Summary:

- iQIYI gave an impressive Q4 performance, with 13 million added subscribers.

- IQ’s strategy to produce more original content will help improve margins.

- Price target of $10.

Spencer Platt/Getty Images News

iQIYI (NASDAQ:IQ) is an online video platform and one of the largest video-viewing sites in the world. Its site resembles that of YouTube, allowing users to upload videos. In addition, the sites offer streaming of movies and dramas. Its prominent monetization model includes membership services, online advertising services, and content distribution. Most of IQ’s revenue comes from memberships, accounting for over 50% of all revenue in Q3. Currently, IQ stock trades at $6, which I think is undervalued considering their fast growth and earnings. I have a PT of $10 for IQ, though there may be some hiccups in the short run.

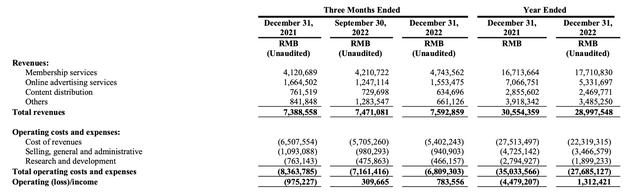

Earnings Results:

In Q4 2022, IQ reported $1.1 billion in revenue, an increase of 3% YoY. This is pretty good considering similar companies such as Netflix (NFLX) generated 1.9% YoY growth over the same period. This also marks the second quarter IQ delivered positive operating cash flows.

Membership subscriptions increased by 15% YoY, however, this was due to the company releasing numerous premium contents in the quarter, driving a subscriber increase of 13 million over the quarter. It is likely this quarter was an exception, and the growth is expected to slow down as the company cannot maintain high numbers of premium content.

Other forms of revenue have slowed down, with advertising down 7% YoY, content distribution down 17%, and others down 21%. These were due to the market and challenging macroeconomic environments in China.

On the bright side, IQ was able to increase its margins by cutting expenses on content spending, decreasing 19% YoY while keeping a strong content library.

For fiscal year 2022, iQIYI generated $4.2 billion in revenue, which was a 5% decrease compared to 2021. Overall, quarter 4 was an impressive turnaround for the company, after facing disappointing results in the first 3 quarters.

Shifting Content Strategy:

Over 2022, IQ produced a historically high number of original content. In 2022, over 50% of the dramas were original, compared to 20% in 2018. According to CEO Mr. Yu Gong.

“The success of the quarter was driven by our original blockbusters. Looking forward, we will continue to focus on our original content strategy to deliver high-quality growth, and to create more value for our stakeholders.”

The strategy has proved successful as IQ consistently produced blockbuster shows and memberships increases at rapid rates. In addition, original shows allow IQ to have tighter cost optimization, as they can manage every step of the process. I expect margins to continue increasing as IQ shifts its content strategy.

IQ original dramas (iQIYI)

In addition, the video streaming (SVoD) market revenue is expected to increase at a CAGR of 10.14% in China. As a leader of SVoD, IQ has lots of room for revenue growth.

Predictions:

In my opinion, the wall street estimates for IQ’s Q1 earnings, set to release on May 16, are slightly high. Analysts’ revenue expectations increased 5.3% QoQ, and increased earnings expectations by 41%. I think IQ will miss revenue expectations, since a large part of their revenue growth this quarter was attributed to blockbuster shows. With a slightly weaker content library this quarter, I do not think IQ can match revenue expectations, as a majority of their revenues are from subscriptions.

On the other hand, I expect a comfortable earnings beat. In Q4, IQ’s EPS was 0.98, beating expectations by 93%. Thus, I expect them to beat the expected EPS of 0.72 by comfortable margins. It is important to recognize IQ’s margins and earnings largely depend on its revenue, since the costs are relatively fixed no matter the revenue.

Even though I think IQ will underperform, I expect them to provide strong guidance as a result of better cost-efficiency and improved income from other sources of revenue.

Valuation:

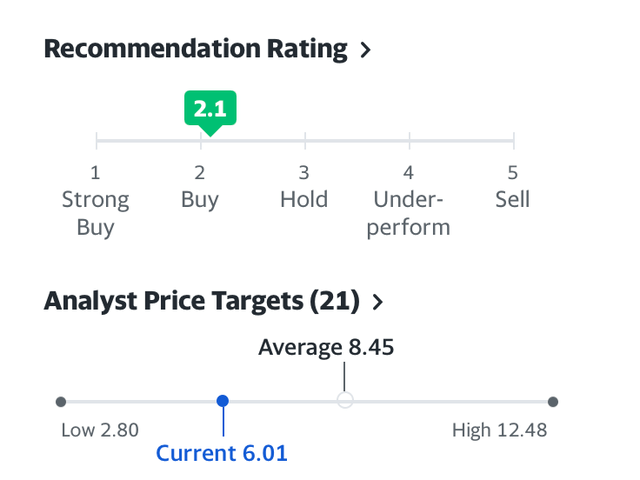

The stock for IQ currently trades at around $6, and traded at as low as $2 back in October 2022. According to Yahoo Finance, the PT is $8.45, giving it a 40% upside.

As for my own valuation, I will compare IQ with similar companies. IQ currently has a P/S ratio of around 1.34. Bilibili (BILI), a similar video sharing and streaming platform also popular China, has a P/S ratio of 2.39. Netflix has a P/S ratio of 4.46. Thus, I think iQIYI is highly undervalued, and should have an upside of 65%, or $10.

Risks:

As much as IQ boasts about its ability to generate revenue in numerous different ways, fact of the matter is that the company is still member dependent. Last quarter, 62.5% of its revenue were from membership services. While this model of business is sustainable, as proved by Netflix’s consistent revenue growth over the years, it does make the company over-reliant on blockbuster shows for revenue growth. IQ has proved themselves to be able to produce high-quality shows, however, they still lack the resume to prove to me of their consistency over long periods of time.

Additionally, even though I enjoy their aggressive cutting of production costs while keeping high value content, it’s also a double-edged sword that can stab back. Netflix over the years have consistently increased production costs in fear of lowering content quality and customer satisfaction. While money does not translate to quality in the film industry, it makes the margin of error a lot smaller when on a tighter budget.

An important metrics to watch this quarter on the earnings report is potential strategies for reviving other sources of revenue. All sources of revenue besides subscription has fallen considerably because of the “challenging macroeconomic environment” (IQ’s earnings report). If these other sources of revenue, such as advertising, makes a return, it will decrease iQIYI’s reliance on the performance of membership subscriptions. Nonetheless, considering the company’s undervaluation and the positive outlook for the SVoD market in China, IQ remains an intriguing investment opportunity with significant potential for growth.

Conclusion:

IQ delivered a very strong 4th quarter performance and proved their new contents to be both high quality and cost-effective. While the company may have some troubles with revenue growth in the short run because of a slightly weaker content library, the pricing of the stock is too attractive to not go in. All in all, I would rate IQ a must buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.