Summary:

- Centene serves the underinsured and uninsured in the U.S. healthcare sector, filling a significant market gap.

- CNC operates through two main segments: Managed Care and Specialty Services, catering to over 26 million members.

- The company has commendable lobbying efforts. However, it faces challenges, including political dynamics, Medicare Advantage Star Ratings, and the potential impacts of the 2024 elections.

- My financial analysis suggests potential vulnerabilities due to interest rate fluctuations and the yield curve’s movements.

- Despite challenges, my valuation suggests CNC is undervalued with a potential upside of 38.1%, leading to a “buy” rating with a $98.0 price target.

PeopleImages/iStock via Getty Images

Centene Corporation (NYSE:CNC) operates in the U.S. healthcare sector, primarily serving the underinsured and uninsured. This focus effectively addresses a notable void in the healthcare landscape. Through its dual-segment strategy, encompassing Managed Care and Specialty Services, CNC has established itself as a comprehensive healthcare provider, catering to a vast membership of over 26 million. However, the company has its challenges. It grapples with political, regulatory, and market dynamics, notably concerns surrounding Medicare Advantage Star Ratings and the potential ramifications of the 2024 elections. Despite these hurdles, I believe that CNC’s overall business model, financial standing, and valuation metrics indicate that the stock might be undervalued. My analysis suggests a potential upside of 38.1% from its current levels. While this projection is promising, it’s essential to recognize the inherent risks associated with CNC’s business model. Given the balance of its strengths and challenges, CNC’s stock offers a compelling investment opportunity, and I rate it a “buy” with a target price of $98.0.

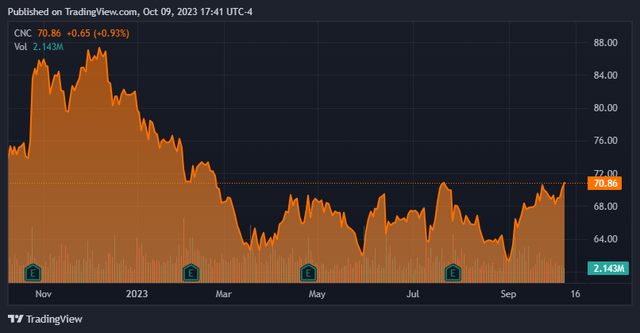

CNC stock remains well below its previous all-time highs. (TradingView.)

Business Overview

Centene, headquartered in St. Louis, Missouri, serves a vital niche in the U.S. healthcare sector by focusing on the underinsured and uninsured. This emphasis fills a notable gap in the healthcare market and reflects CNC’s dedication to ensuring access to medical care for vulnerable groups. The company is divided into Managed Care and Specialty Services and highly depends on the US’s political landscape. The Managed Care segment, emphasizing health plans via government programs, showcases CNC’s commitment to public health. Conversely, the Specialty Services segment, offering services from behavioral health to specialized pharmacy benefits, demonstrates CNC’s adaptability. This breadth enhances CNC’s market presence, making it a comprehensive healthcare entity. Their involvement in government contracts, particularly the TRICARE program, indicates a significant alignment with governmental initiatives. CNC has a long track record since its founding in 1984 and employs over 74,300 individuals today.

With a membership base exceeding 26 million, Centene is the largest provider of managed healthcare insurance in the U.S., primarily delivering its services through Medicaid, Medicare, and commercial products. This extensive member base is a significant financial driver for the company, courtesy of the recurring revenue model inherent in the insurance sector. Being ranked as the 25th company on the 2023 Fortune 500 list further highlights its robust market presence. In my view, CNC’s entrenched position as an intermediary for government-sponsored and privately insured healthcare programs reflects a solid foundation in a competitive market landscape. However, to sustain its market position and work towards long-term growth, I believe it’s imperative for CNC to continually evolve its strategies in response to the dynamic healthcare market. The ability to adapt to policy changes, especially those concerning Medicaid and Medicare, could be pivotal in securing its market position and ensuring a steady revenue trajectory.

Regulatory Challenges and Lobbying Efforts

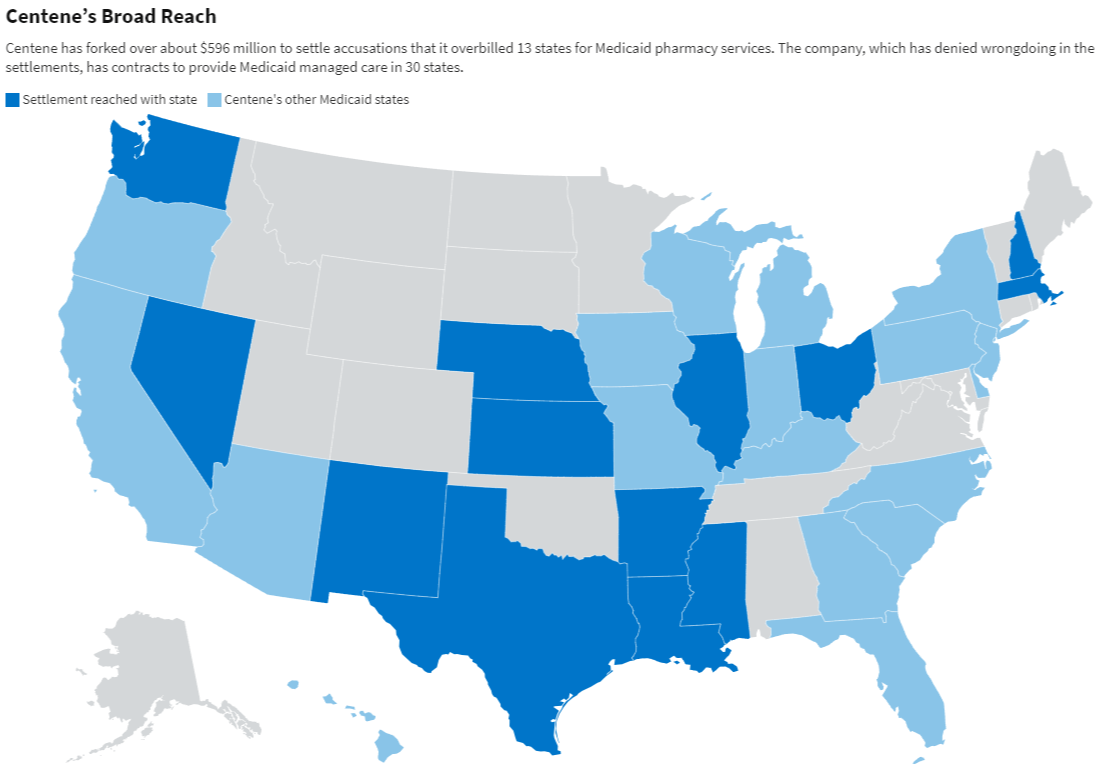

There are concerns regarding CNC’s ability to improve its Medicare Advantage Star Ratings and secure future Medicaid contracts. These aspects are crucial as they affect CNC’s revenue and market position. The Medicare ratings impact financial bonuses, while Medicaid contracts are essential revenue streams. There have been billing investigations and settlements related to Medicaid contracts and an observed decline in Medicare Star Ratings, all challenging CNC’s long-term growth narrative. One consequence of these hurdles was a Morgan Stanley (MS) downgrade with a price target cut from $94 to $73.

Source: KFF Health News.

On the other hand, U.S. states resumed yearly Medicaid reviews in April, intending to complete all renewals by May 31, 2024, which might lead to millions of low-income people losing government healthcare, reversing the surge in Medicaid enrollment during the pandemic. Consequently, the insurance companies like CNC that manage these Medicaid plans could lose millions of customers, as some may choose not to buy private insurance.

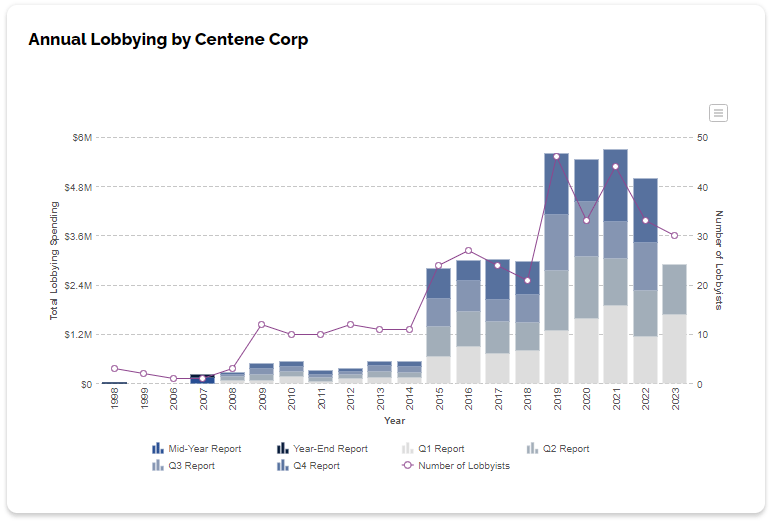

Source: OpenSecrets.org.

In my view, lobbying is key to CNC’s business model. Thus, election risks in 2024, given CNC’s high Medicaid and health insurance exchange exposure, could pose significant challenges. In my opinion, given Centene’s extensive operations in managing Medicaid and Medicare programs, the policy inclinations of Democrats could potentially align more closely with Centene’s business model, possibly fostering a friendlier environment for its growth and operations. Conversely, while Republicans might appreciate Centene’s role in the private sector’s involvement in healthcare, their traditional stance on limiting the expansion of government-funded healthcare programs could pose challenges for Centene, especially if policy shifts lead to reduced funding or more stringent regulations on Medicaid and Medicare programs.

Therefore, the US’s political climate and CNC’s lobbying efforts are key for securing crucial revenue-generating contracts. Additionally, the investigations and settlements underscore a pattern of billing issues and legal challenges CNC faces across different states, impacting its financial standing and potentially its reputation within the healthcare industry.

Valuation and Financial Analysis

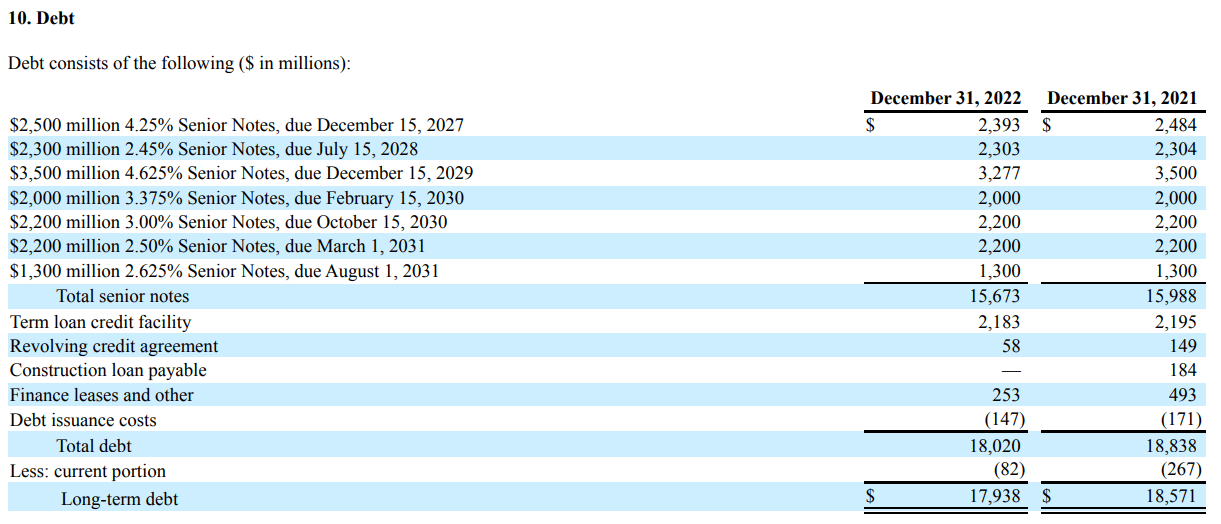

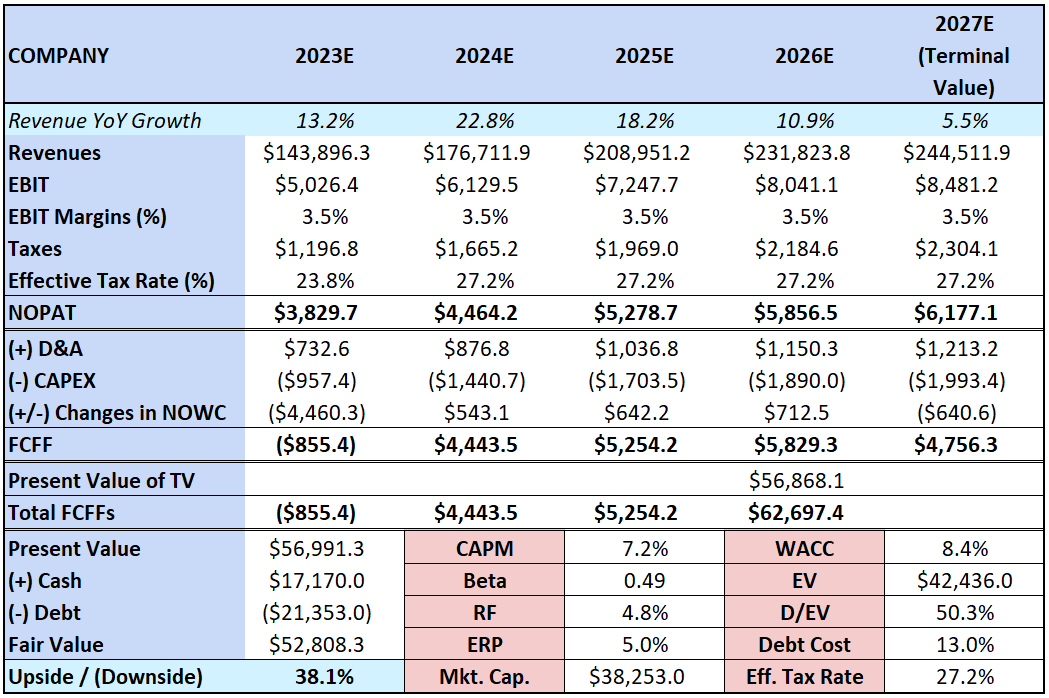

The company has a significant amount of debt, with its enterprise value estimated at around $42.44 billion, and 50.3% of this value is financed through debt. A notable aspect of CNC’s financial structure is its reliance on variable interest rates, predominantly benchmarked against the LIBOR. In my view, this presents a potential vulnerability. Given that the company’s EBIT is roughly $5.02 billion for 2023, a slight 1% increase in interest rates could result in a loss of around half a billion dollars. This equates to nearly 10% of the company’s current annual EBIT.

CNC’s latest 10-K

The recent trend of a steepening yield curve further accentuates this risk. Suppose the Federal Reserve maintains higher rates for an extended period, as they have indicated. In that case, it’s likely that long-term interest rates, which constitute a majority of CNC’s debt, will see a significant rise. This inference is drawn from the current state of the yield curve, which is notably inverted. If short-term rates remain stable, a continued steepening of the yield curve could imply a marked increase for longer-duration debt. I believe this could translate to potential losses amounting to billions for CNC. While these losses might be unrealized and may not immediately impact CNC’s FCF if the company holds its debt to maturity, I believe that given CNC’s highly financialized business model, it’s probable that such losses will be realized over time. However, it’s essential to consider both sides of the coin. If long-term rates were to decrease from their current levels, CNC could benefit. So, I think investors must be aware of CNC’s sensitivity to fluctuations in interest rates and the yield curve’s movements.

Seeking Alpha plus author’s elaboration.

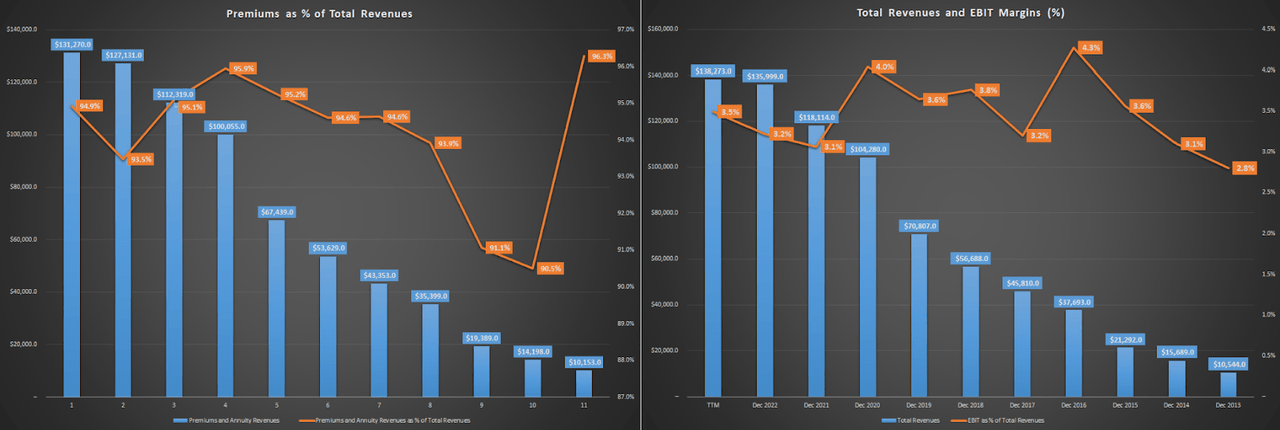

While it’s essential to consider various factors in CNC’s valuation, if we set aside the interest rate risk for a moment, we can determine its fair value using a straightforward DCF model. In my observation, CNC’s EBIT margins have remained relatively consistent, with a long-term average of 3.5% of total revenues since 2013. Similarly, the D&A, CAPEX, and Effective Tax Rates figures have shown stability over time. Based on this data, I incorporated these values into my model. When projecting the 2024 revenue growth rate, I took an average of CNC’s long-term premium-related revenue CAGR since 2013, which stands at 32.4%, and my current growth estimate for 2023, which is 13.2%. This calculation results in a growth rate of 22.8% for 2024. In my view, this approach is logical, given the historical data and current market conditions.

From this point, I gradually reduced the revenue growth rate to 5.5% by 2027, which I believe is a reasonable terminal value for my model, especially considering industry trends and conservative market potential. Finally, I discounted the projected FCFFs using the company’s WACC. I believe this method provides a balanced and objective valuation while accounting for potential future shifts in the market.

Seeking Alpha plus author’s elaboration.

In my analysis, the valuation model indicates that the company is undervalued at its current levels. I estimate a potential upside of approximately 38.1%, translating to a fair value of around $98.0 per share. However, considering the upcoming elections, which might influence the company’s revenues based on the resulting political landscape, is essential. Additionally, the unpredictable yield curve and interest rates pose challenges for the company’s balance sheet and the present value of its debt holdings. Despite these concerns, the company’s underlying business model and savvy lobbying efforts are robust. This leads me to believe CNC is undervalued and merits a “buy” rating at its current levels. My valuation aligns closely with MS’s price target of $94.0 per share before their recent downgrade. While qualitative factors might influence MS’s downgrade, the quantitative data suggests that CNC is significantly undervalued. Indeed, qualitative factors are worth noting, but they don’t justify such a downgrade. Hence, I believe CNC remains a promising investment opportunity at these levels.

Conclusion

Given CNC’s role in the U.S. healthcare sector, it’s evident that it has made strides in addressing the needs of the underinsured and uninsured. CNC’s dual-segment strategy has expanded its reach and solidified its market position in public health. However, Centene’s challenges, especially in politics, regulations, and market dynamics, cannot be overlooked. The concerns regarding Medicare Advantage Star Ratings and the potential outcomes of the 2024 elections add complexity to its business prospects. While these challenges are significant, CNC’s robust business model and financial metrics suggest its stock is undervalued. Accordingly, I estimate it has a 38.1% upside potential from current levels. Yet, investors must approach this with a balanced perspective, weighing both the opportunities and the inherent risks. Based on the data and the company’s resilience, I maintain that CNC’s stock is a promising investment, and I reaffirm my “buy” rating with a target price of $98.0.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.