Summary:

- AGNC Investment Corp. has faced criticism for dividend reductions and share value decline, but current monthly dividend income remains stable.

- I remain bullish on AGNC due to potential rate cuts by the Fed, which could increase equity value and profitability.

- Despite past challenges, AGNC has provided strong income investment returns and potential for future dividend growth in a lower-rate environment.

PM Images

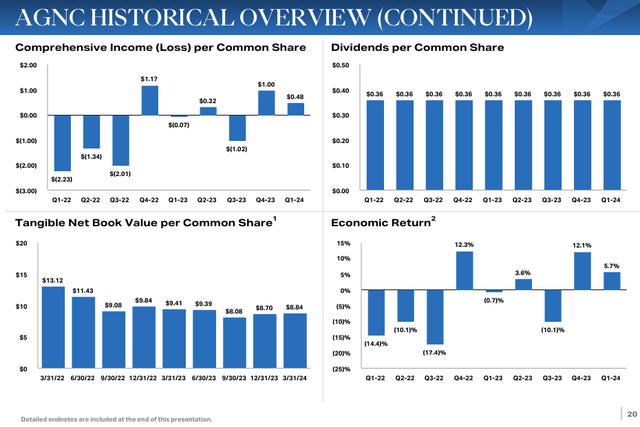

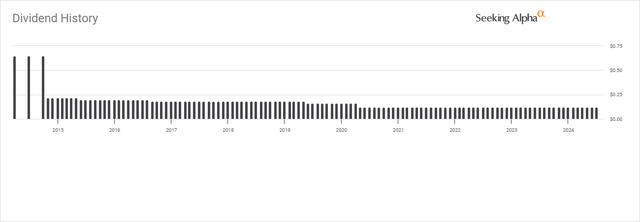

AGNC Investment Corp. (NASDAQ:AGNC) is no stranger to criticism. Many have speculated that their dividend yield was unmanageable, while others have argued that the high-interest rate environment would cripple its underlying business. These opinions aren’t without merit, as AGNC has reduced the monthly dividend payment four times since 2015, and its shares have lost -58.17% of their value over the past decade. While the past paints a specific picture, I am investing in the company AGNC is today, not the company it was a decade ago. Shares of AGNC have been absolutely slaughtered, and the higher for longer rate environment hasn’t helped their underlying value. AGNC has been fairly stable over the past year except for the dip last October when the market sold off, but the real bright spot has been the monthly dividend income. While AGNC has been trying to establish a bottom, it’s been able to maintain the $0.12 monthly dividend despite any negativity. As we head into a lower-rate environment, I am getting more excited about AGNC as I believe the dividend will maintain its current level while the equity on its balance sheet appreciates in value. Shares of AGNC may have declined by more than 50% over the past decade, but I believe there is still value to be unlocked while locking in a gigantic yield on cost at these levels.

Following up on my previous article about AGNC

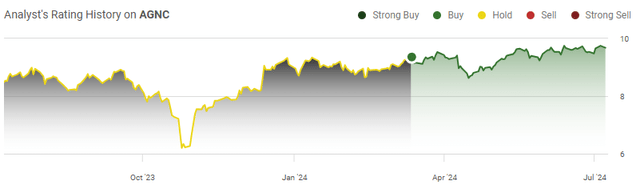

In my previous article, which was published on March 12 (can be read here), I had discussed why I turned bullish on AGNC after being neutral for some time. Shares have declined by -2.23% compared to the S&P 500, which has appreciated by 8.8%. When AGNC’s monthly dividend is factored in, its total return over this period is 2.83%. Now that several FOMC meetings have occurred, and we have a better idea of when the Fed will pivot, I wanted to provide an update on my investment thesis regarding AGNC. I plan on adding to my position in AGNC before the Fed pivots, as it could become a large catalyst for shares to recoup some of the value they have lost over the years.

A look at AGNC’s business model and the Risks to investing in AGNC

Anyone who is considering investing in AGNC should not ignore the past or the current economic environment. While shares of AGNC look as if they are trying to form a bottom, we have seen this story before, and over time, their value has only declined. AGNC has also cut the dividend four times since 2015, and while the yield is close to 15%, it’s only this high because of the declining share value. This is not a situation where AGNC gradually increased the dividend, and the yield grew because the share price remained flat. AGNC’s business revolves around investing in agency mortgage-backed securities. These investments are underwritten with collateralized borrowings in the form of repurchase agreements. Interest is produced from AGNC’s investments, and the difference after paying down their expenses from the borrowing costs is utilized to pay the monthly dividends. AGNC creates a positive spread on their invested capital by borrowing at lower rates than they can turn over by investing the capital into long-term mortgage-backed securities. The assets AGNC invests in become equity on their balance sheet while producing income, but this hasn’t been a good business model from a share appreciation standpoint since AGNC’s inception.

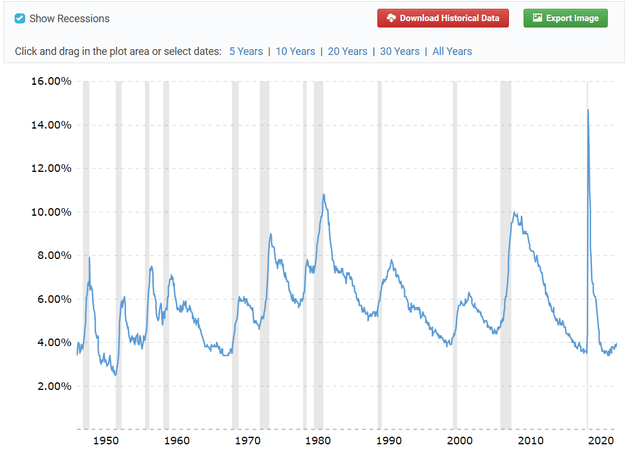

We have seen the risks play out in real time since AGNC went public. AGNC’s IPO was in May of 2008, and its initial share price was $20. Since then, shares have paid out $47.92 in dividend income, but the actual share value has declined by more than 50%. Income investors who have been in AGNC since the beginning may not have much to complain about, but investors who weren’t as fortunate have experienced several dividend reductions with the declining value of their shares. The higher rate environment has negatively impacted AGNC’s funding costs as borrowing has become more expensive. This has impacted the spread between borrowing costs and interest paid, in addition to making the equity less valuable, which has caused the share price to tumble. The main risk now is that the Fed stays higher for longer, and even when a rate cut comes, the Fed will remain at a restrictive level for too long. If the Fed doesn’t cut rates at a quick enough pace, then a recession could be triggered as unemployment continues to climb higher, as the last print was 4.1%. The last thing that AGNC needs is a higher for longer rate environment to cause unemployment to rise and a recession to occur because that will put increased pressure on the entire MBS market. The threat of defaults will climb, and we could see shares of AGNC retrace lower into the mid-single digits. Just because the majority of people want the Fed to cut rates and continue on a lower trajectory doesn’t mean it will happen, and the economy could be on the verge of a recession. AGNC is in a delicate situation because if the macroeconomic environment deteriorates, the equity in their investments could continue to decline, and another dividend reduction could occur.

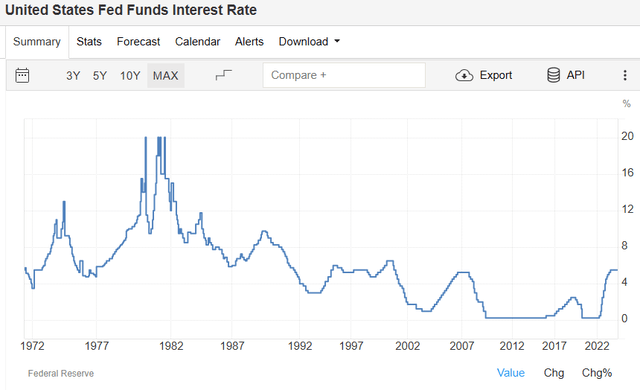

Why I am getting more bullish on AGNC after several FOMC meetings

After leaving interest rates unchanged for seven consecutive meetings, Fed Chair Powell testified to Congress that the Fed needs additional positive data to instill the confidence needed to pivot on rates. While the headline may seem a bit bearish for rate cuts, what I found compelling was that Fed Chair Powell discussed how initiating a rate cut too soon or too late could negatively affect the economy and the employment market. Fed Chair Powell discussed how the labor market conditions have cooled compared to two years ago and that the job market is back in balance, which leads him to believe that the next change in Fed policy will be lower, not higher. The Fed has taken rates to their highest point since the early 2000s and increased them at the quickest pace in more than four decades. Fed Chair Powell continues to stick with the narrative of being data-dependent and saying that the next move is likely to be lower, but lawmakers and spectators are getting restless. The Fed may have been late in starting to take rates higher, but it has to be acknowledged that they have avoided a hard landing so far and that a soft landing is still likely while avoiding a recession.

When I look at how the macroeconomic landscape is unfolding, I think it’s bullish for shares of AGNC. The Fed has a dual mandate, and the second half of its mandate is maximum employment. We are witnessing the impacts of a restrictive rate environment on employment, as the unemployment rate has increased to 4.1%. I believe that the FOMC members are fully aware that every time since 1948, the unemployment rate has increased by 1%, and we have either been in a recession or that a recession has immediately followed. Unemployment has increased by 0.6% over the past year, and if the Fed pushes the U.S. into a recession by keeping rates higher for longer, it will go against the second half of their dual mandate. CME Group is indicating that there is only a 26.7% chance that interest rates remain at the current level coming out of the September FOMC meeting, which is just over two months away. While I would like to see the Fed cut at the upcoming meeting at the end of July, I don’t think it matters in the grand scheme of things if the pivot comes then or in September. I believe that the Fed has achieved its goal of making sure the economy didn’t spiral out of control, and they have made significant progress on inflation. For the Fed to get to a 2% level, I think they will need to cut interest rates, so the mortgage market can soften, which will positively impact rents. All signs are pointing to a pivot at some point in 2024 rather than rates going higher, and this should be very bullish for AGNC.

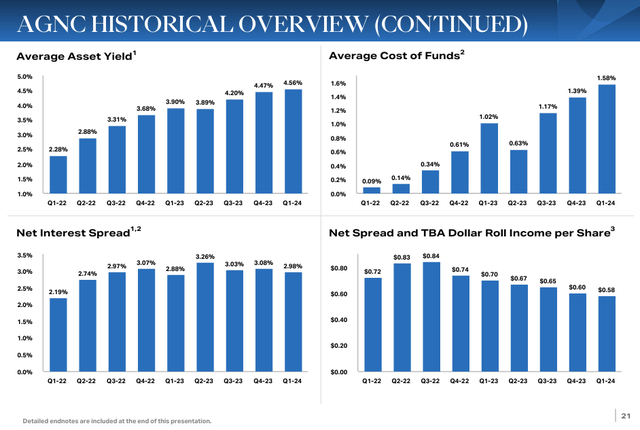

If we are headed into a lower-rate environment, it should be bullish for the equity value of AGNC’s investments and profitability as the interest rate spread should expand. In Q1 of 2024, AGNC generated a $0.01 beat on non-GAAP EPS, which was $0.58, which was $0.22 higher than the $0.36 in dividends that were paid throughout the quarter. AGNC also finished with a tangible net book value of $8.84. Typically, bond prices and interest rates have an inverse relationship because bonds are interest-yielding vehicles. When interest rates increase, new debt is issued with a higher yield, which negatively impacts previously issued debt. Investors won’t pay full price on a previously issued bond because the payout is less than newly issued debt, so the older bonds sell at a discount, so the yields are similar. AGNC is continuously making investments into MBS products, and when rates increase, the older MBS securities become less attractive, so they sell at a discount, causing their value to decline. This is a major reason as to why AGNC’s book value has declined from $25.77 to $9.64 over the past decade. A lower rate environment would be bullish for AGNC because all of the new debt will be issued at a lower coupon rate, and the debt that was issued at higher rates will look more attractive, and the relationship will reverse. This should cause some of the equity on AGNC’s books to even out with some of the newer investments to trade at a premium, as they will have the largest issued coupon rates.

In addition to AGNC’s equity increasing in value, AGNC will likely benefit from a lower rate environment because their borrowing costs will decline. Just because an interest rate environment may be declining doesn’t mean that AGNC’s profitability will suffer. What is more likely to occur is that the interest being paid on the borrowings will decline and increase the spread between what AGNC is paying to service its debt and what they are taking in from their equity investments. This could actually lead to AGNC being able to reverse the trend of cutting their dividend payments, as they will be in a position to generate a larger profit as their cost of capital declines.

Despite AGNC’s dividend declining four times since they went to a monthly payment schedule at the end of 2014, AGNC has still been a strong income investment. Based on the initial IPO price of $20 per share, AGNC has paid 239.6% of its initial share price out in dividends since its inception. Investors need to decide if they are willing to bear a falling share price for lucrative dividend income. The reality is that since going public in May 2008, AGNC has exceeded its annual yield by 14%. Even though shares of AGNC are down more than 50%, the dividend income has paid for the initial investment more than two times over and is still producing $1.44 of dividend income per share on an annualized basis.

Hypothetically, even if AGNC’s share value doesn’t appreciate, and it just trades sideways over the next 10 years, AGNC will pay $14.40 in dividend income if the dividend remains unchanged. That would be a 147.24% return just based on the dividend income, which works out to 14.72% on an annual basis without taking into consideration the powers of compounding if the dividends are reinvested. Even if shares of AGNC decline by 10 or 20%, this would still be an investment that pays for itself if the dividend remains intact. The best part is that in a decade, all the dividend income would be generated, and you would still have an investment that generates reoccurring income that is fully paid for. I think that the dividend is solid as AGNC has been able to maintain its current dividend level since the last reduction at the beginning of the pandemic, and AGNC is generating significantly more non-GAAP EPS than what they are paying out through the dividend.

Conclusion

While AGNC may worry some investors, I am getting more bullish on them as I believe the Fed is getting ready to cut rates in the next few months. AGNC doesn’t have the best track record, but shares can flourish in a lower-rate environment as their cost of capital declines and their current equity investments become more valuable. We could see a situation where AGNC’s share value increases while the monthly dividend continues to produce a double-digit yield based on an investor’s cost basis. There are certainly risk factors to consider, and if the Fed takes interest rates higher, I expect shares of AGNC to fall even further. At this point, investing in AGNC from a capital appreciation standpoint is a play on rates, and I believe that the macroeconomic environment is positioned for rate cuts, not rate hikes. At this point in the rate cycle, I believe AGNC represents a strong risk-reward trade-off as investors are locking in a 14.88% yield with a good probability that its book value will expand over the next several years as interest rates decline.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.