Summary:

- Amazon stock is down significantly after earnings and due to the overall market pullback.

- Earnings contained bright spots that Wall Street overlooked.

- There are challenges ahead, but two metrics indicate that AMZN stock is significantly undervalued.

4kodiak/iStock Unreleased via Getty Images

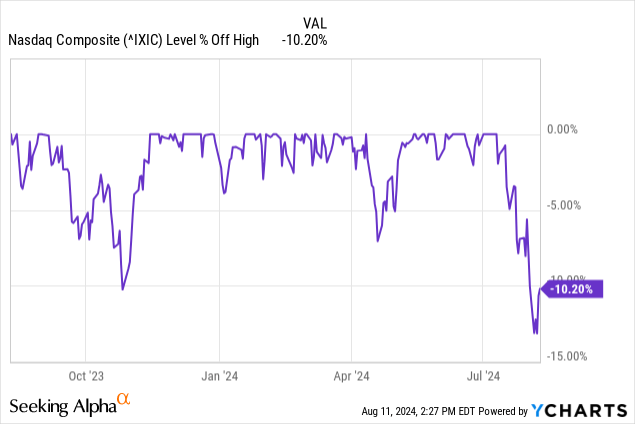

It’s been an exciting couple of weeks in the market. The Nasdaq (QQQ) remains in correction territory (more than 10% off the recent high), despite staging a modest comeback, as shown below.

This should come as no surprise. Nearly 25% of the index relies on Apple (AAPL), Microsoft (MSFT), and Nvidia (NVDA). Warren Buffett’s Berkshire Hathaway (BRK.A)(BRK.B) cut its massive stake in Apple by nearly half, causing some jitters in the market. Meanwhile, Microsoft and Nvidia’s valuations have dropped slightly from historic highs.

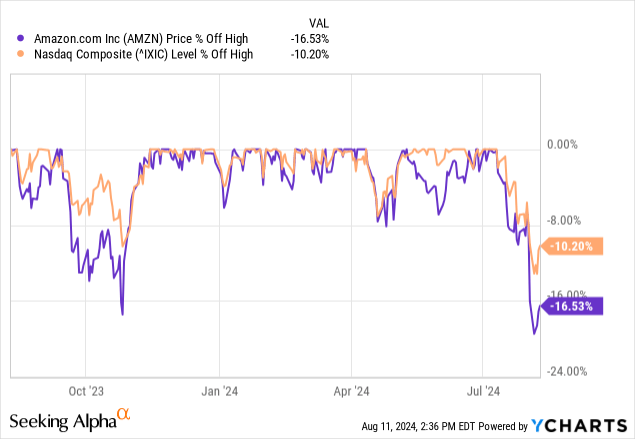

Amazon (NASDAQ:AMZN) suffered more than the overall index, as depicted below, after some misinterpreted its Q2 earnings report.

Amazon’s earnings: Better than advertised

Consumer spending is down; AWS is up

Amazon reported net sales of $148 billion in Q2, on tepid 10% growth. Guidance for Q3 calls for just 8% to 11% growth. Much of this is due to slowing consumer spending. Net product sales increased only 4% in the quarter, a hefty slowdown from the 7% increase in Q1.

Service sales growth also slowed from 17% in Q1 to 15% in Q2. While this doesn’t sound great on the surface, it pays to look beyond the top line.

Amazon is growing sales where it counts, and as I have predicted, the demand for AWS is heating up significantly from 2023.

Here are three key indicators

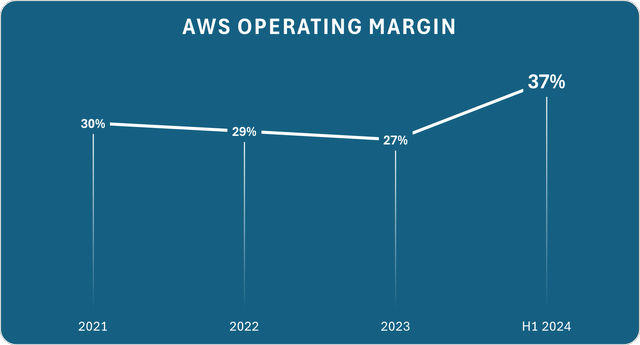

First, the AWS operating margin skyrocketed in the first half of 2024, as shown below.

Data source: Amazon. Chart by the author.

This indicates that Amazon again has pricing power in the industry due to generative AI and the return of companies transitioning to the cloud.

Here are comments from CEO Andy Jassy:

We’re continuing to make progress on a number of dimensions, but perhaps none more so than the continued reacceleration in AWS growth.” “As companies continue to modernize their infrastructure and move to the cloud while also leveraging new Generative AI opportunities, AWS continues to be customers’ top choice as we have much broader functionality, superior security, and operational performance, a larger partner ecosystem, and AI capabilities like SageMaker for model builders.

Bedrock for those leveraging frontier models, Trainium for those where the cost of compute for training and inference matters, and Q for those wanting the most capable GenAI assistant for not just coding, but also software development and business integration.”

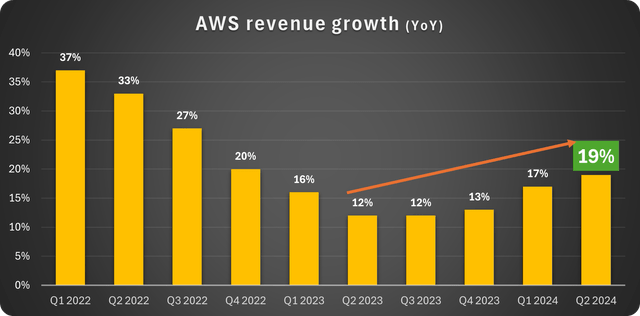

Next, below is the current trend of AWS growth. After a trough in 2023, as companies cut data budgets in preparation for a recession that never came, growth is steadily rising.

Data source: Amazon. Chart by the author.

The margin expansion and growth in AWS allowed Amazon to nearly double its operating income from $7.7 billion in Q2 2023 to $14.7 billion this year. This shows the tremendous effect that growth where it matters (high-margin segments) has compared to the lackluster overall top-line growth.

Finally, it shows up in operating cash flow, which increased 53% in Q2 to $25 billion and 75% over the last twelve months to $108 billion.

Is Amazon stock a great buy now?

Near-term challenges remain

Despite the fantastic AWS results and its outsized importance, there are other challenges. The slowdown in consumer spending is affecting Amazon’s lucrative advertising segment. Advertising growth slowed from 26% in Q4 2023 to 24% in Q1 to just 20% in Q2. This trend could continue. The Federal Reserve is expected to begin cutting interest rates in September, but it takes time to accelerate economic activity.

Market volatility is picking up. When investors are skittish, we could see further drawdowns. Widespread selling of indexes pulls down every included stock, regardless of merit.

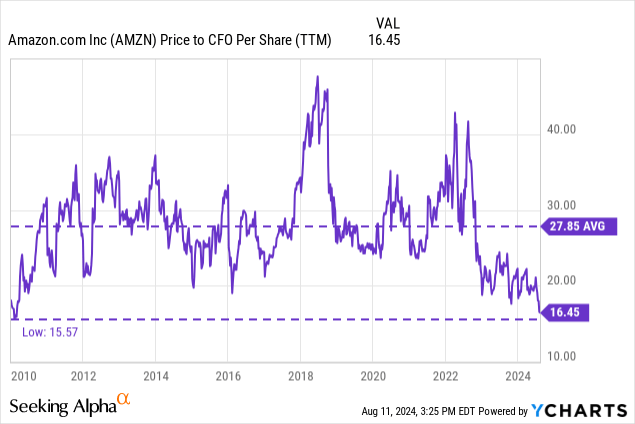

However, long-term investors should consider an important valuation metric that has reached historic lows. As charted below, Amazon’s price-to-cash flow from operations has reached its lowest level in over ten years.

We have to go back to the Great Recession to find this value. The stock needs to rise 69% to get back to the average.

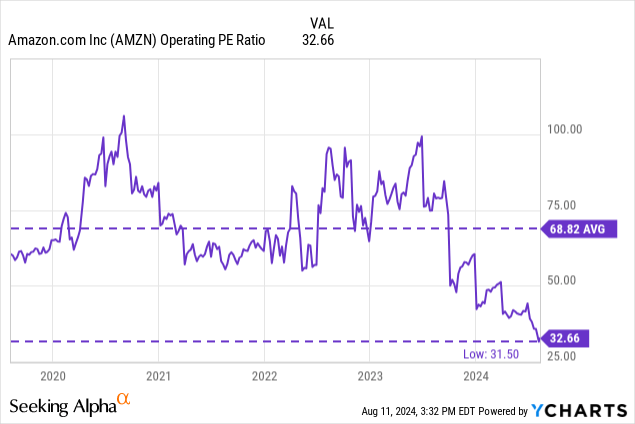

The price-to-earnings (P/E) ratio is also historically low, as is the operating P/E, shown below.

Does Amazon have challenges ahead? Absolutely. Could a jittery market pull it down further? Yes.

However, it sure looks like much negativity has already been priced into the stock. Meanwhile, AWS is on the march and kicking out significant cash flow and operating profits. In my book, this healthy pullback is a terrific long-term opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.