Summary:

- Tesla, Inc. reported its results for the June quarter on July 22nd, causing shares to decline by more than 10% since the earnings release — the selloff has continued since.

- For Q2, revenues in the automotive business were up only 2% YoY, while gross margins fell to a seven-year low.

- To divert investor attention from the struggling core business, Elon Musk is increasingly highlighting potential upside from autonomous driving and AI-related ventures.

- It is important for investors to recognize that the upside in Tesla’s AI venture is highly speculative and is not expected to enhance shareholder value significantly until the mid-2030s.

- I maintain that Tesla stock is at risk of a significant re-rating, potentially aligning with the valuation of a typical GARP asset, which could bring the share price down to approximately $90.

baileystock

Tesla, Inc. (NASDAQ:TSLA) reported results for the June quarter on July 22nd, and shares declined by more than 10% since the earnings release — and the selloff has continued since. The world’s leading electric vehicle (“EV”) manufacturer reported only 2% YoY growth in sales, while gross margins in the automotive business fell to a seven-year low.

Looking at the remainder of 2024, I doubt that a turnaround in the automotive business and a growth re-acceleration is likely. To shift investor focus away from a struggling core business, CEO Elon Musk is increasingly pointing to upside from autonomous driving and AI-related businesses. On that note, however, investors should note that the upside in Tesla’s AI venture is very speculative, and won’t accumulate significant shareholder value until mid-2030, according to my expectations.

With a struggling core auto business and increasing uncertainty around Tesla’s success and timeline in AI ventures, I maintain the view that Tesla stock is at risk of a significant re-rating. This is potentially aligning with the valuation of a typical GARP asset that could see the share price down to ~$90, reflecting an EV/EBIT multiple of around 30x.

Noting the share price performance, Tesla stock has substantially underperformed the market year-to-date. Since the beginning of the year, TSLA shares have fallen by approximately 12%, compared to the S&P 500’s (SP500) gain of about 15%.

Tesla Beats On Earnings, But A Low Bar To Clear

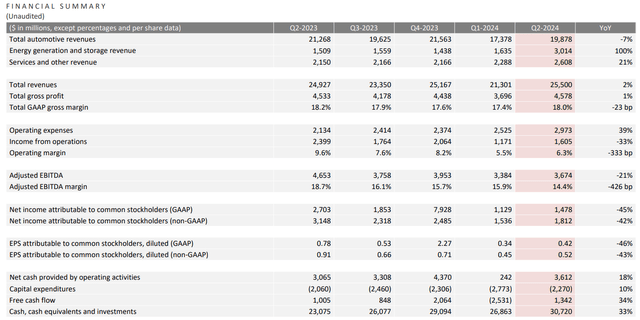

Tesla reported results for Q2 on July 22nd and delivered a mixed performance: During the period spanning April to the end of June, Tesla generated $25.5 billion of revenue, exceeding the consensus estimate of $25.0 billion by 2.0%, according to data collected by Refinitiv. However, revenue expansion in Q2 slowed to 2% YoY, a rate that makes it close to impossible to justify Tesla’s enormous growth valuation premium. Within segments, revenue in the automotive business dropped 7% YoY, while energy generation and storage revenue and services/ others expanded at 100% and 21%, respectively.

Tesla gross profit in Q2 reached $4.58 billion, surpassing the consensus of $4.39 billion by 4.4%, based on a gross margin of 18.0%. However, it is noteworthy to point out that Tesla’s automotive gross margin (excluding credits) was at a seven-year low of 14.6%, reflecting the impact of price cuts and the Cybertruck launch. Earnings before interest and taxes were reported at $1.605 billion (6.3% margin), 15% below the consensus of $1.89 billion. Admittedly, this figure includes significant restructuring and other costs amounting to $622 million. Excluding these costs, the underlying EBIT margin was 8.7%. Non-GAAP EPS came in at $0.52, missing the consensus estimate of $0.62 by 16%, and down 43% YoY.

Lastly, free cash flow was reported at $1.34 billion, significantly below consensus expectation at $1.95 billion, while the company closed Q2 with a net cash position of $18.2 billion.

The Growth Story Gets More Speculative

Tesla’s management indicated that the company is in a transitional phase between growth waves, with energy deployments expected to grow faster than the vehicle business. Following weak Q1 and Q1 automotive performance, paired with a weak consumer demand for auto in 2H 2024, it should be clear that Tesla’s 2024 growth will be noticeably below that of 2023.

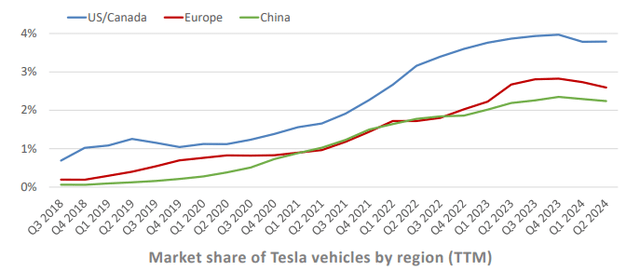

On that note, I highlight that Tesla’s core automotive business faces challenges due to its aging product lineup and market saturation in key regions such as the US and Europe. The company’s reliance on older models like the Model 3 and Model Y limits its ability to drive significant revenue growth through new offerings. Additionally, competitive pressures from both traditional automakers and new entrants in the electric vehicle market are intensifying, further constraining Tesla’s growth potential in the automotive sector. As the below chart highlights, Tesla’s market share looks to be topping at ~4%, ~3%, ~2% for the U.S., Europe and China, respectively.

To shift focus away from a struggling automotive growth story, Musk is increasingly pointing to growth upside from speculative ventures that pose significant execution risks, such as Robotaxis and Optimus. In that context, Elon Musk himself said the following on the latest Tesla earnings call:

The value of Tesla overwhelmingly is autonomy. These other things are in the noise relative to autonomy. So I recommend anyone who doesn’t believe that Tesla will solve vehicle autonomy should not hold Tesla stock. They should sell their Tesla stock. You should believe Tesla will solve autonomy, you should buy Tesla stock. And all these other questions are in the noise.

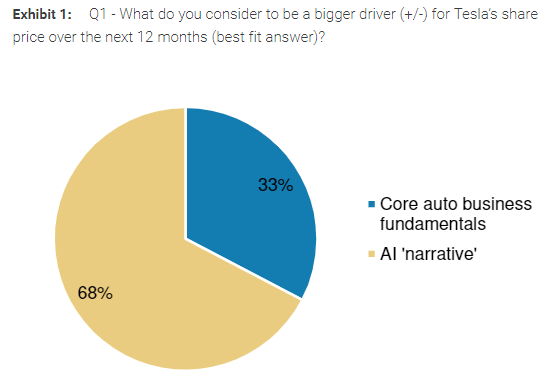

Investors agree: According to a survey conducted by Morgan Stanley, about 70% of investors see the value of Tesla related to “AI” opportunities, rather than the core auto business fundamentals. (Source: Morgan Stanley research note on TSLA, dated July 17th). This is negative, in my view because associating share price expectations with AI narrative renders the company vulnerable to a sharp sentiment repricing.

Morgan Stanley

Diving Into The Robotaxi Equity Story

In my view, there are two distinct, not necessarily mutually exclusive, business models for monetizing Tesla’s Robotaxi technology: First, there is the Robotaxi manufacturer and network operator model: Tesla could design, develop, and produce Robotaxis and operate a ride-hailing platform. This model allows Tesla owners to add their vehicles to the network, similar to an Airbnb (ABNB) approach. This strategy would limit Tesla’s upfront investment, but might also cannibalize new car sales. Second, there is the full ride-hailing Service: Tesla could launch a fully autonomous ride-hailing service with a fleet of Tesla-owned vehicles. While this approach allows Tesla to retain more economic control, it requires significant investment, with potential cash burn of multi-billion dollars before reaching break-even.

In any case, in relation to Full Self-Driving technology and robotaxis, I highlight that these business opportunities remain highly speculative due to regulatory hurdles, technological challenges, and societal acceptance issues. Incidents like the suspension of Cruise’s permit in California following a pedestrian accident illustrate the regulatory and public perception hurdles Tesla must overcome. While I acknowledge the potential long-term value of autonomous driving, the timeline for widespread adoption is uncertain, and I, personally, do not expect meaningful market penetration before mid-/late 2030s.

On top of this uncertainty and long-dated timeline, Tesla may face significant cash burn, potentially exceeding many billion annually, exacerbated by the need to invest heavily in AI hardware and network infrastructure. So the equity story for Tesla’s self-driving ambition does no look all that attractive to me, at this point.

So, long story short: Tesla’s equity value is increasingly connected to an AI promise. However, there is currently little concrete evidence to support the thesis that Tesla is making substantial progress towards an autonomous future — and one that can also be commercialized. Definitely, in any case, progress will be long-dated and costly.

$90 TP Continues To Be My Base Case

With a struggling core auto business and increasing robotaxi uncertainty, I continue to argue that Tesla stock could be at risk of a significant re-rating, potentially aligning with the valuation of a typical GARP (Growth at a Reasonable Price) asset.

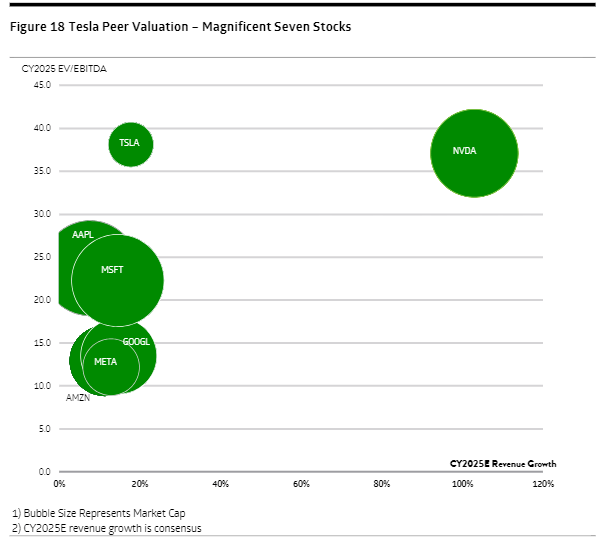

In this context, I consider a ~$90 per share valuation reasonable, reflecting an EV/EBIT multiple of around 30x, similar to the multiples seen in Microsoft (MSFT) and Nvidia (NVDA) shares. However, if Tesla were to align with the lower end of the GARP spectrum, shares could trade at an EV/EBIT multiple of approximately 20x. This is akin to the multiples for Meta Platforms (META) and Google (GOOGL), suggesting a target price as low as ~$60 in my bear case.

Note enclosed valuation map is from TD Cowen. (Source: TD Cowen research note on Tesla dated July 23rd: BIG HAT, NO CATTLE.)

TD Cowen

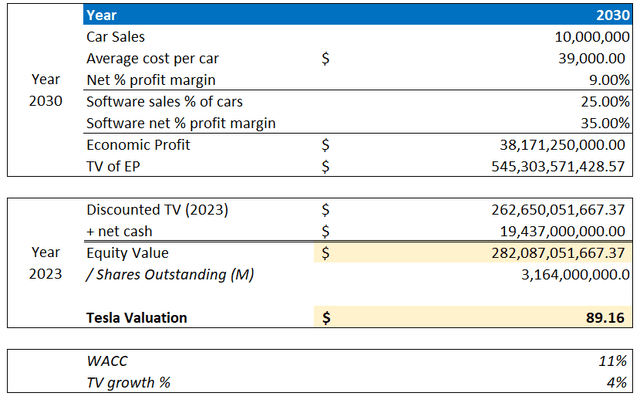

The $90 target price is also in line with my adjusted valuation model for Tesla (to be used as a reference only, as projecting estimates to 2030 is clouded). By 2030, I see Tesla selling about 10 million cars annually, at an ASP of approximately $39.000, and a 9% profit margin for cars. In addition, I project that for every dollar of hardware sale, Tesla generates about 35% of software revenue at a 35% margin (approximately in line with Apple).

Cavanagh Research Estimates & Calculations

Investor Takeaway

Tesla reported its results for the June quarter on July 22nd, causing shares to decline by more than 10% since the earnings release: For Q2, revenues in the automotive business were up only 2% YoY, while gross margins in the fell to a seven-year low. Looking ahead to the remainder of 2024, I am skeptical that a turnaround in the automotive business and a re-acceleration of growth is likely.

To divert investor attention from the struggling core business, Elon Musk is increasingly highlighting potential upside from autonomous driving and AI-related ventures. However, it is important for investors to recognize that the upside in Tesla’s AI venture is highly speculative and is not expected to enhance shareholder value significantly until the mid-2030s, based on my projections.

With the core auto business facing challenges and growing uncertainty around Tesla’s success and timeline in AI ventures, I maintain that Tesla stock is at risk of a significant re-rating. This would potentially align with the valuation of a typical GARP asset, which could bring the share price down to approximately $90, reflecting an EV/EBIT multiple of around 30x. I reiterate a “Strong Sell” rating on Tesla, but also highlight that the thesis could change swiftly if Tesla manages to make substantial and undeniable progress in self-driving technology and other autonomous/ AI business ventures.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.