Summary:

- GameStop moves on rumors, speculation and sentiment.

- There is the potential for another large rally as management has nearly $4B to spend.

- Will they transform the current business or venture into other exciting areas?

PeterPhoto

GameStop (NYSE:GME) has confounded investors using traditional fundamental analysis. Fundamentals always matter in the very long-term, but in the near-term, the stock can rally 100s, even 1000s of percent on memes and hot air and then fall back again just as quickly. Trading GME therefore suits a different approach than simply buying and holding, and I am positioning myself appropriately for the next “pump.”

Not a Buy and Hold

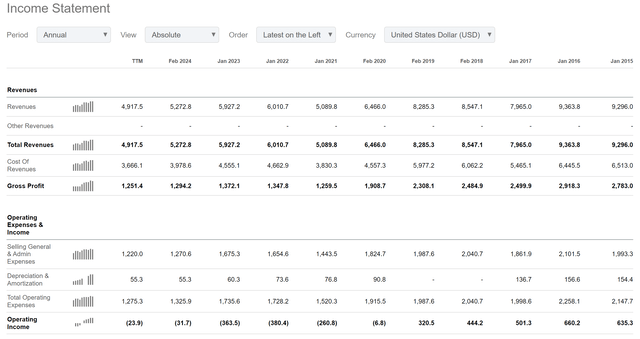

In its current form, GME is a loss-making company, which last posted a modest annual profit in 2019.

GME Financials (Seeking Alpha)

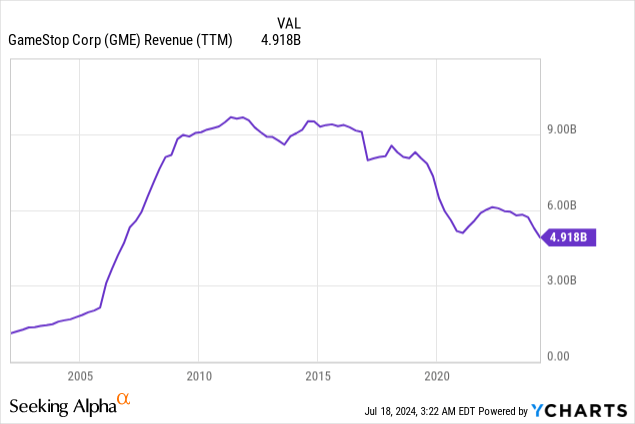

Revenues peaked in 2012 and have steadily declined as competition from other e-Commerce and online video game platforms have squeezed its market share.

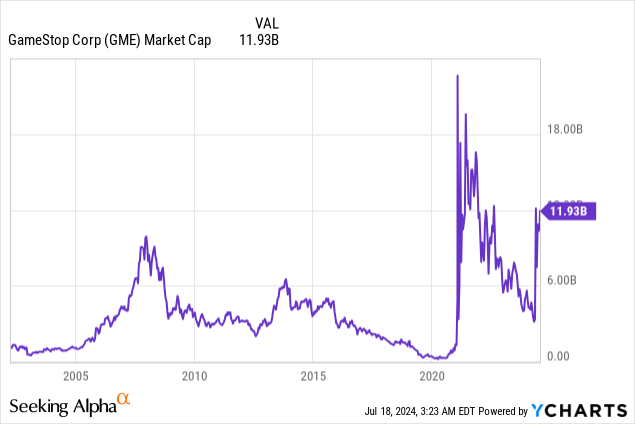

With this backdrop, its market cap has risen to $11.93B, which is more than twice the value it was back in 2012-2015 when revenues were growing and almost double the current amount.

This obviously does not reflect the underlying fundamentals. Indeed, management said this clearly in their announcement in June:

From February 4, 2024 to June 6, 2024, the closing price of our common stock on the NYSE ranged from as low as $10.01 to as high as $48.75 and daily trading volume ranged from approximately 1,731,300 to 206,979,100 shares. During such period, we did not experience any material changes in our financial condition or results of operations that would explain such price volatility or trading volume. Furthermore, since January 2021 through the date hereof, the market price of our common stock has seen extreme price fluctuations that do not appear to be based on the underlying fundamentals of our business or results of operations.

The Real Drivers

GME is down 57% from the May high, but is still up 59% YTD. This volatility is driven by two catalysts.

The first is GME’s popularity as a meme stock and the massive short squeezes it undergoes.

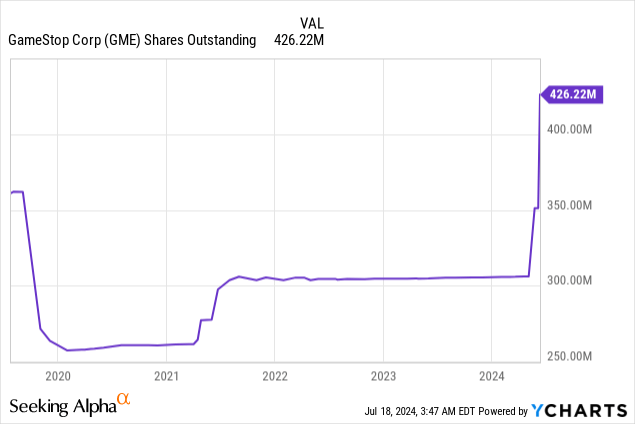

The second is GME’s growing cash pile. Management has wisely taken advantage of the high prices by issuing shares.

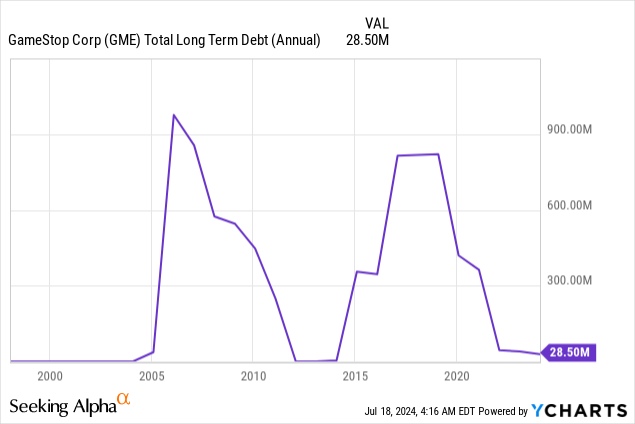

GME first issued 50 million shares in May for approximately $933.4M. 75 million more shares were issued on June 7 and sold on the open market for a total of $2.137B. GME’s cash pile should therefore be nearly $4B. With little in the way of debt, GME has the potential to transform its business or venture into new areas.

We don’t know exactly what management will do with this cash, but speculation and excitement are likely to remain high.

The Next Pump

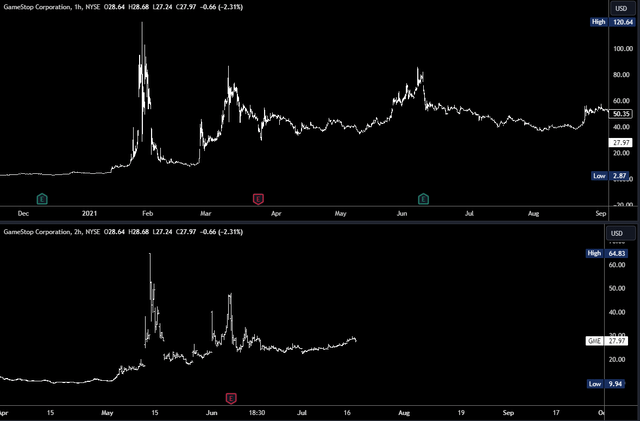

As already outlined, GME does not move in line with changes to its underlying fundamentals. Rather, rumors and speculation trigger bursts of buying and short squeezes which quickly fall back again. We saw this throughout 2021 in the initial stages of GME’s rise from the ashes. It appears to be happening again on a smaller scale, triggered initially by Roaring Kitty and speculation on a company transformation. Indeed, the volatile path of prices this year seems to be following 2021 (note the lower chart from this year is a smaller scale).

GME Chart Comparison (TradingView)

This suggests GME could be setting up for another volatile spike higher to the $48-$50 area, which will likely fade again. We don’t know exactly what will trigger this move, but it likely relates to an announcement on what management will do with the proceeds from the share sales. Will they branch into other areas? A mere mention of the AI buzzword could send the stock soaring briefly, although I struggle to see how they would integrate it into the current business. Crypto? A takeover? There are plenty of exciting things management could announce.

Whatever is announced may well be in the very early stages. Strength is likely sold as has been the case with every other spike higher. I have taken a small position and plan to sell around $48.

At some point, GME may develop a sustainable trend higher if the direction taken by management leads to growth. They certainly have the potential to transform the company and if they succeed, GME could be a proper buy and hold investment.

Risks

GME is a high risk, high reward stock. It traded at $0.64 in 2020 and if the long-term fundamentals don’t improve, it could return there in the very long-term. The outlook largely depends on whether GME can transform its business so announcements on this subject will be important. If the market doesn’t like the direction management is taking, the share price will fall.

Conclusions

GME is in many ways a special stock, and fundamental analysis of the current business will not produce useful results. Speculation and rumors drive prices, and there is the potential for another “pump” higher in the coming months as management is likely to announce plans for their cash pile. I plan to sell into any large spike higher as it is very likely to fall back again. A longer-term buy and hold approach is risky until the direction of the company is clearer.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.