Summary:

- UnitedHealth Group has markedly outperformed the S&P 500 since my last buy rating.

- The managed care company’s revenue and adjusted diluted EPS climbed in the second quarter.

- UnitedHealth Group enjoys an A+ credit rating from S&P.

- Shares are priced 6% below my fair value estimate.

- UnitedHealth Group could deliver 30% cumulative total returns through 2026.

A pharmacist assists a customer. Morsa Images/DigitalVision via Getty Images

One of my favorite proverbs translated into English that is attributed to the Roman general and leader Julius Caesar in De Bello Civili is as follows: “Experience is the best teacher.”

How simple and yet powerfully true those words ring. These words can be applied to any discipline or vocation in life.

Reading and learning the theories is one thing. Living it out and executing it well is entirely another.

A prospective parent can read all the parenting books under the sun, but nothing can truly prepare them for parenthood. A prospective surfer can watch others ride the waves all day, but they’re a novice until they give it a shot themselves.

The same can be said about investing. Ultimately, one has to dive into it. I would argue some level of base knowledge is preferable. That could just be my personal bias of having learned the theory of it from ages 12 to 20, though. Once one begins investing, it’s best to just roll with the punches and adapt as needed.

In my seven years of real-money investing, experience has taught me quite a bit. One of the most important lessons is to keep investing as simple as buying great businesses at or below fair value.

In theory, this is easy. In practice, it’s not always so obvious. An investment thesis can and will change over time. Sometimes, for the better. Sometimes, for the worse. Nobody is ever going to be right all the time.

I have found, though, that an insistence upon quality and a margin of safety tends to work out more often than not. One of the best examples of a core holding in my portfolio that has worked out well is UnitedHealth Group Incorporated (NYSE:UNH).

Since purchasing my first tranche in October 2019, I am up 174% with dividends. Along with occasional purchases in that time, this has pushed UNH up to my eighth-biggest holding and 2.1% of my portfolio.

When I last covered the managed care giant with a buy rating in May, I appreciated UNH’s dominance in the global health insurance industry. As much of a big fish as the company is in a big pond, there’s enough room in this multi-trillion-dollar industry for UNH to become an even bigger fish. The company’s exceptional financial strength was another attractive characteristic. Finally, UNH was moderately undervalued.

Today, I’m going to be reiterating my buy rating. In my view, UNH’s second-quarter results shared on July 16th were strong. The company’s credit rating from S&P is best-in-class. UNH’s payout is safe and its fundamentals point to plenty of double-digit dividend growth ahead. Lastly, shares of the managed care juggernaut remain modestly discounted.

UnitedHealth Outdid Itself Again In Q2

UNH Q2 2024 Earnings Press Release

I have found that the highest-quality businesses usually share the same vision. This is the drive to constantly improve in every conceivable key performance indicator. That’s precisely the kind of approach that it takes to succeed in business and to stay on top.

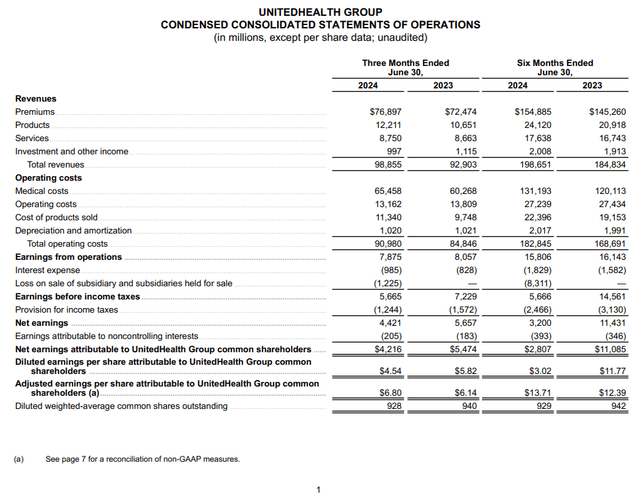

UNH conveyed that it fits into this category with its second-quarter results. The company’s total revenue grew by 6.4% year-over-year to $98.9 billion during the quarter. For context, that was $44 million ahead of the Seeking Alpha analyst consensus for the quarter. This was the 16th straight quarter that UNH exceeded the analyst consensus for total revenue.

UNH Q2 2024 Earnings Press Release

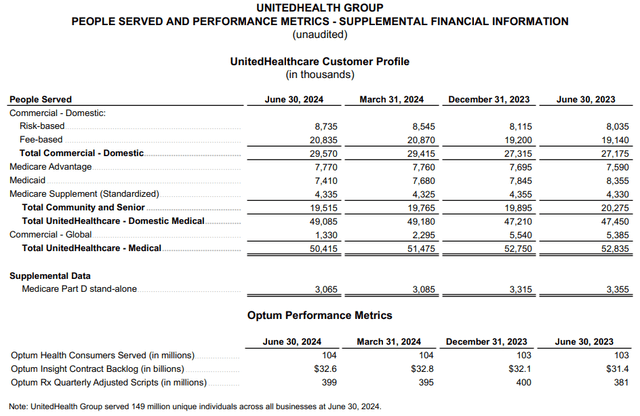

UNH’s total medical membership declined 4.6% over the year-ago period to 50.4 million in the second quarter. At a glance, this would seem to be disappointing.

But just as I highlighted in May, there’s a perfectly good reason why this drop in medical membership isn’t alarming. This is because UNH closed its deal to divest its Brazil operations. That was the only reason why the company’s medical membership base contracted. Factoring this out of the mix, total medical membership would have shown slight growth.

UNH offset the impact of this divestiture by flexing its pricing power. Higher premiums and product revenue are what pushed the topline higher during the second quarter.

UNH’s adjusted diluted EPS rose by 10.7% year-over-year to $6.80 for the second quarter. That was $0.17 better than Seeking Alpha’s analyst consensus and the 16th straight quarter of beating the adjusted diluted EPS consensus.

Thanks to disciplined underwriting and savvy cost management, the company’s net profit margin expanded by 20 basis points to 6.4% in the quarter. Along with a 1.3% reduction in the diluted share count from buybacks, this is how UNH’s adjusted diluted EPS growth surpassed total revenue growth during the quarter.

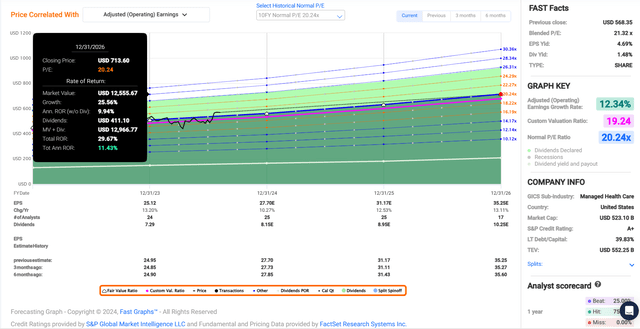

For 2024, the FAST Graphs analyst consensus is that adjusted diluted EPS will climb by 10.3% to $27.70. Beyond this year, UNH’s growth prospects look to be intact.

The company anticipates that it can deliver 13% to 16% annual adjusted diluted EPS growth over the long haul. That’s underpinned by expectations for a double-digit growth rate in Optum’s revenue and an 8 to 10% annual revenue growth rate for UnitedHealthcare. As UNH makes additional investments, it also expects that its operating cost ratio will improve by 20 to 40 basis points per year.

Combined with targeted acquisitions and share repurchases, this is the company’s path to such growth. For my money, I think this is realistic.

It appears as though other analysts are convinced as well. In 2025, the FAST Graphs analyst consensus is projecting that adjusted diluted EPS will rise by 12.5% to $31.17. For 2026, another 13.1% growth in adjusted diluted EPS to $35.25 is anticipated.

UNH’s appeal doesn’t end at its growth profile, either. The company’s financial health is the envy of its industry. UNH’s interest coverage ratio through the first half of 2024 was 8.6 (excluding the loss on the sale of its Brazilian subsidiary).

UNH’s net debt balance was $43.8 billion as of June 30. Against $35.6 billion in annualized first-half EBITDA (factoring out the aforementioned loss on the sale of its Brazilian subsidiary), the company’s net debt-to-adjusted EBITDA ratio was 1.2. These elements are why S&P awards an A+ credit rating to UNH on a stable outlook – – the highest credit rating in its industry (unless otherwise hyperlinked or sourced, all details in this subhead were according to UNH’s Q2 2024 Earnings Press Release and UNH’s Investor Conference 2023 Book).

Fair Value Has Topped $600 A Share

Since my previous article, shares of UNH have gained 10% as the S&P 500 index (SP500) has been flat. Yet, I would argue that shares are almost as appealing now as they were in late May.

UNH’s current-year P/E ratio of 20.5 is about in line with its 10-year normal P/E ratio of 20.2. I would argue that the managed care company should continue to command such a valuation multiple. This is because UNH’s 12.3% annual forward growth outlook demonstrates that the growth prospects are holding up well.

The calendar year 2024 will soon be almost 62% complete. This leaves another 38% of 2024 and 62% of 2025 ahead in the coming 12 months. This is how I get a forward 12-month adjusted diluted EPS input of $29.84.

Applying my fair value multiple of 20.2 to this input, I arrive at a fair value of $604 a share. From the current $566 share price (as of August 7, 2024), that equates to a 6% discount to fair value. If UNH matched the growth consensus and reverted to my fair value, it could generate 30% cumulative total returns through 2026.

A Dividend Aristocrat In The Making

The Dividend Kings’ Zen Research Terminal

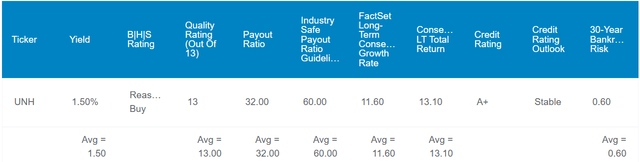

UNH’s 1.5% forward dividend yield is the same as the median healthcare sector forward yield. Just like my last article, this is enough for a C+ grade from Seeking Alpha’s Quant System for forward dividend yield.

UNH’s immediate income is fine, but the trajectory of that income over time is the bigger story.

In June, UNH hiked its quarterly dividend per share by 11.7% to $2.10. That is double the sector median of 4.9%, which is enough for the A grade from the Quant System. This implies that double-digit annual dividend growth is here to stay for the foreseeable future.

That’s buoyed not just by a 12%+ annual growth forecast but a sustainable payout ratio as well. The company’s payout ratio is poised to register in the high 20% to low 30% range in 2024. This is approximately half of the 60% payout ratio that rating agencies desire from the industry per The Dividend Kings’ Zen Research Terminal.

That’s why I’m confident UNH can build on its 14-year dividend growth streak to become a Dividend Aristocrat in the second half of the next decade. This is enough for an A grade from the Quant System for consecutive years of dividend growth.

Risks To Consider

UNH is a company that’s executing for shareholders, but it still faces risks.

A risk in the near term is that the breach of Change Healthcare in February could end up costing more to UNH. The company raised its impact on full-year 2024 EPS from a midpoint of $1.25 ($1.15 to $1.35) to $1.975 ($1.90 to $2.05). If these cost estimates continue to rise, that could have a marginally negative impact on UNH’s profits in the next few quarters.

Just as I noted in my prior article, another risk to the company has to do with the business mix. Approximately 40% of UNH’s topline is derived from premium revenue linked to the Centers for Medicare and Medicaid Services. That means the company’s growth fortunes are tied to the U.S. Government. If UNH can’t stay in the good graces of its largest customer, that could break the investment thesis in a worst-case scenario.

One final risk to the company is its ability to appropriately price its insurance products. It’s a delicate balancing act. If UNH prices products too high, this could lead members to go elsewhere. If products are priced too low, that could hamper the company’s profit margins.

Summary: An Unbeatable Dividend Stock

UNH is a remarkably impressive business. The company operates as the leader of a massive and growing industry. UNH’s balance sheet is A-rated. The market-beating (and sector-matching) dividend has a lengthy growth runway ahead. On a forward basis, the current valuation represents a slight discount.

In my perspective, UNH is a business of the utmost quality whose underlying stock could offer attractive total returns for the foreseeable future. That’s why I’m maintaining my buy rating now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.