Summary:

- GameStop Corp. reports anticipated earnings results amidst another short squeeze, with Roaring Kitty’s long position potentially making him a billionaire.

- The stock initially surges, but later trades down after the earnings results reveal a miss on revenue and EPS.

- The reasons behind the early release of earnings and the selloff are unclear, leaving uncertainty about the future of the stock.

Flashpop/DigitalVision via Getty Images

Thesis Summary

GameStop Corp. (NYSE:GME) has just reported anticipated earnings results just as the stock was experiencing another short squeeze.

Roaring Kitty, who is credited as being the initiator of the original GameStop squeeze, has made a comeback, showing off his substantial long position in the stock, perhaps aiding in this latest move.

The stock was up to over $60 pre-market, making Roaring Kitty potentially a billionaire, but the anticipated results, which featured a miss on revenue and EPS, have thrown a jug of cold water on the rally, with GME stock now trading down.

As far as I see it, this time around, the shorts will be disappointed.

GameStop Saga Part 2

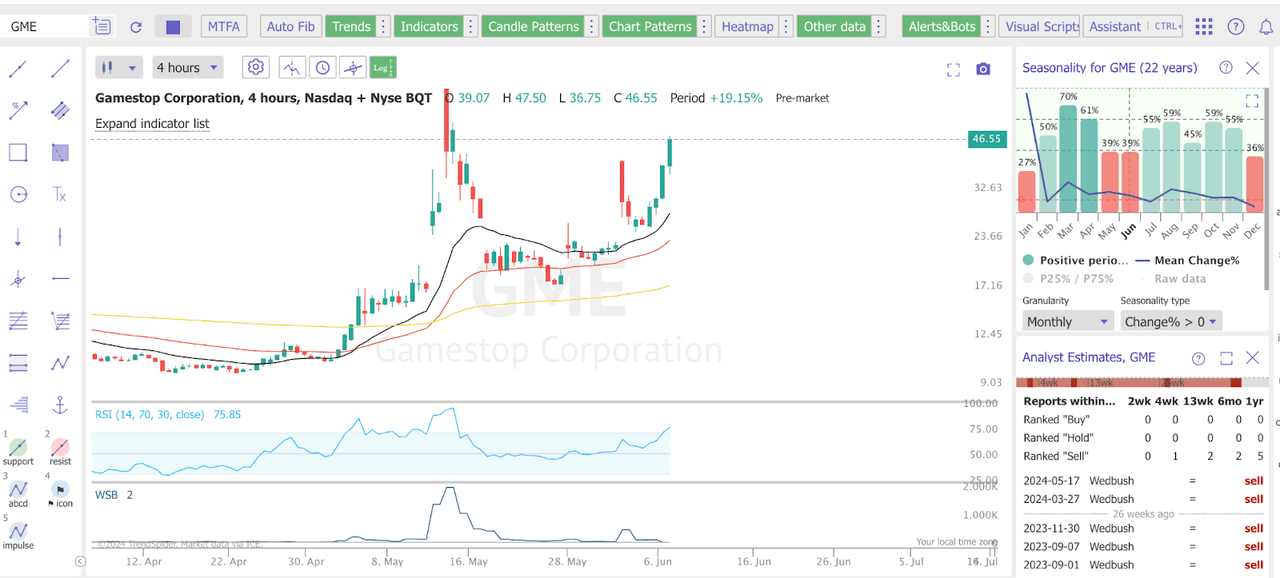

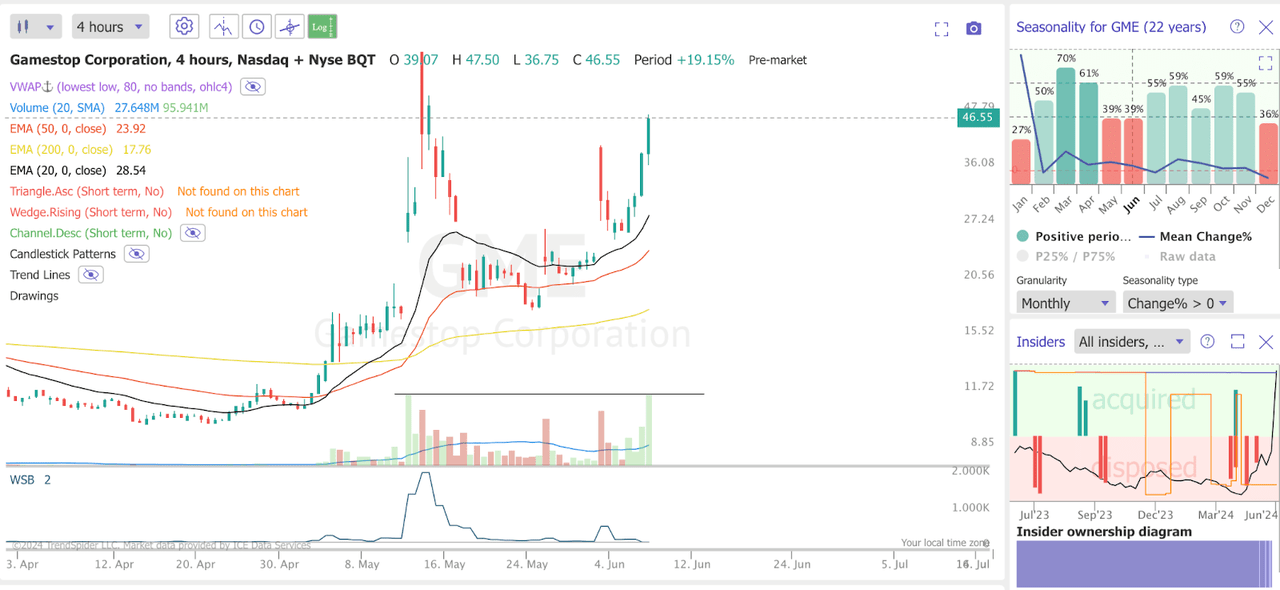

The GameStop short-squeeze made a comeback two weeks ago, and after dying down, it was reignited this week.

The stock exploded on May 15th just as mentions on Wall Street Bets (which we can see in the pane at the bottom) also exploded to over 1.8 million.

The rally died down after a few days, but then re-sparked as Roaring Kitty entered the scene.

Following three years of silence, Keith Gill, (Roaring Kitty) flashed his substantial position in GameStop last Sunday, which consisted of both stock and call options. By Monday’s open, this position was estimated to be worth over $386 million.

In fact, it was estimated that at $65 a share, which GameStop was close to during today’s pre-market, Gill’s position value would be over $1 billion.

The trader turned Internet celebrity has been active on social media again, and in fact has a livestream scheduled for today.

Unfortunately for Roaring Kitty, it looks as if he will not be a billionaire today. As I write this, just ahead of the market open, GME has given up all its pre-market gains, now down around 10%.

But who knows what the market open will bring.

Earnings Results; Why?

In a surprising move, GME, which was scheduled to release earnings results on the 11th, has released them ahead of time.

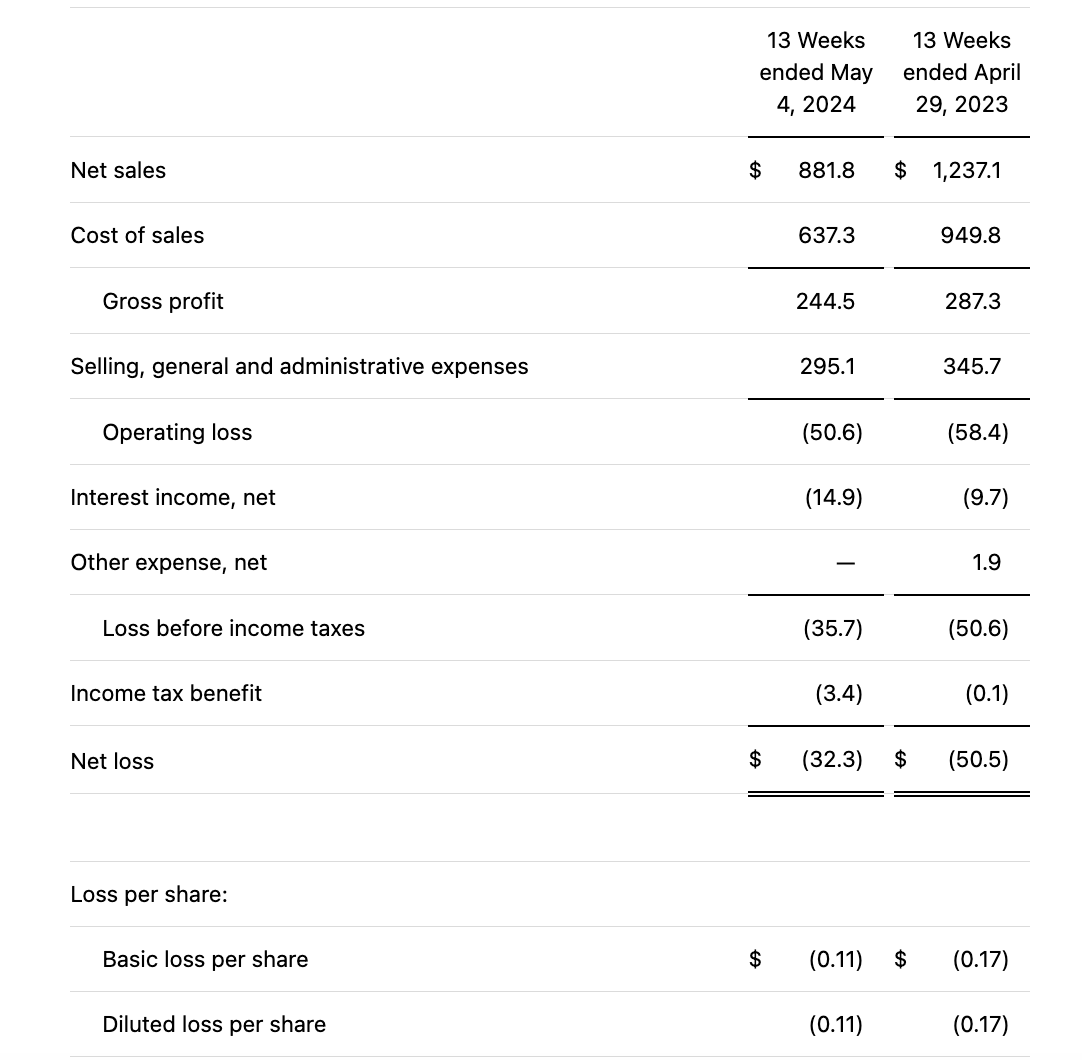

GME Earnings (Press Release)

The company’s sales fell to $881.9 million, though this actually led to a smaller operating loss and better EPS YoY. GME lost $0.11 per share compared to $0.17 for the 13 weeks ended April 29, 2023. The company also holds a little over $1 billion in cash and marketable securities.

GameStop management will not be holding a conference call today.

At this point, we must ask ourselves the question; why?

Why did management decide to post results early? The most logical answer would be that the company wanted to capitalize on the hype created by Roaring Kitty and the upcoming livestream. Well, if that was their intent, it certainly backfired.

The stock has lost all its pre-market gains. And, again, I ask, why?

It’s not like fundamentals are driving this stock in any way. I don’t think many people are actually looking at the earnings miss and thinking, “yeah, this is not worth $60/share anymore.”

So why the sell-off?

Sometimes, anticipation is far better than the real thing. With GME’s earnings results still pending for another week, there was plenty of room for speculator’s imaginations to run wild. Now, however, they have to deal with the crude reality that GameStop has nothing new to offer. That is still just a falling company.

With that in mind, I wonder; was a sell-off exactly what these early earnings were intended to do?

Unfortunately, not a question we can really answer right now

Is GME a Buy?

So, with GME now selling off, you might be tempted to buy some at the open. It’s already squeezed twice in the last couple of weeks. Maybe there’s room for a third run-up?

Before you get ahead of yourself, bear in mind a couple of things.

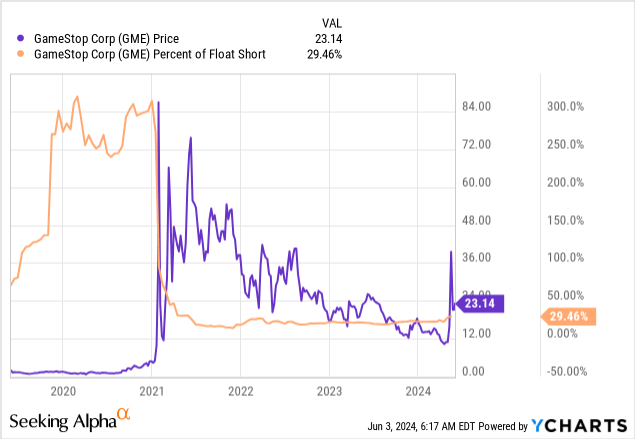

Short float GME (YCharts)

This time around, the percentage of stock being shorted is much lower than back in 2021. This caps the potential for a short squeeze substantially.

On the other hand, note that this second squeeze has been accompanied by a much smaller peak in interest from the WSB Crowd, as seen in the mentioned on the bottom pane. Meanwhile, the volume seems to be topping out at a similar level as May 15th.

Final Thoughts

We’ll have to see, however, if the reappearance of Roaring Kitty will make a difference this time around. Today’s market open will no doubt be a make-or-break point for the stock. The old saying first coined by Anthony Weldon in 1650 comes to mind.

Fool me once, shame on you; fool me twice, shame on me.

But which side will the fools be on this time?

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Joint the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video