Summary:

- Disney’s upcoming financial results for Q3 of fiscal year 2024 are highly anticipated by investors.

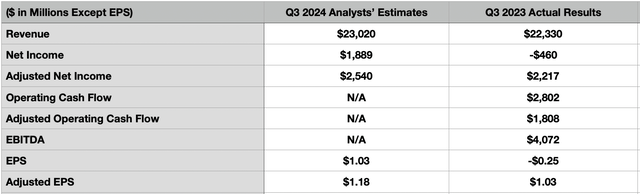

- Analysts expect revenue to increase by 3.1% year over year to $23.02 billion, with earnings per share expected to improve significantly.

- Despite recent box office successes not impacting this quarter by much, Disney’s fundamentals and debt reduction efforts make it a strong buy.

RomoloTavani

Those who follow my work closely know that one of my favorite companies is The Walt Disney Company (NYSE:DIS). I truly believe it’s one of the best companies in the world, which is why, even though it’s only my 7th largest out of eight holdings, it still accounts for a hefty 9% of my portfolio. But of course, even the best companies can face issues from time to time. Since my last article on the company was published in early May of this year, an article in which I reaffirmed my ‘strong buy’ rating for the stock, shares are down 12.1%. That compares to the 5.6% increase seen by the S&P 500 over the same window of time.

The good news is that, in the coming days, management is going to be coming out with new data covering the third quarter of the 2024 fiscal year. That is expected to occur before the market opens on August 7th. Leading up to that point in time, there are some things that investors should be paying attention to. Obviously, if the data comes in very poorly, there is definitely a possibility that the stock could deserve a downgrade. But given the past and given other indicators, I believe that it will only bolster my argument that the stock is significantly undervalued.

What to watch out for

The first thing that investors and market watchers will be looking for when financial results are provided by management on August 7th will be the headline news items like sales and earnings per share. At present, analysts are forecasting revenue for the company of about $23.02 billion. If this comes to fruition, it would translate to a year over year increase of 3.1% compared to the $22.33 billion the company reported the same time last year.

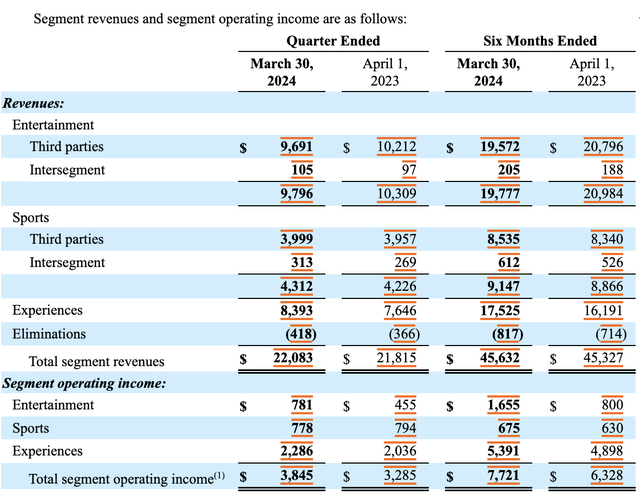

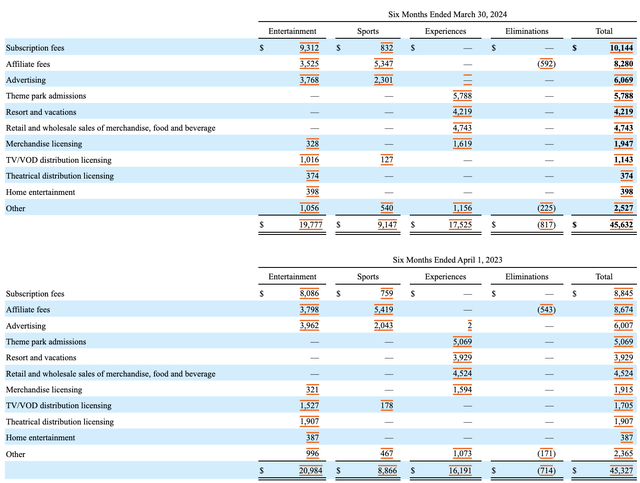

In my last article about the company, which I urge you to read, I covered financial results for the second quarter of this year and for the first half of the year in its entirety. Overall revenue for the business was slightly higher year over year, driven by growth in some of the key areas of the business, most notably its Experiences segment. The Sports segment reported a modest increase in sales as well. But a lot of this growth was offset by weakness involving its Entertainment segment. For the first half of this year, revenue of $19.78 billion fell short of the $20.98 billion reported one year earlier.

This came even though subscription revenue, courtesy of the company’s streaming businesses, reported a year over year increase in sales of 15.2%. The company suffered from declining affiliate fees, falling advertising revenue, a drop in merchandise licensing sales, and a plunge in theatrical distribution licensing revenue. The theatrical distribution licensing side was the most impacted, with sales dropping from $1.91 billion to $374 million. A much stronger showing in the box office last year compared to this year seems to have been responsible for this decline.

I would argue that there are reasons to be optimistic. Most parts of the company are thriving. And again, for more details on that, I would refer you to my prior aforementioned article on the business. It delves deep into the operations seen in the second quarter of last year compared to the year prior, as well as for the first half of each respective year. Unfortunately, I don’t expect the theatrical distribution side of the company to report a year-over-year increase. However, there will likely be some positive rhetoric regarding some of the company’s most recent releases.

On June 14th, for instance, the company released Inside Out 2, which has become the highest grossing animated film in history with a global box office of $1.51 billion, $613.7 million of which is attributable to the domestic box office. But seeing as how the company’s third quarter ended at the end of June of this year, I don’t expect much impact from the film until the final quarter of the year. And I expect no impact from the release of Deadpool & Wolverine that came out on July 26th. But seeing as how global sales have already hit $438.3 million, with domestic sales of $205 million, and considering that this makes the company the record holder for the highest grossing opening weekend for an R-rated film domestically, I suspect a big positive impact for the company in the fourth quarter.

On the bottom line, analysts expect earnings per share of $1.03. That would be a big improvement over the loss per share of $0.25 reported for the third quarter of 2023. That would translate to an improvement from a net loss of $460 million to a net gain of $1.89 billion. On an adjusted basis, earnings are expected to climb from $1.03 to $1.18. That would represent an increase from $2.22 billion to $2.54 billion. Obviously, there are other metrics that investors should be paying attention to. In the third quarter of 2023, the company generated operating cash flow of $2.80 billion. If we adjust for changes in working capital, this would increase to $1.81 billion. And lastly, EBITDA for that time was $4.07 billion.

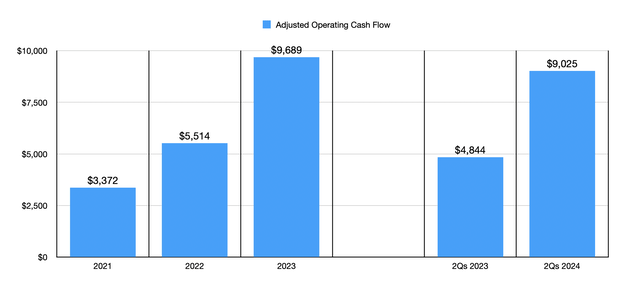

The most important of these profitability metrics, to me, is adjusted operating cash flow. And I think investors have every reason to believe that there will be a year-over-year improvement. As you can see in the chart above, the company has successfully grown adjusted operating cash flows from $3.37 billion in 2021 to $9.69 billion in 2023. As the global economy reopened following the COVID-19 pandemic, and as management engaged in cost-cutting initiatives, cash flows for the company improved drastically. For the first half of 2024, the business reported adjusted operating cash flow of $9.03 billion. That’s nearly double the $4.84 billion reported one year earlier.

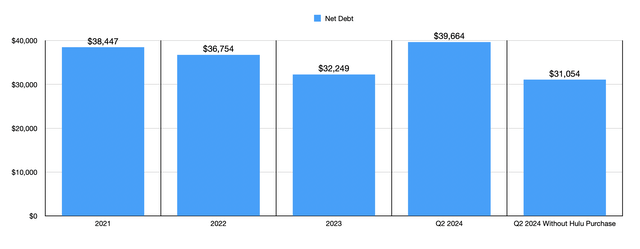

Another important thing that investors should be paying attention to will be debt. Management has done a fine job of reducing leverage over the past few years. From 2021 through 2023, net debt on the company’s books dropped from $38.45 billion to $32.25 billion. Net debt did end up growing to $39.66 billion by the end of the second quarter of 2024. But this was only because of the $8.61 billion payment that management made to Comcast (CMCSA) for the 33% of Hulu that Disney is purchasing. Without this payment, net debt in the most recent quarter would have been $31.05 billion. I would imagine that further debt reduction will occur in the most recent quarter. Now, it is possible that the company could ultimately have to pay out more money for this Hulu stake. But that’s because the payment it made only covered the minimum required of it. The two companies are currently going through a process to determine what the ultimate purchase price will be. So it’s not unthinkable that a few billion dollars might eventually be required to square that circle.

Takeaway

Fundamentally speaking, I think that Disney is one of the best companies out there. I think that management has made tremendous progress following a couple of dark years caused mostly by the COVID-19 pandemic. Unfortunately, much of its recent box office successes will not show up in this upcoming quarterly release. But with box office numbers starting to recover and the company’s market share of the domestic box office growing from 16.20% last year to 17.96% year-to-date, I think that investors will have plenty of updates for management and plenty of fundamental reasons to remain optimistic about the company. Because of this, I’m keeping the firm rated a ‘strong buy’ for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!