Summary:

- ROKU remains a long-term streaming winner, thanks to the growing subscriber base and stable ARPUs from the robust device sales.

- The device segment’s ongoing cash burn has also been well-balanced by the expanding advertising opportunities and stable market shares.

- With zero debts and stable profit margins, ROKU is well positioned to emerge stronger after the normalization of macroeconomic outlook.

- For now, with the stock market extremely volatile, we urge investors to hold on to their dry powders and observe the stock’s movement before adding.

- Based on ROKU’s sideways trade pattern, we believe that it still offers a viable vehicle for swing trades prior to the eventual capital appreciation after 2025.

Colin Anderson Productions pty ltd

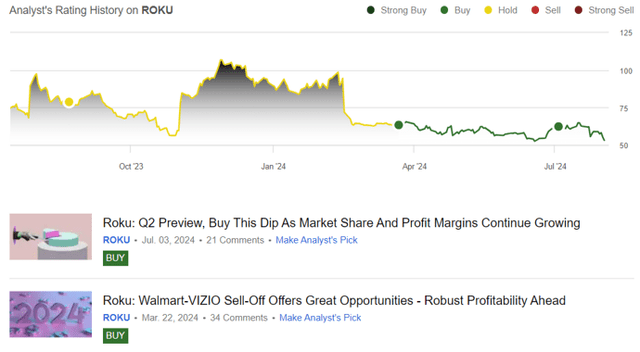

We previously covered Roku (NASDAQ:ROKU) in July 2024, discussing why we had reiterated our Buy rating, thanks to the recent Nielsen report highlighting the platform’s growing streaming market share.

Combined with the strategic sports/ advertiser partnerships thus far, we believed that it remained well positioned to grow profitably moving forward, with it likely to translate into the stock’s potential capital appreciation ahead.

Since then, ROKU continues to be well supported at its previous support levels of $50s, with the sideways trading confirming our thesis that the stock is likely to eventually grow into its premium valuations.

While the company continues to report robust performance metrics in the FQ2’24 earnings call while offering excellent forward guidance, resulting in our reiterated Buy rating, it comes with a certain caveat for an improved margin of safety.

We shall discuss further.

ROKU’s Long-Term Investment Thesis Remains Robust

Author’s Historical Rating

Seeking Alpha

Well, after two rounds of Buy ratings for the ROKU stock, it is apparent that our bullish sentiments have yet to work out as intended. This is despite the company reporting consistently growing top-lines and four consecutive quarters of positive adj EBITDA and Free Cash Flow generations.

FQ2’24 Performance

ROKU

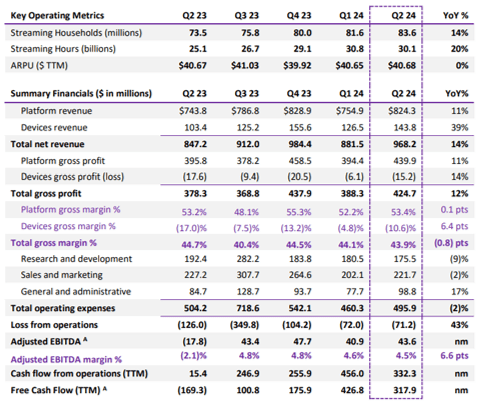

For reference, ROKU has reported consistently improving operating metrics, with growing streaming households of 83.6M (+2M QoQ/ +10.1M YoY) and stable ARPUs in FQ2’24.

This has led to the robust platform revenues of $824.3M (+9.1% QoQ/ +10.8% YoY), partly attributed to the accelerating advertising opportunities as well (sum unspecified).

While ROKU continues to report ongoing cash burn for the Device segment, with the guidance of sustained negative gross profit margins over the next few quarters, we are not overly concerned.

This is because the Device sales growth continues to accelerate at double digits percentages on a QoQ/ YoY basis, thanks to the growing retailer partnership across Amazon (AMZN), Costco (COST), and Target (TGT), amongst other specialty retailers.

This development well balances the potential headwinds from the Walmart (WMT) and Vizio (VZIO) deal, while naturally growing its reach, streaming households/ hours, and eventually, advertising/ platform revenues, resulting in a net positive effect on its financial performance.

With $317.9M of Free Cash Flow generated over the LTM (+287.7% sequentially), or the equivalent of 8.4% in Free Cash Flow Margins (+13.6 points sequentially), it is apparent that ROKU’s operations remain sustainably profitable enough.

Combined with its inherent lack of debt, we maintain our optimism surrounding its long-term prospects and ability to pursue future growth opportunities.

At the same time, ROKU has been strategically expanding its unique asset, The Roku Home Screen, through the addition of a video advertising unit. Demand appears to be very robust as well, with initial beta testing already sold out attributed to its partner advertisers, such as Home Depot (HD) and Disney (DIS).

This is also why we believe that the management’s FQ3’24 guidance appears to be reasonable, with the overall net revenues of $1.01B (+5.2% QoQ/ +10.9% YoY) and adj EBITDA margins of 4.4% (-0.1 points QoQ/ +6.5 YoY) implying its ability to generate stable profitability at scale.

Exploration Of Relative Valuation, With Price Target Recalculation

ROKU 2Y Stock Price

TradingView

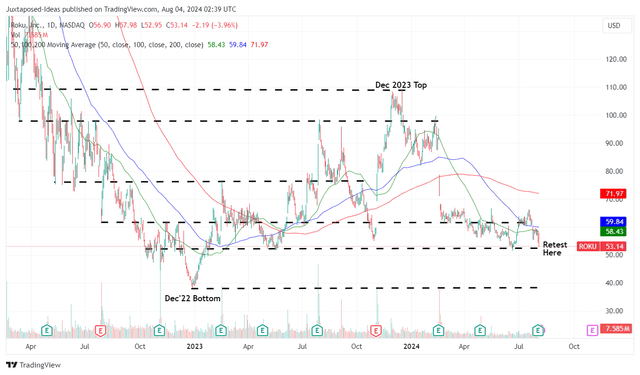

Unfortunately, ROKU is still unable to hold on to its recent gains while retesting its previous support levels of $52s and trading below its 50/ 100/ 200 day moving averages after the excellent FQ2’24 earnings call.

For context, we had offered a fair value estimate of $40.60 in our last article, based on the LTM adj EBITDA per share of $0.79 ending FQ1’24 (+152.6% sequentially) and FWD EV/ EBITDA valuation of 51.46x.

This is on top of the intermediate-term price target of $83.30, based on the consensus FY2025 adj EBITDA per share estimates of $1.62 (expanding at a 2Y CAGR of +43.2%).

ROKU Valuations

Tikr Terminal

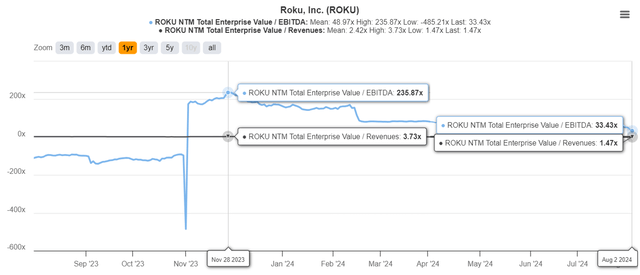

On the one hand, ROKU’s FWD EV/ EBITDA valuation has been consistently moderated from the previous levels of 51.46x to the current levels of 33.43x.

This is despite the stable consensus forward estimates, with ROKU still expected to generate a robust bottom line growth at a CAGR of +347.3% between FY2023 and FY2026, or adj growth at +39.2% between FQ2’24 and FY2026.

On the other hand, ROKU’s moderation appears to be somewhat warranted after comparing to the streaming market leader, Netflix (NFLX), which recently reported FQ2’24 earnings call with adj FWD EV/ EBITDA valuations of 23.30x and the consensus adj EBITDA growth at a CAGR of +25.1% between FY2023 and FY2026, or adj growth at +14.5% between FQ2’24 and FY2026.

After this comparison, it is apparent that ROKU is still trading at a relatively reasonable valuation despite the moderation, significantly aided by the stable streaming market share of 1.5% in June 2024 (inline MoM/ +0.5 points YoY), implying its ability to engage advertisers despite the intensifying streaming/ advertising competition.

And it is for this reason that we will be updating our fair value estimates and long-term price targets.

Based on the currently lower FWD EV/ EBITDA valuations of 33.43x and the updated LTM adj EBITDA per share of $1.21 ending FQ2’24 (+179% sequentially), we are looking at an updated fair value estimate of $40.45, implying that ROKU continues to trade at a notable premium at current levels.

At the same time, based on the same consensus FY2025 adj EBITDA per share estimates of $1.62 (expanding at a 2Y CAGR of +43.2%), it seems that there may be a minimal margin of safety to our updated intermediate term price target of $54.

It is apparent by now, that we have been overly exuberant surrounding ROKU’s near-term prospects, despite the obvious sideways trading pattern since early 2023.

Does This Mean That We Will Be Downgrading ROKU?

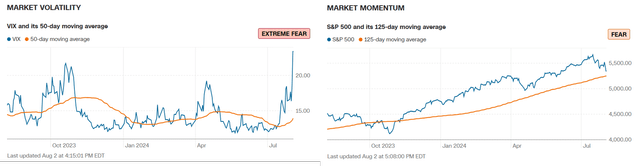

Market Momentum Turning Pessimistic

CNN

Not quite.

Based on ROKU’s sideways trade pattern, we believe that it still offers a viable vehicle for swing trades, prior to the eventual capital appreciation from 2025 onwards.

Nonetheless, while the stock appears to be well supported at current levels of $50s, it is no secret that the wider stock market has been rather volatile over the past few weeks, with the CBOE Volatility Index hitting new heights and the SPY increasingly near the prior 125 trading days rolling average.

Combined with the impacted labor market triggering intensifying recession fears, we believe that the next few months may bring forth more volatility until the Fed pivots as projected by the September 2024 FOMC meeting.

As a result, while we are reiterating our Buy rating for ROKU, it is with the caveat that investors hold on to their dry powders and observe the stock’s movement for a little longer, before adding upon a bounce from the established support levels of $50s.

Otherwise, if market sentiments further deteriorates from current levels, it is not overly bearish to project a potential pullback to its December 2022 bottom of $40, implying a possible downside of -24%.

Therefore, while we maintain our optimism surrounding ROKU’s robust long-term prospects, it pays to be prudent in the near term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.