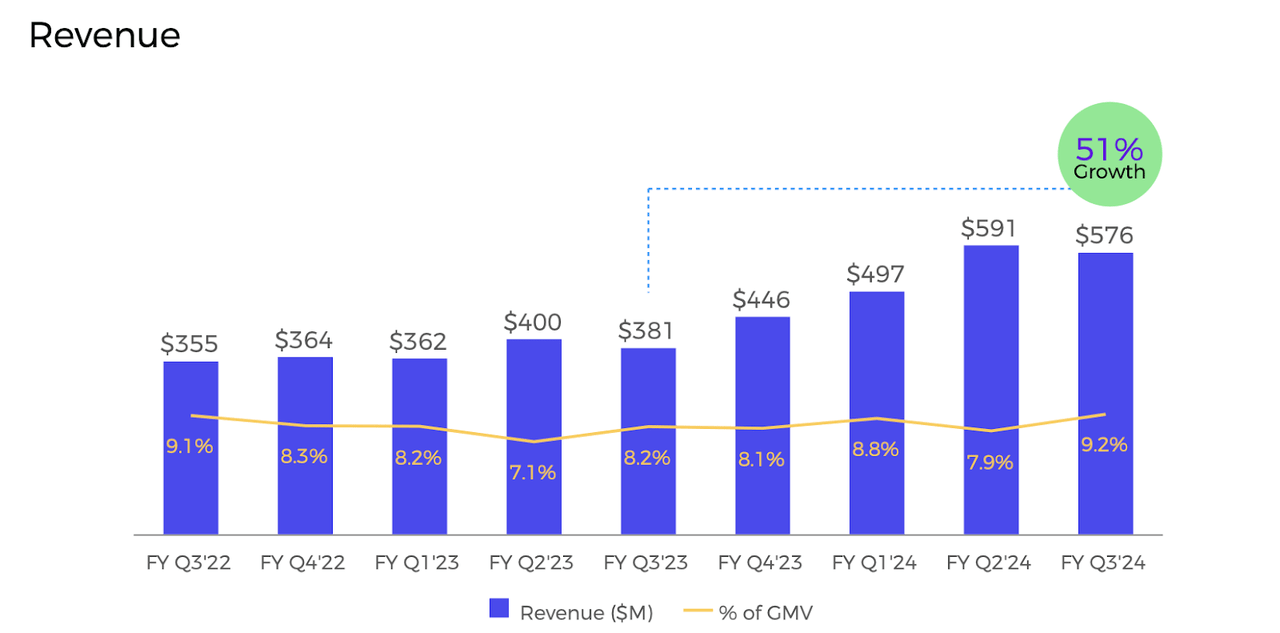

AFRM saw revenue grow 51% YoY as it continues to benefit from pricing initiatives. Recall that for several quarters following the rise in interest rates, AFRM was unable to raise its own APRs, leading to lower monetization rates relative to GMV.

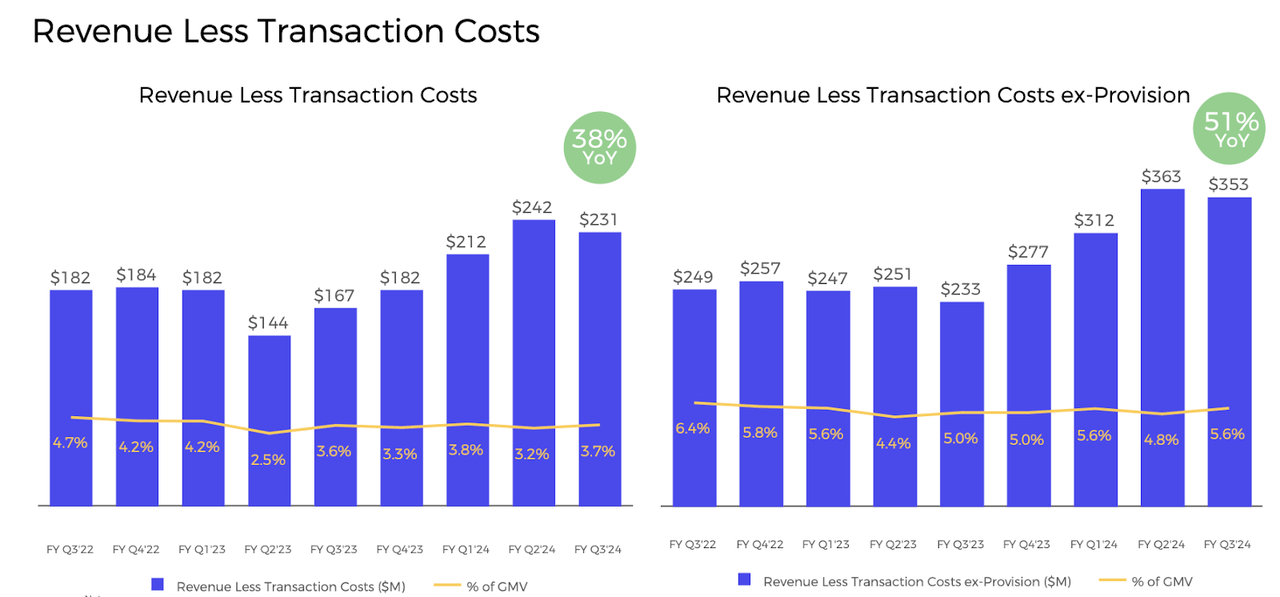

AFRM saw revenue less transaction costs grow at a 38% YoY clip, with 10 bps of margin expansion YoY.

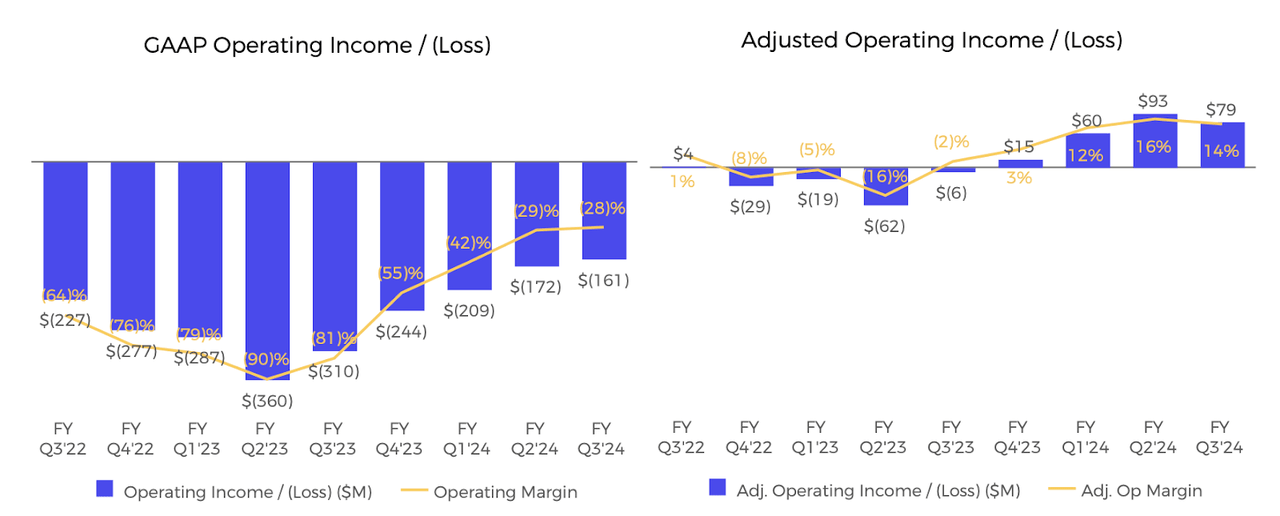

AFRM saw its adjusted operating margin swing from negative 2% to positive 14% YoY and made some progress on reducing its GAAP operating loss.

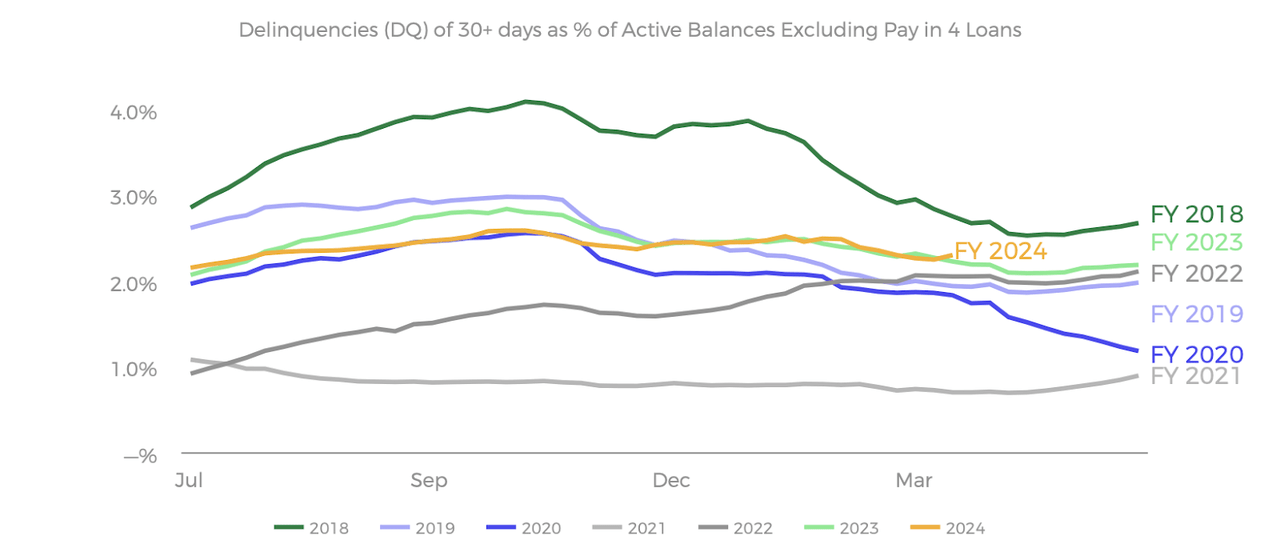

The company has seen its 30+ days delinquency trend line very similarly to last year and not substantially worse than prior years. Bears had worried that the BNPL market might face great credit risk amidst the higher interest rate environment, but AFRM has passed the test with flying colors.

The company ended the quarter with $1.6 billion of cash versus $1.4 billion in convertible debt.

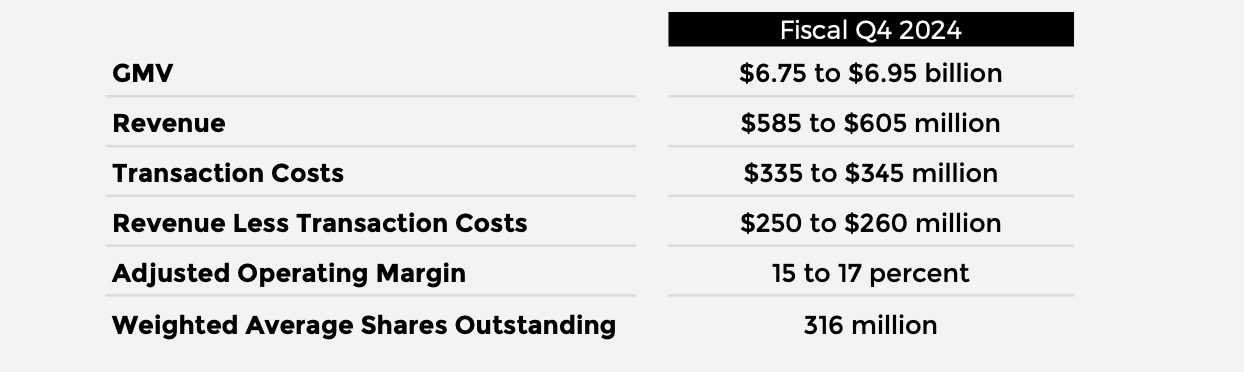

Looking ahead, management has guided for up to 26% GMV growth, 35.7% revenue growth, and adjusted operating margins of up to 17% (versus 3% in the prior year)

FY24 Q3 Presentation

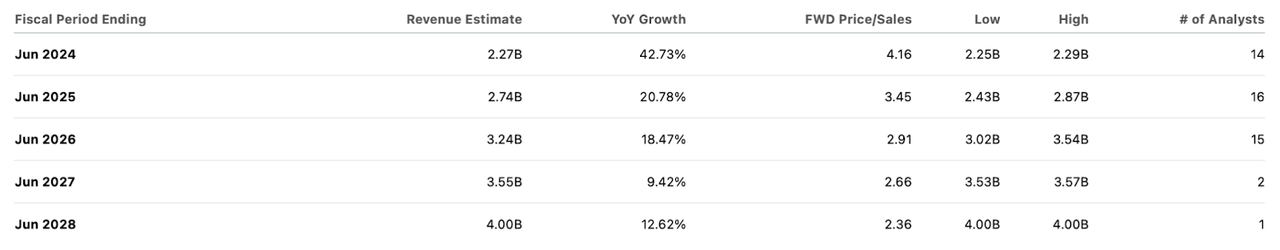

On the conference call, management notably refused to directly answer how much the pricing initiatives boosted growth. I think it is reasonable to assume that current growth rates are being significantly boosted by macro factors and may decelerate in the upcoming year. Management warned about upcoming tough comparables in the fourth quarter, stemming from that being the quarter in which they launched 36% APR caps. Management also appeared to imply that they view 20% top-line growth as being sustainable at least in the medium term.

Is AFRM Stock A Buy, Sell, Or Hold?

Subsequent to the end of the quarter, there was two important pieces of news. First, the company was highlighted as coming to Apple Pay later this year. Second, AAPL itself announced that it will no longer be offering its own BNPL product in the United States. In one fell swoop, the “Big Tech risk” story appears to have been addressed.

The stock recently traded hands at just over 4x sales and 11x gross profits.

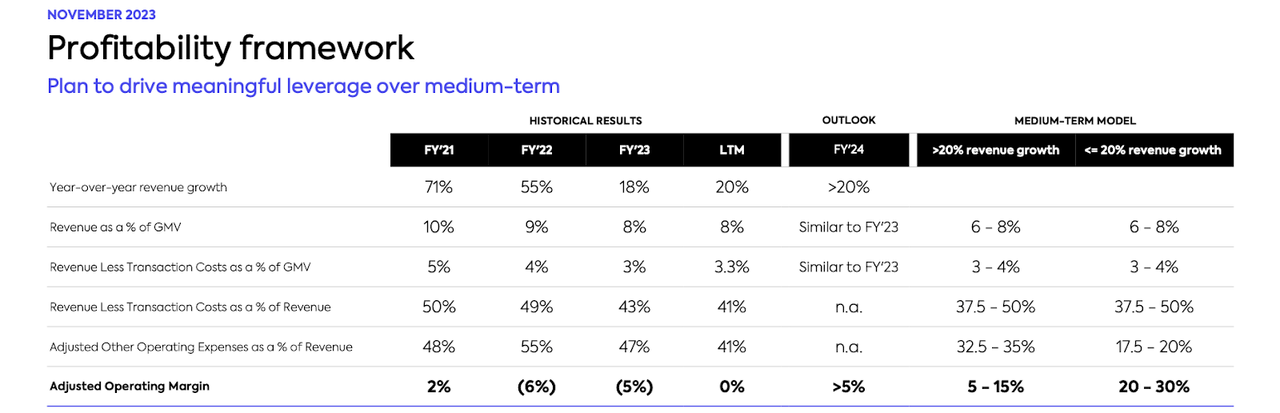

Management has guided for 20% to 30% adjusted operating margins as top-line growth decelerates below 20%.

November 2023 Presentation

Assuming 20% long term net margins, AFRM is trading right around 20x long term earnings. That looks like a reasonable multiple given the 20% projected top-line growth rate next year. Plus, given the company’s solid financial performance since the rise of interest rates, I am of the view that the stock does not deserve to trade at discounted cyclical multiples. It must be noted that the company’s BNPL loans are ultra-short duration by design and the company does not face fleeing-deposit risk due to not being a traditional bank. Even if we assume gradual multiple compression to around 15x earnings (which still looks more than justifiable given the strong balance sheet), the stock appears poised for market-beating returns if it can sustain 15% to 20% growth for many years.

AFRM Stock Risks

It is possible that interest rates rise again, at which point AFRM might need another period of time to adjust their risk models and pricing. There are numerous BNPL operators, it is admittedly unclear if consumers will remain loyal to one brand. I suspect that the BNPL market might become somewhat similar to what we are seeing with PayPal (PYPL) branded processing, in which certain BNPL operators benefit from a first mover advantage before facing competition from other BNPL competitors on the checkout screen. It is notable that PYPL trades at low valuations, which might be a disappointing foreshadowing for what might eventually happen to AFRM.

AFRM Stock Conclusion

AFRM is executing strongly with accelerating GMV growth and a solid push into non-GAAP profitability. AAPL’s latest slew of BNPL announcements appear to disproportionately benefit AFRM, with potential positive impact to the valuation multiple. I see ongoing top-line growth as being enough to drive market-beating returns. I reiterate my buy rating for the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFRM, PYPL, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.