Summary:

- Agilysys, Inc., a leading hospitality software company has a strong combination of revenue growth and profitability.

- Agilysys stock has fallen recently due to a large selling shareholder making a block sale.

- The company continues to execute well, adding customers and broadening their hospitality suite within current customers.

Dimensions/E+ via Getty Images

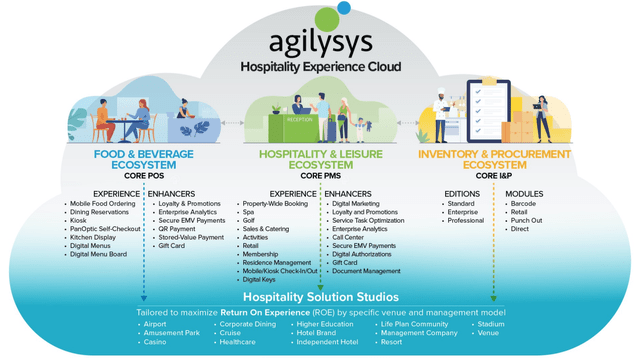

Agilysys, Inc. (NASDAQ:AGYS) is in the business of making experiences for many travelers around the world smoother and more efficient. AGYS is in the sweet spot between growth and profitability, with 21% revenue growth combined with a solid 13% EBITDA margin. In the current environment, the focus continues to be on the companies with exceptional growth and those with growth at the right price (GARP). ASYS falls into this bucket with a long track record of growth and earnings growth, albeit a bumpy trajectory until recently.

The company continues to expand its hospitality cloud offering, pushing for an increased subscription component to maximize customer life cycle revenues. This push has also resulted in increased R&D expenses to improve product offerings and provide a holistic offering for hospitality clients. The company has some major clients with big pockets, including the biggest casinos in the United States, giving a solid earnings outlook and good visibility. Looking into the details, you can see why this is a solid pick for a growth investor portfolio.

Q1 Investor Presentation (AGYS IR)

Fiscal Q3 – Strong end to Calendar 2023

This small-cap company is seeing continued strength even during this period of macroeconomic uncertainty, with both improved revenue and margins. Revenue was 60.6m, of which a record 35.1m was recurring revenue. This 21% revenue growth is quite solid, with 29.9% growth in their subscription solutions. This growth is highlighted by an impressive 90% of their 81 properties added in the quarter were subscription-based.

This momentum in selling their recurring solutions means higher margins and better long-term value going forward. Gross margins were up 0.8% y/y to 62.5%. The company continues to move towards a subscription model to increase its recurring revenue as a portion of total revenue. This will increase margins in the long term, although for now there is variability in margins short term.

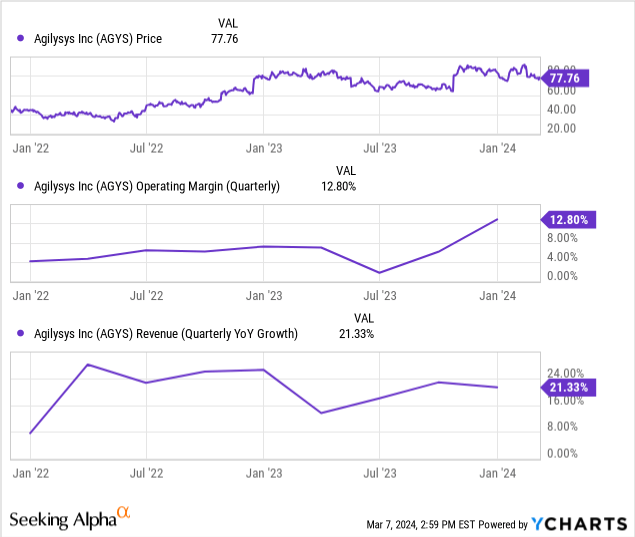

As you can see below, operating margins have improved since the post-COVID hospitality recession, improving to 12.8% in the most recent quarter. This has led to a solid $20.1m of operating income for the past 12 months. Revenue growth has been inconsistent but stabilizing now in the high teen % range with the majority now subscription revenues. Product revenue from their InfoGenesis POS system is doing well despite becoming more standardized across operating systems and mobile offerings, hurting their product revenue growth (less required POS systems due to improving the product). This is lower margin revenue, however, and is another tailwind for margins on the subscription portion of the business.

A more streamlined offering from AGYS is a reason they have been able to upsell very well in their existing customer base, including adding lots of new properties and resorts within those customers. Their property management system also had a strong quarter, adding 11 customers, one of the best quarters ever for AGYS. Strength has been coming from Europe and North America, with weakness still present in Asia with tourism continuing to pick up through 2024. Large companies continue to move towards a subscription model even as software stays on-premise. AGYS is offering a full stack of solutions including physical offerings,

Sales backlog is up 6% compared to a year ago, with the strong recent conversion of clients slowing pipeline growth for the coming fiscal year. They are still guided to a solid 17.5% growth of revenue but the upside to that number is likely as service areas continue to strengthen. After full-year revenue growth of 21.8% in F2023 to $198.1 million, AGYS isn’t seeing a significant slowdown in demand like other software companies. They increased guidance after the Christmas quarter up to $236.5m at the midpoint for F2024 ending after the current quarter.

The company continues to invest in marketing, cloud infrastructure, and support for future growth, but will still hit 15% EBITDA margins for the year. Considering the company is a small size continuing to focus on longer-term opportunities is essential to creating long-term value. They also need to stay ahead of the competition, especially due to the small nature of their target market in hospitality. They are leaning into a full subscription model which has helped improve margins, and managed to continue to grow at a steady cadence all the while. Combined with a recent pullback from an all-time high of $91 to now $77, the stock has become quite interesting from a valuation perspective.

As you can see above, operating margins have continued to tick higher and revenue growth has stayed strong even after minor hiccups in 2023. Even amid the solid performance, the stock has lagged with -an 11% return over the past year. Recent underperformance has been caused by a temporary downswing from selling shareholders unloading shares. Usually, situations such as this are good buying opportunities as the fundamentals remain unchanged but prices are lower.

The shareholders sold 3.4% of outstanding shares in February, but the price has fallen 15% showing an overdone reaction. This is a great opportunity for new money to accumulate shares, and other funds are likely buying now based on short-term weakness.

Conclusion – Offering creating opportunity

Agilysys, Inc. stock is a great purchase now as funds start to rotate out of mega-cap names into smaller companies through 2024. If you believe in that likelihood, companies like Agilysis should do well with its combination of growth, profitability, and reasonable valuation. The stock is above recent support and has been at all-time highs in 2024, with the potential to push through those levels in spring or summer. This is one that will remain under the radar due to its B2B nature and small size, but should not be ignored for strong capital gain potential for 2024.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGYS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.