Summary:

- Lumen Technologies, Inc. has rallied over 200% in the last week due to strategic partnerships with big companies, showing potential for increased cash flow.

- Renewed interest and AI data center demand are driving growth.

- While Lumen could be worth buying after a pullback, the stock remains highly risky and volatile, with limited upside potential at its current price.

studiodav/iStock via Getty Images

Thesis Summary

Lumen Technologies, Inc. (NYSE:LUMN) has rallied over 200% in the last week after announcing Q2 results, which featured strategic partnerships with big companies which will bring material upside to cash flow.

Though Lumen’s business has been around for many years, it is benefitting from renewed interest as AI data center demand continues to increase.

With that said, I believe Lumen could be worth a buy after the pull-back. This is a valuable business with tangible, valuable assets and a competent CEO.

I believe LUMN could still rally substantially from these levels, though this is clearly a highly risky and volatile stock.

What does Lumen do?

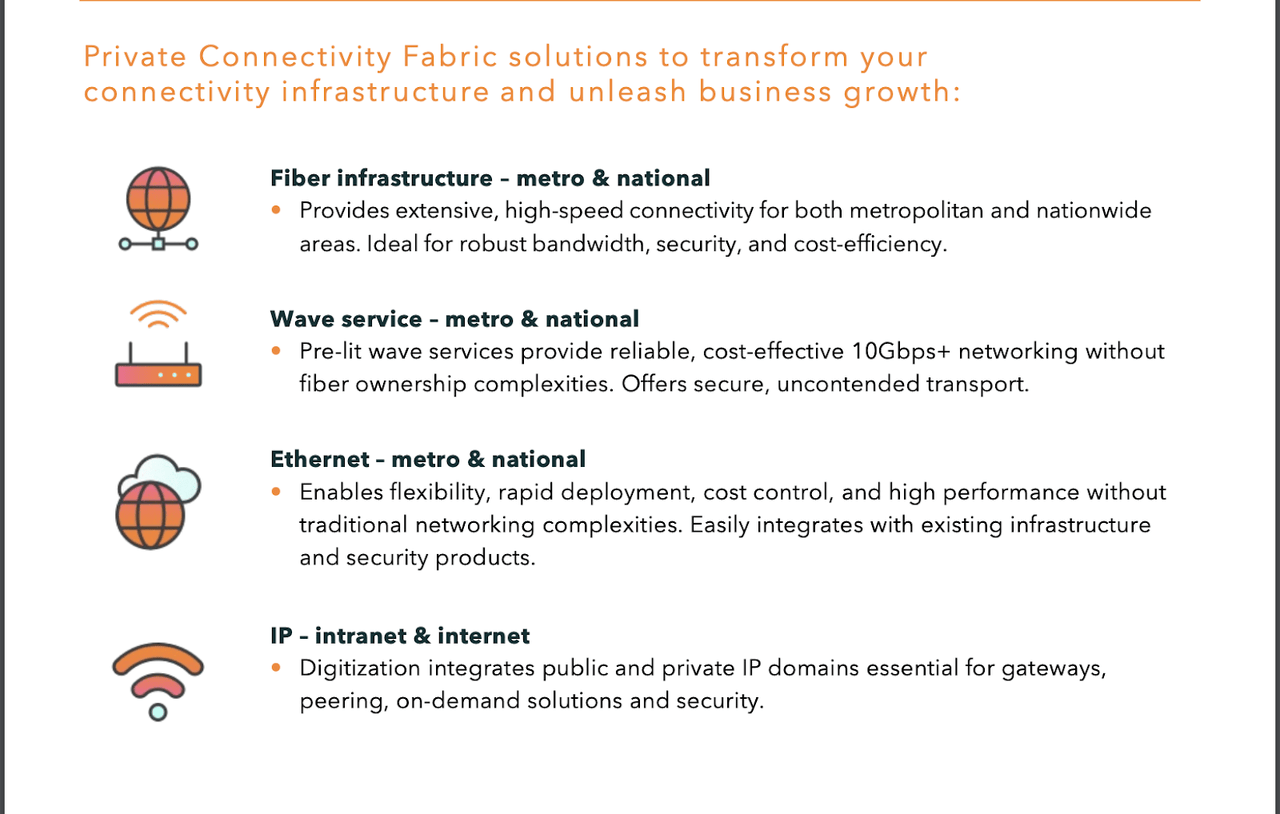

Lumen provides telecommunication services in the US and around the world. The company essentially provides the infrastructure and network needed to actually set up and connect data centers.

For example, Lumen provides the necessary fiber optic infrastructure, IP domains, and wave services to allow businesses to meet their connectivity needs.

Lumen Private Connectivity (Investor slides)

Telecommunications companies have been around for quite some time, and so has Lumen in one form or another.

The Oak Ridge Telephone Company was Lumen’s earliest predecessor, dating as far back as the 1930s. More recently, the company was known as CenturyLink, which merged with Level 3 back in 2017.

This was one in a long string of acquisitions by CenturyLink, which eventually left the company with over $35 billion in long-term debt and substantial write-offs.

In 2020, CenturyLink changed its name to Lumen and began to divest its assets, leaving a much leaner enterprise behind.

So, let’s look at where we are in the latest quarter.

Q2 Update

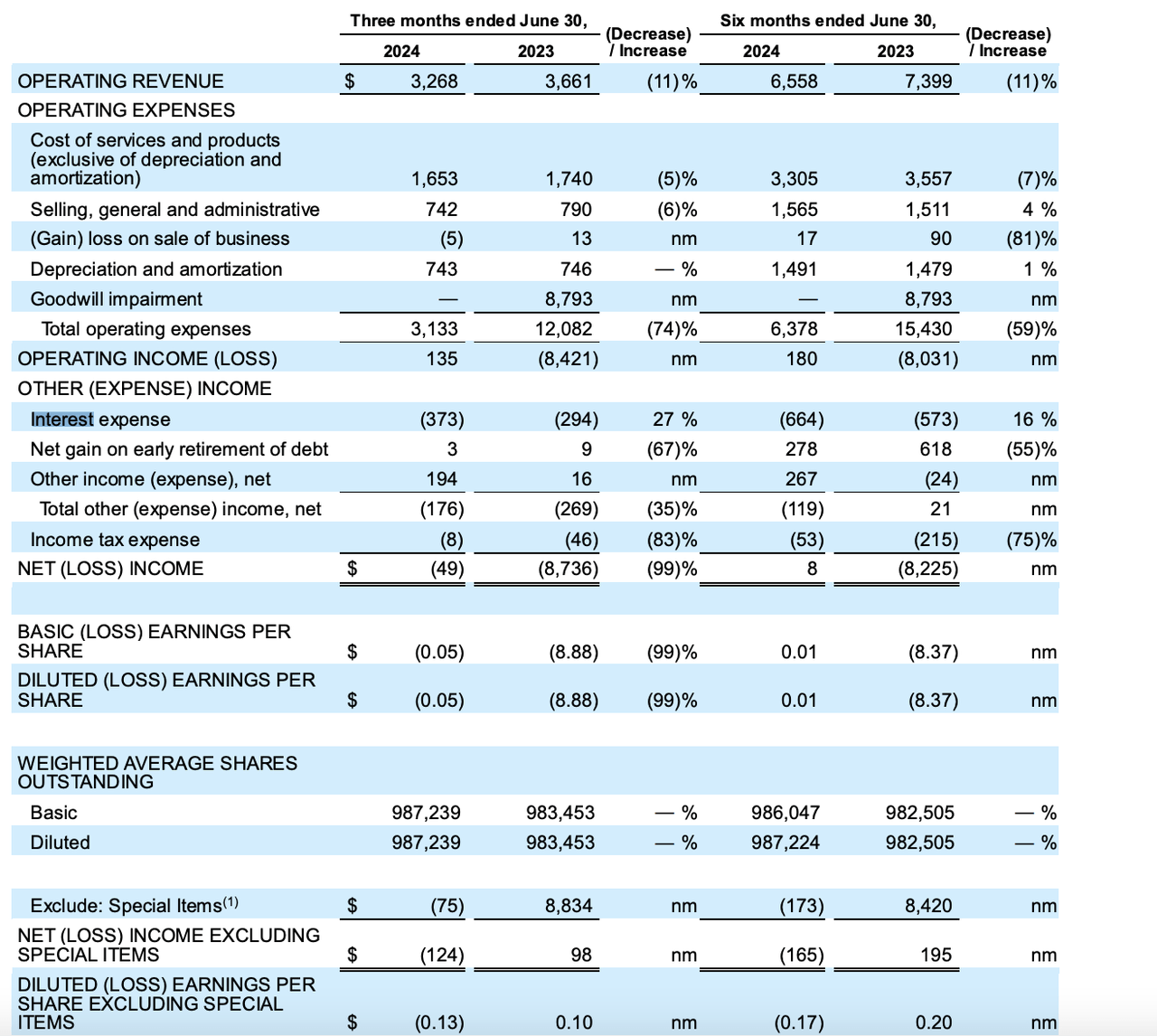

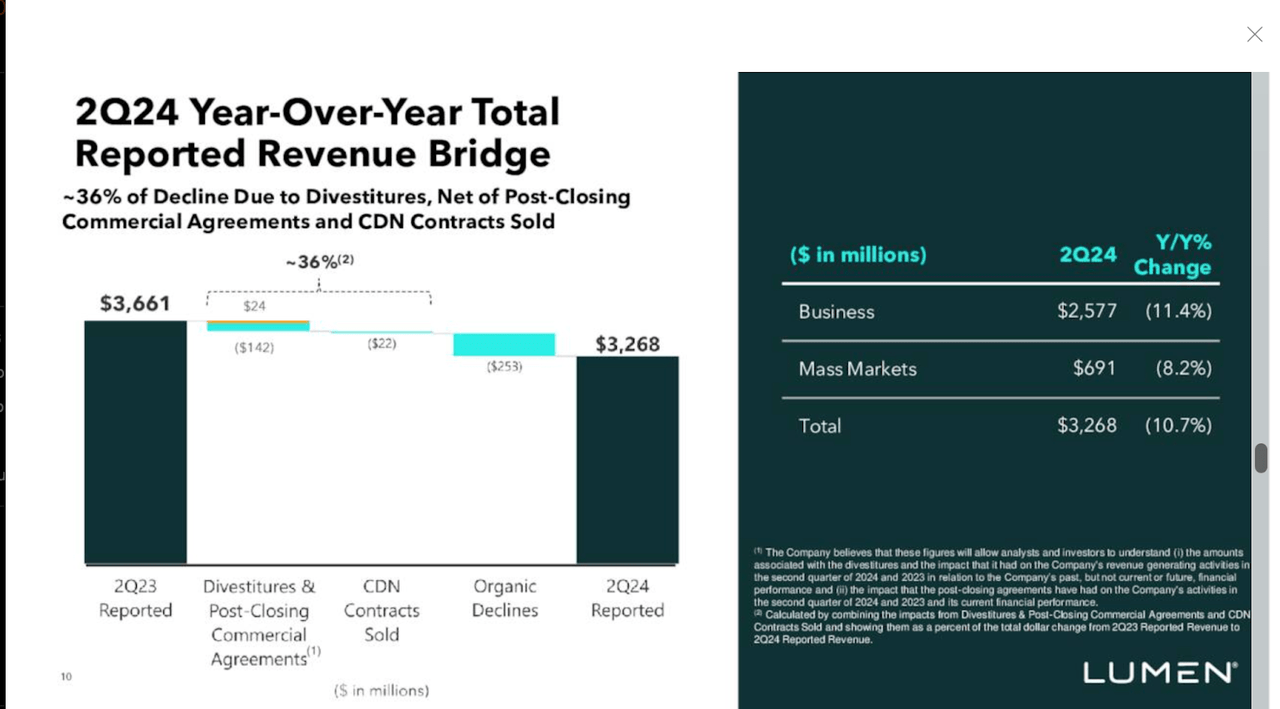

The company’s revenues were $3.268 billion in Q2, down 36% since last year.

2024 revenues (Investor slides)

Of course, this can be attributed to the fact that the company underwent some divestment.

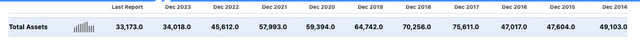

Total assets (SA)

We can see how the company’s assets have been decreasing since 2018, now less than 50% of what they once were.

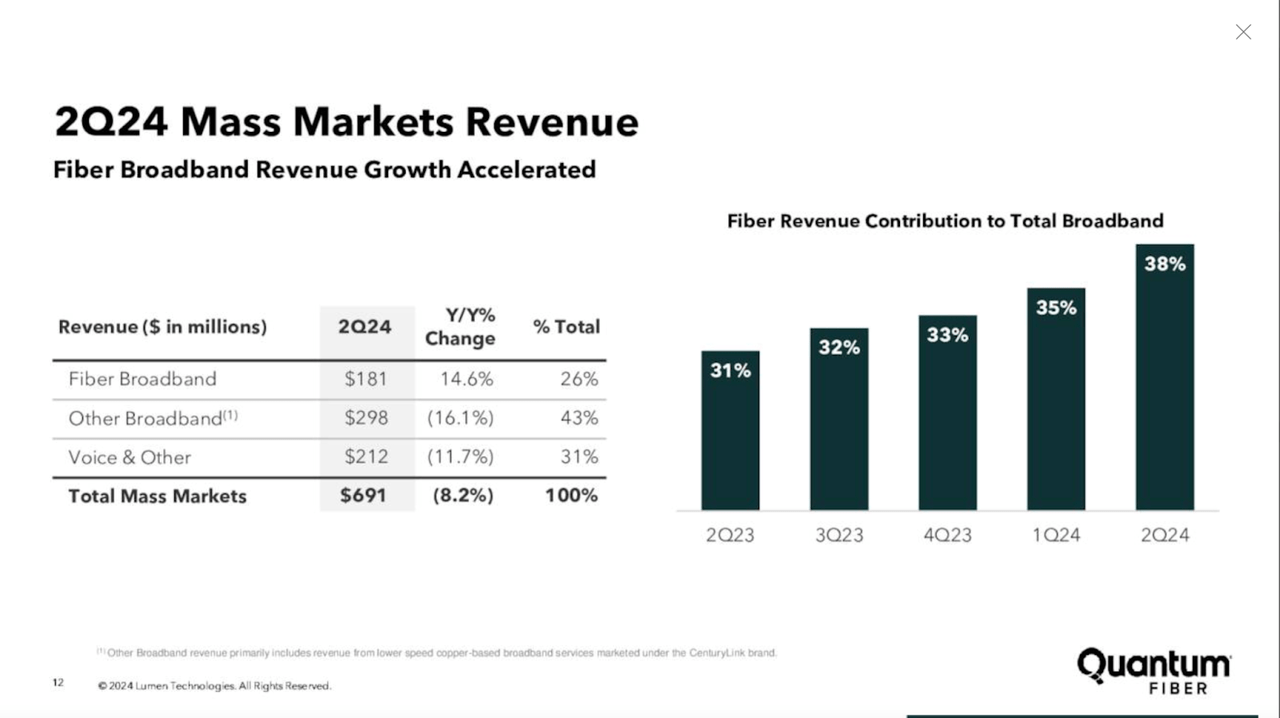

2024 mass markets revenue (Investor slides)

Fiber revenue is the growth segment, now representing over 38% of the company’s revenues.

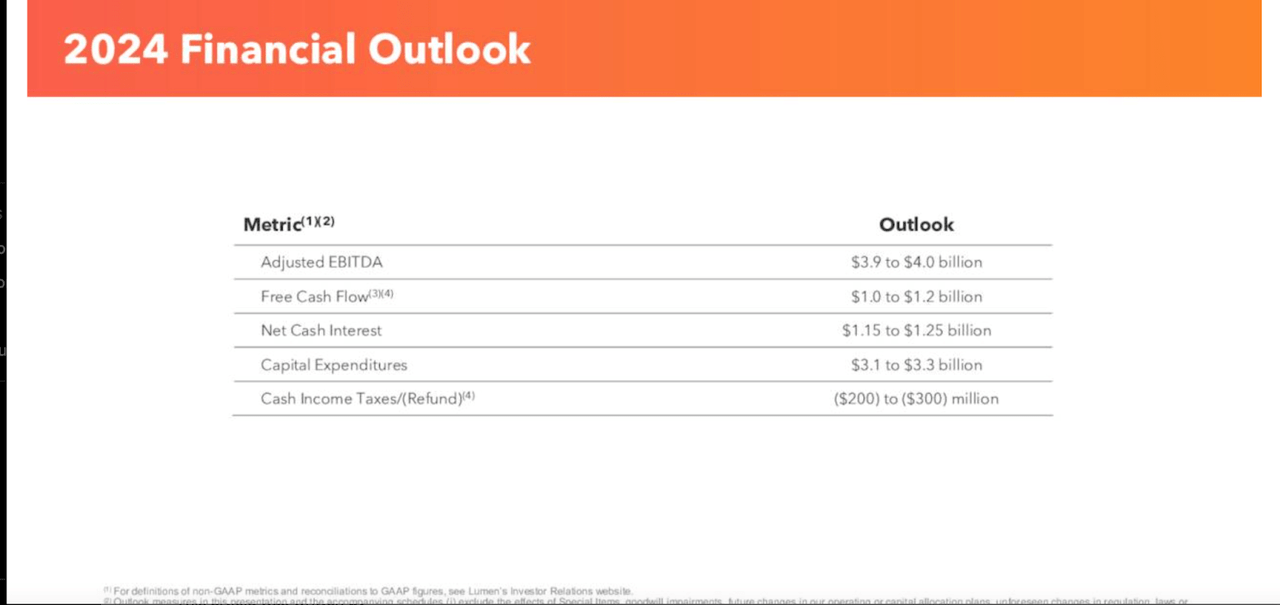

2024 Financial Outlook (Investor slides)

For the full year, the company expects to achieve almost $4 billion in EBITDA, a free cash flow of over $1 billion, and will spend $3.2 billion in capital expenditures.

The Good, The Bad The Ugly

Lumen has certainly attracted a lot of attention recently, which is understandable after the stock more than doubled after earnings.

So, first off; why the big rally? This can be attributed to a few factors.

Firstly, the partnership with Microsoft:

Today, Lumen Technologies, Inc. (LUMN) and Microsoft Corporation (MSFT) announced a new strategic partnership that will use the Microsoft Cloud to further drive Lumen’s digital transformation. In addition, Microsoft has chosen Lumen to expand its network capacity and capability to meet the growing demand for its data centres due to AI.

Source: Seeking Alpha.

The connection with Microsoft is a great headline, and it proves the idea that Lumen’s network will be needed to meet the growing AI demand.

On the other hand, Lumen also secured a meaningful deal with Corning Incorporated (GLW)

Corning and Lumen Technologies reach an agreement to reserve 10% of Corning’s global fibre capacity for each of the next two years to interconnect AI-enabled data centres

Source: Corning Q2.

In terms of how this affects revenues/bookings, the company put out a Press release stating that $5 billion in deals had been secured, with another $7 billion in the works.

With all these great developments, it’s unsurprising, at least in hindsight, that insiders were adding to their holdings in the last few weeks.

LUMN insider activity (Nasdaq)

But is everything as good as it seems?

Despite a great quarter and a promising outlook, we have to understand why this company was trading at $1.5 only a few weeks ago.

The truth is, that despite some AI promises, this company is still burdened by debt, and will not run a profit for some time.

Depreciation, cost of services, and interest expenses are eating into the operating income, the stock lost 13 cents per share in the last quarter.

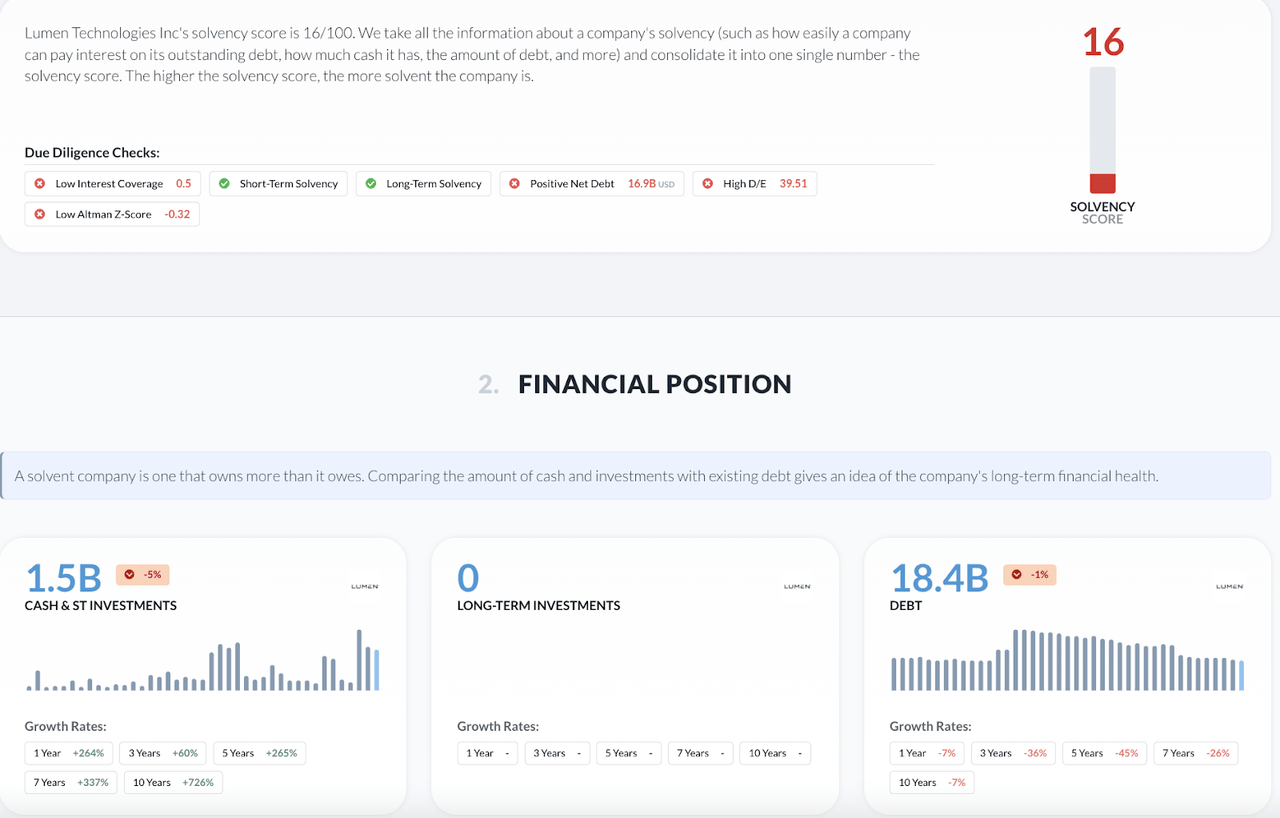

As we can see, Lumen receives a solvency score of 16 according to Alphaspread. Its total assets barely cover liabilities, but right now, it is burning cash as fast as it spends it.

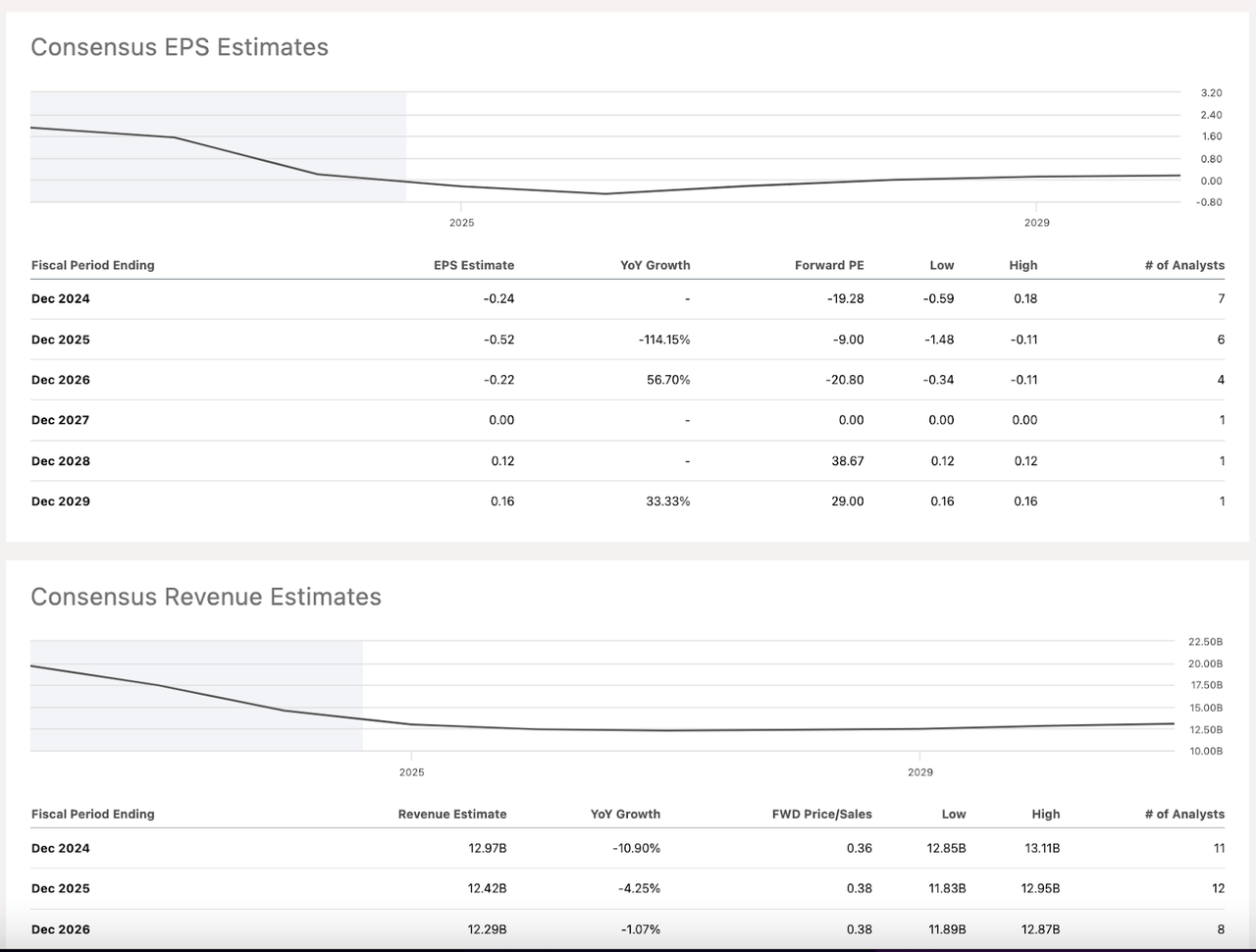

Analysts don’t expect to see a meaningful change in revenues and earnings over the next couple of years.

My 2 cents

Lumen has shown some promise after the last quarter, but is this enough to certify a turnaround?

Insiders were happy to buy shares ahead of this quarter, but the question is if this can materialize into either an actual and sustainable turnaround or, as some have speculated, Lumen can get bought out by another company.

The essence of the turnaround story can be captured in this statement by the CEO from the earnings call:

To summarize what’s happening, the dramatic rise in AI innovation is bringing explosive growth in data center build-out. And data centers simply have to be connected. We’re honored that technology powerhouses like Microsoft and several other big technology firms are choosing Lumen to build their AI backbone. And they’re choosing us for two reasons. First, our world-class fiber network with its unique routes, vast coverage, and state-of-the-art fiber solutions from our strategic partnership with Corning.

And second, the digital platform we’re building that makes consumption quick, secure, and effortless.

Source: Earnings Call.

To summarize the summary, the turnaround hinges on two factors:

-

Continued AI data center demand.

-

Lumen gained more contracts by providing an improved service.

On the first point, I do believe demand for data centers will be robust, at least for a few years. However, we have already seen some signs of a slowdown in this regard. It’s clear, that the sentiment right now is that companies simply can’t afford to not invest in AI, but we have yet to see this pay off meaningfully.

On the other hand, while Lumen did score some meaningful contracts, I find it difficult to see how exactly it will outperform competitors. Telecommunication is a highly regulated and competitive industry, and I just don’t think investors will see the “AI growth” they expect here.

Finally, while clearly Lumen was a great buy at $1.50 the company now trades at around $5, which greatly limits the upside.

My fellow SA contributor Brett Ashcroft valued the company at $5.90 if it were to be acquired. This was a well-thought-out piece of work based on the company’s assets and liabilities.

This means the current upside is quite limited, with LUMN trading at $5 right now, while substantial risks remain.

Lumen is still a very fragile company, which is being weighed down by debt and isn’t making enough to actually turn a profit and give back to investors, at least not right now.

Final Thoughts

Lumen is not a bad company, and management has done very well in turning things around. However, as an investor considering a buy now at $5, I simply don’t see enough upside compared to the possible downside. The broader market could turn, AI mania could subside, and Lumen is already in a weak position. A bad quarter could quickly send this back down.

All in all, the juice has been squeezed on this one, and it would be best to wait for another dip before adding.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Joint the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video