Summary:

- AGNC Investment had a minor underperformance in quarterly BV and core earnings/EAD equivalent.

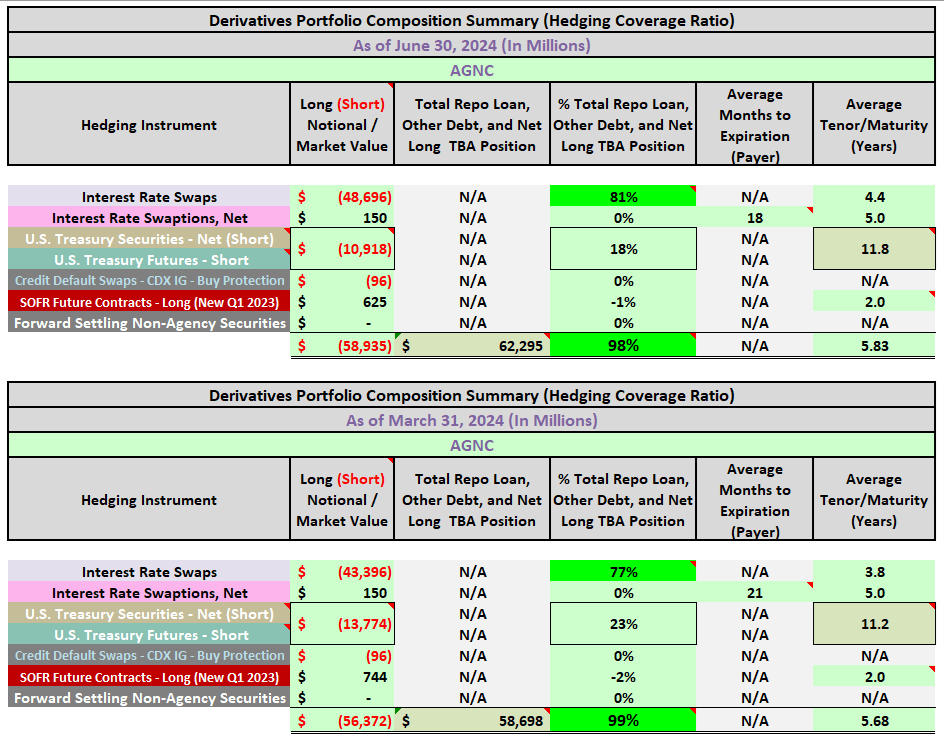

- AGNC’s hedging coverage ratio decreased to 98%, remaining defensive in a rising interest rate environment.

- AGNC’s lifetime CPR expectations decreased, and the company’s dividend per share rate is expected to remain stable.

t_kimura

By Scott Kennedy, produced with Colorado Wealth Management Fund.

AGNC Commentary

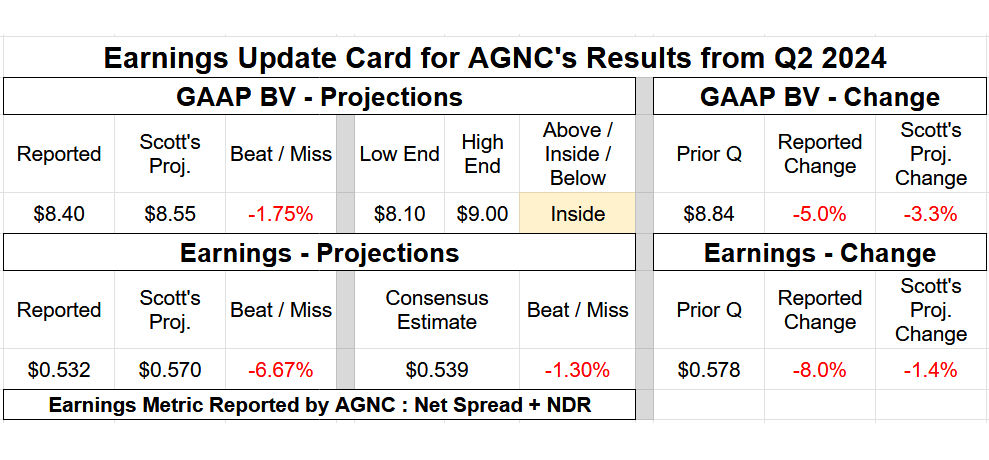

- Quarterly BV Fluctuation: Minor Underperformance (1.7% – 1.8% Variance).

- Net Spread and Dollar Roll Income (Expense) (Core Earnings/EAD Equivalent): Minor – Modest Underperformance (Low End of Range).

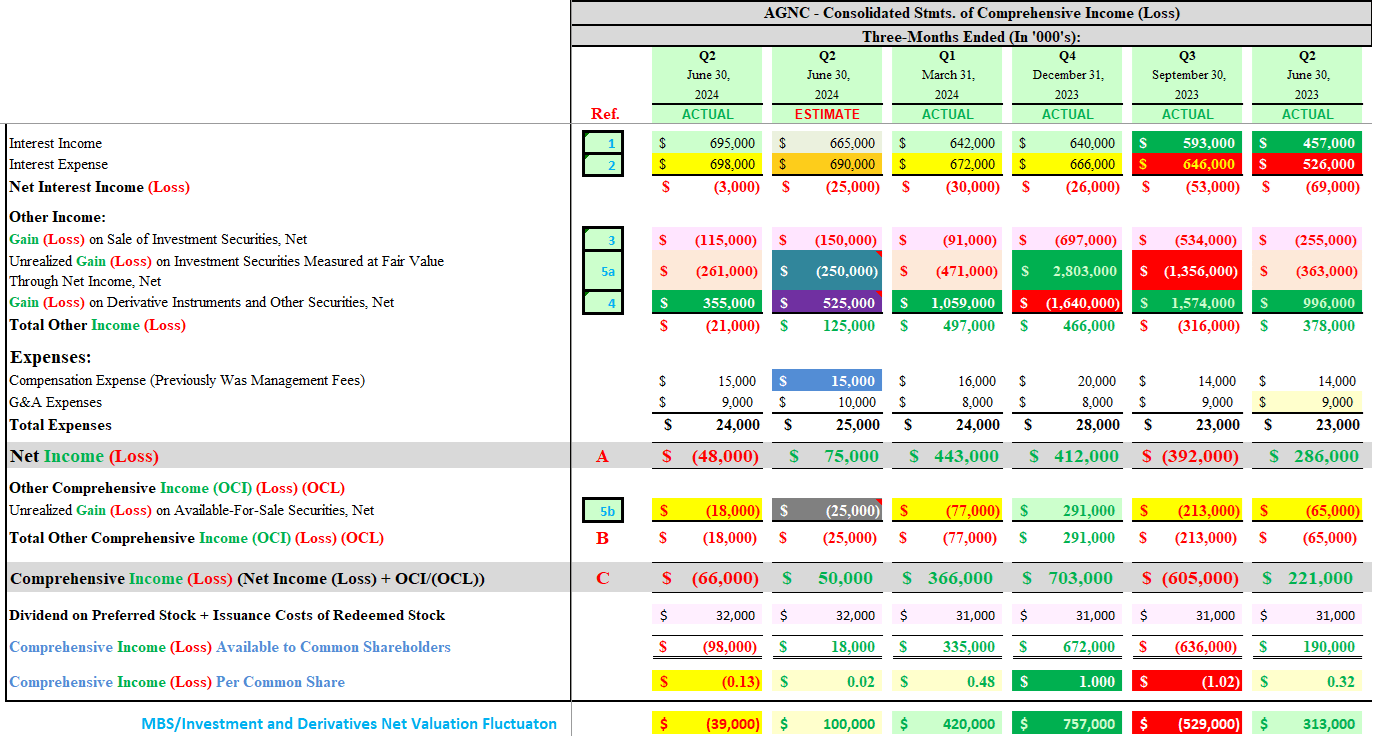

A bit of an underperforming quarter regarding AGNC Investment’s (NASDAQ:AGNC) BV in my opinion (nothing overly “alarming”). AGNC recorded a minor – modest quarterly BV decrease versus my projected minor decrease. AGNC increased the company’s on-balance sheet fixed-rate agency MBS portfolio a bit more when compared to my expectations. However, a shift to higher coupons (which experienced less severe price decreases) largely mitigated more severe MBS valuation losses versus expectations (due to AGNC’s larger portfolio size). AGNC’s derivatives sub-portfolio experienced slightly – modestly less enhanced valuation gains when compared to my expectations. This was mainly due to the fact AGNC added a good deal to the company’s interest rate payer swaps position (including the fact most were towards the long-end of the yield curve). I assumed AGNC would simply allow maturing swaps to “run-off” the balance sheet, with only a very minor amount of new payer swaps being added. The main negative to this strategy is the underlying fixed pay rate on all new interest rate payer swap contracts are notably less attractive versus expiring swaps. Simply put, this “dings” both valuations and current period hedging income (discussed in a bit). As anticipated, AGNC slightly decreased the company’s off-balance sheet net long TBA MBS position. Similar to some sub-sector peers, AGNC continued to heavily utilize the company’s at-the-market (“ATM”) equity offering program, which ultimately led to some minor tangible BV accretion (as anticipated).

A bit of an underperforming quarter regarding AGNC’s core earnings/EAD equivalent in my opinion as well. AGNC’s net spread and dollar roll income/EAD underperformance was mainly due to the aforementioned modest increase in the company’s interest rate payer swaps position (mainly in new contracts towards the long-end of the yield curve). AGNC’s net periodic interest income on interest rate swaps (current period hedging income) was a ($21) million underperformance during Q2 2024. AGNC’s NDR income came in largely as expected (only a ($5) million variance). Operational expenses also came in largely as expected (see the income statement table provided below).

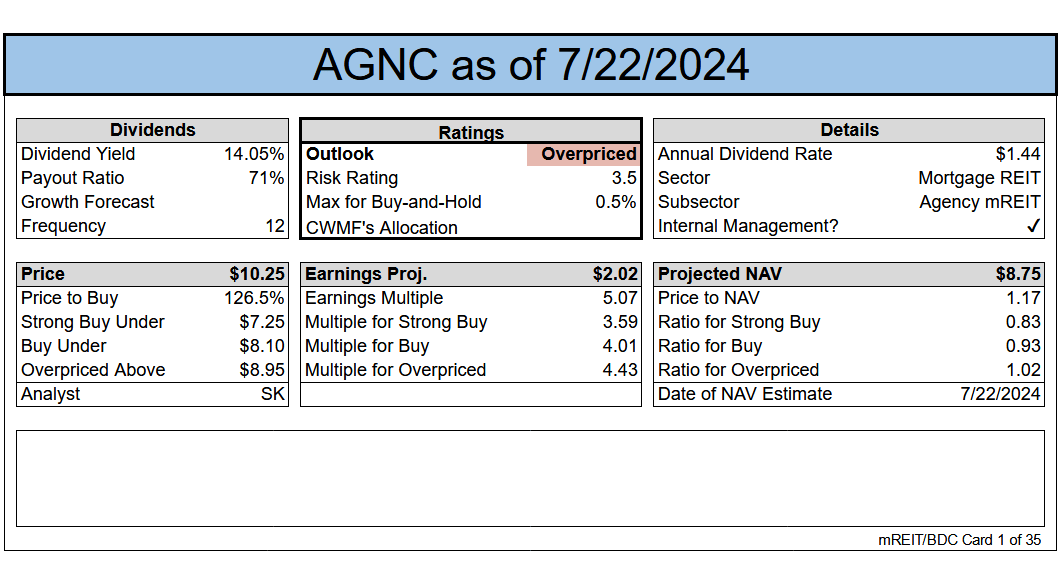

A risk/performance rating of 3.5 for AGNC remains appropriate in the current environment/over the foreseeable future.

We will use many terms in this article that may be unfamiliar to readers. We’ve created a glossary for those that are interested.

Change or Maintain

- BV/NAV Adjustment (BV/NAV Used Interchangeably): Our projection for current BV/NAV per share was adjusted: Down ($0.20) (To Account for the Actual 6/30/2024 BV/NAV Vs. Prior Projection). Price targets have already been adjusted to reflect the change in BV/NAV. The update is included in the card below and the subscriber spreadsheets.

- Percentage Recommendation Range (Relative to CURRENT BV/NAV): No Change.

- Risk/Performance Rating: No Change. Remains at 3.5.

Hedging

- Hedging Coverage Ratio: Decrease from 99% to 98%.

The REIT Forum

Income Statement (Actual Vs. Projected)

The REIT Forum

Earnings Results

The REIT Forum

Note: BV at the end of the quarter. Subscriber spreadsheets and targets use current estimates, not trailing values.

Valuation

The REIT Forum

Ending Notes/Commentary

AGNC’s lifetime CPR expectations decreased from 10.4% as of 3/31/2024 to 9.2% as of 6/30/2024. This was slightly more aggressive versus my expectation of 10.0% (this metric is highly open to managerial judgement). AGNC remained somewhat defensive, regarding risk management strategies, with a hedging coverage ratio of 98% as of 6/30/2024. This generally bodes well in a rising (or elevated) interest rate environment; typically lowers the severity of BV losses via more enhanced derivative valuation gains when spread/basis risk remains subdued. However, a hedging coverage ratio that high would become a burden if rates/yields quickly net decreased; lowers the enhancement of BV gains via more severe derivative valuation losses, especially if spread/basis risk rises. Of course, a company’s net duration gap matters as well, but this is a general tendency.

I believe AGNC remains in relatively “good shape” to maintain its current monthly dividend of $0.12 per common share. That said, I cannot rule out a minor decrease if the Board of Directors/management becomes very cautious. I do not anticipate an increase in AGNC’s dividend per share rate as the company’s REIT taxable income remains lower versus the company’s net spread and dollar roll income.

I/we continue to believe AGNC does not represent good value here. I personally believe AGNC is still one of the better-run agency mREIT sub-sector peers from a long-term performance perspective. However, the market continues to value AGNC at the largest premium in the sector by a pretty wide margin. Simply put, I continue to believe the market is “ahead of itself” regarding AGNC’s valuation. I continue to believe the near-term environment remains fairly challenging for the agency mREIT sub-sector (though should gradually improve looking into 2025 and beyond). I would like to see spread stabilization, over a period longer than a couple of weeks, along with AGNC’s stock price trading at a notably more attractive valuation before considering an investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Want the best research? It’s time to raise your game. Get access to several features you won’t find on the public side.

You can get access to everything we have to offer right now. Try our service and decide for yourself.