Summary:

- Goldman Sachs reported strong Q2 2024 earnings with record base management fees and trading revenue.

- Investment banking fees are on the rise for major banks, indicating a potential turning point in the industry.

- GS’s prospects appear solid with recent initiatives, a strong investment banking backlog, and positive sentiment towards IPOs.

franckreporter

Early this week, Goldman Sachs (NYSE:GS) reported Q2 2024 earnings. A surge in trading revenue, coupled with record base management fees, contributed to solid results. As I’m penning these words, the stock is on track to record its eighth consecutive day of gains.

Investment banking was in the doldrums throughout 2023, presenting a headwind for the bank, but there is ample reason to believe that trend is coming to an end.

Less than a week ago, JPMorgan (JPM) and Citigroup (C) also reported Q2 earnings. Both of those banks beat consensus due to robust growth in investment banking fees and strong equities trading. Their results buttress claims by Goldman Sachs that a turning point is just around the corner, likely aided by a coming drop in the Fed’s interest rate.

Add to that a handful of recent initiatives, and a reasonable argument can be made that the bank’s prospects appear solid.

Reviewing Recent Results

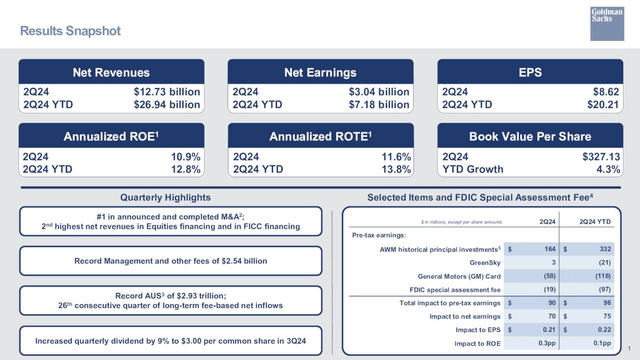

GS reported Q2 2024 results on the 15th of July. GAAP EPS of $8.62 beat consensus by $0.22. Although that trumped the $3.08 posted in the comparable quarter, it was well below the $11.58 reported in Q1; however, investors should know the bank reported unusually robust trading revenue for the first quarter of this year.

Revenue of $12.7 billion beat analysts’ forecasts by $300 million. That figure beat the comparable quarter’s $10.9 billion in revenue but fell short of the $12.4 billion reported in the prior quarter.

GS breaks down its operations into three segments. The Global Banking and Markets segment generated nearly two-thirds of the company’s revenue in 2023. Revenues for that segment hit $8.18 billion for the quarter, a 14% increase year over year.

Much of that growth was due to a 21% year-over-year increase in investment banking fees to $1.73 billion. However, the bank’s surge in investment banking fees pales in comparison to the 50% plus increase reported by JPMorgan Chase and Citigroup.

Fixed income, currency, and commodity trading, known as FICC, is a division of this segment. FICC reported an increase in net revenue to $3.18 billion, up 17% from the comparable quarter. That growth was largely due to higher revenue in interest rate products, currencies and mortgages.

Asset & Wealth Management contributed about 30% of revenues in 2023. That segment recorded revenue of $3.88 billion for the second quarter of 2024, up 27% year over year.

The firm’s Platform Solutions segment generated 3% of revenues in 2023. Revenue for the segment increased by 2% to $669 million.

Where You’ll Find The Gold In Goldman Sachs

As one of the world’s largest investment banks, Goldman Sachs’ brand and reputation provides the competitive advantage needed to recruit top talent and attract investment banking deals.

The bank’s scale and global presence gives it the leverage to compete for large cross border deals. GS is the top bank for mergers and acquisitions, the number two bank for global equity underwriting, and Morningstar lists GS among the top 10 investment banks for fixed-income underwriting.

As one of the largest broker/dealers in the world, GS generates annual trading revenue in a range of $10 billion to $20 billion plus.

An example of the bank’s heft and reach lies in the revelation earlier this week that GS plans to raise $2 billion for its first Asia Pacific-focused private equity fund.

Goldman Sachs’ investment arm is targeting sovereign wealth funds, pension funds and private investors for the new fund. The fund will allocate approximately half its capital to investment opportunities in Japan. According to an anonymous source, the bank hopes to have its first close by the end of this year.

In a similar deal, just yesterday, it was revealed that the bank is partnering with JPMorgan Chase to raise money for a Middle East-focused open-ended fund.

In another development, just last month, Goldman Sachs’ private banking chief revealed management’s goal to double lending to ultra-wealthy private bank clients over the next five years.

A past initiative to build the bank’s consumer business fared poorly. Nonetheless, it resulted in Goldman’s total deposits hitting $441 billion in the first quarter, up from $190 billion in 2019. In a move designed to take advantage of the increased deposits and at the same time broaden Goldman’s business beyond trading and investment banking, GS is targeting clients with more than $10 million in their accounts.

By providing short-term loans to clients using their holdings such as real estate assets or securities as collateral, the unit posted record growth in financing in the first quarter of this year.

Goldman’s wealth management loans lag their competitors by a wide margin. Loans as a percentage of the bank’s wealthy client assets is 3%, while competitors average a 9% rate.

This is a way to increase their wallet share of a client who they already have a relationship with. You deepen the client relationship, you create sticky revenue.

Ebrahim Poonawala, banking analyst at Bank of America

During the introduction to this article, I noted that GS and its chief competitors are reporting a surge in investment banking fees. There is a consensus among analysts that deal-making and IPOs should accelerate markedly beginning in the back half of 2024.

During the earnings call, management expressed confidence in the bank’s prospects moving forward.

Our investment banking backlog is up significantly this quarter. From what we’re seeing, we are in the early innings of the capital markets and M&A recovery. And while certain transaction volumes are still well below their 10-year averages, we remain very well positioned to benefit from a continued resurgence in activity.

David Solomon, CEO

And just yesterday, Morgan Stanley’s CFO uttered a similar sentiment during that company’s earnings call.

The investment banking backdrop continues to improve, led by the US, the advisory and underwriting pipelines are healthy across regions and sectors. Inflation data has continued to moderate, which has helped stabilize front-end rates and support boardroom confidence and sponsor reengagement. As buyers and sellers make progress to close the valuation gap, we expect that we are still in the early innings of an investment banking rebound.

Sharon Yeshaya, CFO, Morgan Stanley

Furthermore, a recent survey by GS reported issuer and investor sentiment related to IPOs is increasingly positive. Of those polled, 10% stated they had a very high-risk appetite for IPOs, with 41% having a somewhat high risk and 30% neither high nor low risk.

Debt, Dividend, And Valuation

GS has BBB+ rated credit, landing the company in the lower third of investment grade level credit rankings.

The company’s common equity Tier 1 ratio regulatory minimum of 13.9% was increased 90 basis points following the last stress test. Management’s goal is to maintain a 50- to 100-basis point buffer above its regulatory capital requirements. The bank increased the Tier 1 ratio to 14.8%.

Goldman Sachs currently yields 2.44%. The Board of Directors approved an increase in the quarterly dividend by 9% to $3.00.

The dividend payout ratio is 17.79% and the 5-year dividend growth rate is 27.62%. The bank’s low payout ratio and investment grade credit rating indicate the dividend is safe and should continue to grow at a solid pace for the foreseeable future.

With a market cap of nearly $171 billion, GS bought back $3.50 billion in stock in Q2. However, during the earnings call, management advised that share repurchases would be pared back due to the increase in the stress capital buffer.

The bank’s forward P/E of 13.83x is well above the 5-year average P/E ratio for the stock of 10.49x.

GS is trading for $505.24 per share. The 24 analysts who follow the company have a 12-month average price target of $487.41. Eight rate GS as a Strong Buy, 6 provide a Buy rating, 9 a Hold rating, and one analyst grades the stock as a Sell.

As of the end of June, Goldman’s Tier 1 common equity ratio was 15.7%.

Is GS A Buy, Sell, Or Hold?

Recent quarterly results for Goldman Sachs, JPMorgan Chase, Bank of America, Morgan Stanley, Citigroup, and Wells Fargo (WFC) revealed that each of the banks posted double-digit increases in investment banking revenue.

Although merger-and-acquisition (M&A) volumes increased by high single digits of late, they are still well below the number of deals witnessed post pandemic. Additionally, future Fed rate cuts will likely spur M&A activity.

Increased M&A activity will likely lead to a growth in Goldman’s revenues in the coming quarters, and management is working to strengthen the bank’s wealth-management businesses to generate steady fee revenue during lulls in dealmaking and trading.

Overall, Goldman Sachs is a solid business that should benefit from rate cuts and a strong uptick in M&A activity that is on the horizon. Add to that a well-funded dividend that is growing at a double-digit pace while also offering a reasonable yield, and you have a reasonable argument to invest in Goldman Sachs.

Unfortunately, I estimate that GS is trading at a near 10% of the stock’s fair valuation. Consequently, I rate Goldman Sachs as a Hold.

I do not hold a position in GS.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have no formal training in investing. All articles are my personal perspective on a given prospective investment and should not be considered as investment advice. Due diligence should be exercised and readers should engage in additional research and analysis before making their own investment decision. All relevant risks are not covered in this article. Although I endeavor to provide accurate data, there is a possibility that I inadvertently relay inaccurate or outdated information. Readers should consider their own unique investment profile and consider seeking advice from an investment professional before making an investment decision.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.