Summary:

- Cyngn has filed to raise $35 million in an IPO from the sale of its common stock.

- The firm is developing software for industrial mobile autonomous robot vehicles.

- CYN is still at the development stage for its software solutions.

Quick Take

Cyngn (NASDAQ:CYN) has filed to raise $35 million in an IPO of its common stock, according to an S-1 registration statement.

The firm develops software that helps create autonomous driving fleet activity for industrial fleets.

CYN isn’t currently generating revenue and is still in development for its software solutions.

When we learn more about the firm’s valuation and pricing expectations, I’ll provide a final opinion.

Company & Technology

Menlo Park, California-based Cyngn was founded to help automate industrial vehicle fleet operations across a range of environments via its software.

Management is headed by Chairman and CEO Lior Tal, who has been with the firm since 2016 and was previously director of international growth and partnerships at Facebook.

Below is a brief overview video of the firm’s DriveMod software in action:

(Source)

The company’s primary offerings include:

-

DriveMod – autonomous driving software

-

Cyngn Insight – Tool suite for managing AV fleets

-

Cyngn Evolve – AI training

Cyngn has received at least $114 million in equity investment from investors including Benchmark Capital, Andreessen Horowitz, Redpoint Ventures and PI International Holdings.

The firm seeks relationships with OEM vehicle companies that can integrate its DriveMod software into manufactured vehicles during assembly; also the firm can retrofit its software to already-built vehicles.

The company has generated only a small amount of revenue, back in calendar year 2019.

Market & Competition

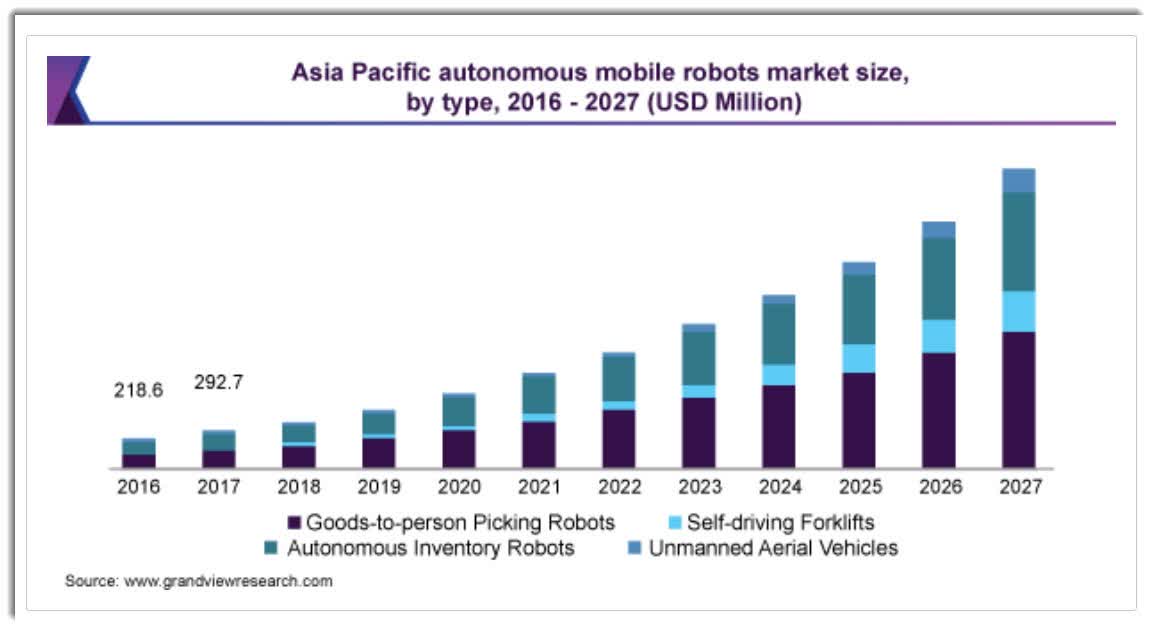

According to a 2021 market research report by Grand View Research, the global market for autonomous mobile robots was an estimated $1.9 billion in 2019 and is forecast to reach $8 billion by 2027.

This represents a forecast CAGR of 19.6% from 2020 to 2027.

The main drivers for this expected growth are a demand for increased operating efficiencies and reduced employee safety problems.

Also, below is a chart showing the historical and projected future growth trajectory of autonomous mobile robots in Asia:

(Source)

Major competitive or other industry participants include:

-

ABB

-

Bleum

-

Boston Dynamics

-

Clearpath Robotics

-

GreyOrange

-

Harvest Automation

-

IAM Robotics

-

inVia Robotics

-

Kuka AG

-

Teradyne

Financial Performance

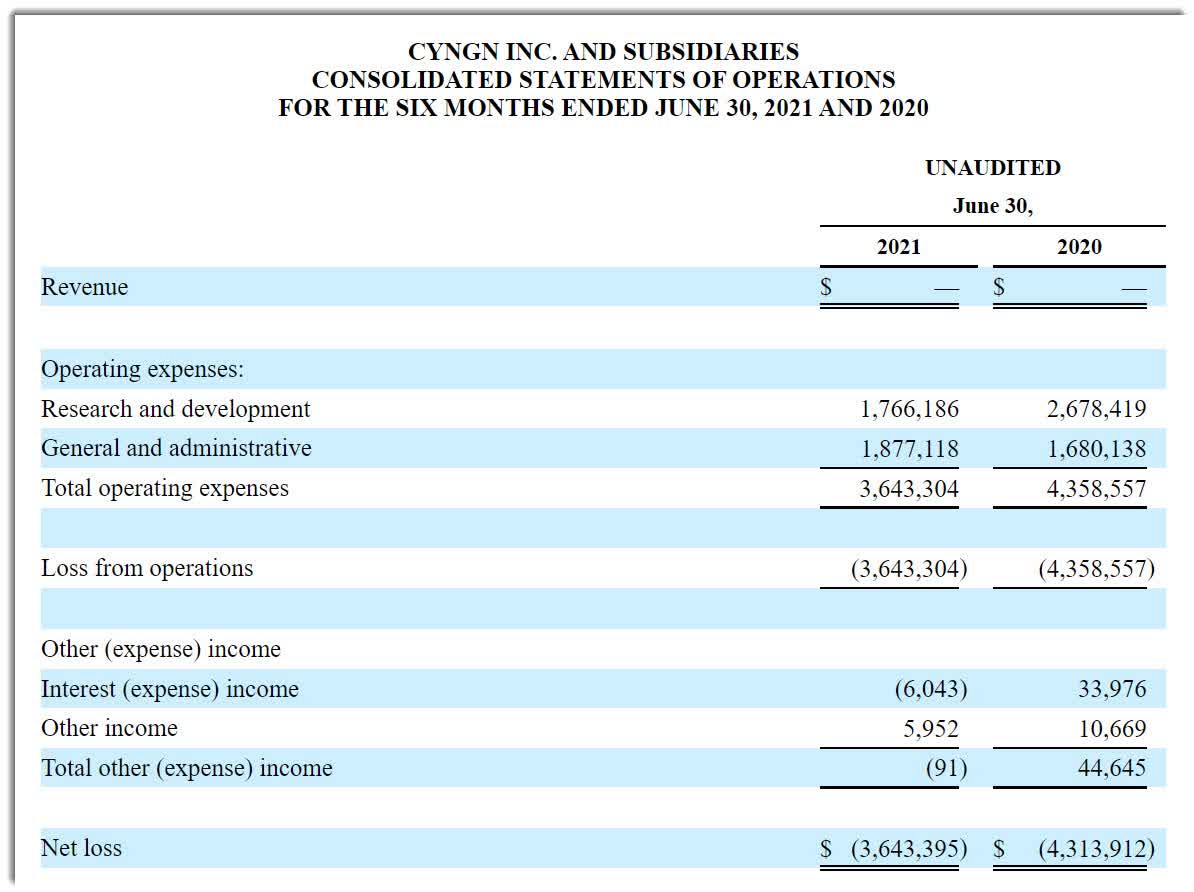

Cyngn’s recent financial results can be summarized as no recent revenue and significant R&D and G&A expenses:

Below are relevant recent financial results derived from the firm’s registration statement:

(Source)

As of June 30, 2021, Cyngn had $3.4 million in cash and $2 million in total liabilities.

Free cash flow during the six months ended June 30, 2021, was negative ($3.6 million).

IPO Details

Cyngn intends to raise $35 million in gross proceeds from an IPO of its common stock, although the final figure may vary.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

The principal purposes of this offering are to increase our capitalization and financial flexibility, and create a public market for our common stock. We currently intend to use the net proceeds we receive from this offering for working capital and other general corporate purposes, including funding our operating needs. However, we do not currently have specific planned uses for the proceeds.

(Source)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the firm is not a party to any claim or proceeding that would have a material effect on its business.

The sole listed bookrunner of the IPO is Aegis Capital Corp.

Commentary

Cyngn is seeking to go public for its unspecified corporate expansion initiatives.

The firm’s financials show no revenue since a little revenue in 2019.

Free cash flow for the six months ended June 30, 2021 was negative ($3.6 million).

The market opportunity for autonomous mobile robots in an industrial setting is large and expected to grow at a significant rate, so the firm will benefit from strong industry growth dynamics in the years ahead.

Aegis Capital is the sole underwriter and the two IPOs led by the firm over the last 12-month period have generated an average return of 323.8% since their IPO. This is a top-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is the still early stage of development of the firm’s software technologies, especially with respect to the many product ‘handling edge cases, unique environments, and discrete object’ handling challenges.

When we learn more about the firm’s valuation and pricing expectations, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investing in IPOs is an inherently volatile and opaque endeavor. My research is focused on identifying quality IPO companies at a reasonable price, but I’m wrong sometimes. I analyze fundamental company performance and my conclusions may not be relevant for first-day or early IPO trading activity, which can be highly volatile and unrelated to company fundamentals. This report is intended for educational purposes only and is not financial, legal or investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!