Summary:

- The feasibility study for Phoenix and the updated pre-feasibility study for Gryphon confirmed the very low operating costs for the projects.

- The combined net asset value for all of Denison’s projects is around $2B, while the market cap of the company is only about half that amount.

- So, the valuation is attractive following the updated figures now in June 2023.

Liens

Investment Thesis

Denison Mines (NYSE:DNN) did last month release a very strong feasibility study (“FS”) on Phoenix and an updated pre-feasibility study (“PFS”) on Gryphon, which are both part of the 95% ownership of the Wheeler River project. Phoenix is the core ISR asset and Gryphon is an underground asset, several years behind Phoenix in the development pipeline, with very respectable figures as well.

The updated figures for Phoenix and Gryphon confirm the attractive valuation for the company. In this article, I will discuss the figures that were released and break down the valuation of the company.

The stock price of Denison has mostly been rangebound between $1 and $2 over the last two years, where the stock price is still in the lower part of that range, even if we have seen a bounce from the most recent lows.

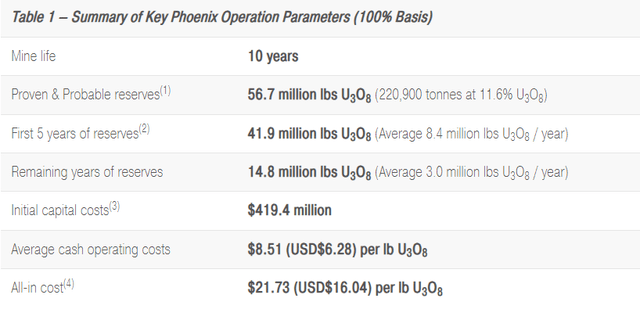

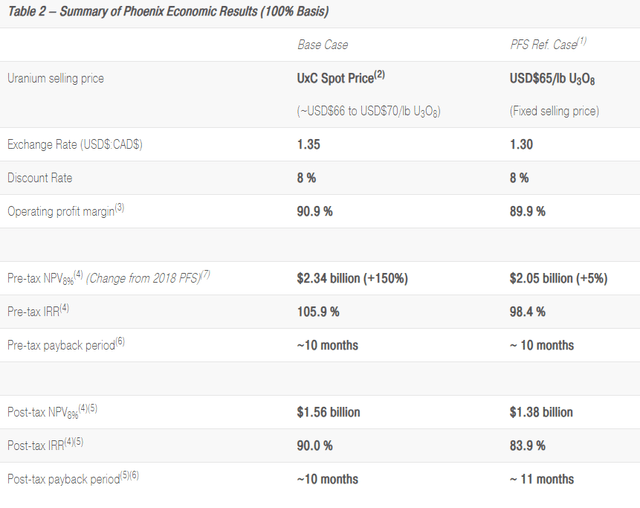

Phoenix Feasibility Study

The pre-feasibility study on Phoenix that Denison has previously relied on, was from 2018. So, an updated study was very welcomed and incorporates the inflation we have more recently seen in mining, but the numbers remain extremely strong.

The FS confirms a mine life of 10 years for Phoenix, with 8.4Mlbs of annual production of uranium during the first 5 years of operations, which declines more in the back half of the mine life. It is probably fair to assume Gryphon will ramp up around the time production volume at Phoenix declines more substantially.

The initial capital cost for Phoenix is estimated to be around C$400M or $300M, on a 95% basis, which I am not overly concerned about, and the operating costs are extremely competitive. The cash cost is estimated to be $6.28/lb and the all-in cost is estimated to $16.04/lb.

Phoenix does, with a uranium price of $66-70/lb and a discount rate of 8%, have an after-tax net present value of C$1.56B or $1,156M, which implies a fantastic IRR of 90%. The NPV has increased compared to the PFS, which is very impressive in this inflationary environment, even if a small part of the difference is due to the marginally higher uranium price assumption used in the FS compared to the PFS.

Figure 2 – Source: Denison Press Release Figure 3 – Source: Denison Press Release

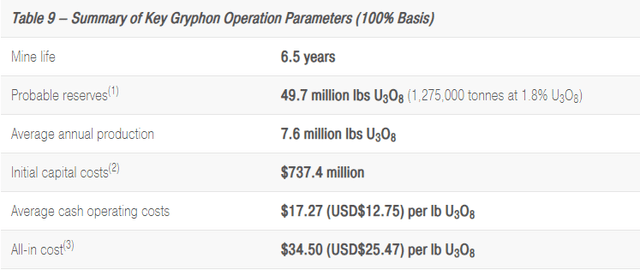

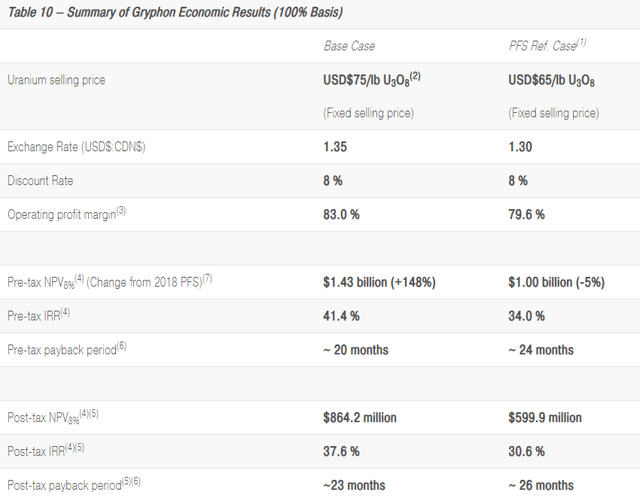

Gryphon Update

The update on Gryphon did confirm an annual production of 7.6Mlbs of uranium, with a mine life of 6.5 years. The initial capital cost is more substantial at C$737M, even if the cashflows from Phoenix are likely to fund this project.

While the operating costs are not as extreme as for Phoenix, a cash cost of $12.75/lb and an all-in cost of $25.47/lb for Gryphon would still make this a low-cost asset in a global comparison. The IRR is relatively good at 37.6%, even if that is based on a $75/lb uranium price. The after-tax NPV for the project, using the $75/lb uranium price and an 8% discount rate, is estimated to be C$864M or $640M.

Figure 4 – Source: Denison Press Release Figure 5 – Source: Denison Press Release

Valuation & Conclusion

Denison does apart from the 95% ownership interest in the Wheeler River project have a 22.5% ownership in the McClean Lake Uranium Mill. However, I have been reluctant to prescribe any value to this asset as Denison has already been paid for the toll milling fees the mill receives from processing the Cigar Lake ore. There is certainly some value in the ownership interest in the mill, as new ore will eventually be processed there, but the value is more marginal.

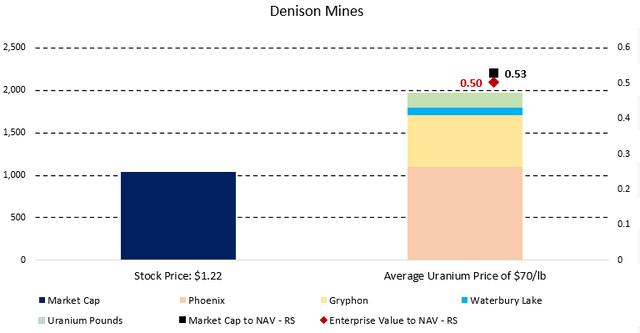

The company does also have a 67.4% ownership interest in Waterbury Lake, which did in a 2020 PEA have an NPV of C$109M using a $65/lb uranium price and an 8% discount rate, which refers to Denison’s share specifically. If we assume a $70/lb uranium price to make it comparable to the other projects and convert it to USD, we are talking about an NPV around $90M.

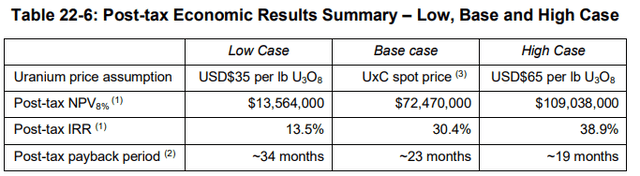

Figure 6 – Source: Waterbury Lake 2020 PEA

In 2021, following a larger bought deal, Denison did strategically acquire 2.5Mlbs of uranium at very attractive prices to hold as liquidity or possibly be used to partly fund the construction of Phoenix. In a $70/lb uranium price scenario, this uranium would be worth $175M.

So, if we put the values together for Phoenix, Gryphon, Waterbury Lake, and the uranium on the books, at an average uranium price of $70/lb, we get a combined net asset value of $1,971. This translates to a market cap to NPV of 0.53 or an enterprise value to NPV of 0.50.

Figure 7 – Source: My Estimates Primarily Based on Technical Reports

Denison does still have the permitting of Phoenix & Gryphon ahead, which is a substantial potential risk factor for the company. I am on the other hand not concerned with the financing, as the uranium pounds can be used to partly cover initial capital cost for Phoenix. Also, with an IRR of 90% and a recent feasibility study in place, it should not be a problem getting a substantial debt financing in place when the project is permitted.

It is also important to remember that Denison Mines is one of very few development companies in the uranium industry with its projects located in one of the best mining regions of the world, the projects have substantial scale, and extremely low costs. So, I view the current valuation for Denison as very attractive.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DNN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like this article and is interested in more frequent analysis of my holding companies, real-time notifications on portfolio changes, together with macro and industry analysis. I would encourage you to have a look at my investing group, Off The Beaten Path.

I primarily invest in turnarounds in natural resource industries, where I have a typical holding period of 1-3 years. Focusing on value offers good downside protection and can still provide great upside participation.