Summary:

- Canopy Growth Corporation completes a forced reverse split to meet NASDAQ listing requirements.

- Reverse splits often lead to further downside pressure on a stock and can result in bankruptcies or delistings.

- Canopy Growth’s fundamental problems, including declining revenues and high debt, make the stock a Sell.

tolgart

After a brutal few years in the Canadian cannabis space, Canopy Growth Corporation (NASDAQ:CGC) was forced to complete a reverse split in order to meet the listing requirements for the NASDAQ. The company famously chose to list on the major U.S. stock exchange to the detriment of the business by missing out on the U.S. cannabis market. My investment thesis remains Bearish on the stock following the reverse split that doesn’t solve the fundamental problems with the business.

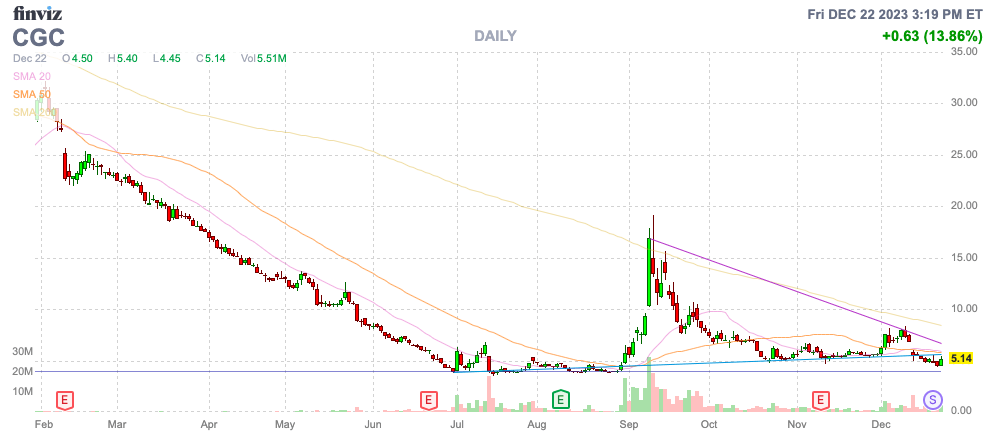

Source: Finviz

Forced Reverse Split

Canopy Growth completed a 1-for-10 reverse split this last week. The stock went from $0.50 to the current price above $5.

The key to a reverse split is that shareholders have the same economic position in a stock. An investor with 1,000 shares worth $0.50 each had $500 worth of stock. After the reverse split, the same investor now has 100 shares worth $5 each for the same investment of $500.

Typically, reverse splits occur with companies struggling financially causing a stock to fall below the $1 continued listing requirement of the major exchanges and lead to further downside pressure on a stock once above $1 again. A lot of investors will snap up these stocks thinking they are cheap trading below $1 while shorts will pile in when the stock jumps back to $5 due to psychological reasons.

According to old research from 2011 published in the Journal of Economics and Business, nearly 60% of reverse split firms ultimately weren’t able to even survive independently, with the majority being delisted or filing for bankruptcy. The substantial level of bankruptcies make stocks with reverse splits problematic to own.

Not all reverse splits end badly. MoneyLion Inc. (ML) is a prime example of how some splits are irrationally forced by the market. The stock has soared to yearly highs today, and has bounced over 500% off the lows following a reverse split. If anything, the reverse split caused the excessive weakness in the fintech stock leading to irrational fear and an ultimate rally when the company started producing EBITDA profits.

Focus On Fundamentals

Ultimately, investors need to focus on the fundamentals of a stock involved in a reverse split. In the case of Canopy Growth, the numbers just aren’t good enough to warrant an investment.

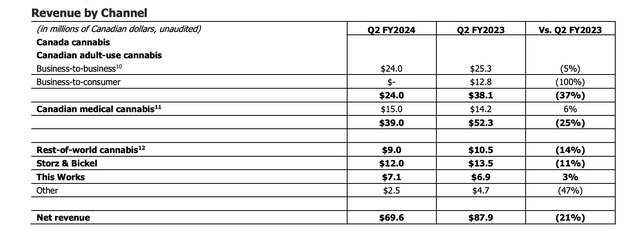

Back in early November, Canopy Growth reported FQ2’24 revenues declined dramatically as follows:

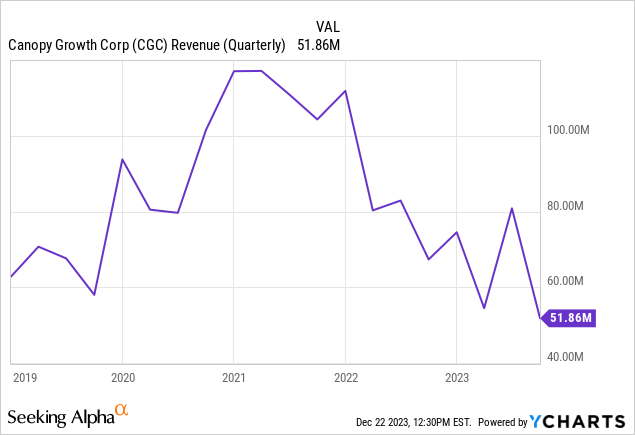

The company has seen dramatic revenues declines in the last couple of years. Despite billions of dollars in investments and several large acquisitions, Canopy Growth has seen revenues slump by over 50% since the peak.

In essence, the numbers suggest the fundamentals led to the low stock price and the ultimate requirement for the reverse split. The recent bankruptcy and disposal of the BioSteel business highlights the lingering problem of a Canadian cannabis business involved in a global business without any strong base.

For FQ2, Canopy Growth did start reporting organic revenue growth with overall gross margins of only 33%. The Canadian cannabis company still reported an adjusted EBITDA loss of C$11.9 million with free cash flow of negative C$67.1 million due in large part to spending C$28 million on interest payments.

The company is again promising a path to adjusted EBITDA profits exiting FY24, or just another quarter away with the FY end in March. Canopy Growth continues to slash costs leading to the constant path of lower revenues and spiral downward.

The cannabis company cut FQ2 SG&A costs by C$32 million YoY to only C$40 million. The problem is that Canopy Growth has never been able to constantly deliver solid gross profit, much less growth, to offset the lowered spending levels.

The company had a net debt balance of C$411 million at the end of September. The stock only has a market cap of $428 million following the split, with the enterprise value around $750 million.

Canopy Growth has repaid a lot of debt from issuing more shares. The share count had surged to over 716 million pre-split, up from only 472 million.

The annualized revenue run rate based on exiting This Works and BioSteel will cause further dramatic dips in revenues. Canopy Growth sold This Works for just C$15.9 million after the business generated C$7.1 million in revenues from FQ2 alone.

Source: Canopy Growth FQ’24 earnings release

The adjusted quarterly revenue likely will slip towards $45 million, or less than $200 million annually. The stock now trades at ~3.5x EV/S targets, which is drastically higher than other cannabis assets with solid EBITDA profits.

Takeaway

The key investor takeaway is that Canopy Growth Corporation stock remains a Sell. The stock is less appealing after the reverse split, with a seemingly never-ending restructuring making the remaining business difficult to value and the path to breakeven EBITDA not nearly enough to warrant an investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.