Summary:

- Centene, a leading health insurance provider, has consistently delivered double-digit EPS growth but the market remains cautious in valuing the company.

- The company has recently begun repurchasing its outstanding shares, suggesting a maturing strategy, and is expected to balance between buybacks and business reinvestment.

- Despite a discrepancy between GAAP and non-GAAP earnings, Centene’s future prospects appear promising with potential for low double-digit growth, especially if GAAP earnings align with non-GAAP earnings.

IvelinRadkov/iStock via Getty Images

Introduction

Being among the country’s leading health insurance providers, Centene (NYSE:CNC) has experienced remarkable growth, much like its peers. For nearly two decades, the company has consistently delivered annual double-digit EPS growth, becoming an expectation among investors. Despite maintaining these expectations and recently raising 2023 earnings guidance during their latest Q2 2023 earnings call, the market continues to adopt a conservative approach in valuing the company. However, this cautious sentiment presents an opportunity for investors to acquire equity in a fast-growing and profitable company at an advantageous price.

Q2 2023 Earnings

Centene’s Q2 earnings release brought positive news, as the company surpassed expectations both on the top and bottom lines. The non-GAAP EPS for the quarter was $2.10, beating estimates by $0.05. This impressive performance led Centene to raise its 2023 guidance by $0.05, now expecting at least $6.45 in earnings per share for the year.

The outstanding Q2 results boosted the confidence of CEO Sarah London, who reaffirmed the company’s full-year 2024 guidance of at least $6.60 non-GAAP EPS.

She also acknowledged the low valuation which the company is currently trading at, with a promise of more share repurchase to come.

So while the market trades us at 10x to 11x earnings, we’ll keep on executing, buying Centene shares

The strong quarterly performance can be attributed to higher revenues than anticipated, with an impressive $1.07 billion surplus over the estimated $36.54 billion. This achievement was driven by robust growth in both the marketplace and Medicaid sectors, contributing significantly to the earnings beat.

Capital Allocation

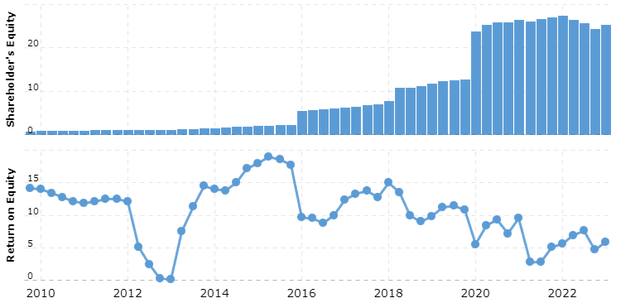

Over the past two decades, Centene’s EPS growth has remained consistent, but the sources of this growth have been intricate and challenging. The company has issued a substantial number of shares and pursued aggressive acquisitions, with a noteworthy 40% increase in outstanding shares in both 2016 and 2020. While these equity offerings have successfully allowed them to acquire businesses without negatively impacting their annual EPS figures, they have made it difficult to forecast future growth. Determining the pace of organic business growth through reinvestment and equity building is challenging due to the skewed ROE graph caused by the equity offerings.

Recently, Centene has started repurchasing its outstanding shares, which might suggest that the company is maturing. It is unclear if this strategy is part of a long-term plan by management. However, assuming these shares are bought back at a fair ~15 P/E ratio, a potential yield of 6.66% could be achieved. Although this yield is lower than their current 18% annual EPS growth, it’s essential to recognize that not all earnings are likely to be used solely for share buybacks. The company will probably strike a balance between buybacks and reinvesting in the business. Reinvestments may yield a few percentage points more than share buybacks, with an estimated ~8% ROE, leading to a high single-digit annual EPS growth rate.

Valuation

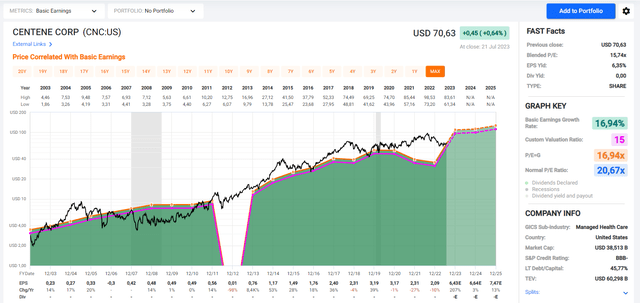

When considering adjusted net income per share, the profitability over the past decade appears impressive. There have only been a few instances of negative growth. The average growth rate of 18% has outperformed the market by 9.1% annually. The consistent profit growth has made a standard 15-earnings multiple a reliable benchmark for intrinsic valuation. However, after the financial crisis, the stock deviated from this multiple for an extended period before fundamentals eventually prevailed.

Looking ahead, it is reasonable to expect a return to a ~15 EPS, considering the projected growth in adjusted EPS. Such a scenario would indicate that the stock is undervalued by approximately 30%. Although this margin may not seem substantial, given the high earnings growth, it has the potential to yield market-beating returns over time.

One potential obstacle to a short-term correction towards higher valuations is the current discrepancy between GAAP and non-GAAP earnings. Viewing the GAAP earnings alters the picture slightly, as certain items, such as real estate impairments and divestitures of specific businesses, have been excluded by Centene for the last two years. This exclusion raises questions about undervaluation. If the two earnings measures fail to align soon, the market may start to prioritize the GAAP-earnings over the adjusted earnings.

Historically, this mismatch has been temporary for Centene, and higher GAAP-earnings are expected to materialize soon. Analysts from Yahoo Finance project that GAAP-earnings will catch up next year, which could serve as a significant catalyst for the stock to regain a ~15 earnings multiple once again.

Stock Chart

Quick disclaimer: A technical analysis in itself is not a good enough reason to buy a stock, but combined with the company’s fundamentals, it can greatly narrow your price target range when investing.

Centene’s current pricing seems favorable when considering its position relative to its 50-month moving average. As is often observed with medium- to fast-growing profitable companies, Centene typically trades above its 50-month moving average, and any dips below this average tend to act as strong support levels. This trend has been evident in Centene’s stock performance thus far.

Considering that there have been no signs of fundamental deterioration, and the guidance for the company’s future is not pessimistic, it is probable that Centene’s stock will return to intrinsic value above 50-month moving average. This likelihood is reinforced by the fact that it aligns with the price target derived from fundamental valuation.

Final Thoughts

Centene presents an intriguing investment opportunity due to its long history of consistent double-digit EPS growth, along with a raised guidance and a valuation below the industry average.

However, there is a consideration regarding its strategy of diluting shareholders to finance significant acquisitions. While this approach has been successful thus far, it makes predicting future growth more challenging. As Centene has become a major player in the market, finding suitable acquisition targets becomes more difficult. Therefore, a natural shift towards organic growth through reinvestments, dividends, or share repurchases seems likely, with the potential to yield a high single-digit yield.

Taking into account the below-average earnings multiple in conjunction with the raised adjusted EPS guidance, Centene’s future prospects appear promising, potentially resulting in low double-digit growth. This outlook is further bolstered if the GAAP earnings align with the non-GAAP earnings, as analysts expect.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.