Summary:

- Etsy reported its Q1 FY24 earnings, where revenue grew just 0.8%, as GMS and adjusted earnings declined. However, the company grew its Active Buyers by 1.9% YoY to 91.6M.

- The company launched Gift Mode, an interactive gift shopping experience, and improved search relevance for buyers, in order to attract and accelerate the frequency and size of purchases.

- ETSY faces headwinds from declining consumer discretionary spending amid a tough macroeconomic and competitive landscape.

- While the company can deliver long-term upside, I expect short-term volatility to continue until the management is able to translate its initiatives into accelerating GMS on the platform.

grinvalds

Introduction & Investment Thesis

Etsy (NASDAQ:ETSY) is an e-commerce marketplace for handmade and vintage items that has severely underperformed the S&P 500 and Nasdaq 100 YTD. The company recently reported their Q1 FY24 earnings, where revenue grew 0.8% YoY while adjusted earnings declined 1.4% YoY. The company has been facing headwinds from declining consumer discretionary spending, which has negatively impacted their Gross Merchandise Sales (GMS). While it remains committed to its product innovation, with the launch of Gift Mode and improving search capabilities for buyers on the platform to improve their experience and accelerate the frequency and size of purchases, the macroeconomic environment and the competitive landscape are continuing to push downward pressure on its margins.

For FY24, the company is expected to grow its GMS modestly while maintaining similar profit margins compared to the previous year. Assessing both the “good” and the “bad,” I believe that while the stock has long-term upside, I expect short-term volatility to continue until the management successfully translates its product innovation into accelerating GMS. As a result, I will stay on the sidelines and rate the stock a “hold.”.

About Etsy

Etsy is an e-commerce marketplace that connects 91.6M Active Buyers with Sellers globally. Their primary marketplace is Etsy.com, where they connect artisans and entrepreneurs with customers looking to purchase handmade or vintage items by curating quality listings and providing a reliable shopping experience. In addition to Etsy.com, the Etsy marketplace also consists of Reverb Holdings, which is a musical instrument marketplace, and Depop, which is a fashion resale marketplace.

In terms of their business model, Etsy generates its revenue primarily from its marketplace activities, which include transaction fees, payment processing, and listing fees, as well as ancillary services such as on-site advertising, shipping labels, and other seller services.

The good: Revenue and Active Buyers grew despite decline in GMS, Launch of Gift Mode, Improving Search Relevance for Buyers

Etsy reported its Q1 FY24 earnings, where revenue grew 0.8% YoY to $646M. While GMS declined 3.7% YoY to $3B under a challenging macroeconomic environment, Active Buyers grew 1.9% YoY to 91.6M. At the same time, Etsy also managed to successfully reactivate 6.3M buyers, up 5.9% YoY, while also growing their retention of active buyers compared to the previous year.

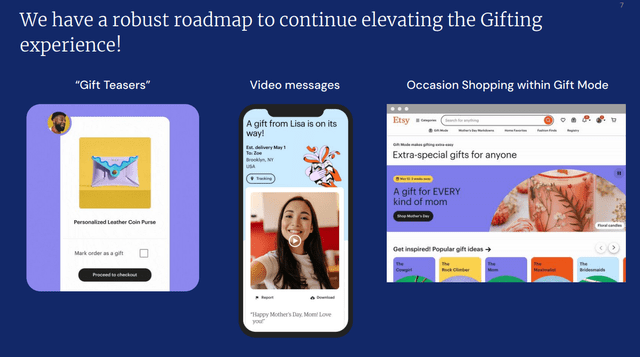

The company continued to drive robust product innovations in its marketplace to attract buyers and increase the frequency and size of purchases as it launched Gift Mode, which is their interactive gift shopping experience that combines AI and human curation to help buyers find the perfect present. During the earnings call, Josh Silverman, CEO of Etsy, said that Etsy’s total gifting GMS grew in the low single-digits in Q1, outpacing online gift-focused peers, who saw YoY declines. I believe that as the company continues to build buyer awareness, the launch of Gift Mode allows them to improve the overall customer experience and get more buyers into the funnel, with Etsy already seeing success with its PR campaigns with over 200% increase in conversion volume.

Q1 FY24 Earnings Slides: Product Roadmap for Gift Mode

At the same time, the company also made progress on improving their search relevance, which includes updates to their retrieval engines and ranking algorithms that better understand the context for the buyer’s search, which, I believe, will allow the buyers to easily find what they are looking for, leading to higher conversion rates and sales on the platform.

Meanwhile, Etsy continued to leverage AI to suppress and remove product listings that violated their policies, removing 115% more listings than in the previous year. While I believe the heightened level of takedowns negatively affected their GMS on the platform to a certain extent, it is an important investment to ensure an elevated customer shopping experience on the platform, which will position them for long-term success.

The bad: High inflation and interest rates squeeze consumer spending hurting sales and margins, coupled with strong competition

The macroeconomic environment continues to be a headwind for Etsy, with inflation stubbornly over the Fed’s 2.2% target, which is forcing them to keep interest rates higher for longer. This has pushed Americans to tap into credit card debt, which sits at an all-time high of $1.13T, while personal payments as a percentage of credit debt also continue to rise. At the same time, the labor market is also starting to show early signs of weakness as Job Opening continue to decline and Average Hourly Earnings grow more slowly. I believe this has squeezed a significant portion of Americans’ discretionary spending as they increasingly look for deals.

During the earnings call, Josh Silverman echoed similar observations to mine, which I have quoted below:

To that point, while U.S. unemployment is low and inflation data is mixed, consumer sentiment remains depressed, which some speculate can be attributed to the very high cost of money. Consumer wallets remain squeezed so there’s often a little left after paying for food, gas, rent and child care. And there’s significant data indicating that the largest e-commerce platforms have primarily been able to grow by selling everyday essentials at very low prices.”

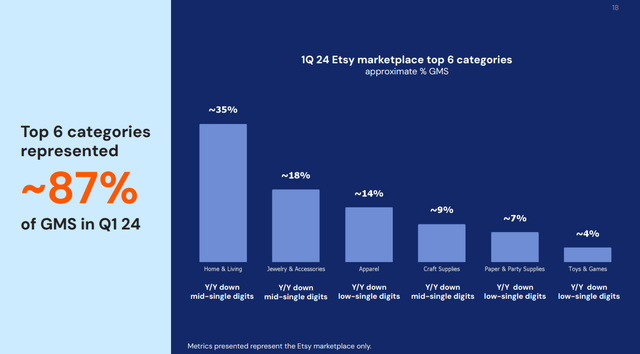

Q1 FY24 Earnings Slides: Declining spend per categories on Etsy’s platform

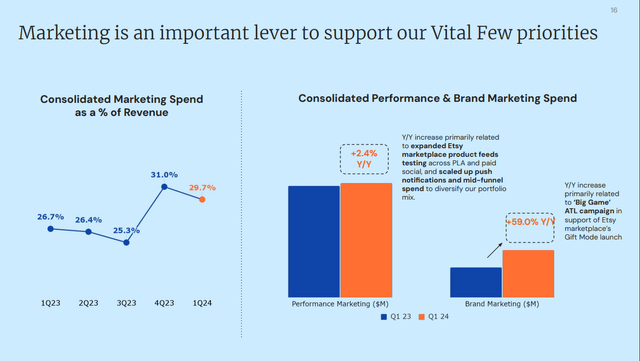

This is putting pressure on operating margins, where Etsy generated $167.9M in Adjusted EBITDA, down 1.4% YoY, with a margin of 26% compared to 26.6% a year ago. As GMS on the platform declines, Etsy’s marketing initiatives have to work even harder to drive growth. While the company is focused on remaining nimble and lean, where it saw improved productivity from their product development organization as well as developing engaging full-funnel marketing activities across channel to improve the quality of their inventory and enhance the customer journey, I am concerned that margins can come under further pressure should the US labor market weaken, leading consumers to pull back more on discretionary spending, coupled with increasing competition from Chinese companies such as PDD Holdings’ (NASDAQ:PDD) discount platform Temu, Amazon (NASDAQ:AMZN) and Walmart (NYSE:WMT) which are able to offer deeper discounts in the “sea of sameness in e-commerce,” as the CEO pointed to during the earnings call.

Q1 FY24 Earnings Slides: Improving Marketing as a percentage of revenue

Tying it together: Etsy is a “hold”

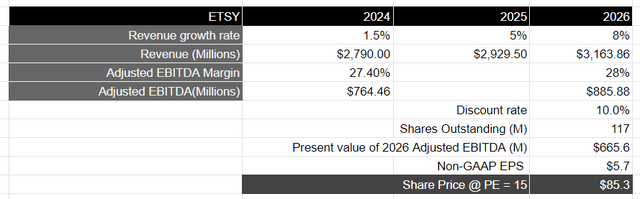

Looking forward, the management has guided for GMS to accelerate modestly YoY in the second half of FY24, while Adjusted EBITDA margin remains at par with FY23 at approximately 27.4%. For the purpose of this valuation, I will assume revenue to trend in line with GMS and therefore expect it to grow modestly by 1.5% YoY to $2.78B in FY24, with an Adjusted EBITDA of $764M. I believe that unless the US and global economy enter a recession, Etsy should be able to hit its FY24 targets, as it remains lean and nimble in its operations to continue to build on its product innovations to improve its customer journey on the platform, which should help it attract buyers while highlighting value through discount-related signals in order to competitively position itself.

Over the following 2 years until FY24, I expect Etsy to grow at least in the high single-digit range as consumer spending recovers, allowing it to generate approximately $3.16B in revenue. Assuming the company is able to maintain its margins at the current levels, it should produce an Adjusted EBITDA of $885M by FY26, which would be equivalent to $732M when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18, I believe Etsy should be trading at par with the S&P 500 given the growth rate of its earnings during this period of time. This would translate to a price target of $85, which represents an upside of 35%.

There is no doubt that the upside looks attractive, and I believe that it can be achieved over the long term should the company return to growth mode. However, the journey can be volatile, in my opinion, as I believe Etsy’s management needs to be able to translate its current product innovation into higher GMS on the platform, while maintaining its profitability. Until then, I expect investor sentiment to be dampened. Assessing both the “good” and the “bad,” I believe that there are higher uncertainties at the moment, which is why I will choose to remain on the sidelines and wait for further progress in the coming quarters to reassess my investment thesis. Until then, I will rate the company a “hold.”

Conclusions

While Etsy is driving robust product innovation with its Gift Mode as well as improving its search capabilities to enhance the customer journey on the platform, the declining spend on categories, coupled with an uncertain macroeconomic environment and a strong competitive landscape that is positioned to offer better value, is pushing me to stay on the sidelines, making this stock a “hold” at the moment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.