Summary:

- AGYS is a leading player in the enterprise hospitality software with a long list of blue chip clients.

- The focus on its Property Management System (PMS) is expected to provide a growth opportunity in FY 2024 and beyond.

- AGYS appears undervalued based on my target price model. The stock is also trading near its 6-month low today. I give it a buy rating.

EXTREME-PHOTOGRAPHER/E+ via Getty Images

Agilysys (NASDAQ:AGYS) is a company that provides a comprehensive suite of software designed to enhance operational efficiency and improve guest experiences in hotels, resorts, restaurants, casinos, cruise lines, and other hospitality establishments. The solution ranges from point of sale/POS, property management system/PMS, inventory, to procurement.

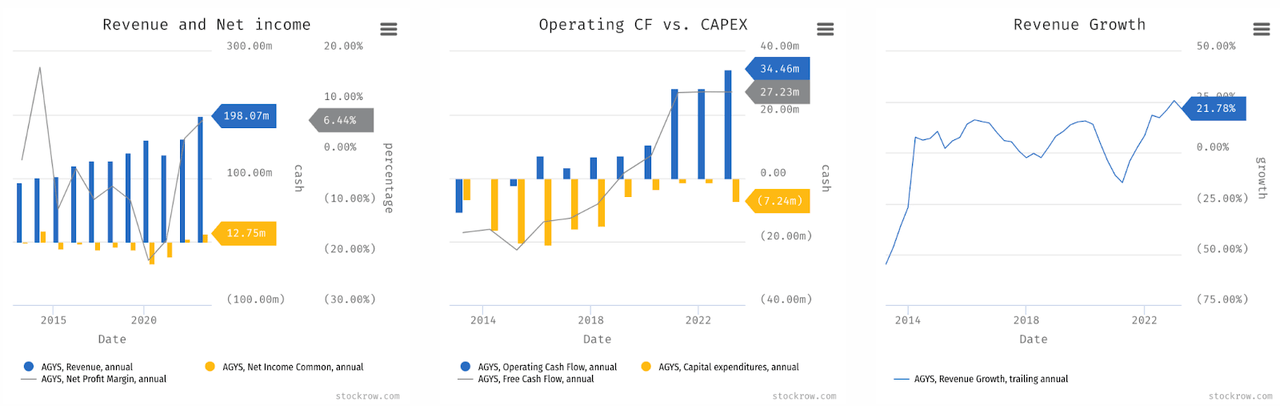

AGYS appears interesting at first glance. As did all of the travel-related stocks, AGYS took a hit in FY 2021 during COVID-19. However, it seems to have bounced back and even turned net profitable since. AGYS also has a long list of blue chip clients, such as Mandarin Oriental/MO and InterContinental Hotels Group/IHG. With the exception of FY 2021, AGYS has also had accelerating double-digit growth for the past five years. Revenue growth in FY 2023 was ~22%, an acceleration from 19% the year before and from the pre-pandemic level of 10%-14%.

I give AGYS a buy rating. The stock appears undervalued today based on my target price model. AGYS is also trading near its 6-month low, which means that the price is attractive to initiate a position today.

Catalyst

I have identified some potential noteworthy catalysts driving AGYS’s growth. First off, AGYS is a leading enterprise hospitality solution with a relatively high switching cost. Its POS or PMS offerings, for instance, are used on a daily basis across all critical activities within its customers’ properties. As such, replacing the solution may entail high data migration costs and service downtime that may be less acceptable in the hospitality industry.

The fact that AGYS has acquired blue chip customers such as IHG or MO, which owns various properties globally, also further helps AGYS’s growth through sales expansion of its solutions into more properties. Eventually, having more increased presences within its customer’s property footprints would also end up creating a higher switching cost.

AGYS also has strong fundamentals. Overall, growth has accelerated to ~20% from the 10% – 15% range over the past few years. While revenue growth experienced a major decline in FY 2021 due to COVID-19, profitability and OCF/operating cash flow have improved since then. OCF has in fact been on a significant upward trend. OCF margins were merely ~6% pre-COVID, but since then, it has been between 17%-20%. It appears to me that AGYS turned the challenges of COVID-19 into an opportunity to focus on the bottom line, which is a good thing. While many companies in the same situation might have a similar idea, few could actually demonstrate the capability to turn profitable and cash flow positives.

It is likely that AGYS will continue seeing growth in FY 2024. As of Q4 2023, AGYS seems to have been benefiting from the increasing demand for its solutions across both existing and new customers, which I may attribute to the broader anticipation of a higher rebound in global tourism.

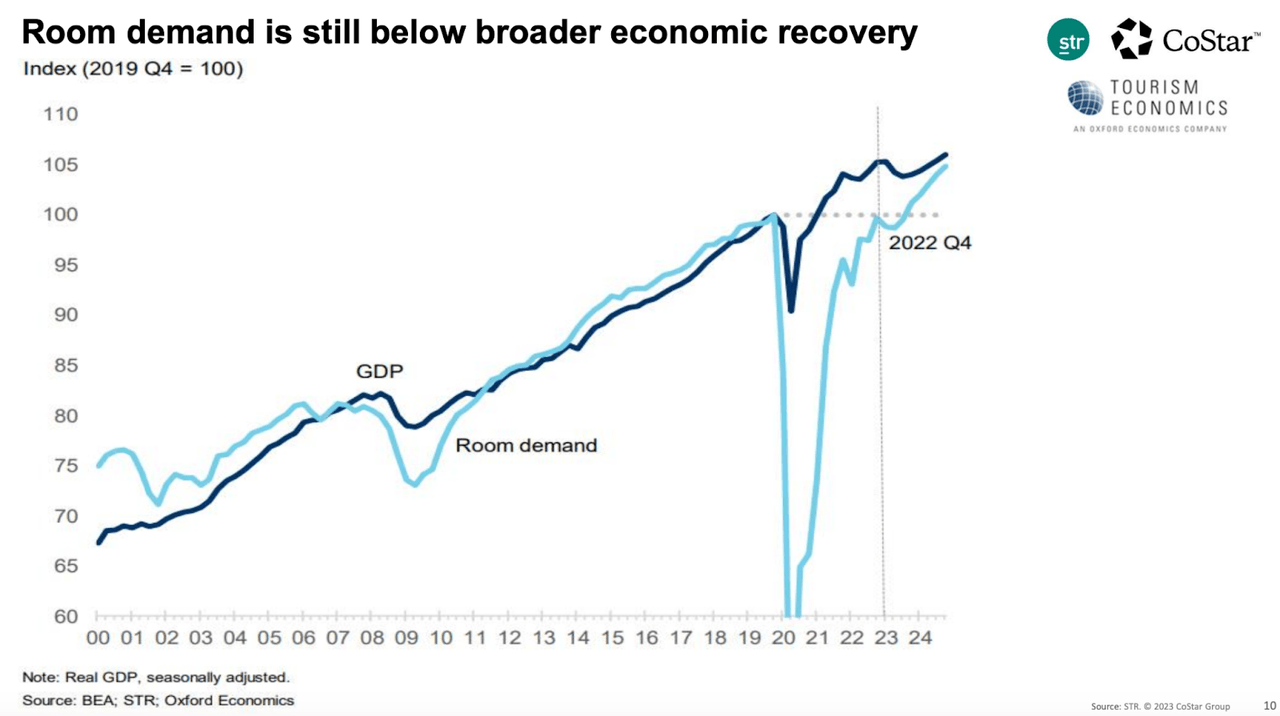

A report published by CoStar Group on the European hotel performance in March 2023, for instance, suggests that while room demand is still lower than the economic recovery, it will track more closely in FY 2024. As such, continued near-term growth is possible for AGYS in EMEA (especially in Europe), the area where it is already seeing strength today. In addition, AGYS may also see a further rebound in APAC, which is currently lagging behind in recovery, probably sometime in FY 2024.

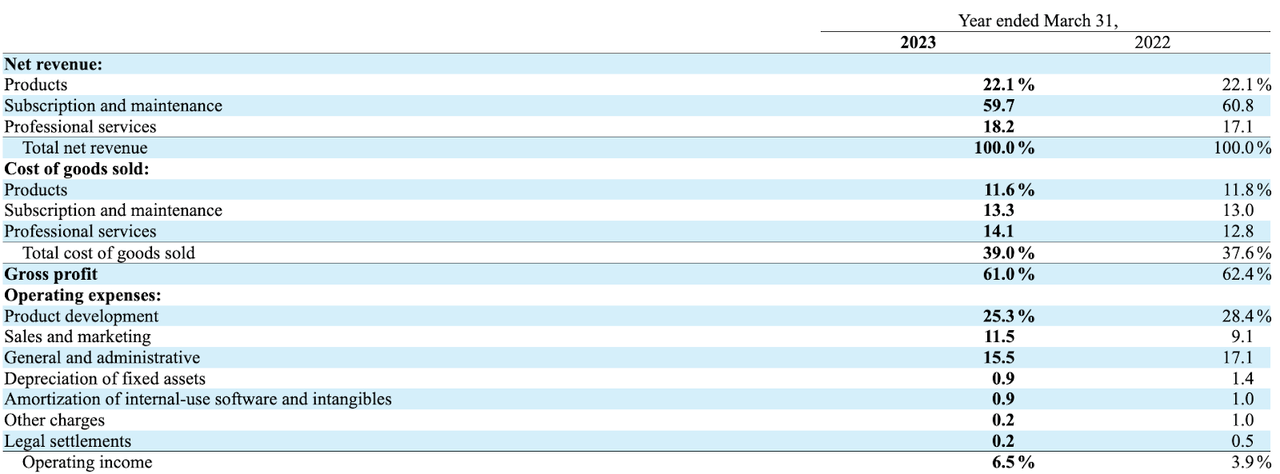

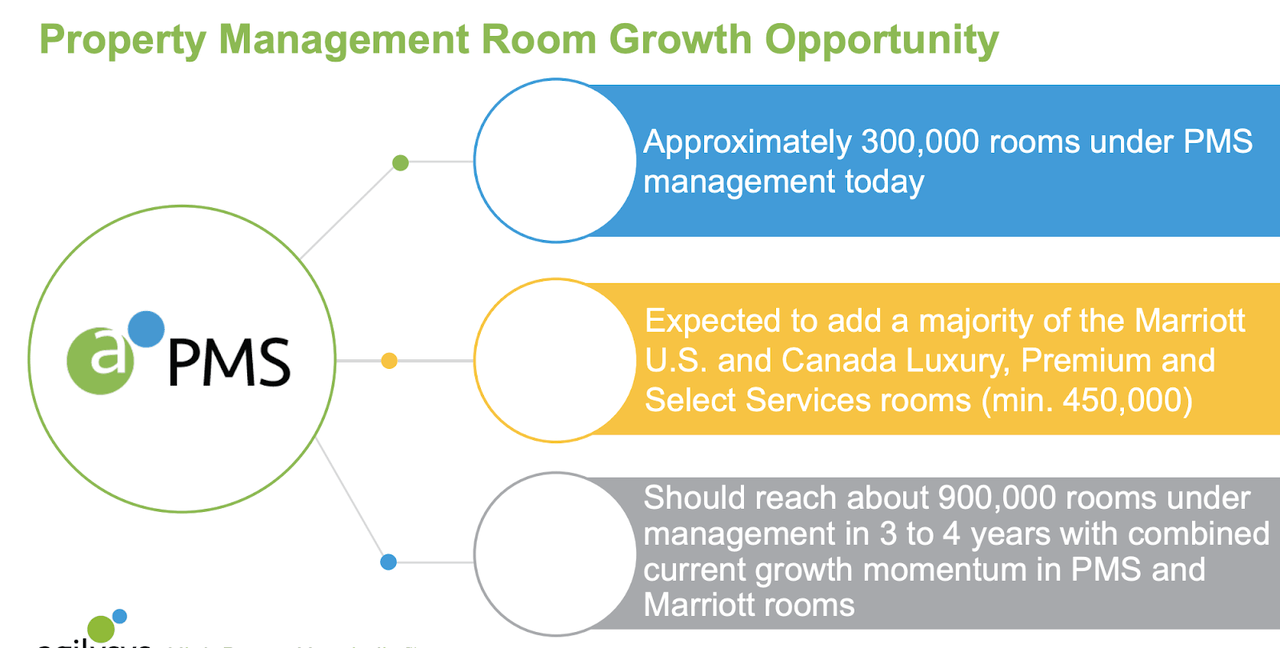

In FY 2024 and beyond, I expect PMS to present a growth opportunity for AGYS. In FY 2024, AGYS will see a higher proportion of professional services/PS revenue in its revenue mix, given its main focus to deliver PMS capability for its newly-signed client Marriott. Given the seemingly complex implementation process, the deployment of PMS will happen in several steps, with the initial ones taking place in FY 2024. Therefore, AGYS will only recognize the subscription and maintenance/SM revenue driven by the PMS once it is fully implemented.

Since PS seems to precede product deployment, I believe that the increase in lower-margin PS revenue in FY 2024 could then serve as a leading indicator for future higher-margin SM and product revenues. This is aligned with AGYS’s expectation of declining adjusted EBITDA margin from ~15% in FY 2023 to around 13% in FY 2024.

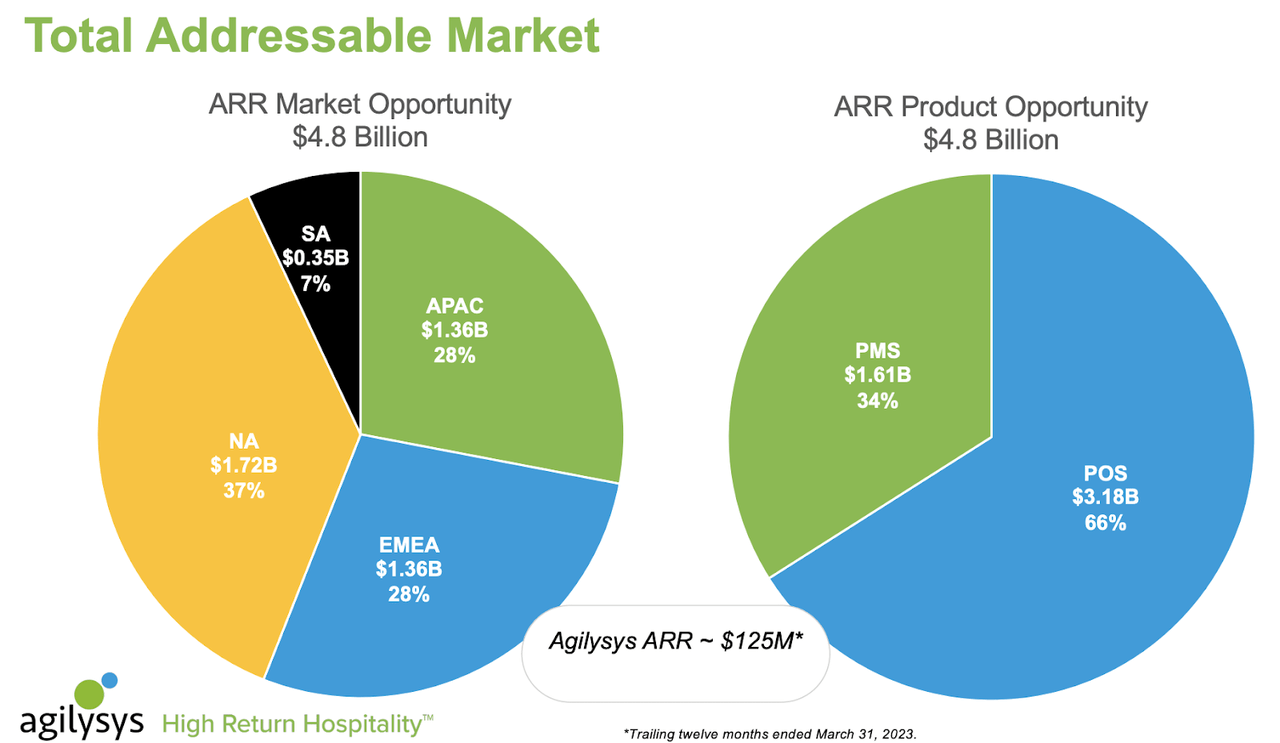

I think that while scaling the PMS business may cause temporary margin contraction, the future benefit outweighs the short-term negative impact. The magnitude of the contraction within the adjusted EBITDA margin is mostly negligible, but acquiring Marriott as a PMS client is a big win. POS has traditionally been the biggest business for AGYS, and as of Q4, it was 59% of revenue. However, PMS represents an immediately attractive opportunity given its market size. As of Q4, PMS made up only 21% of AGYS revenue, suggesting that there is still room for growth.

The PMS project with Marriott will help AGYS to triple its rooms under management in 3 to 4 years from now. But most importantly, the agreement signed last year will only cover the selected Marriott US and Canada locations, meaning that there is an opportunity to expand that to other Marriott locations globally.

Risk

I believe that downside risk remains minimal. Nonetheless, it is important to note that AGYS will continue to make necessary operational spending ahead of the full implementation of its projects. Since it may negatively impact adjusted EBITDA for FY 2024, I would probably anticipate a potential temporary correction to a small degree due to some market overreaction that may present downside risk.

Furthermore, the expected increase of lower-margin PS revenue for FY 2024 may also trigger a temporary valuation multiple adjustments. Therefore, assuming a less ideal scenario where these factors come into play, solid execution will also be critical for AGYS to maintain the 16% – 19% revenue growth guidance. Eventually, smooth execution may neutralize the correction effect and even help drive premium valuation for the stock towards the end of FY 2024 once the market probably starts to price in the potential growth from the PMS project revenues.

Valuation/Pricing

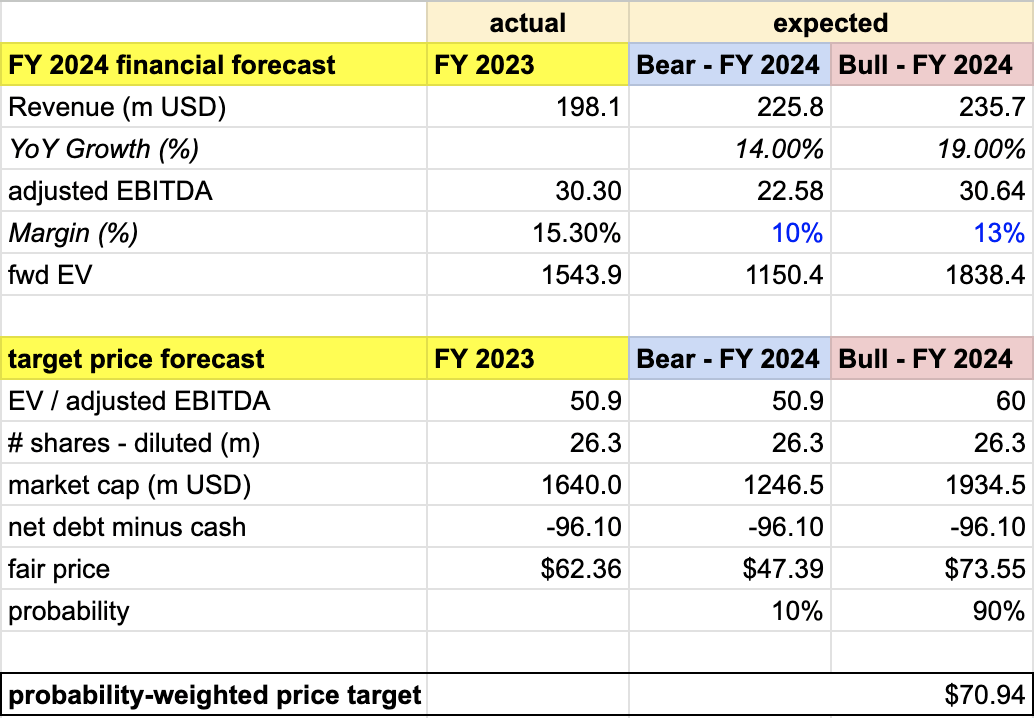

To estimate the target price for AGYS in FY 2024, I assume the following bull vs bear scenario:

-

Bull scenario (90%) – AGYS to finish FY 2024 with revenue of $235.7 million, meeting the high-end of its 19% revenue growth guidance. Adjusted EBITDA margin will be 13%, consistent with the management’s guidance as well.

-

Bear scenario (10%) – AGYS to finish FY 2024 with revenue of $225.8 million, missing its revenue growth guidance (16% – 19%). Adjusted EBITDA margin will be 10%, slightly lower than the management’s expectation.

I assign an EV/adjusted EBITDA (EV/aEBITDA) of 60x for AGYS under the bull scenario, considering that AGYS actually had an EV/aEBITDA of ~64x in May when it finished FY 2023 with aEBITDA margin of 15%. Since AGYS will see aEBITDA margin contraction to 13%, I would accordingly expect EV/aEBITDA for FY 2024 to contract slightly to probably somewhere closer to 60x. For the bear scenario, I assign AGYS an EV/aEBITDA of ~50.9x, which is the valuation derived from today’s most recent market cap.

Author’s own analysis

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of ~$71 per share. Since AGYS is currently trading at ~$65 as of today, the stock appears undervalued by 9.2%.

I rate the stock a buy. Overall, I think that AGYS has relatively been richly valued, most probably due to the qualities I highlighted earlier in this coverage. However, the current price is attractive today.

The fact that the stock is currently trading near its 6-month low suggests that there appears to be more upside than downside. I would also note that my target price model assumes a 10% chance of a bear scenario occurring. This is probably a more conservative way to look at things, since AGYS generally has a good visibility into its revenue projection due to its business model.

Conclusion

AGYS appears to be an interesting stock to take a look further. It has blue chip clients like Mandarin Oriental and InterContinental Hotels Group and has shown double-digit revenue growth for the past five years, except in FY 2021 due to COVID-19. There are potential catalysts for future growth, and downside risk seems minimal aside from the higher level of operational spending that may affect adjusted EBITDA for FY 2024, leading to a potential temporary correction. Overall, I rate the stock as a buy. AGYS has often been richly valued, but given that it is currently trading near its 6-month low, I feel that the price is attractive today.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.