Summary:

- Denison Mines Corp. is a Canadian uranium exploration company with a clean balance sheet and CAD$47 million in cash.

- The demand for nuclear energy is increasing due to the growth of AI infrastructure and data centers, as well as expansion in China and India.

- Denison Mines is focused on projects in Canada’s Athabasca Basin and has high-grade uranium deposits, making it a compelling investment.

metamorworks

Investment Thesis

Denison Mines Corp. (NYSE:DNN) is a Canadian uranium exploration company. Denison has a reasonably clean balance sheet, with approximately CAD$47 million in cash and equivalents. It’s not a particularly large amount of cash. But what it lacks in cash, it more than makes up for in the fact that the business has no significant debt.

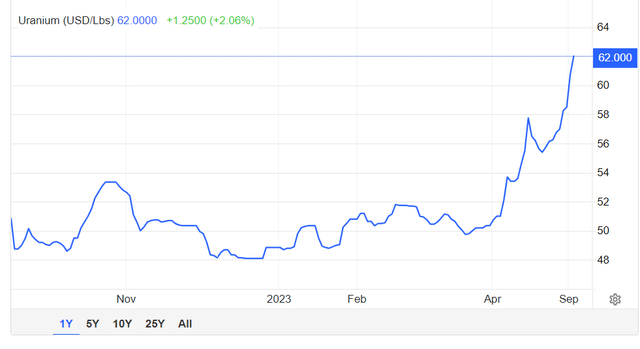

However, the business is not in production as of yet, as it must wait until the price of uranium stabilizes above $60 per lbs for a period of months. But with uranium prices jumping higher of late, there’s a lot to be excited about Denison.

In this analysis, I explain my thoughts on nuclear energy, why Denison is a compelling investment, and some of the risks that readers should be mindful of.

Personally, I’m investing in Uranium Energy Corporation (UEC), but frankly speaking, I don’t believe there’s that much to tell them apart. Realistically, if the price of uranium stays above $60-70 per lbs for some time, both these companies will do well. Note, in this analysis, I’ve not discussed the impact of Small Modular Reactors (”SMRs”), as I’ve already discussed this at length here.

Why Invest in Nuclear Energy?

Uranium plays a crucial role in nuclear energy, making it an integral part of the broader transition towards cleaner and more sustainable energy sources.

Nuclear power plants provide what is known as “base load” power, which means they can operate continuously at a high capacity level. This stability makes them well-suited for supplying the consistent electricity needs of energy industries, such as AI infrastructure.

More specifically, high energy demand, in the context of AI infrastructure and data centers, has become a significant challenge as technology continues to advance. The rapid growth of digital technologies, such as AI and cloud computing, has led to a massive increase in demand for energy. These data centers are the backbone of AI infrastructure, supporting tasks like data storage, processing, and machine learning model training.

Nuclear power is a low-carbon energy source that can provide a stable and substantial electricity supply to meet the energy needs of data centers and AI infrastructure. Unlike fossil fuels, nuclear power does not produce direct carbon emissions during electricity generation, making it an environmentally friendly option.

On top of the demand for more nuclear energy in the West, the expansion of nuclear energy in China and India can further increase demand. These countries are actively investing in nuclear power to meet their growing energy needs.

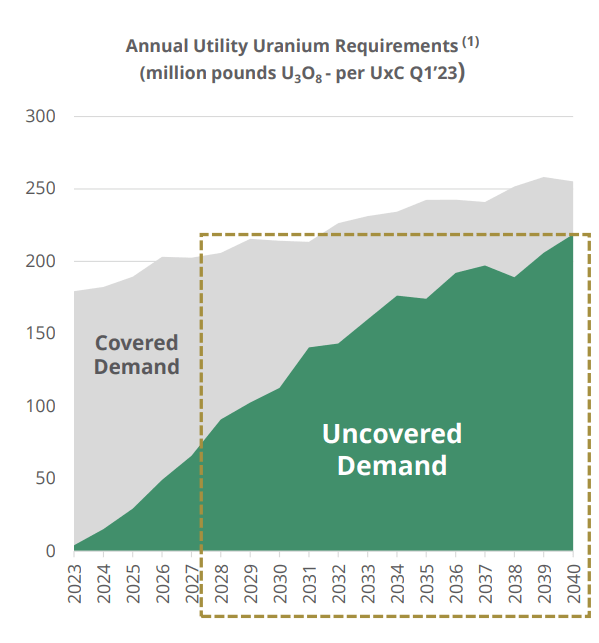

This context, all points to the inevitable fact, that there’s just not enough supply to meet the oncoming demand, see below.

DNN August presentation

As you can see above, starting in 2024 and into 2025, demand for uranium is rapidly increasing, with supply not likely to match demand.

Why Invest in Denison Mines?

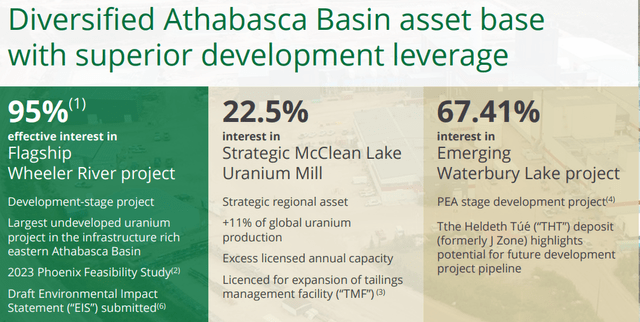

Denison Mines is engaged in the exploration and acquisition of uranium assets, with a focus on projects in Canada’s Athabasca Basin. One of Denison Mines’ main projects is the Wheeler River Uranium Project. This project includes the Phoenix and Gryphon uranium deposits, which are among the highest-grade uranium deposits in the world.

Denison Mines is actively working on advancing its flagship Wheeler River Project to bring these deposits into production.

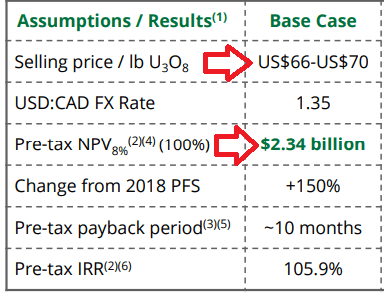

DNN August presentation

In this graphic above, we see that assuming the price of uranium is in the $66 to $70 per lbs range, its net present value is around CAD$2.4 (or $1.8 billion). This means that even now, after the rally this stock had, the business is still selling for less than its NPV.

What Are The Risks?

There are two main risks facing Denison.

Firstly, the exact size of the secondary supply of uranium remains uncertain, and this ambiguity could potentially exert downward pressure on uranium prices.

Secondary supply includes sources such as government stockpiles, uranium recycling, and excess inventories, among others. Due to the lack of transparency and comprehensive data on these secondary sources, all stakeholders are forced to grapple with limited visibility into the magnitude of available uranium supply. This uncertainty can make it challenging to assess the balance between supply and demand in the uranium market.

To be clear, the story of there being a shortfall in uranium supply in the middle of this decade isn’t new. Market participants have known about this aspect for at least two or three years. So it’s important to keep in mind that the new uranium prices we are seeing are not reflective of any new information.

This leads me to my second risk factor. While the prospect of higher uranium prices may seem enticing, it’s crucial to consider that such a scenario could trigger a substantial near-term supply response, albeit with a time lag of a few years.

When uranium prices rise significantly, it becomes economically viable for uranium producers to restart idled mines, explore new deposits, and expand production.

This potential influx of additional uranium supply could act as a restraining factor on further price escalation. As a result, while the uranium market may experience upward momentum in response to various factors such as increased demand from nuclear power generation, the anticipation of substantial supply coming online in the future can act as a lid on the extent to which uranium prices can continue their upward trajectory.

The Bottom Line

While they’re not in production yet due to uranium price conditions, recent price increases in uranium offer promising prospects.

I believe that Denison stands to benefit if uranium prices stay above $60-70 per lbs. The growth in nuclear energy, especially in China and India, points to a supply-demand gap in uranium. Denison Mines focuses on projects like the Wheeler River Uranium Project, with high-grade uranium deposits, positioning them well for potential future production. However, there are risks, including uncertainty in secondary uranium supply and the possibility of increased production in response to rising prices.

Altogether, it’s difficult not to be excited about Denison’s prospects over the next twelve months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Michael is long UEC. Michael recommends UEC as part of the Deep Value Returns service.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.