Summary:

- EV maker Canoo continues to burn cash of about $300-400 million a quarter, and forthcoming production will need to be funded by more fundraising.

- SVB’s failure has made financial conditions much tighter, making further capital raises much harder and putting Canoo’s future in doubt.

- With 15% of shares sold short, a short squeeze is quite possible and a short selling approach could be very risky.

- We rate Canoo as a sell or avoid.

Scharfsinn86

Introduction

Canoo (NASDAQ:GOEV) is a pre-revenue EV truck builder. Sometime soon it will likely start selling their vehicles to Walmart (WMT) amongst others.

But despite around $2 billion in sales orders, we believe there is considerable doubt about the survival of Canoo over coming quarters. The reasons are:

- Canoo continues to burn cash of about $300-400 million per quarter and reserves must be low, so further raising must happen soon.

- Using Tesla as a guide, even commencing production won’t help Canoo reach a cash-flow positive position for several years.

- The failure of several Silicon Valley Bank (SIVB) amongst other banking problems has tightened financial conditions, making further fund raising for Canoo harder or impossible.

Launching a new vehicle manufacturer is so hard it used to be considered impossible.

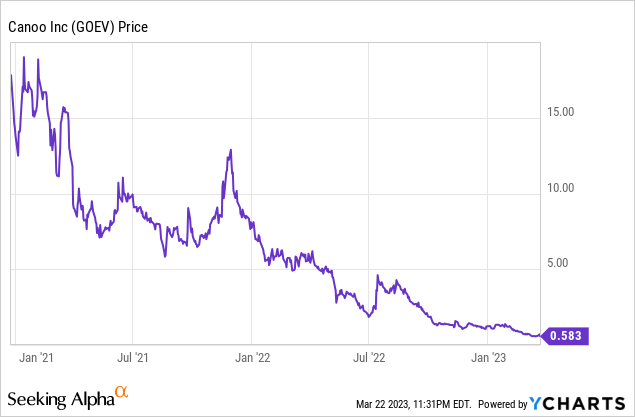

For decades that was accepted wisdom until Tesla (TSLA). Canoo might have a great team and orders, but the capital requirements might be beyond them. Market doubts have caused a stock price collapse.

Tesla made new car companies seem possible. Canoo has a few of Tesla’s advantages. There are far more EV competitors now. Financial conditions are much tighter now, too. Can the CEO attract cash and media like Elon?

It all seems very unlikely.

Canoo will need a lot of luck and exceptional management to avoid bankruptcy and reach sustainable production. Easier investor gains are elsewhere.

Our rating for Canoo is to sell.

Canoo doesn’t have much cash left to burn

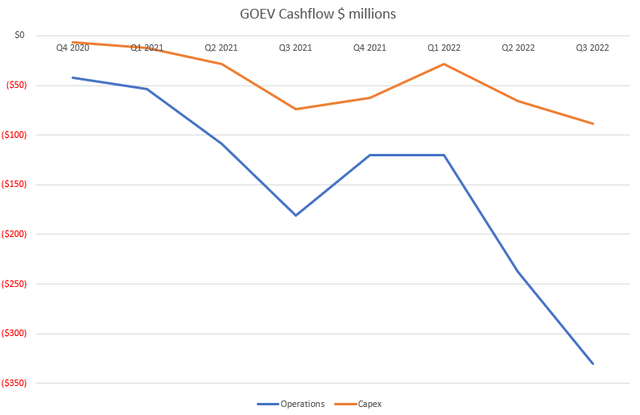

Launching a car company involves burning cash for many quarters, and that’s been true for Canoo. Here are their quarterly cash flows since Q4 2020.

Quarterly cash burn is now well north of $300 m as production nears. Canoo has regularly raised cash over the last few years yet cash and equivalents on hand at the end of Q3 2022 was about $9 m.

Yes, at the end of Q3, there was further liquidity of $390 million available. This was $210 m of pre-paid agreements with Yorkville Advisors, $190 m of an “At the Market” program and $10 million from existing shareholders. At current burn rates, that would last 4 months – aka around the end of January.

This also assumes those three options are 100% rock solid – a big assumption.

On February 6 Canoo announced a raising of a further $52 million by issuing 50 million shares at 1.05 a share and warrants for 50 million more. Adding 100 m shares to the existing 356 m shares was a huge dilution for a modest raise. That’s enough cash for another 3-6 weeks. The stock price is far lower now.

By now (aka mid-March), Canoo will again be low on cash if cash flow is similar to Q2 and Q3 2022. It should be. Starting manufacturing is expensive.

But won’t manufacturing fix things?

The Tesla example shows: not for at least a year or so.

Tesla shows cash need continues for years

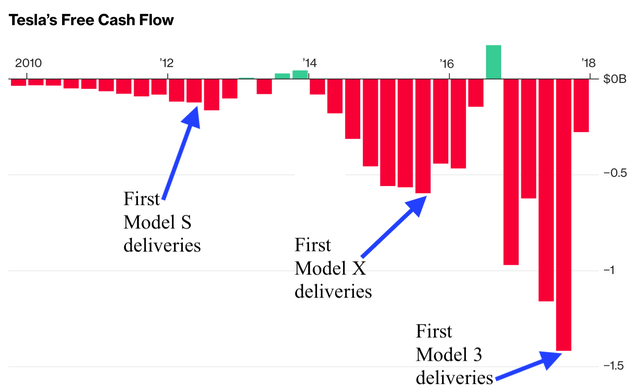

Yes, Tesla and Canoo are different companies but both are fundamentally manufacturers of electric vehicles. The Tesla example will be a useful case study to see what Canoo’s immediate future may resemble.

First point: It took Tesla 5 years to become consistently cash flow positive.

Yes, part of that was launching new product lines, but the fact remains is that positive cash flow takes time. Many forget now, but there was a lot of doubt that Tesla would survive. Even Elon Musk admits he wanted to sell Tesla in 2017.

Tesla started manufacturing in 2013 and became consistently cash flow positive only in 2018.

Tesla’s cash flow actually got worse the quarter after commencing Model S production.

Keep in mind that the Model S is a premium car with excellent gross margins. Today, Tesla is famous for having far higher margins than other EV manufacturers.

So, commencing production won’t fix Canoo’s cash flow problems for several quarters at least, and possibly a year. It might even make it worse short term.

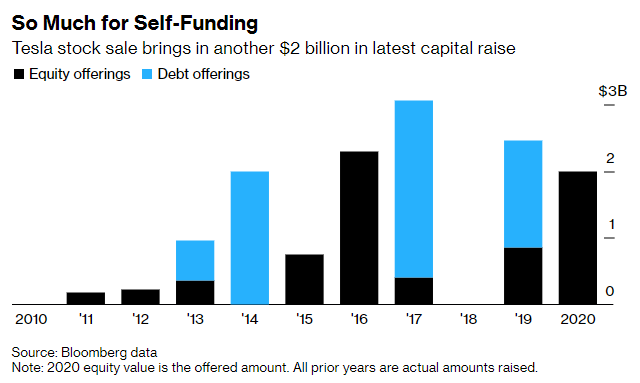

This means fundraising will need to continue. Here is Tesla’s history with regards to fund raising.

Bloomberg

As the figure above shows, Tesla actually raised far more money after starting production in 2013 than it did prior.

How did Tesla pull this off?

A CEO with an ability to sell big ideas and comfortable with a controversial and high-profile persona. But also necessary were easy financial conditions in 2013-2018, with zero or low interest rates that allowed for investor risk-taking.

Even if Canoo’s CEO can lift his profile, financial conditions are far tighter today.

Can Canoo raise in tight financial conditions?

GOEV will need to keep raising during a period of market fear.

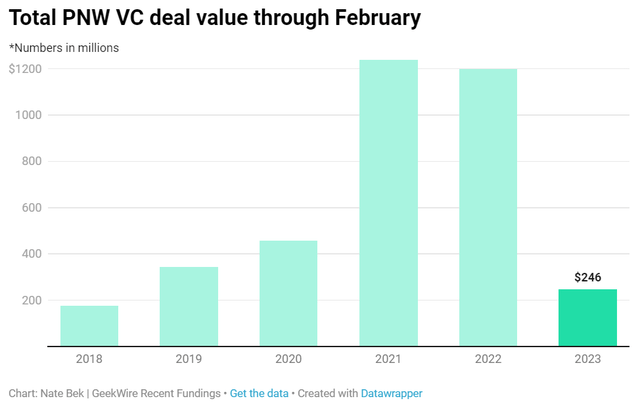

One way to see this is to look at the risky end of investing – Venture Capital. It’s been the slowest start for VC deals through February for several years.

Rising rates had already made 2023 a super slow start before the bank collapses we have seen in March. That will only make things much worse.

Although Canoo is a publicly listed firm and not private like VC-backed firms, it is pre-revenue and thus in a similar position on the risk spectrum to VC.

As PitchBook senior analyst Kyle Stanford confirmed:

“There would never have been a good time for the bank to fall, but this is another major pressure on the market that will accelerate the pricing correction in VC.”

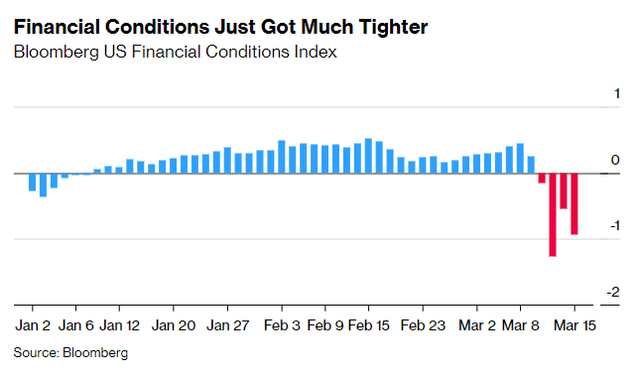

It’s not just VC land that is tightening. Financial conditions across the board are now very much in risk-off phase.

In early 2023 financial conditions were already only modestly positive. But bank collapses have changed the whole dynamic around deal flow. Keep in mind that this is a normal part of what happens when interest rates rise.

Or put another way, this Warren Buffett quote seems apt.

Only when the tide goes out do you learn who has been swimming naked.

Well, the tide is roaring out right now.

Canoo’s cash levels are low, its stock is depressed (making further equity issues of useful size hard) and the markets are stressed. Will it find its swimmers in time?

The counter-arguments

Many Canoo bulls argue one, or several, of the following:

- The CEO has a large share-holding.

- It has $2 billion in orders.

- Canoo has lots of patents.

- Canoo is cheaper, relatively, than Rivian (RIVN).

These are all true, but none of these address the fundamental concern. Will Canoo be able to keep raising enough cash over the next 2-3 years to reach a cash-flow positive position?

I know many companies, even ones owned 100% by their CEO, that have gone broke over the years. That $2 B in orders is better than having no orders, but keep in mind, only $700 m is guaranteed. Even delivering that will probably take more cash than Canoo has available. Banks aren’t inclined towards high-risk lending right now. Patents don’t help cash flow unless you start selling them, and no one is suggesting that.

A white-knight M&A deal is a possibility, hence one reason why shorting is risky. It’s also costly to short and a crowded trade vulnerable to a squeeze. But also don’t rely on M&A to buy. It is just as likely potential acquirers will wait for a better bargain in bankruptcy, buying assets free of contingent liabilities.

Finally, the fact that Canoo is cheaper than Rivian provides no comfort when the big concern is the lack of cash. RIVN also isn’t a like-for-like comparison.

Rivian has been producing for several quarters, and its stock market capitalization of $11 billion still allows for useful levels of fund raising from equity. Coincidently, it has about $11 billion of cash levels on the balance sheet.

Please note: I’m not suggesting to buy RIVN here, just comparing it GOEV.

Canoo by contrast is now worth roughly $255 million on the market, making equity raises either hard or fantastically dilutive.

Conclusion: Risks are too high, so sell

The best hope is that the CEO, board, or management team is able to induce a large bullish investor into a big capital raise before the March 30 meeting.

That’s never impossible but, under current market conditions, would be an achievement of Muskian proportions. A small raise would only delay the inevitable.

We wish the CEO and team well in their efforts. But sometimes circumstances are just too much and there is no luck when you need it.

For our money, we rate Canoo a sell.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.