Summary:

- Hycroft Mining booked a loss from operations of $20.5 million in H1 2022, but it still had $157.8 million in the bank as of June.

- Yet, the company is focusing on drilling out the Hycroft Mine instead of proceeding to the construction stage.

- In my view, this is a sign that there is little confidence that technical challenges can be successfully overcome and is costing the company a lot of momentum.

edwardolive

Introduction

In March, I wrote a bearish article on a small gold miner named Hycroft Mining Holding Corporation (NASDAQ:HYMC) in which I said that its shares seemed to have attracted significant retail investor interest and that the share price was likely to return to below $0.30 in the near future.

Shortly after that, Hycroft Mining became a meme stock as movie theater chain AMC Entertainment (AMC) and mining investor Eric Sprott announced they are each investing $27.9 million in cash in Hycroft in exchange for 23,408,240 shares. In addition, AMC and Sprott each got 23.4 million warrants exercisable at $1.07 per share.

This deal has strengthened the balance sheet of Hycroft Mining and the share price has been holding up above $1.00 since then. However, I think that the H1 2022 financial results of Hycroft Mining look underwhelming and that the company seems to be stalling the development of its flagship project. With momentum being lost, I think it’s just a matter of time before its share price returns back below $0.30 per share. Let’s review.

Overview of the latest developments

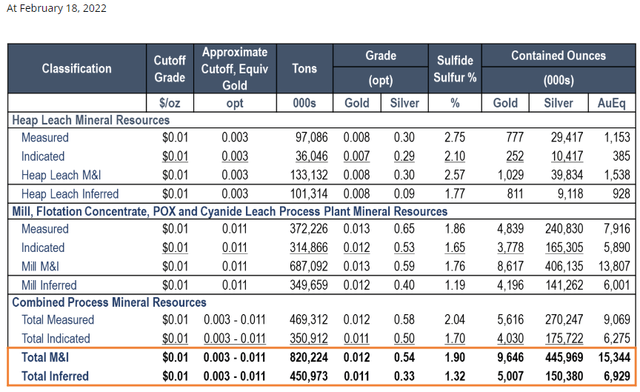

In case you haven’t read my previous articles on Hycroft Mining, here’s a quick description of the business. The company’s main asset is a gold and silver project in the northern part of the state of Nevada named Hycroft Mine which has measured and indicated resources of 9.65 million ounces of gold and 446 million ounces of silver. However, you can notice from the table below that the grades are pretty low and that almost all of the material is sulfide, which is usually technically challenging to process.

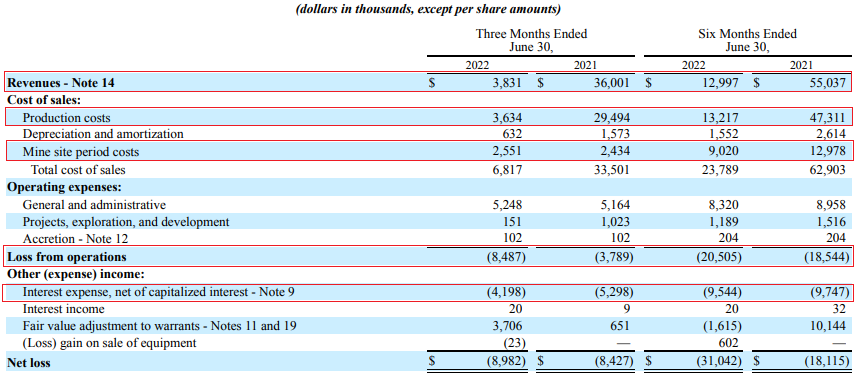

The company has a pre-commercial scale direct leaching run-of-mine (ROM) operation at the site which is expected to proceed through the end of 2022. In H1 2022, Hycroft Mine produced a total of 10,924 ounces of gold and 30,515 ounces of silver. However, this ROM operation is bringing in less and less revenue each quarter and is unprofitable at the moment. In H1 2022, Hycroft Mining sold 6,740 ounces of gold and 16,879 ounces of silver for $13 million but production and mine site period costs came in at $22.2 million. The loss from operations for the period was $20.5 million, which represents an increase of 10.6% year-on-year. In addition, Hycroft Mining had interest expenses of another $9.5 million.

Hycroft Mining

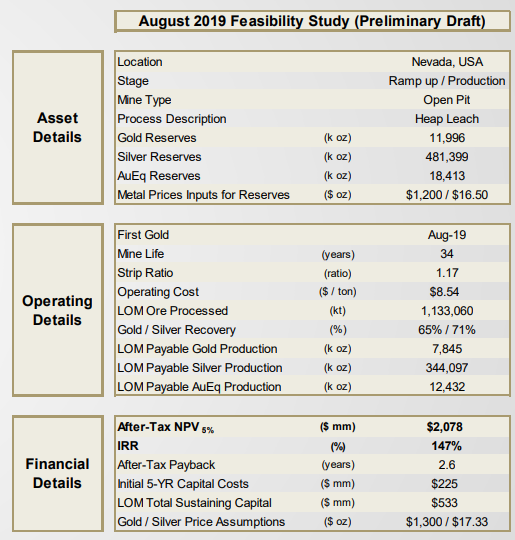

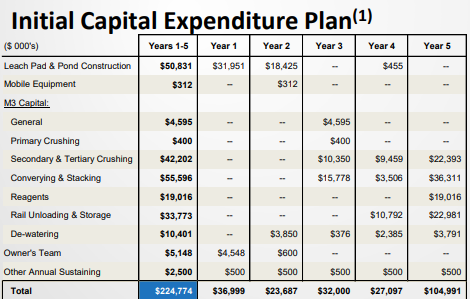

Looking at the future of the Hycroft Mine project, the company released a heap leaching feasibility study in 2019 which showed that a relatively modest initial CAPEX of about $230 million would deliver a mine with a net present value of over $2 billion at $1,300 per ounce of gold. At today’s price of gold of around $1,800 per ounce, the NPV stands at around $4 billion.

Hycroft Mining

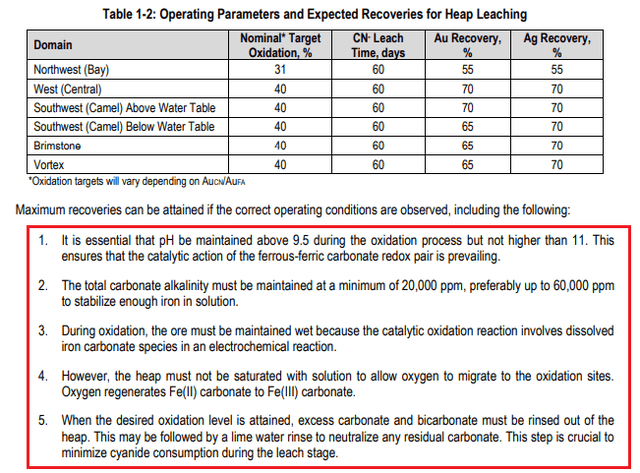

However, you should take these figures with a grain of salt. You see, refractory sulfide gold ores need to be processed using sophisticated treatment methods. Hycroft Mining’s plan to solve this issue is to use iron (as ferric chloride) in the oxidation solutions but this is an unproven technology and there are several technical challenges that need to be addressed.

Hycroft Mining

In light of this, I find it unsurprising that Hycroft Mining is not proceeding with the construction of the mine despite finally having the funds to do so. You see, the company had $157.8 million in the bank as of June 2022 as it completed a $138.6 million at-the market equity offering program shortly after its deal with AMC and Sprott.

Hycroft Mining

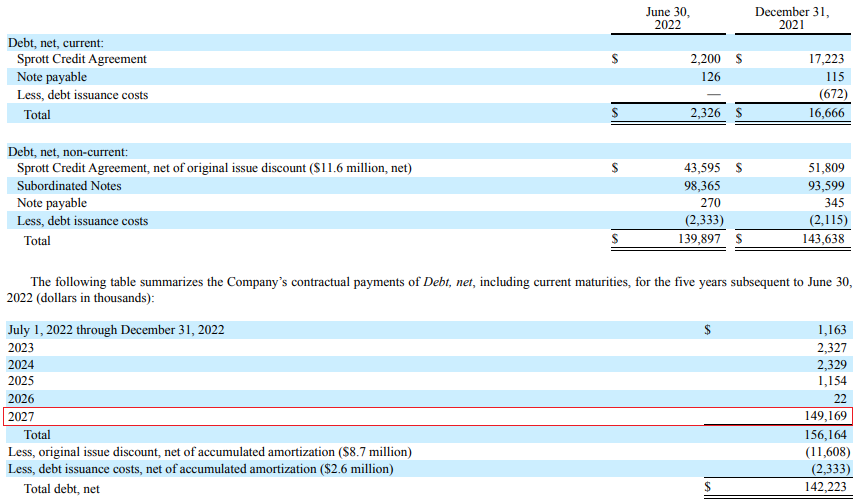

Yet, Hycroft Mining’s focus at the moment is on an exploration program that includes infill drilling as well as 100,000 feet of RC drilling and 25,000 feet of core drilling. I’ve never seen a mining company with a feasibility study stage project embark on such a large drilling program instead of proceeding to the construction phase which leads me to think that there is little confidence that the Hycroft Mine can be built and put into commercial operation without a hitch. Another issue for investors is that the market valuations of exploration and development stage mining companies are mainly driven by momentum, and this is being lost here. And it’s not like Hycroft Mining can afford to delay the construction of its mine for long as almost all its debt has to be repaid in 2027.

Hycroft Mining

Overall, I think that Hycroft Mining is in trouble despite raising almost $200 million in equity over the past year as the company’s annualized loss from operations is about $40 million and it doesn’t seem to have the confidence in its technology to put the Hycroft Mine into commercial production. In my view, the most likely scenario at the moment is that Hycroft Mining continues to bleed cash over the next few years before getting into a liquidity crisis in 2027. With momentum gradually being lost, this could result in a significant decrease in the company’s market valuation.

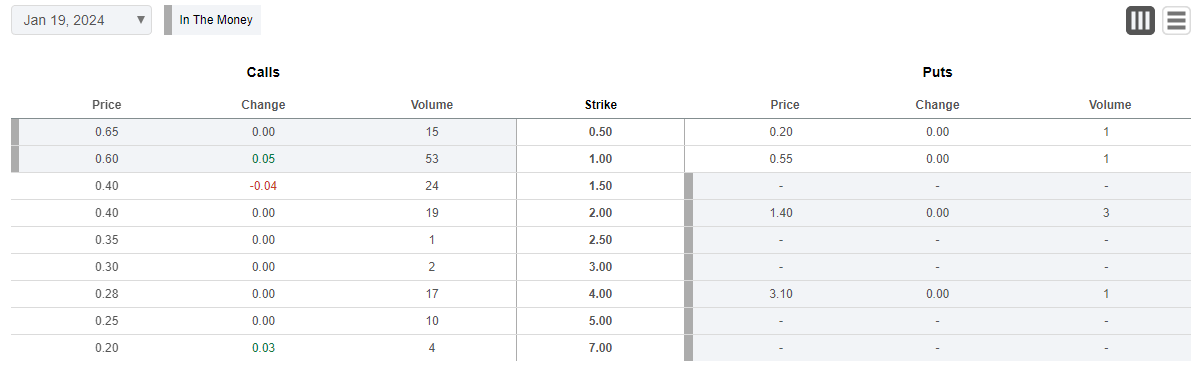

I’m bearish on Hycroft Mining and data from Fintel shows that the short borrow fee rate stands at 8.92% as of the time of writing. However, hedging seems tough here as long-dated call options are expensive at the moment.

Seeking Alpha

Considering the prices of commodities are notoriously volatile, it could be best for risk-averse investors to avoid this stock.

Investor takeaway

Hycroft Mining was aiming to develop a 3-5-year ROM plan to generate positive cash flows but it seems this plan has failed as loss from operations was $20.5 million in H1 2022 alone.

The company had $157.8 million in the bank as of June yet its focus in the near term is on exploration despite Hycroft Mine being a feasibility study stage project. In my view, this move is a clear sign that there are a significant number of technical or operational issues that need to be addressed before proceeding to the construction phase. This is likely to cost the company momentum, which could drive down its market valuation in the near future.

Overall, I think that Hycroft Mine won’t enter the construction phase anytime soon and that Hycroft Mining could have a liquidity crisis on its hands in 2027.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial adviser. All articles are my opinion – they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like this article, consider joining Bears and Resources. I post my portfolio and shortlist there and you can also find exclusive ideas from our community of investors. I like to focus on undervalued companies that the market is ignoring, like an island of misfit toys. Both long and short ideas.

So, what can you expect to get from this service?

- Exclusive articles

- Access to my portfolio and watchlist

- Interviews, ideas, portfolios, watchlists, and comments from other investors I’ve invited to the service

- A chat room with access to me and the other investors