Summary:

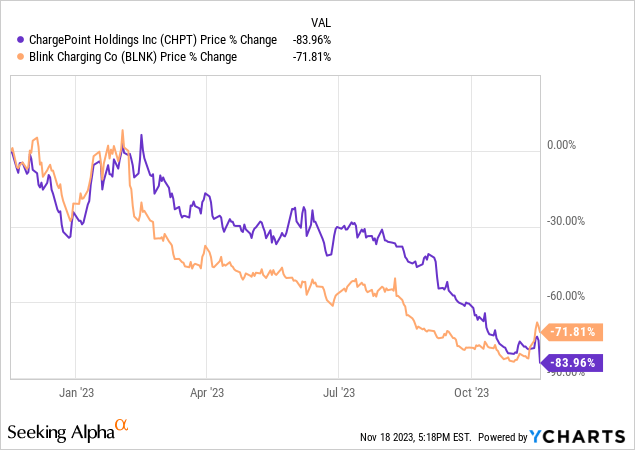

- ChargePoint and Blink Charging have collapsed over the last year as investor sentiment towards EV economy stocks wanes.

- Both companies are losing money every quarter and have been heavily dependent on selling new equity to bridge their liquidity gap.

- Near-term dilution is set to continue with the current low multiple of both tickers set to accentuate the impact of new equity issues.

Serenethos/iStock Editorial via Getty Images

The last year for electric vehicle stocks has been disastrous. Lordstown Motors (RIDEQ) and Proterra (OTCPK:PTRAQ) have filed for Chapter 11 bankruptcy and a plethora of tickers from Canoo (GOEV), Arrival (ARVL), and Faraday Future (FFIE) all teeter on the brink of collapse as their liquidity base gets eroded by consecutive quarters of net losses and free cash burn. Only industry leader Tesla (TSLA) has come out unscathed. To state the situation was not meant to end up this way would be an understatement. EVs remain the future of transportation but the industry is seemingly collapsing. Where does this leave charging stocks ChargePoint (NYSE:CHPT) and Blink Charging (NASDAQ:BLNK)? CHPT is down 84% over the last year with BLNK down 72%.

The investment pitch for both EV charging tickers is built on the back of the increasing adoption of EVs in the US and other developed markets. The US Department of Energy estimates that between $53 billion to $127 billion of capital investment is required to build out the charging infrastructure needed to support a scenario where there are 33 million EVs on US roads by 2030. To be clear, EVs and chargers have a symbiotic relationship and the long-term adoption of EVs needs to be mirrored by the growth of charging infrastructure. Hence, both tickers formed simple pick-and-shovel plays on a broader macro trend set to play out over the decade and beyond.

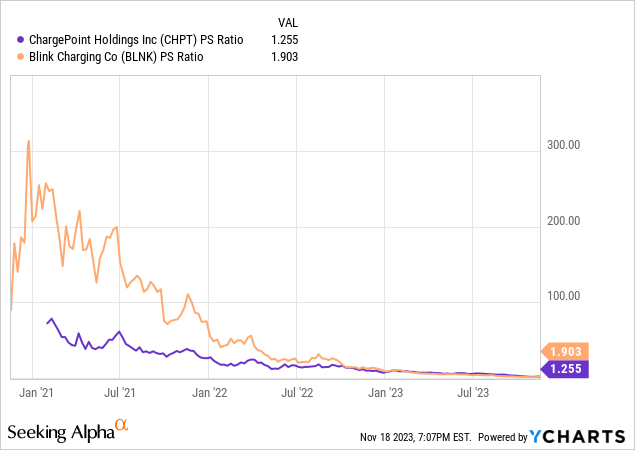

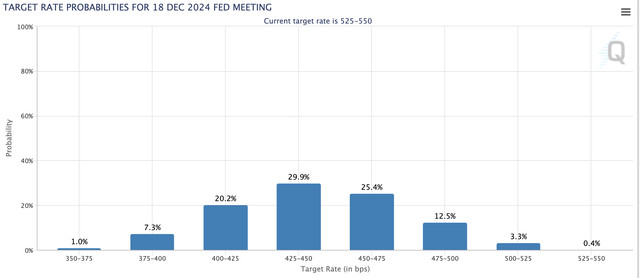

EV sales in the US came in at 313,086 in the third quarter of calendar 2023, setting a volume record and showing material growth of 50% over its year-ago comp. Sales are set to surpass one million for the first time in November. Critically, the retrenchment of their price-to-sales multiples forms the most pressing headwind. Euphoria, hype, and ravenous animal spirits defined the investor capital in their common shares in early 2021. The Fed’s almost 2-year fight with inflation has made this capital more restive and averse to risk. BLNK is now changing hands for a 1.9x price-to-sales multiple versus 1.3x for CHPT, both down markedly from 2021. With interest rates remaining higher for longer likely to keep this new zeitgeist that has led to the collapse of EV stocks in place for much of calendar 2024, does CHPT or BLNK form a better buy? CHPT currently has the edge for being cheaper.

Liquidity, Free Cash Burn, And Cash Runway

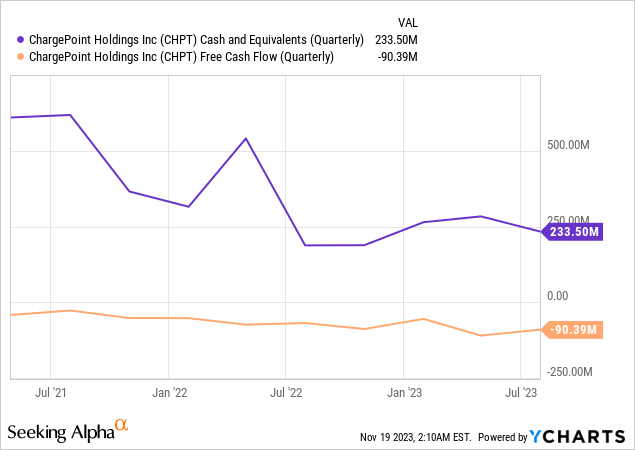

Campbell, California-based CHPT is the larger company with a $730 million market cap versus $260 million for BLNK. Existing liquidity is key here with equity capital markets being more restrictive for fundraising and debt being more expensive with a Fed funds rate currently at a 22-year high. CHPT held cash and equivalents of $233 million at the end of its last reported fiscal 2023 quarter. This was down from $471 million in the year-ago period and came as CHPT continues to own the largest network of Level 2 chargers in North America with a 50% market share.

This is a strong moat as 90% of future US chargers are set to be Level 2s. CHPT has since been able to raise $175 million through the sale of its common stock and an additional $57 million from its at-the-market offering facility. The company’s cash position, including restricted cash, now sits at roughly $397 million at the end of October 2023. This liquidity position represents 47% of CHPT’s market cap and means just over four quarters of cash runway against a trailing 12-month free cash burn of $344 million from the end of July 2023.

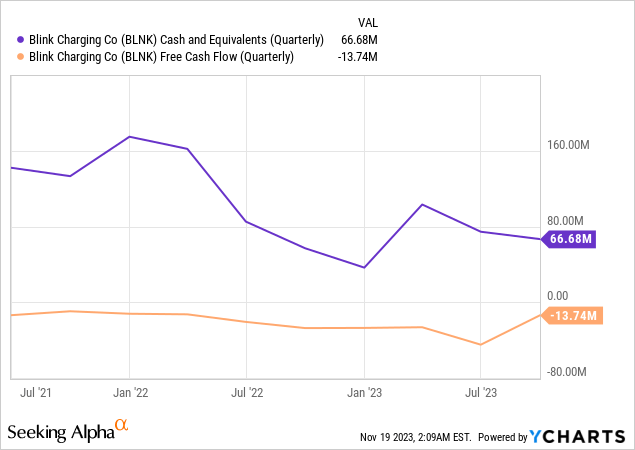

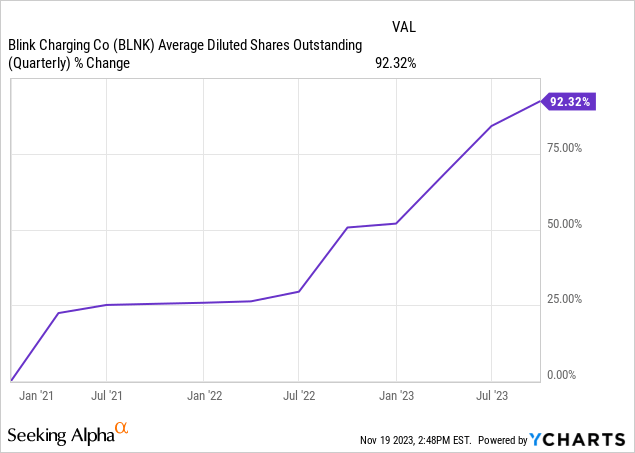

BLNK’s cash and equivalents stood at $66.7 million at the end of its most recent quarter. This was up from $57 million in the year-ago period but down sequentially as the company recorded a free cash burn of $13.7 million. Miami Beach, Florida-based BLNK has also been highly dependent on new equity sales to plug its liquidity gap against a trailing 12-month free cash burn of $112 million. BLNK has seen its average diluted shares outstanding grow 92% over the last three years with the company’s current liquidity position now providing it with around five quarters of cash runway against its annualized free cash burn from its last reported quarter. This cash runway would dramatically slim to just over two quarters against its trailing 12-month free cash burn. The company also has an at-the-market offering facility to raise $230 million in funds.

Dilution, Margins, And Revenue Guidance As Sentiment Set For Recovery

CHPT has seen its shares outstanding grow by 58% since the end of April 2021 after it completed its business combination with blank check company Switchback Energy Acquisition Corporation. This dilution for both tickers is set to ramp up on the back of their cheaper multiples and lower stock prices. It’s a lot easier to raise $10 million in funds when trading at a 300x price-to-sales multiple versus 1.9x. BLNK’s current ATM facility is 87% of its current market cap. The common shares of both firms did catch a bid on broad market enthusiasm that the Fed is set to pivot to a more dovish stance next year on the back of two consecutive interest rate pauses. This would represent some risk for what’s currently a 30% short interest in the shares of BLNK and a 21% short interest in CHPT’s shares.

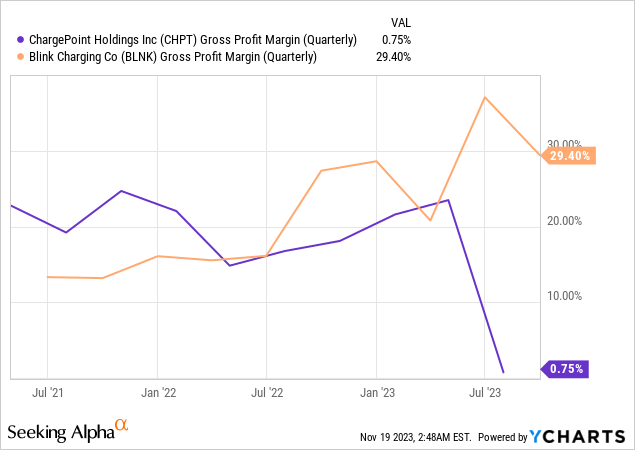

CHPT fell 35% in intraday trading last week after the pre-release of its fiscal 2024 third-quarter earnings. The company expects third-quarter revenue of $108 million to $113 million, down from a prior range of $150 million to $165 million. The company’s prior second-quarter GAAP gross margins dipped markedly to 0.75% following a $28 million, around 19 margin point impairment to the cost of goods sold taken to address higher supply chain component costs and supply overruns for their first generation DC charging products. There was another 3 margin point headwind from selling these DC charging products at the pre-impairment cost structure. BLNK reported a gross profit margin of 29.4% for its last reported quarter. The company also raised its fiscal 2023 revenue guidance range to $128 million to $133 million from a prior range of $110 million to $120 million.

CME FedWatch Tool

The most important chart for both tickers is from the 30-Day Fed Funds futures pricing data with a recovery of risk-off sentiment set to improve if the Fed decisively ends its battle with inflation early next year. The current price-to-sales multiple for both companies could stand to recover against the current revenue base for both firms. Both CHPT and BLNK have been aggressive in tapping their shares and are set to continue to dilute shareholders. Hence, I’m not a fan of either ticker even with EV adoption set to continue on an upward trajectory.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.