Summary:

- U.S. stocks have seen remarkable gains over the past decade, but replicating this success in the 2020s will be challenging.

- eBay offers an attractive valuation and potential for growth in a competitive market.

- EBAY’s strong financials, aggressive buybacks, and healthy dividend yield make it an enticing choice for investors.

ymgerman

Introduction

When it comes to the market, I’m not necessarily bearish. However, I’m cautious because of two reasons.

- Stocks are trading at lofty valuations, especially after the market decided to price in six rate cuts for 2024 over the past three months.

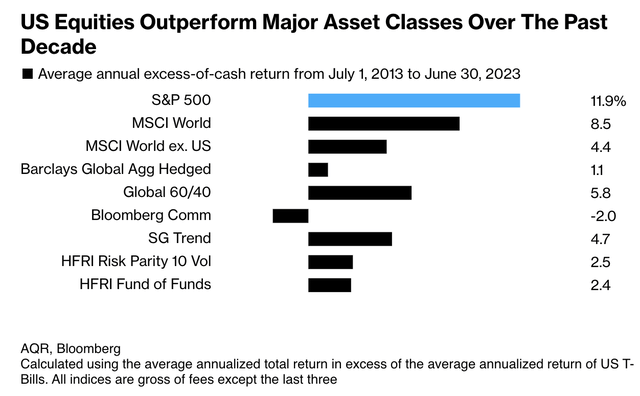

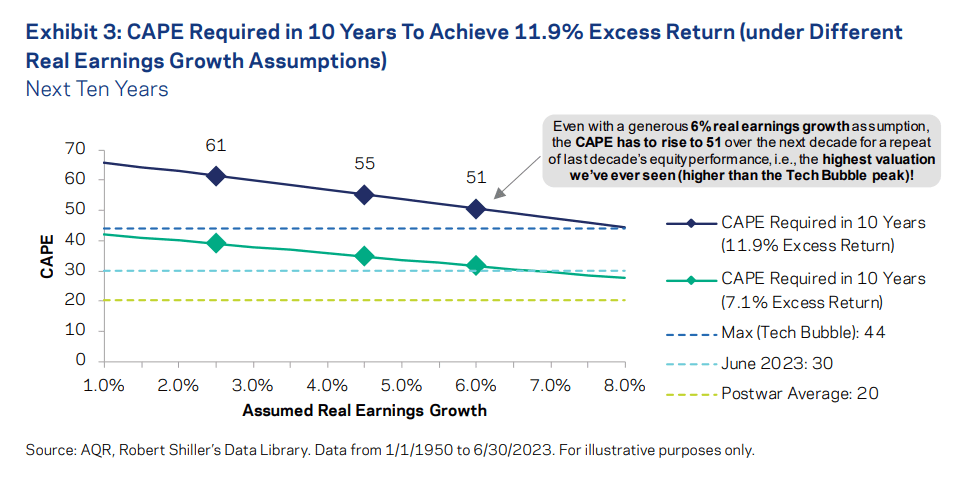

According to a recent Bloomberg article, a remarkable decade has unfolded for U.S. stocks, rewarding buy-and-hold investors while outperforming other asset classes, as we can see in the chart below. Since 2013, the S&P 500 has returned 11.9% per year.

However, as the 2020s unfold, replicating this success will be challenging, requiring extraordinary expansions in earnings and valuations.

According to the article, replicating the past decade’s gains demands substantial increases in earnings and valuations.

Even with a generous 4.5% annual growth in real earnings, achieving a repeat performance would necessitate pushing the cyclical P/E to an unprecedented 55.

AQR (Via Bloomberg)

Adding to that, even with optimistic forecasts of 11% and 12% profit growth in 2024 and 2025, achieving double-digit gains in consecutive years is rare.

The market, seemingly priced for perfection, must witness significant growth to boost the ‘E’ in the ‘P/E’ ratio.

Onto reason number two.

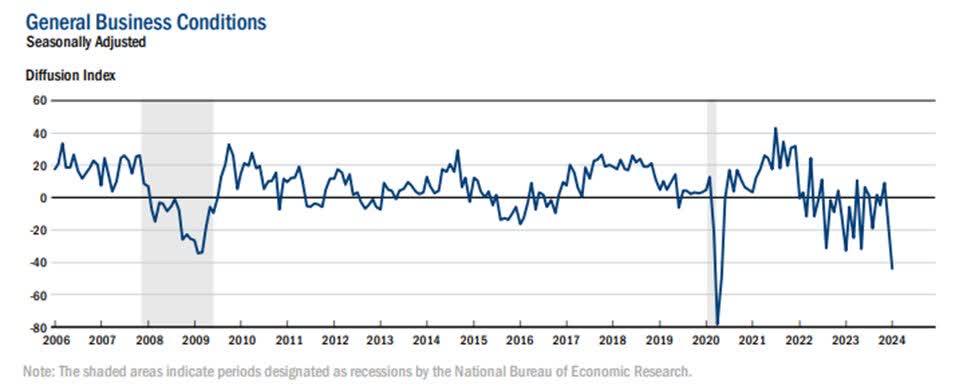

- Economic growth is in a poor state, as leading indicators like the Empire State Manufacturing Index just hit a new multi-year low.

Federal Reserve Bank of New York

The same goes for consumer sentiment and economic growth in regions like Europe (it also suffers from an energy crisis) and China.

Hence, I’m increasingly focusing on stocks that trade at attractive prices.

While I am not a traditional “value” investor, I believe that we could witness a shift from growth to value over the next few years.

That’s where eBay Inc. (NASDAQ:EBAY) comes in.

I started covering the stock on October 11, 2023, when I used the title “eBay: An AI-Fueled Comeback With High Potential Returns.”

Since then, the stock is down roughly 6%.

What makes eBay special is its attractive valuation and ability to grow in a highly competitive market. Sure, competitors are fierce, and poor consumer sentiment isn’t helping.

However, the company is trading at roughly 10x free cash flow, which not only indicates a cheap valuation but also opens up the door for management to massively buy back stock, further helping the long-term value of the stock.

With that said, let’s dive into the details!

Strength Amid Headwinds

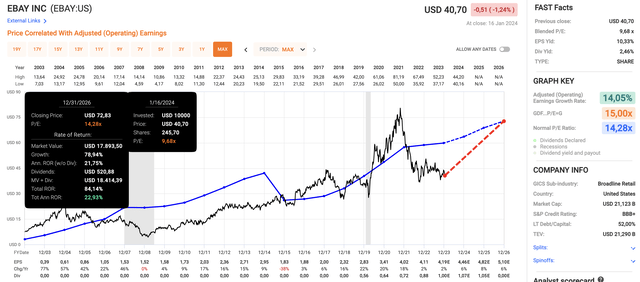

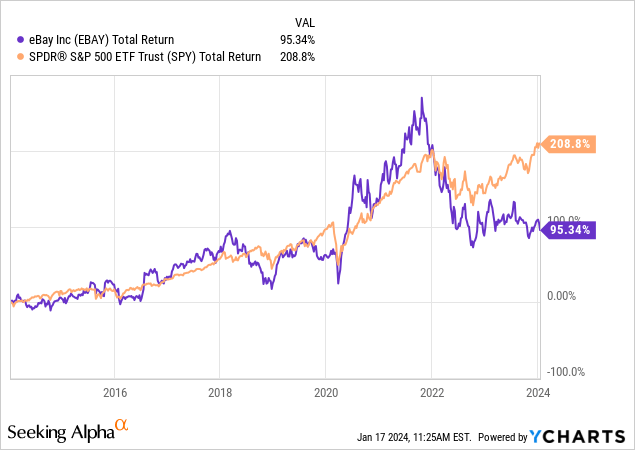

As we can see in the chart above, until late 2021, EBAY did very well, beating the S&P 500.

Unfortunately, once the pandemic ended, central banks dialed back QE and switched to rate hikes. That’s when companies like eBay started to feel tremendous headwinds.

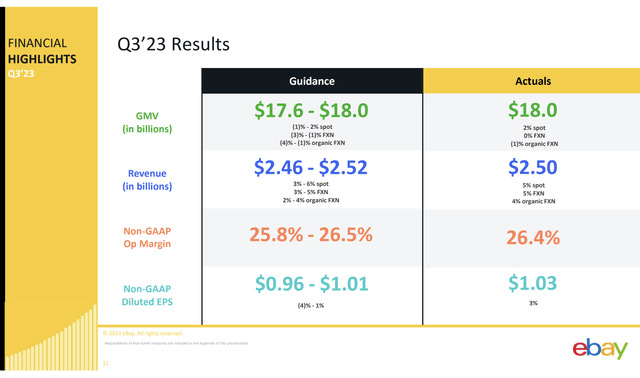

The good news is that in its most recent earnings (3Q23), the company showed resilience, as it reported a gross merchandise volume (“GMV”) of approximately $18 billion, marking a 1% decrease on an organic basis.

- The GMV decline was attributed to a 1% organic decrease, while foreign exchange provided a nearly 2-point tailwind to reported GMV growth.

- The U.S. market experienced a 2% organic decrease, showing an improvement of over 2 points sequentially.

- International GMV remained flat on an FX-neutral basis and increased by nearly 4%, as reported.

- Focus categories, particularly P&A, contributed positively to the overall growth, outpacing the rest of the marketplace. eBay Refurbished and luxury focus categories also showed positive trends.

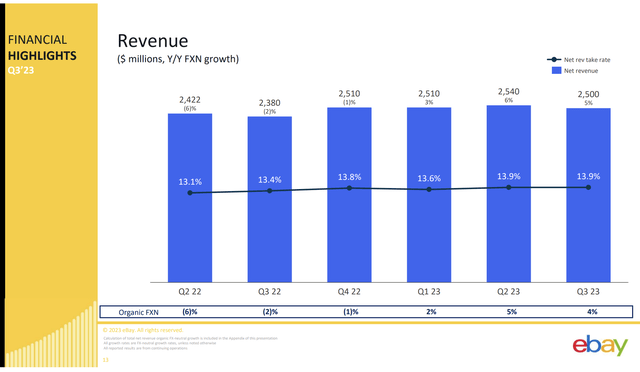

Despite this, revenue saw growth, reaching $2.5 billion, a 4% increase organically, as we can see in the overview above.

Furthermore, the trailing 12-month active buyers remained stable at 132 million, with enthusiast buyers at 16 million.

Enthusiast spending per year was approximately $3,000, showing stability quarter-over-quarter but a modest year-over-year increase. These metrics suggest a consistent and engaged user base, which is very important for a company “like” eBay.

The take rate was 13.9%, down modestly quarter-over-quarter but up nearly 50 basis points year-over-year. This is visible in the chart below.

Advertising played a significant role, contributing to total advertising revenue growth of 24% to $366 million, representing over 2% penetration of GMV.

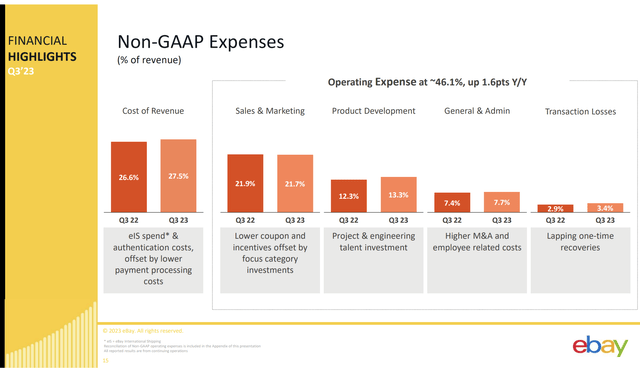

With regard to profitability, which is equally important, the non-GAAP operating margin was 26.4%, reflecting a 2.5-point year-over-year decrease.

Investments, recent M&A activities, and the eBay International Shipping program contributed to this margin decline.

Gross margin decreased by nearly 90 basis points year-over-year, primarily due to the ramp of eBay International Shipping.

With that in mind, the company also maintained a robust balance sheet, ending the third quarter with cash and non-equity investments of $5.4 billion and gross debt of $7.7 billion.

The company is expected to keep its net leverage ratio below 2.0x (EBITDA) in the years ahead. It has a BBB+ credit rating, which is just one step below the A range.

Shareholder Returns & Valuation

Besides having a good business model that benefits from some people having too much stuff and others looking for bargains, it is a cash machine.

Analysts estimate that eBay is able to generate $2.3 billion in free cash flow this year (2024), which would translate to 11% of its current market cap!

Ignoring oil and gas stocks, this may be the highest number I have seen in the past few quarters.

When combining a healthy balance sheet with a load of excess cash, the company is in a great spot to reward shareholders, which is what it has been doing.

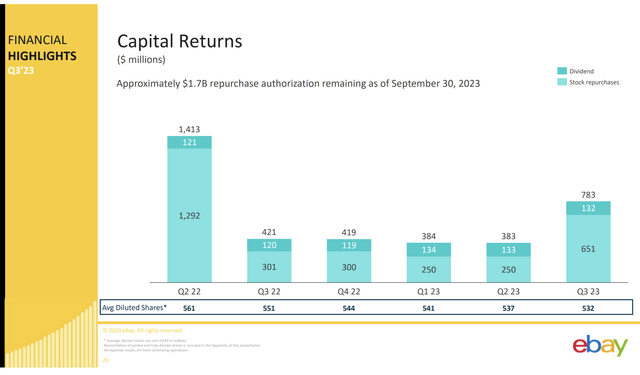

The company repurchased over $650 million of its shares at an average price of approximately $44 during the third quarter, with $1.7 billion remaining under the current buyback authorization.

Additionally, a quarterly cash dividend of $132 million was paid in September.

Since the beginning of 2022, eBay has returned nearly $5.2 billion to shareholders through repurchasing dividends, representing approximately 125% of cumulative free cash flow over that period, which was only possible because of its healthy balance sheet.

Furthermore:

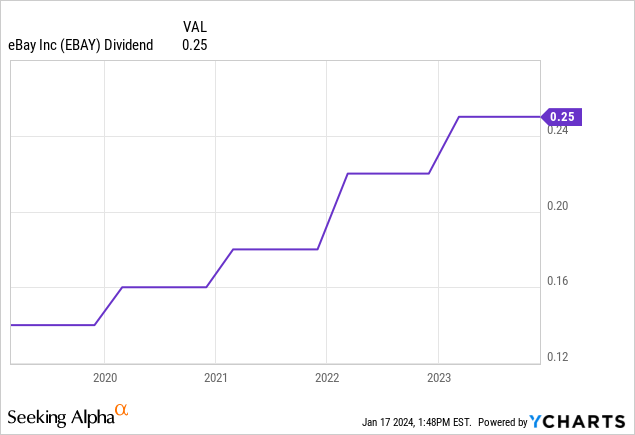

- EBAY currently pays $0.25 per share per quarter in dividends. This translates to a yield of 2.5%. That’s roughly 100 basis points above the S&P 500 yield.

- This dividend is protected by a very low payout ratio of just 22% (using 2024E EPS).

- The most recent dividend hike was 13.6% on March 8, 2023.

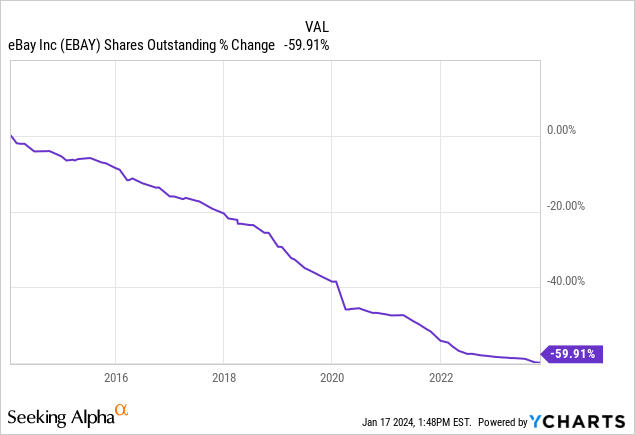

With regards to its buybacks, over the past ten years, EBAY has bought back 60% of its shares, which makes it one of the most aggressive repurchasers in the S&P 500.

The good news is that I believe that this can last.

Not only is the company expected to generate more than 10% of its market cap in free cash flow this year, but it is also working on a path to sustained long-term growth.

Using the data in the chart below:

- eBay is expected to grow its EPS by 6% this year, followed by 8% growth in 2025 and 6% growth in 2026.

- As a result of aggressive buybacks and poor stock price performance, the company is trading at a blended P/E ratio of just 9.7x! The S&P 500 is trading at roughly 22x earnings.

- The company’s normalized valuation going back to 2003 is 14.3x.

- A return to that valuation by incorporation of its expected earnings growth could result in a fair stock price of $72, which is 80% above the current price.

The question is, where is the growth coming from?

After all, a strong outlook is nice, but it’s not everything.

How eBay Is Expected To Grow

Last month, during the Barclays Global Technology Conference, the company discussed some measures to support long-term growth.

On top of benefiting from a rising trend in e-commerce, the company noted that its emphasis on focus categories, such as parts and accessories, refurb, luxury, and collectibles, has proven successful.

Its commitment to these specific segments contributes to revenue growth, attracting enthusiasts and consumers looking for unique, pre-loved, or specialized items.

Essentially, eBay’s strategic pivot three years ago marked a turning point in its business model.

Shifting the focus to non-new in-season items showed a forward-thinking approach, capturing opportunities in the growing market for unique and vintage products.

This evolution aligns with changing consumer preferences and positions eBay as a go-to platform for distinct, non-traditional items.

And then there’s AI!

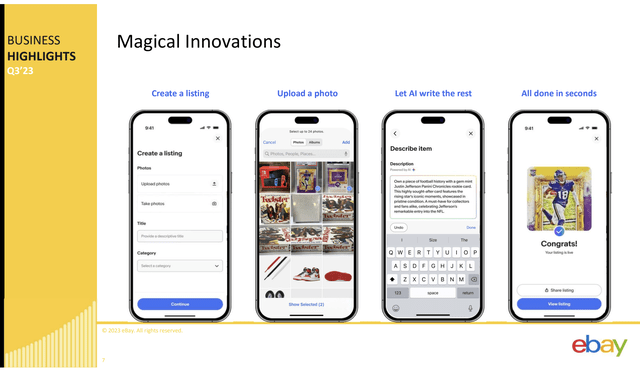

eBay’s focus on innovation and creating customer-centric experiences remains a critical factor in its growth strategy.

Investments in product development, including the use of generative AI, have allowed eBay to streamline processes, reduce friction, and enhance the overall customer journey.

Initiatives like the magical listing flow, image-based generative AI, and smart targeting in advertising demonstrate eBay’s commitment to staying at the forefront of technological advancements in an industry with increasingly low entry barriers.

Furthermore, the evolution of eBay’s payment systems has created opportunities for growth.

By providing alternative forms of payment that support higher average selling price (“ASP”) transactions, eBay ensures a relevant proposition for customers.

The flexibility in payment options, coupled with initiatives like Buyer and Seller FX, contributes not only to user satisfaction but also enhances eBay’s financial performance.

While none of these growth measures will have a meaningful impact on its growth trajectory, they likely ensure that eBay remains on top of important trends, allowing customers to use its platform more easily and targeting specific niches that other competitors aren’t likely to exploit.

All things considered, I really like eBay. While it is a company that comes with competition risks, I believe the market is underestimating the attractiveness of its business model and its valuation.

As such, I’m considering adding the stock to my dividend growth portfolio this year, as it would give me some diversified consumer exposure. Especially if inflation remains sticky, I expect eBay to enjoy secular benefits like strong second-hand sales.

Takeaway

In a market where caution is key, eBay emerges as a resilient player.

Despite headwinds, its strategic focus on non-new, unique categories and innovative use of AI positions it for sustained growth.

Trading at a compelling valuation, the company’s robust financials, aggressive buybacks, and a healthy dividend yield make it an enticing choice.

As I explore potential additions to my portfolio, eBay stands out as a diversified consumer exposure, poised to capitalize on the ongoing shift to e-commerce and the enduring appeal of second-hand sales amid persistent economic challenges.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-week FREE TRIAL plus Brad Thomas’ FREE book.